The GBPJPY keeps the bullish trend– Forecast today – 3-11-2025

Despite the weakness of the GBPJPY pair’s trading on Friday, the attempt of its stability above the extra support at 201.70 accompanied by our bullish expectation, fluctuating near 202.55 level.

Stochastic attempts to surpass 50 level, which will increase the chances of gathering positive momentum in the current period, to ease the mission of targeting positive stations by its rally towards 203.55 initially, then attempts to renew the pressure on the barrier at 203.95.

The expected trading range for today is between 202.00 and 203.95

Trend forecast: Bullish

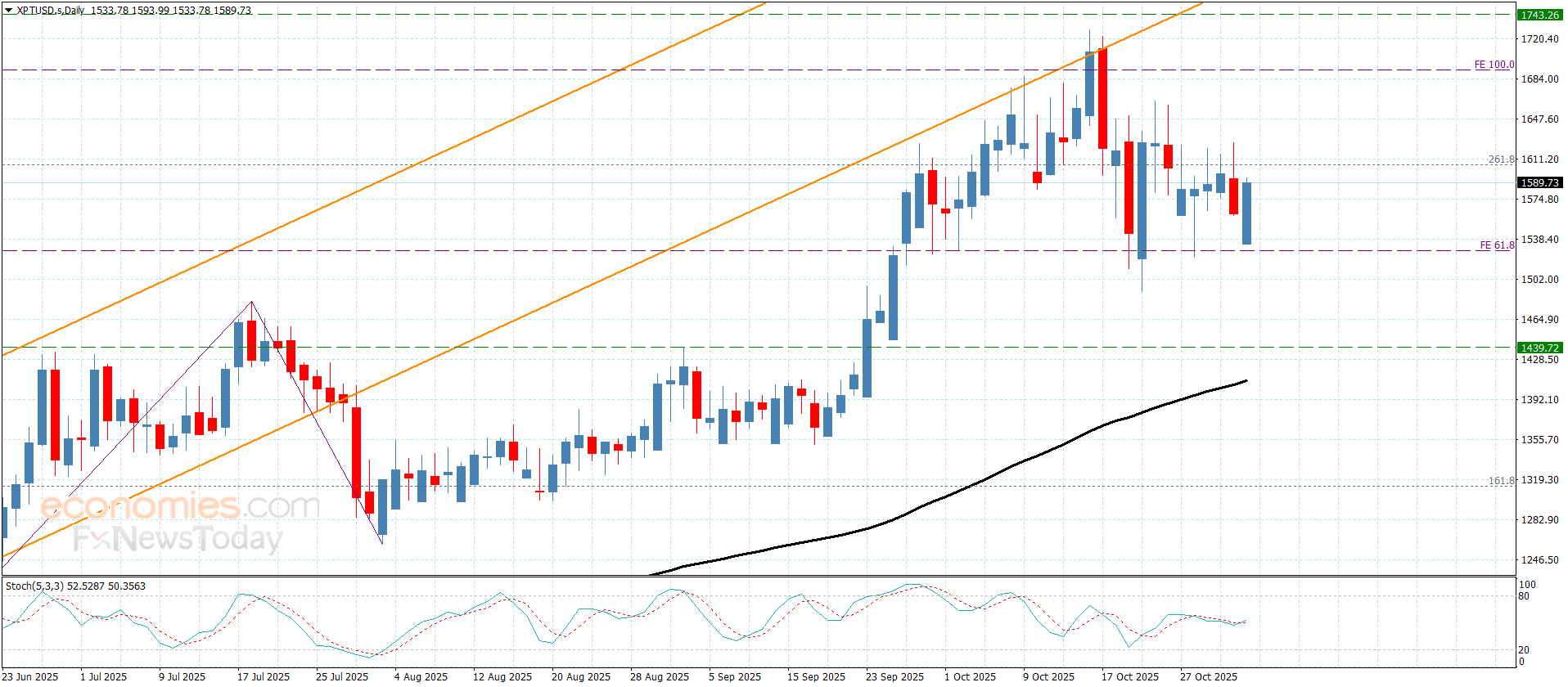

Platinum price settles above the support– Forecast today – 3-11-2025

Platinum price succeeded in facing the negative pressure, to settle above the support level at $1525.00, forming bullish wave to settle near $1605.00 level as appears in the above image.

The price needs an extra bullish momentum that allows it to surpass the current barrier, to confirm its readiness to resume the bullish attempts by its rally towards $1655.00 reaching the next target at $1695.00.

The expected trading range for today is between $1525.00 and $1655.00

Trend forecast: Bullish

Copper price repeats the sideways fluctuation– Forecast today – 3-11-2025

Copper price remains affected by the stability of the extra barrier near $5.2000, reducing the chances of resuming the bullish attack, providing more sideways trading by its stability near $5.0500.

Reminding you that the bullish scenario will remain valid if the price settles above the support at $4.7500, to increase the chances of gathering the required positive momentum to surpass the barrier and target extra positive stations that might begin at $5.3200, while reaching below this support and providing negative close will force it to provide bearish corrective trading, to suffer clear losses by reaching $4.5100 and $4.3500.

The expected trading range for today is between $4.9000 and $5.2000

Trend forecast: Fluctuated within the bullish trend

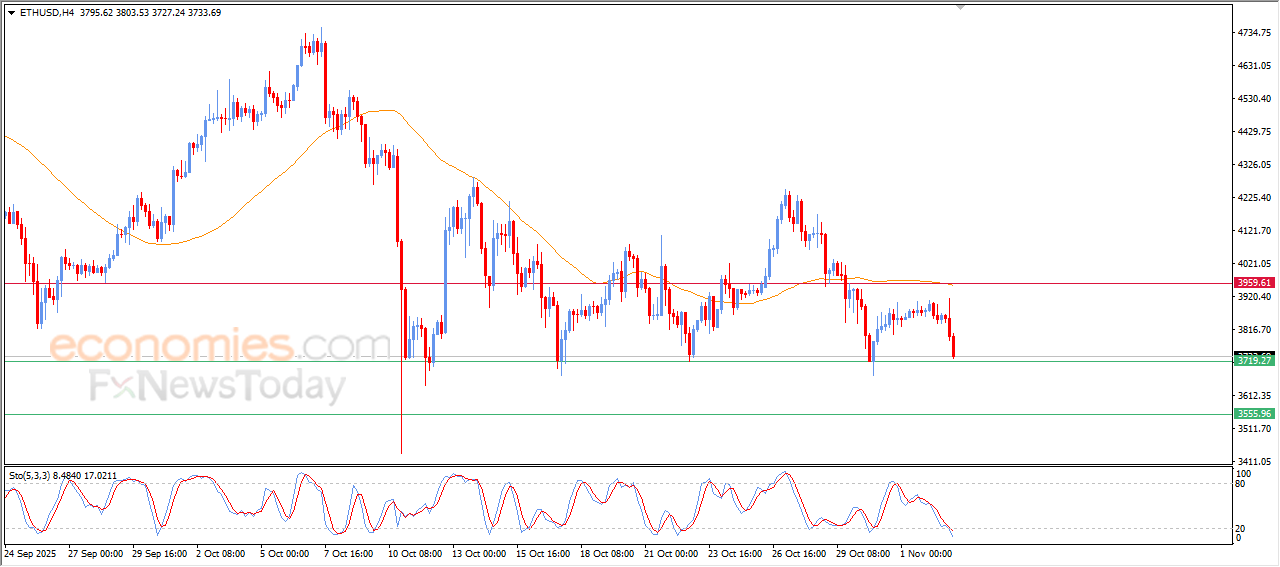

The (ETHUSD) is getting ready to break key support- Analysis- 03-11-2025

The (ETHUSD) price slipped lower in its last intraday trading, preparing to break the key support at $3,720, amid the continuation of the negative pressure that comes from its trading below EMA50, with the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, indicating the volume and the strength of the bearish momentum.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025: