The GBPJPY fails to confirm the breach– Forecast today – 19-9-2025

AI Summary

- GBPJPY failed to confirm breach above 200.45, indicating bearish correctional bias

- Stochastic showing negative momentum, increasing chances for extra losses towards 198.60

- Expected trading range for the day is between 198.60 and 200.40, with a bearish trend forecasted

The GBPJPY pair attempted to regain its bullish momentum by its rally above 200.45, to record some gains by hitting 201.20 level, but its decline again below the barrier and providing new negative close supports the dominance of the bearish correctional bias, to notice its stability near 199.55.

The stability below the barrier and stochastic attempt to provide negative momentum might increase the chances for suffering extra losses, to expect reaching 198.60, then attempts to press on the extra support at 197.80.

The expected trading range for today is between 198.60 and 200.40

Trend forecast: Bearish

Platinum price continues the sideways fluctuation– Forecast today – 19-9-2025

Platinum price remains under the effect of the sideways track, due to the continuation of the main indicators’ contradiction, especially by stochastic reach to 50 level, which forces it to delay the bullish attack and hold near the moving average 55 at $1382.00 level.

The stability of the price above the support at $1355.00 is important for confirming the continuation of the positivity, to keep waiting for gathering the positive momentum, to ease the mission of surpassing $1400.00 level, then begin recording the targets at $1422.00 and $1435.00.

The expected trading range for today is between $1370.00 and $1422.00

Trend forecast: Bullish

Copper price didn’t move anything– Forecast today – 19-9-2025

Copper price provided slow sideways trading, despite its stability within the bullish track, to keep fluctuating near $4.5500 level, announcing its surrender to form an extra barrier at $4.6200 level against the bullish attempts.

The positive factors began by the unionism of the main indicators by providing positive momentum, and the continuation of forming extra support at $4.2600 level makes us expect surpassing the current obstacle to reach the extra stations near $4.7500 and $4.9500.

The expected trading range for today is between $4.5000 and $4.7500

Trend forecast: Bullish

The (ETHUSD) gathers its positive momentum- Analysis- 19-09-2025

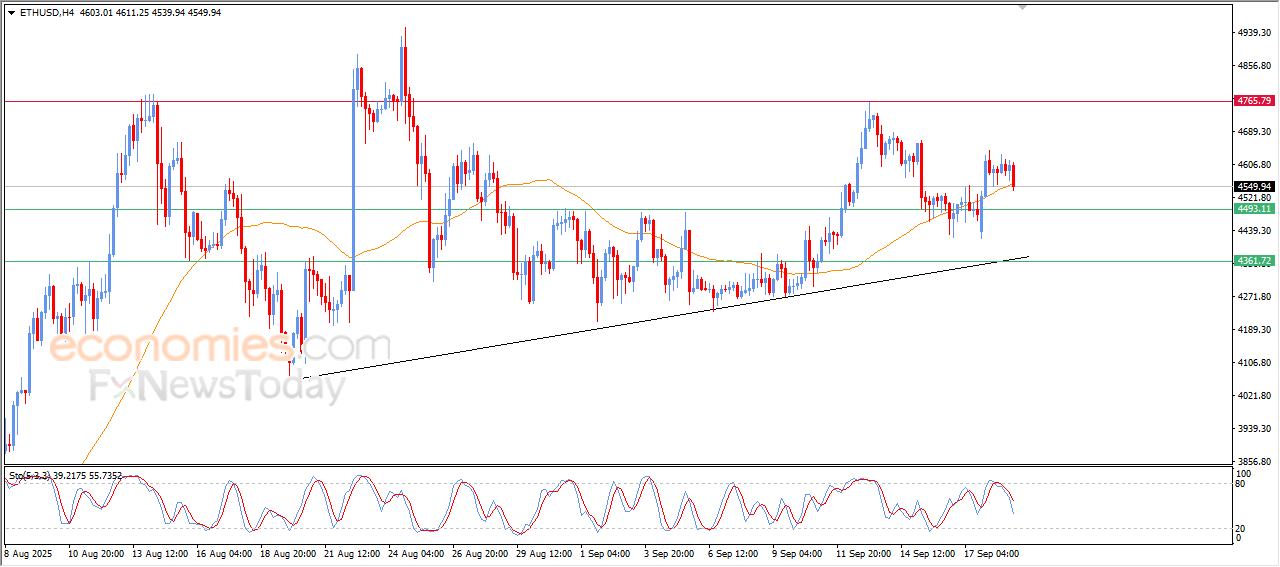

The (ETHUSD) price declined in its last intraday trading, amid he emergence of the negative signals on the relative strength indicators, in attempt to offload its overbought conditions, gathering its positive strength that might help it to recover and rise again, leaning on support of its EMA50, amid the dominance of the main bullish trend and its trading alongside minor bias line on the short-term basis, reinforcing the chances for the price recovery on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025: