The GBPJPY hits the target – Forecast today – 7-11-2024

The GBPJPY pair resumed the bullish rally yesterday, taking advantage of the additional support line stability at 197.35, to notice achieving the first additional target at 199.40 and settling near it, also, stochastic exit from the overbought areas might force the price to provide correctional negative rebound to target 198.30 and 197.75 levels.

These factors allow us to suggest the correctional bearish bias for today until reaching the mentioned correctional stations, while breaching the barrier and holding above it will reinforce the chances of resuming the bullish attack that might target 200.60 initially.

The expected trading range for today is between 198.30 and 199.60

Trend forecast: Bearish

Platinum price provides negative signal – Forecast today – 7-11-2024

Platinum price formed new negative attack yesterday by touching 965.00$ level, to provide negative signal that supports the attempt to move to the negative track in the near-term and medium-term period.

Despite bouncing towards 980.00$, stochastic fluctuation near 20 level will increase the negative pressures to agree with 995.00$ level attempt to form additional barrier, allowing us to suggest targeting 962.00$ and 949.00$ levels.

The expected trading range for today is between 960.00$ and 990.00$

Trend forecast: Bearish

Copper price suffers some losses – Forecast today – 7-11-2024

Copper price faced strong negative pressures yesterday, to push it to crawl below 4.2600$ support line and face 23.6% Fibonacci correction level at 4.2050$ followed by bouncing bullishly again.

The contradiction between the major indicators confirms surrendering to the domination of the sideways bias, noting that forming continuous obstacle at 4.3900$ against the bullish attempts will increase the pressure on the current trades, to expect attacking 4.2050$ level again, while breaking it will push the price to suffer additional losses by crawling towards 4.1450$ and 4.0800$ levels.

The expected trading range for today is between 4.1500$ and 4.3500$

Trend forecast: Bearish

Top 4 Cryptocurrencies to Buy Now: November Investment Picks for a Strong 2025 Portfolio

With November here and the end of the year approaching, the cryptocurrency market offers exciting investment opportunities that should not be overlooked. Current market conditions have positioned several popular and highly-regarded cryptocurrencies at attractive entry points, making this an ideal time for investors to build a strong and diversified portfolio.

This article will spotlight the top four cryptocurrencies to buy now, worthy of consideration in your investment strategy, no matter its size. These selections could potentially turn a modest investment of $50 to $100 into substantial gains.

Ethereum (ETH)

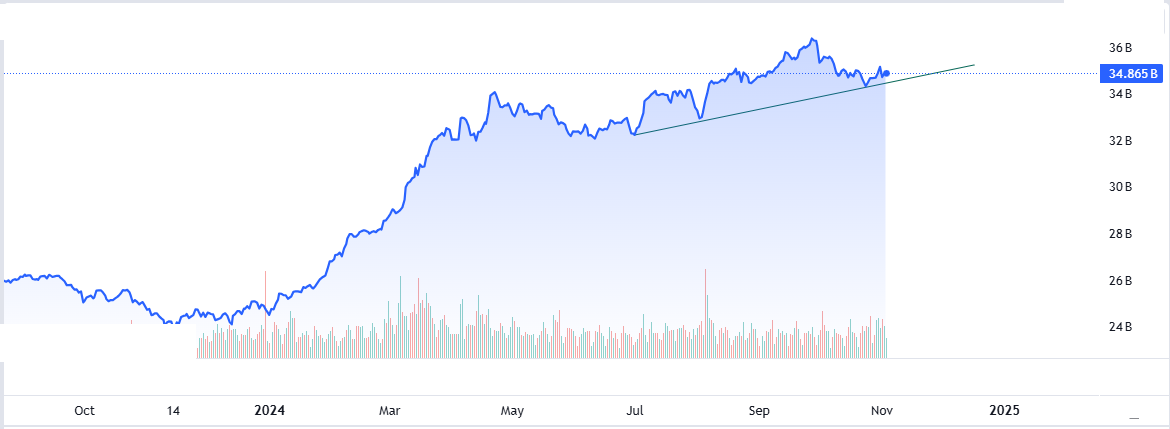

As both a cryptocurrency and a blockchain platform, Ethereum is a favorite among developers due to its potential applications, such as smart contracts that execute automatically upon meeting conditions and non-fungible tokens (NFTs). Ethereum has also significantly reduced its energy consumption while retaining its position as a leading platform for decentralized finance (DeFi).

Ethereum has seen tremendous growth from April 2016 to the end of October 2024, with its price increasing from around $11 to approximately $2620, marking a 23,717% gain.

Cardano (ADA)

ADA has yielded remarkable returns since its inception, with early investors enjoying gains exceeding 3000% during bullish markets. Cardano holds a prominent position in the cryptocurrency and blockchain space thanks to its research-based approach and formal verification methods, ensuring a high level of security and reliability.

U.S. Dollar Coin (USDC)

The U.S. Dollar Coin (USDC) is a stablecoin, meaning it is backed by the U.S. dollar and aims to maintain a 1 USDC to 1 USD ratio. Operating on Ethereum, USDC can be used to complete global transactions.

TRON (TRX)

TRON was established in 2017, with an initial valuation of $0.0019 per token. At its peak in 2018, TRX reached $0.2245, marking a 11,715% gain within months. Currently, TRX is valued at around $0.16.

Best Crypto Trading Brokers November 2024

- Pepperstone - Best overall crypto trading broker for beginners in November 2024. Founded 2010. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in cryptocurrencies (CFDs) November 2024. Founded 2008. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top crypto trading platform for educational materials and copy trading in November 2024. Founded 2009. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.