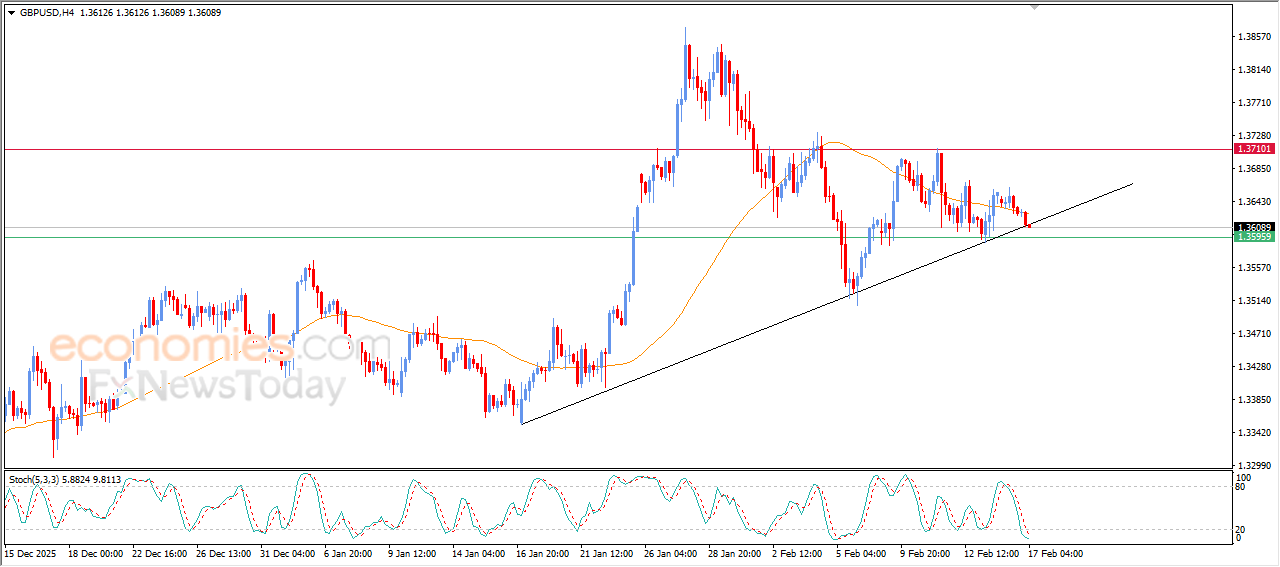

GBPUSD price is between mixed signals - Analysis- 17-02-2026

GBPUSD declined in its last intraday trading, surpassing EMA50’s support, which put it under negative pressure, but it remains leaning on main bullish trend’s support line on short-term basis, providing chance for fining a new higher low to use it as a base to gain the required bullish momentum for its recovery and rising again, reinforces by the relative strength indicators reaching oversold levels, exaggeratedly compared to the price move, indicating the beginning of forming positive divergence.

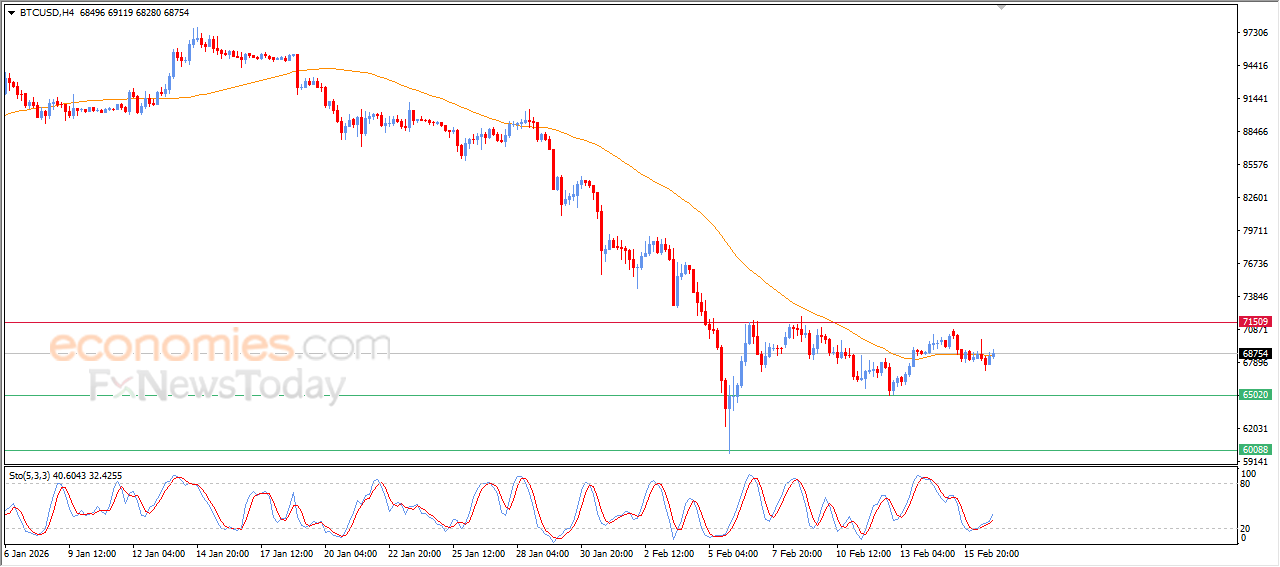

Bitcoin (BTCUSD) is experiencing cautious rebound, support by its oversold condition- Analysis-17-02-2026

Bitcoin’s price rose slightly in its last trading on the intraday levels, supported by the emergence of positive signals from relative strength indicators after reaching sharp oversold levels, in attempt to absorb these conditions and regain the balance.

Despite this limited improvement, the technical image remains negative, amid the continuation of the trading below EMA50, reinforcing the dominance of the main bearish trend on short-term basis and limits the chances of turning this rebound to positive track in the upcoming period.

Crude oil prices record limited gains under pressure from technical indicators- Analysis- 17-02-2026

Crude oil prices settle on cautious gains in their last trading on intraday levels, however this rise is facing clear technical obstacles, after reaching EMA50’s resistance, accompanied by retesting previously broken main bullish trend line, which puts these trading under negative pressure.

These pressures increase by the emergence of negative overlapping signals from relative strength indicators after reaching exaggerated overbought levels compared to the price move. There is likelihood of forming negative divergence that might ease the way for the bearish track return in the upcoming period.

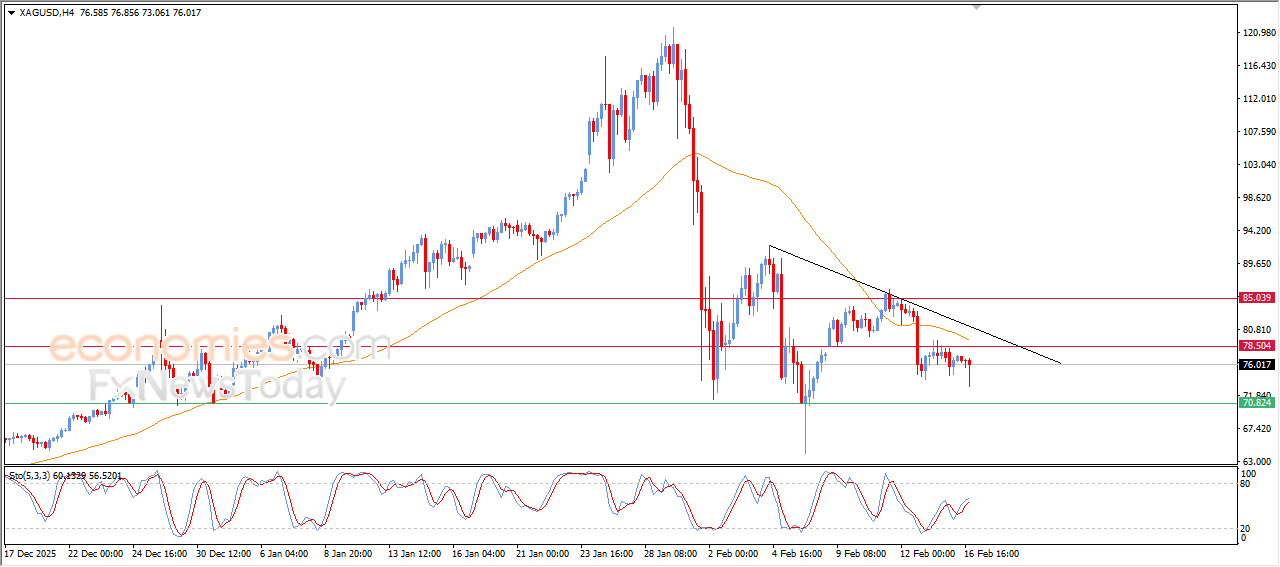

Silver price loses momentum and remains under technical pressure –Analysis– 17-02-2026

Silver price (SILVER) declined in its recent intraday trading, as the short-term corrective downtrend continues to dominate. The price is moving alongside a minor descending trendline that reinforces this negative path. Additional pressure stems from trading below EMA50, which represents dynamic resistance limiting the chances of a near-term recovery.

Moreover, the Relative Strength indicators entering overbought levels indicates fading positive momentum and strengthens the probability of continued selling pressure in the coming period.