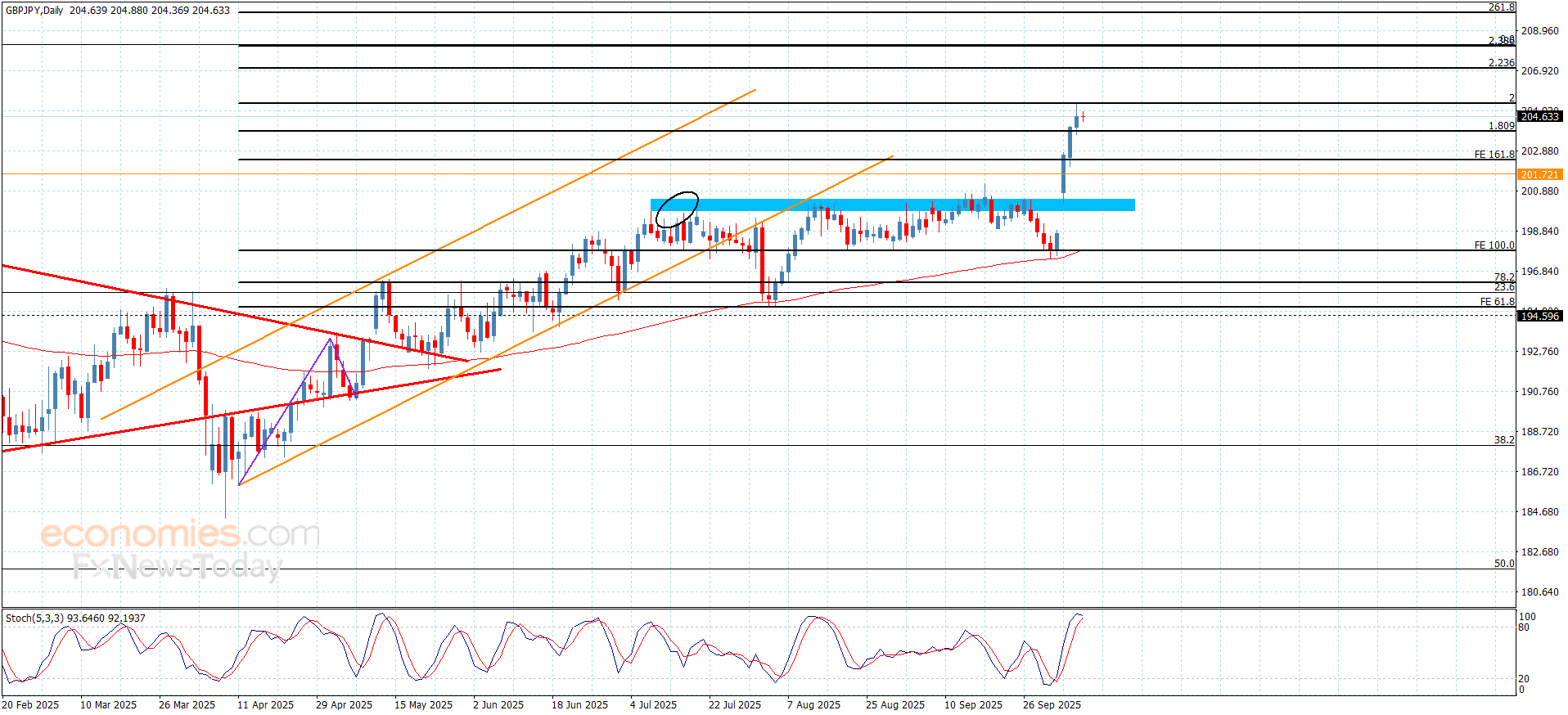

The GBPJPY hits the suggested target– Forecast today – 9-10-2025

The GBPJPY pair ended the bullish rally by hitting 205.35 level, facing 2.00%Fibonacci extension level, forming a new barrier against the bullish attack, providing weak sideways trading by its stability near 204.50.

Note that stochastic attempts to exit the overbought level might force the price to provide corrective trading to target 203.80 and 203.35 level, while breaching the current barrier will confirm its move to new bullish stations, to attempt to achieve extra gains by its rally to 205.75 reaching 207.05.

The expected trading range for today is between 203.80 and 205.15

Trend forecast: Bearish

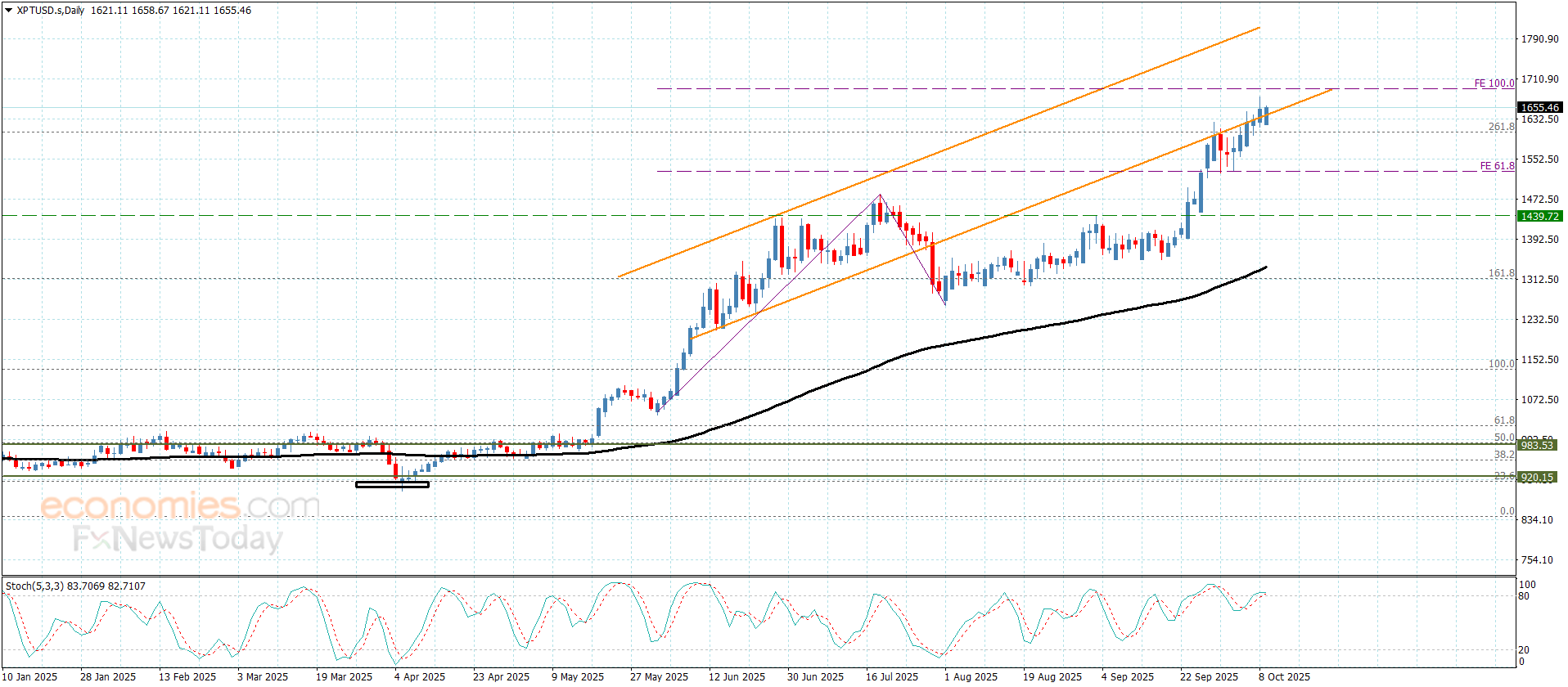

Platinum price repeats the positive stability– Forecast today – 9-10-2025

Platinum price repeated providing positive closes in the last period by its stability above $1600.00 level, forming an extra support against the bullish attempts, attempting to settle within the minor bullish channel’s levels by its fluctuating near $1655.00.

Note that stochastic attempt to settle within the overbought level might provide extra positive momentum, reinforcing the mission of recording positive stations, which might begin at $1690.00 and $1727.00, while the price decline below the mentioned extra support might force it to provide mixed trading, and there is a chance to decline towards $1665.00 before recording any of the suggested extra targets.

The expected trading range for today is between $1600.00 and $1690.00

Trend forecast: Bullish

Copper price is paving the way for a new rise – Forecast today – 9-10-2025

Copper price began today’s trading with a new positivity, attempting to breach the barrier at $5.0600 level, to confirm its surrender to the suggested bullish scenario.

We recommend waiting for confirming the activation of the price with the positivity of the main indicators by its rally towards $5.200 level, then attempt to press on the barrier at $5.3200, forming the initial main target of the current bullish track.

The expected trading range for today is between $4,988 and $5.2000

Trend forecast: Bullish

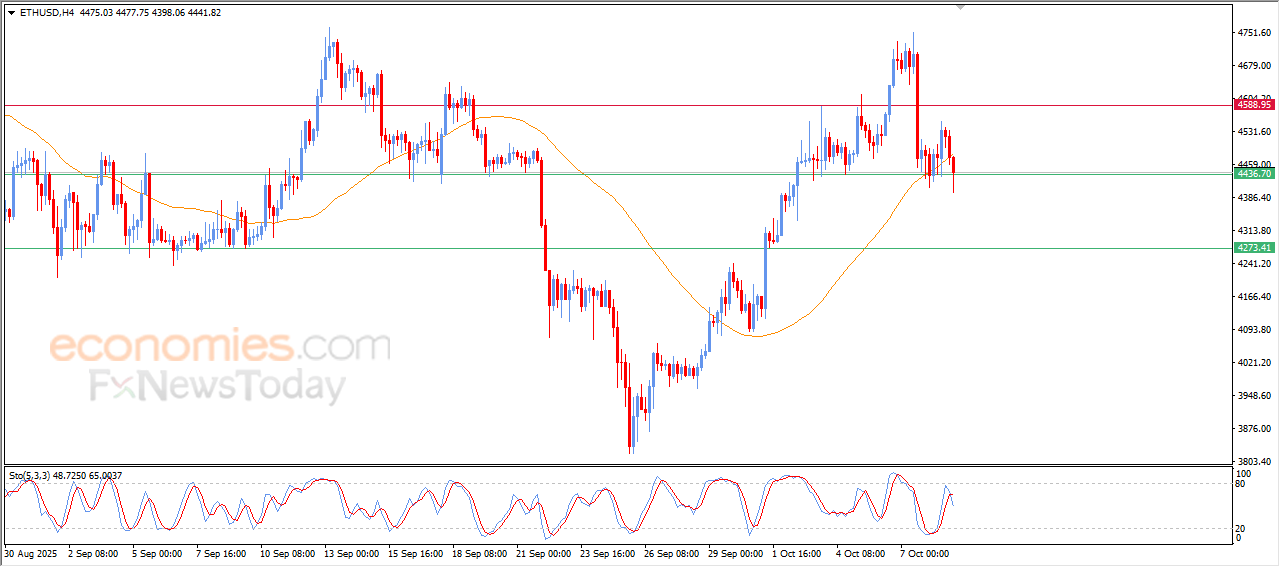

The (ETHUSD) price is under negative pressure- Analysis- 09-10-2025

The (ETHUSD) price declined in its last intraday trading, surpassing the support of its EMA50, putting it under negative pressure that intensifies with the emergence of the negative signals on the relative strength indicators, after reaching overbought levels, preparing to break the critical support of $4,435, under the dominance of bearish corrective wave on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025: