The GBPJPY settles below the barrier– Forecast today – 4-9-2025

AI Summary

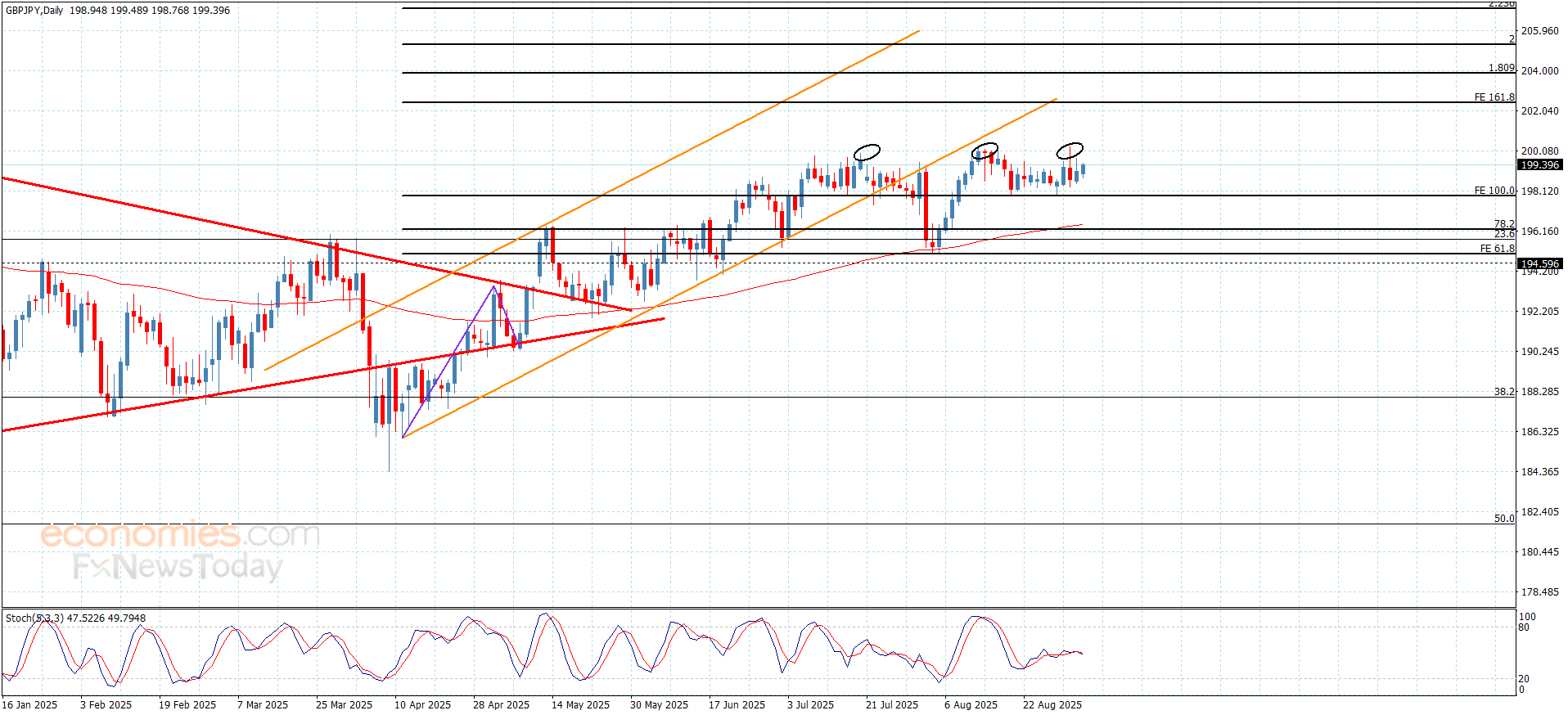

- GBPJPY pair settling below barrier at 200.40, delaying bullish attack and increasing chances of bearish correctional track

- Support levels at 197.85, 197.20, and 196.20, with potential for extra losses if broken

- Potential for bullish attempts if price breaches barrier, with target gains at 200.90 and 202.45, expected trading range between 197.85 and 199.80, trend forecasted as bearish

The GBPJPY pair formed more of the mixed sideways trading, due to its negative stability below the barrier at 200.40, announcing delaying the bullish attack in the current period, which increases the chances for activating the bearish correctional track, to expect attacking the support at 197.85, while breaking it will force it to suffer extra losses that might extend towards 197.20 reaching the next support at 197.85 and breaking it will force it to suffer extra losses that might extend to 197.20 reaching the next support at 196.20.

While the price success by breaching the barrier and holding above it will open the way for renewing the bullish attempts, to ease the way for achieving extra gains that might extend to 200.90 reaching 161.8%Fibonacci extension level at 202.45.

The expected trading range for today is between 197.85 and 199.80

Trend forecast: Bearish

Platinum price is waiting for confirming the breach– Forecast today – 4-9-2025

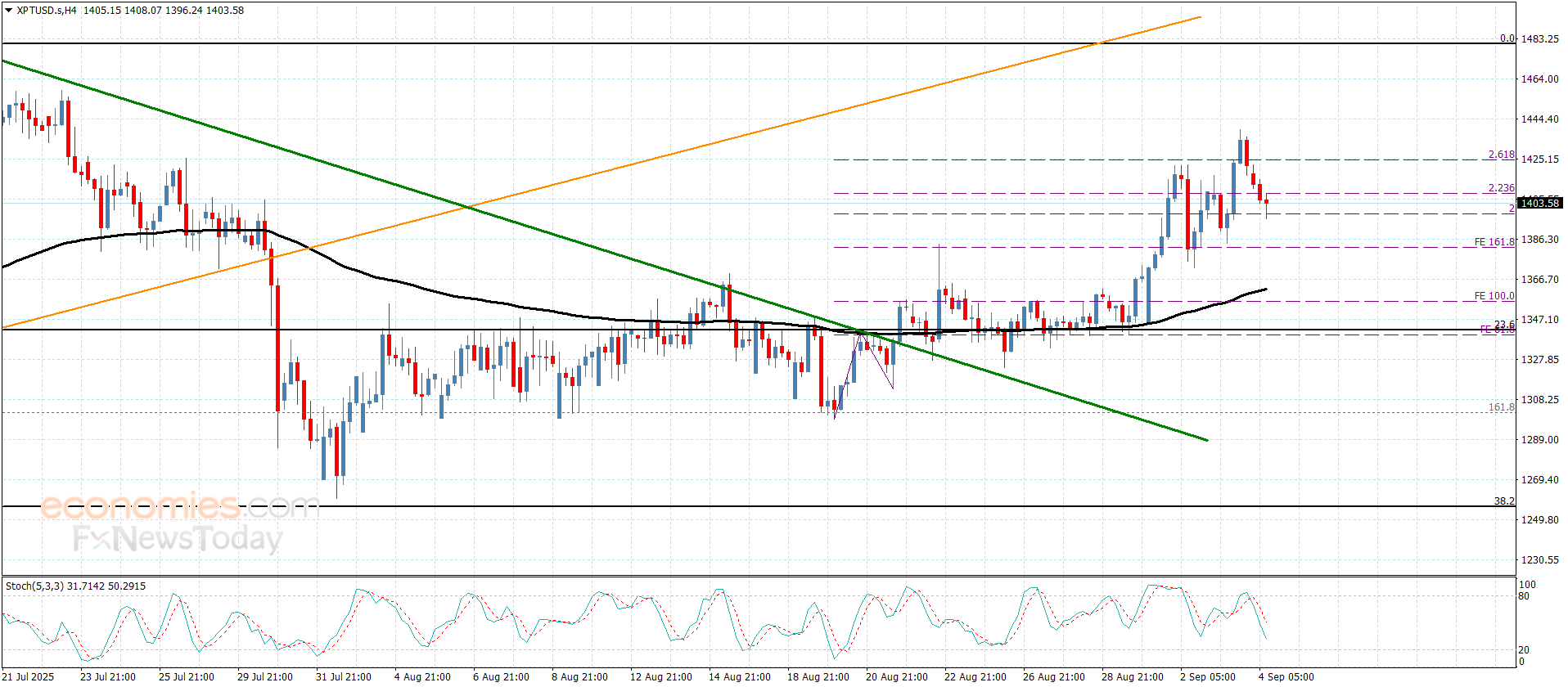

Platinum price recorded some extra gains by its rally to $1440.00, but it neediness to the positive momentum pushed it to decline below the barrier at $1426.00, which forced it to provide mixed trading by its stability near $1400.00.

Reminding you that the attempt of forming extra support at $1383.00 level will confirm the trading’s confinement within the bullish track, to keep waiting for gathering the extra positive momentum, which allows it to confirm breaching the barrier and reaching extra stations at $1455.00 level and $1480.00.

The expected trading range for today is between $1390.00 and $1455.00

Trend forecast: Bullish

Copper price repeats the positive closes– Forecast today – 4-9-2025

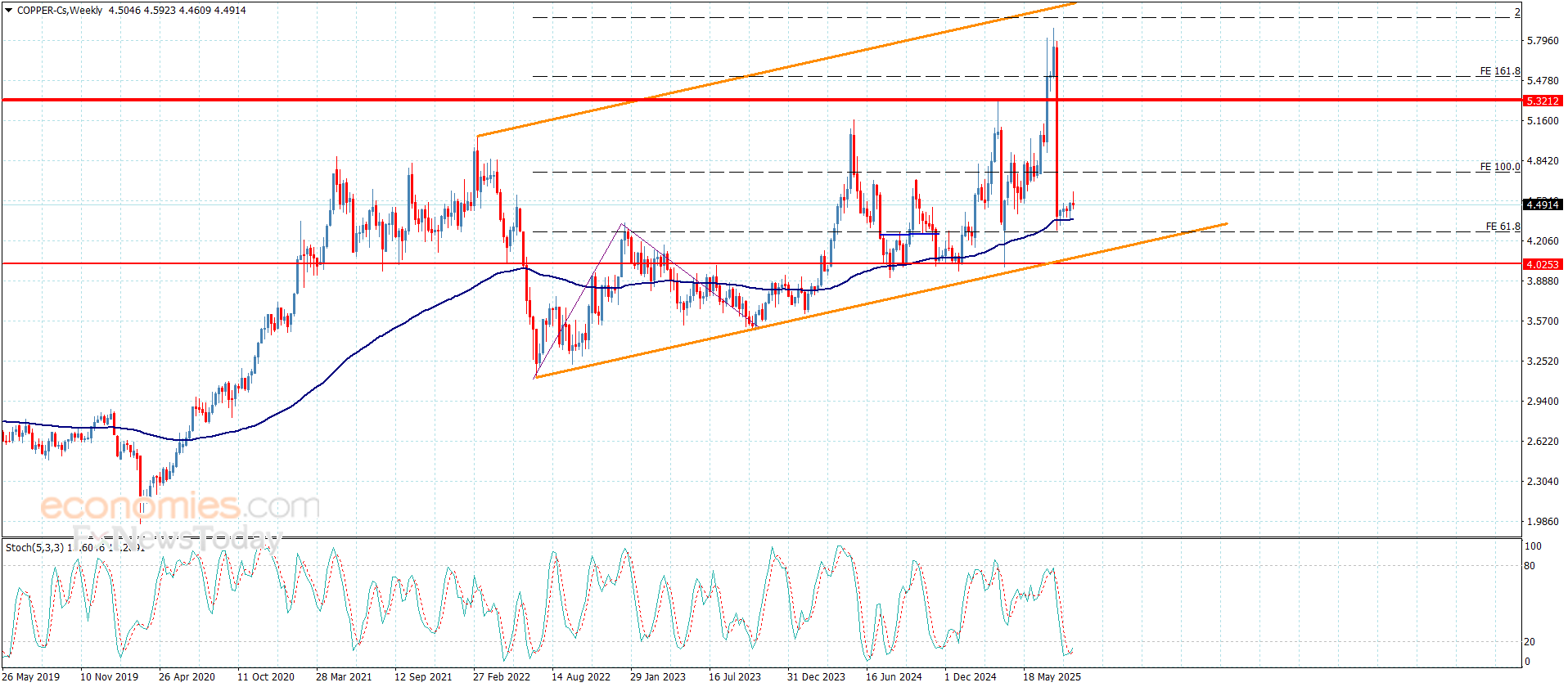

Copper price touched $4.5950 yesterday, to approach from the initial positive target, which forces it to form sideways fluctuation, due to its neediness to the positive momentum by the stability of stochastic with the oversold level.

While the stability of the price is within the bullish track, by moving away from the extra support at $4.2600, by providing positive momentum by the moving average 55, these factors make us keep the bullish suggestion, to expect surpassing $4.6200 level and reaching the next target near $4.7500.

The expected trading range for today is between $4.4200 and $4.7500

Trend forecast: Bullish

The (ETHUSD) attempts to offload its overbought conditions- Analysis- 04-09-2025

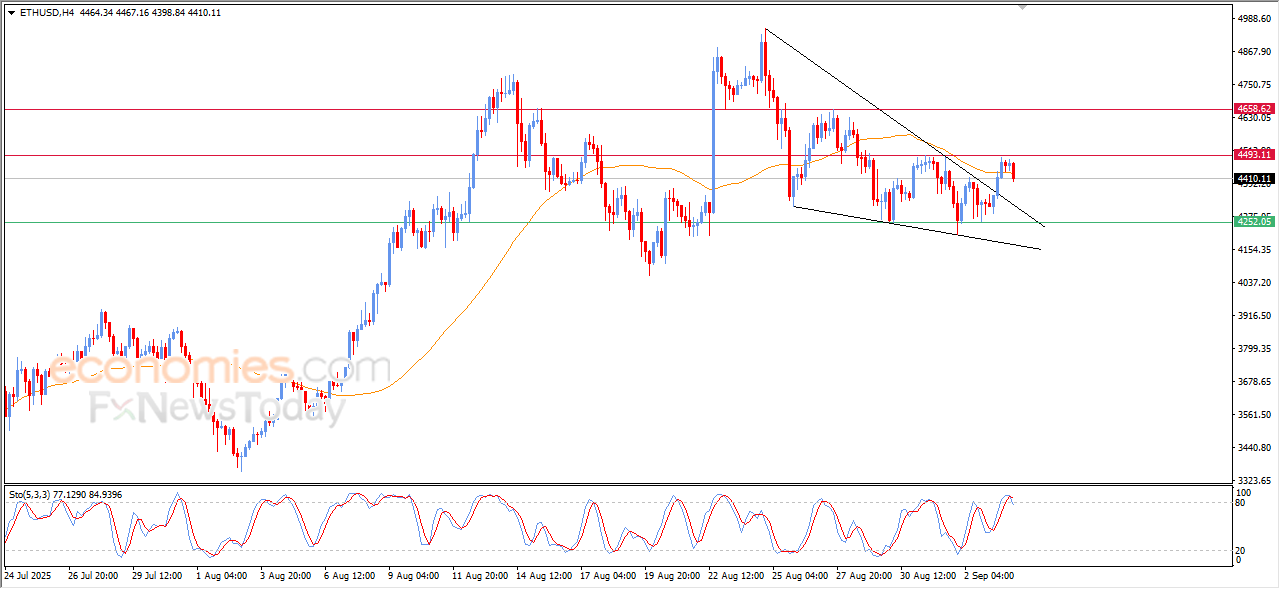

The (ETHUSD) price declined in its last intraday levels, attempting to gain bullish momentum to assist it to recover and rise again, and attempts to offload some of its clear overbought conditions on the (RSI), with the emergence of the negative signals after its success in its previous trading to get rid of the negative pressure of the EMA50, affected by positive technical formation of the short-term basis, which is the falling wedge pattern.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025: