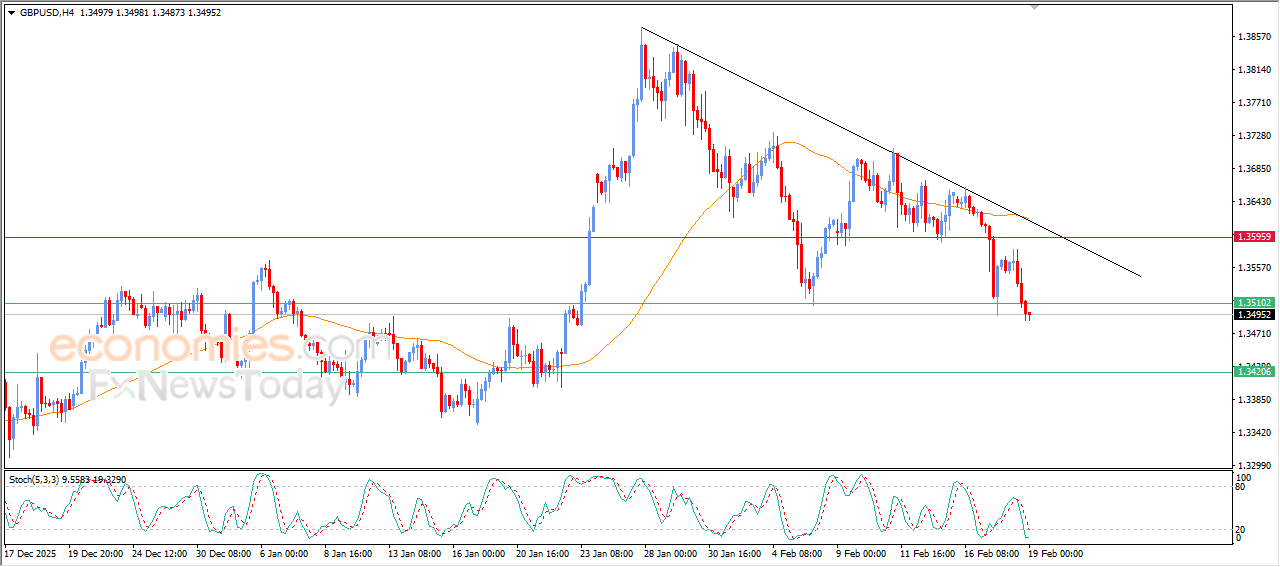

GBPUSD price breaks our expected target - Analysis- 19-02-2026

GBPUSD kept declining in its last intraday trading, to break 1.3510 support in its last intraday trading, this support represents an expected target in our previous analysis, amid the continuation of the negative pressure due to its trading below EMA50, reinforcing the stability and dominance of the bearish corrective trend on short-term basis, with its trading alongside supportive trend line for this path, besides the emergence of negative signals from relative strength indicators, despite reaching oversold levels.

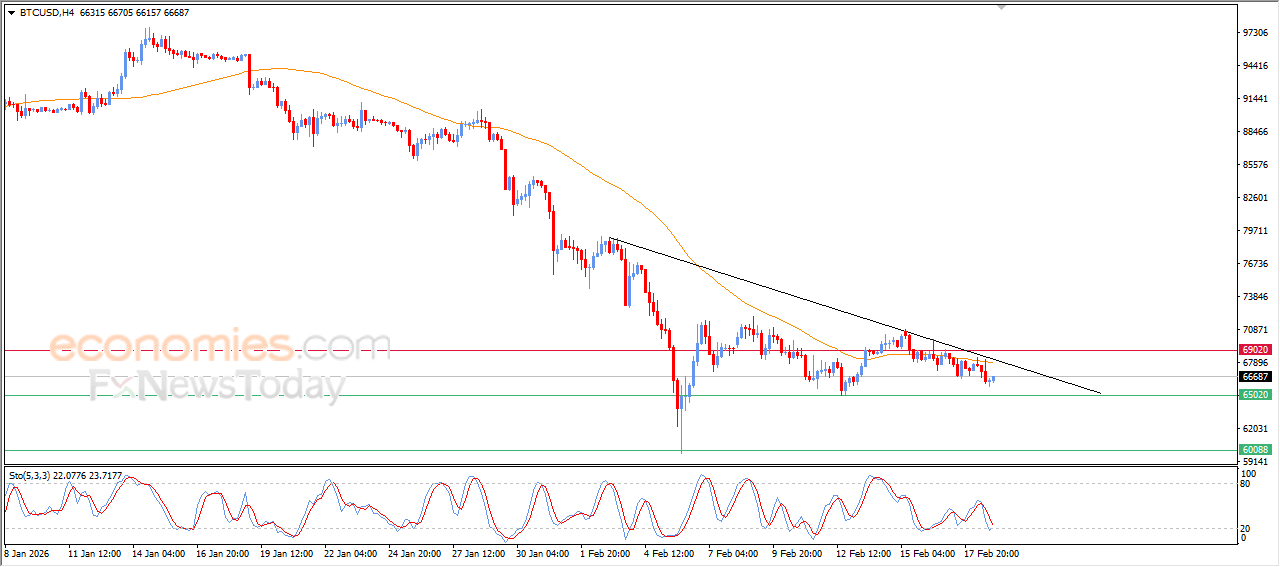

Bitcoin (BTCUSD) consolidates its losses under bearish trend pressure - Analysis-19-02-2026

Bitcoin’s price (BTCUSD) settles clear losses in its recent intraday trading, as it remains under the main short-term bearish trend dominance, with its trading alongside minor bearish trend line, indicating the dominance of the sellers, especially after losing any strong technical motivators for an affective rebound.

Negative pressure becomes more evident with trading below EMA50, which acts as dynamic resistance supporting the bearish outlook. In addition, consecutive negative signals from relative strength indicators persist, despite reaching deeply oversold levels. This suggests that oversold conditions are insufficient to reverse the trend, keeping the probability of further decline intact.

Crude oil prices reach our expected target- Analysis- 19-02-2026

Crude oil prices settle near their highest intraday levels, keeping strong gains after its stability at the previously expected target at $65.35 key resistance, the price is attempting to take a breather to gain the required bullish momentum to breach this key resistance and holding above, opening the way for a new bullish wave.

The price is attempting to offload some of the overbought conditions on relative strength indicators, especially with the emergence of negative overlapping signals that might indicate temporary slow momentum, but the continuation of the main bullish trend dominance on short-term basis, besides the dynamic support that is represented by the trading above EMA50 reinforced the chances of resuming the bullish trend and extending its gains.

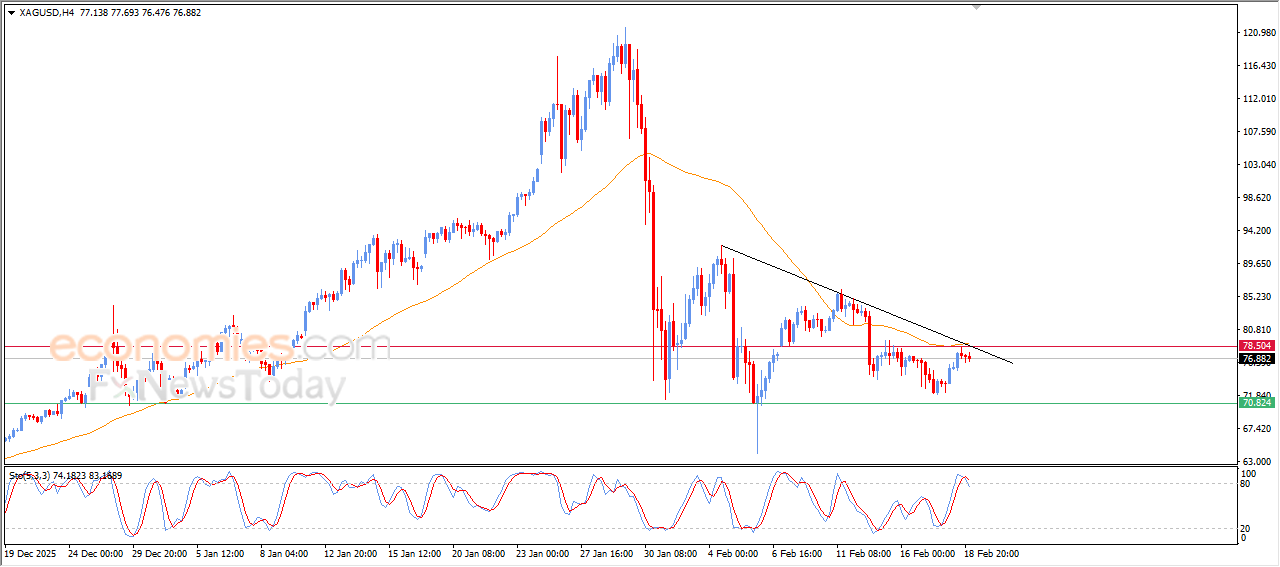

Silver Price is showing clear negative signals– Analysis-19-02-2026

Silver prices (SILVER) declined in their last intraday trading, after testing minor bearish trend line on short-term basis, accompanied by reaching EMA50’s resistance, forming double technical barrier that turned the selling pressures back, this decline indicates the importance of technical levels, especially with the absence of momentum to breach and hold above it.

The negative overview is reinforced with the emergence of weakness signals from relative strength indicators, after recording negative divergence after reaching exaggerated overbought levels compared to the price, indicating the likelihood of the decline continuation on near-term basis, unless it surpassed these technical resistance levels and confirmed a positive price reversal.