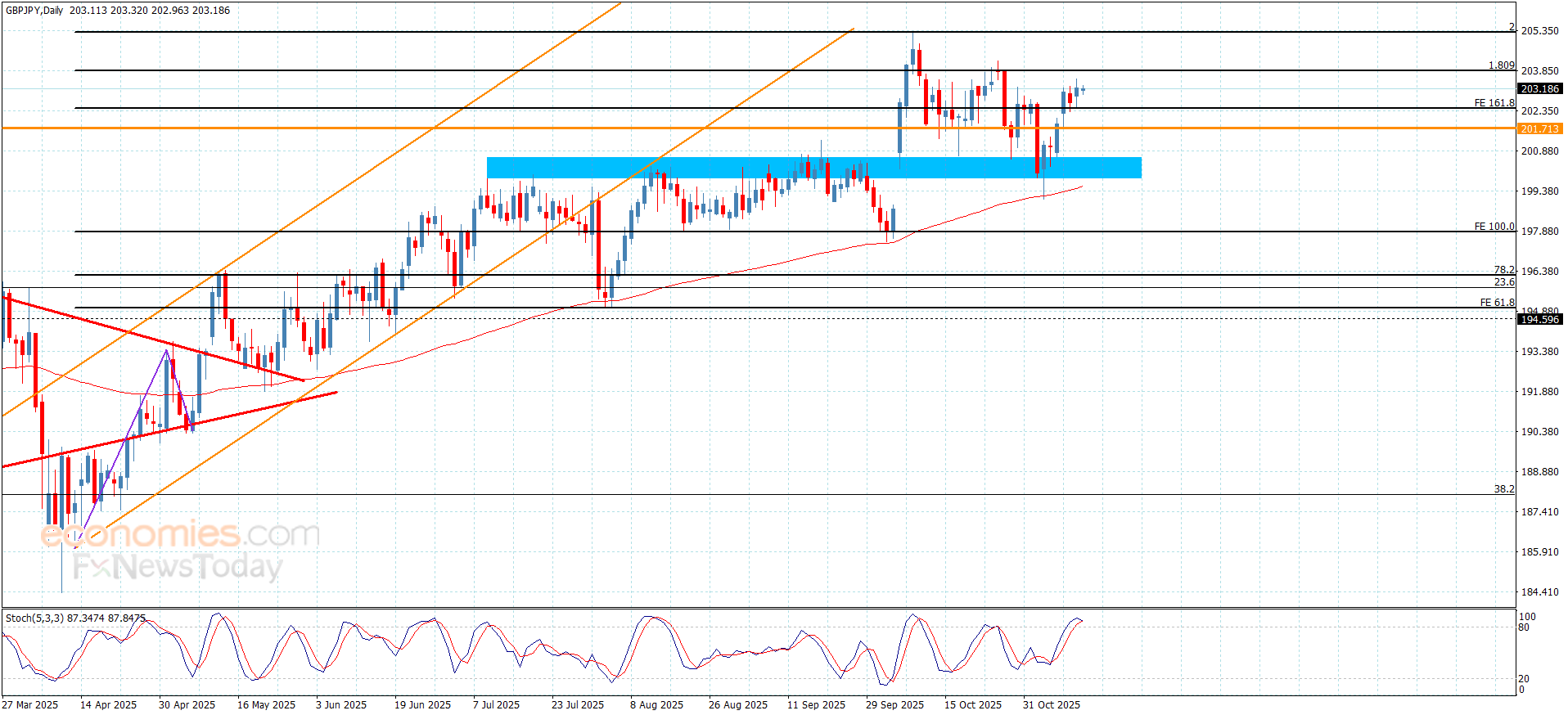

The GBPJPY is without any news– Forecast today – 13-11-2025

The GBPJPY pair didn’t record any new positive target since yesterday, affected by stochastic attempt to exit the overbought level, forming sideways trading to keep its fluctuation near 203.10 level.

Reminding you that the stability above the support level at 201.70 forms a main factor to confirm the bullish scenario, which makes us wait to gather bullish momentum, motivating the pressure on the barrier at 203.95 to find an exit for resuming the bullish attack in the near period and recording extra gains that might begin at 204.65 and 205.25.

The expected trading range for today is between 202.50 and 204.65

Trend forecast: Bullish

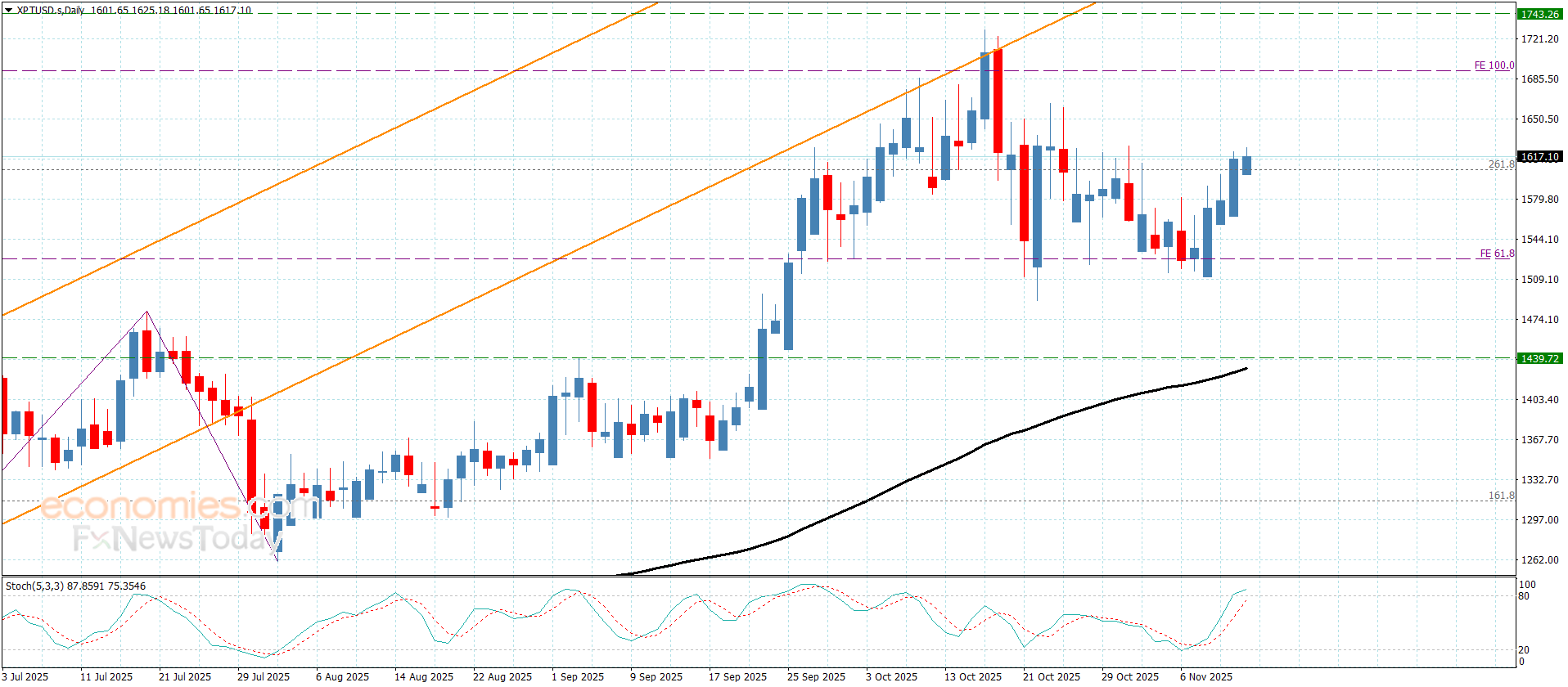

Platinum price surges above the barrier– Forecast today – 13-11-2025

Platinum price ended yesterday’s trading by providing positive signal by its rally above the sideways track that is represented by $1605.00 level, announcing its readiness to resume the main bullish attack, to record extra gains by hitting $1625.00 level.

Note that stochastic reaching towards the overbought level will increase the chances of gathering bullish momentum to ease the mission of recording extra gains by its rally towards $1660.00 reaching the next main target at $1692.00, while the risk of changing the trend is represented by breaking the support at $1520.00.

The expected trading range for today is between $1580.00 and $1640.00

Trend forecast: Bullish

Copper price confirms the continuation of the positive trading– Forecast today – 13-11-2025

Copper price confirmed the positive scenario by its stability within the bullish channel’s levels, fluctuating near $5.1000, to move away from the extra support at $4.7500.

Note that gathering positive momentum is important to form strong bullish waves, to surpass the barrier at $5.2000 level, to extend the trading towards the extra stations at $5.3200 and $5.5000.

The expected trading range for today is between $4.9000 and$5.3200

Trend forecast: Bullish

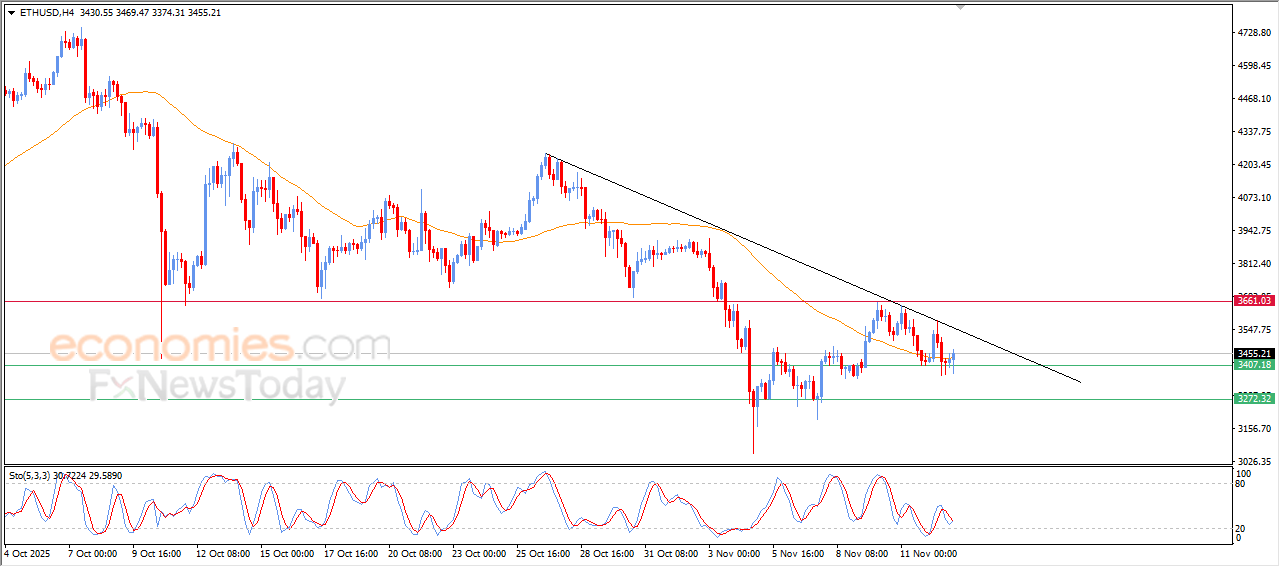

The (ETHUSD) is getting some support- Analysis- 13-11-2025

The (ETHUSD) price rose slightly in its last trading on the intraday levels, as it is leaning on the support of EMA50, gaining some bullish momentum that helped it achieve these gains, amid the dominance of the main bearish trend and its trading alongside supportive minor trend line of this track on the short-term basis, with the emergence of the negative signals on the relative strength indicators, after offloading its oversold conditions, opening the way for recording more of the losses.

VIP Trading Signals Performance by BestTradingSignal.com (20-31 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 20-31, October 2025: