The GBPJPY confirms the positivity– Forecast today – 20-1-2026

The GBPJPY pair ended yesterday’s trading by providing positive close above 212.00 level, to settle above the bullish channel’s support, confirming its readiness to form strong bullish waves in the near and medium period.

Forming extra support by the moving average 55 fluctuation near 211.40, by stochastic attempt to reach overbought level, these factors support our bullish scenario, to keep waiting for targeting212.80 level and surpassing it will form the next main target of the bullish trading at 213.45 level.

The expected trading range for today is between 211.80 and 213.45

Trend forecast: Bullish

Platinum price resists stochastic negativity– Forecast today – 20-1-2026

Platinum price kept attempting to provide negative momentum by stochastic exit from 80 level, noticing the continuation of its fluctuation in sideways range near $2340.00 level, keeping its stability above $2235.00 support.

We recommend waiting to gather the bullish momentum and its rally near $2420.00 level, to confirm its readiness to resume the bullish moves and targeting new historical stations that might target $2500.00 and $2545.00.

The expected trading range for today is between $2280.00 and $2420.00

Trend forecast: Bullish

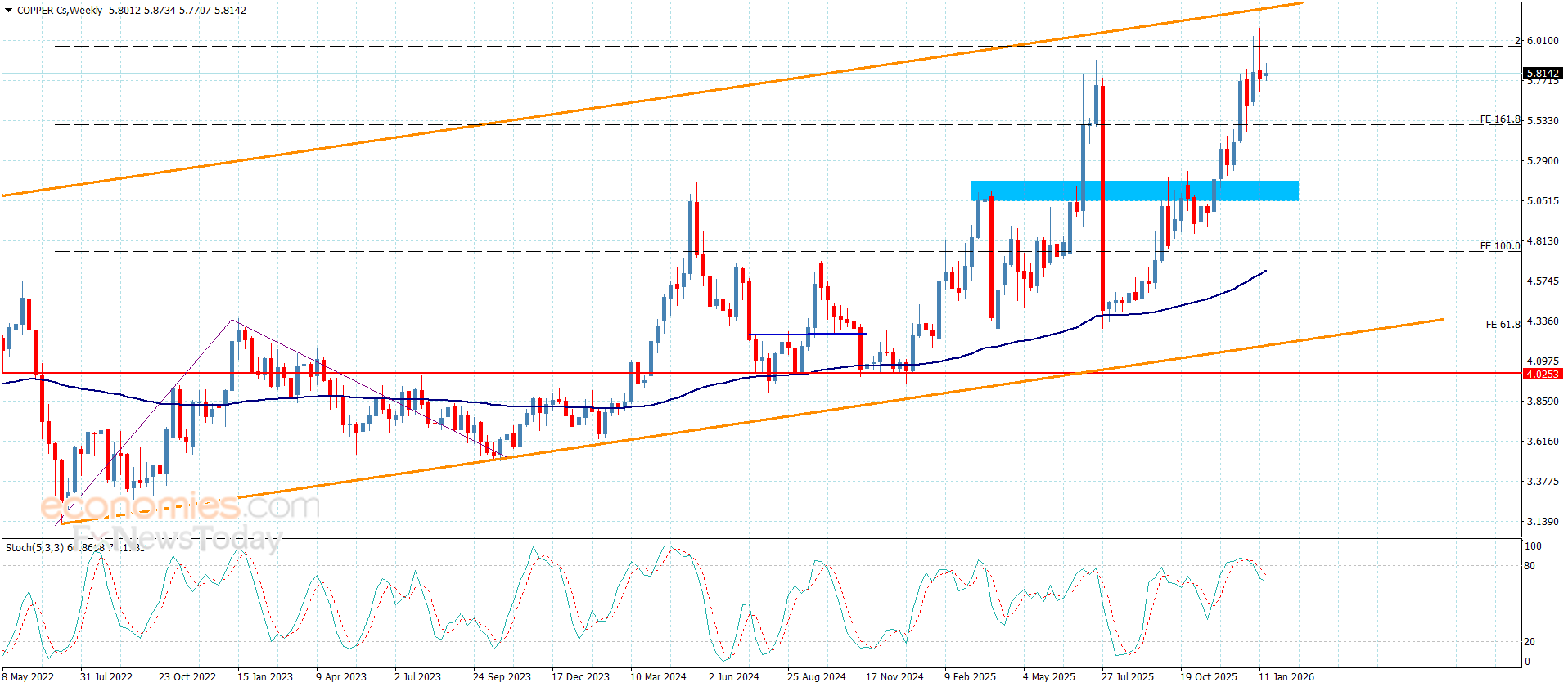

Copper price repeats the negative closes– Forecast today – 20-1-2026

No change for copper price attempts to activate the bearish corrective scenario due to the stability below the barrier at $5.9700 in the last trading, and stochastic exit from overbought level confirms facing intraday bearish pressures, keeping our expectations of targeting $5.6500 level reaching $5.5100 support.

While the price return to settle above the barrier and providing positive close will reinforce the chances of resuming the main bullish movement by its rally towards $6.1900 directly, to face the resistance of the bullish channel’s resistance, to monitor its behavior to detect the expected trend in the upcoming trading.

The expected trading range for today is between $5.7500 and $5.9500

Trend forecast: Bearish

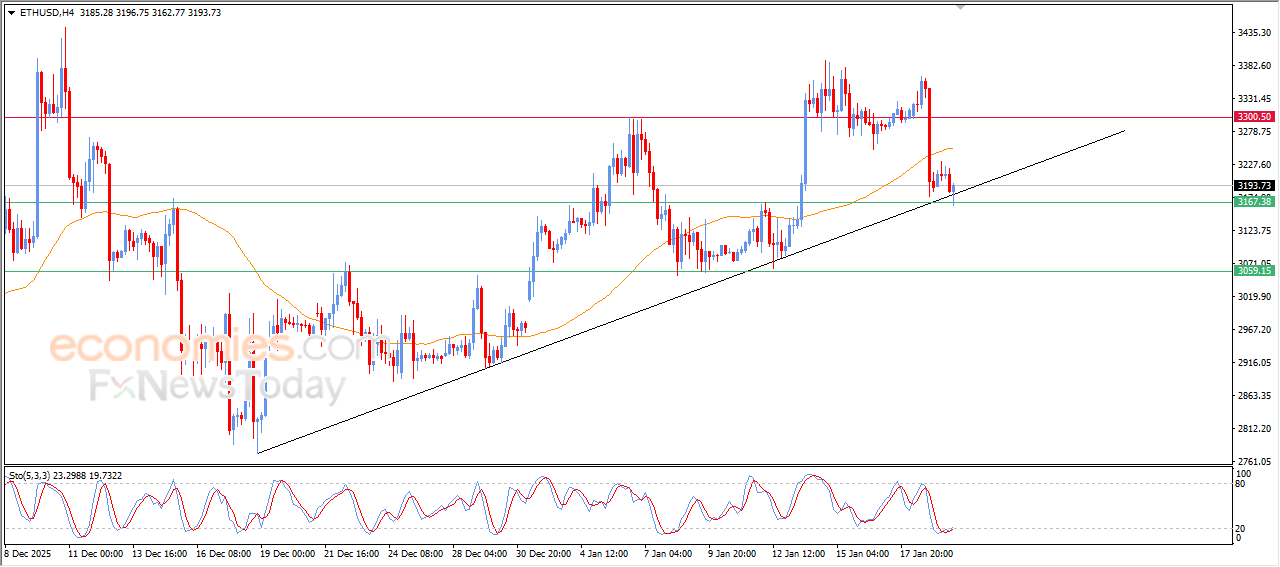

The (ETHUSD) gets some support- Analysis- 20-01-2026

The (ETHUSD) price rose slightly in its last trading on the intraday levels, due to its holding on main bullish trend line on short-term basis, gaining some bullish momentum to help it recover some of its previous losses, and attempting to offload some of its clear oversold conditions on relative strength indicators, especially with the emergence of positive signals from there, on the other hand, the price is under negative pressure due to its trading below EMA50, which reduces the chances of full recovery on the near-term basis.