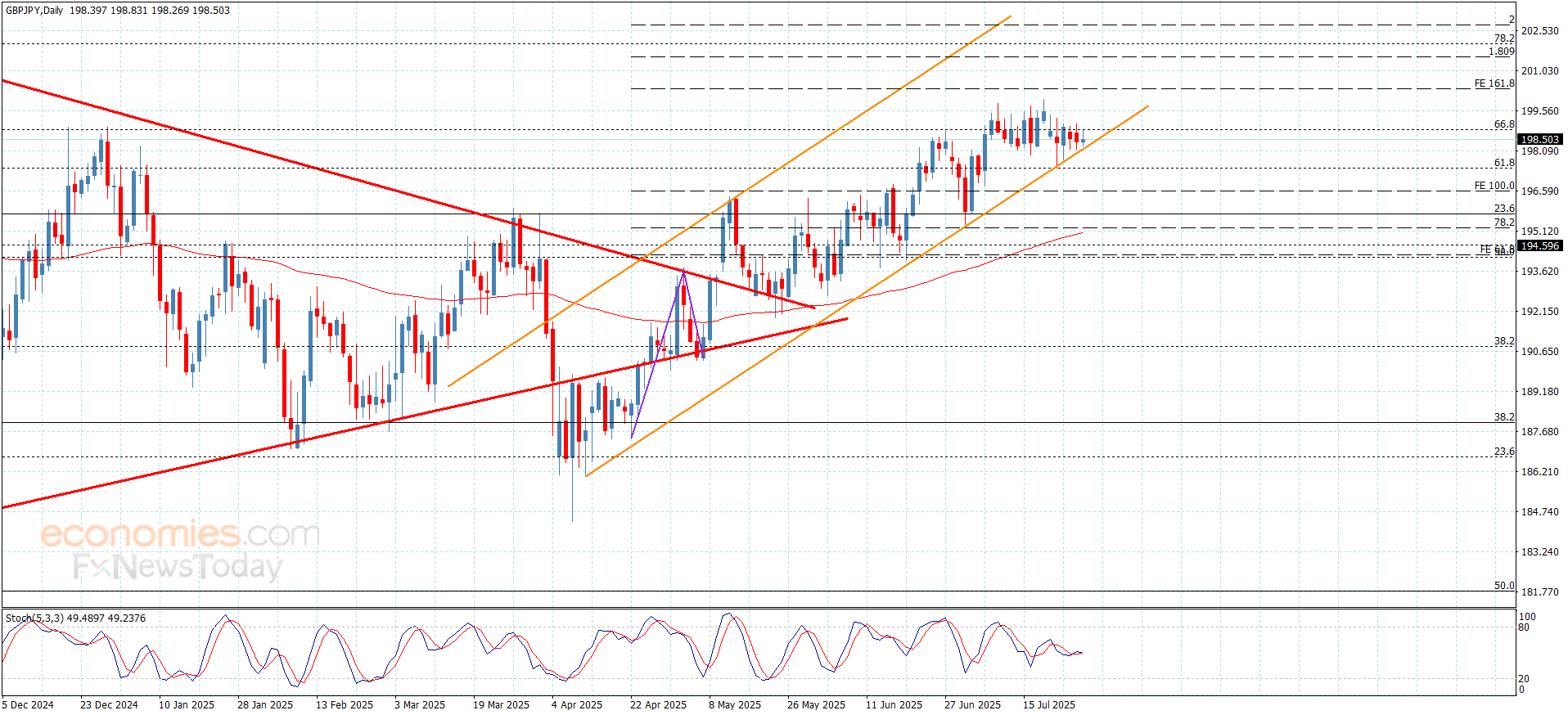

The GBPJPY attempts to settle within the bullish channel– Forecast today – 28-7-2025

AI Summary

- GBPJPY pair showing bullish momentum within minor bullish channel

- Target levels at 199.25 and 200.35, with support at 198.10

- Expected trading range for the day between 198.25 and 200.35, trend forecast is bullish

The GBPJPY pair continued facing stochastic negativity in the last trading by providing repeated positive closes above the support of the minor bullish channel at 198.10, reinforcing the chances for gathering the positive momentum, and activating the bullish attempts to target 199.25 level, then wait for reaching the next main target at 200.35.

Noting that the price decline below the current support will force it to form some of the bearish correctional trading by reaching 197.50, reaching the main support at 196.56.

The expected trading range for today is between 198.25 and 200.35

Trend forecast: Bullish

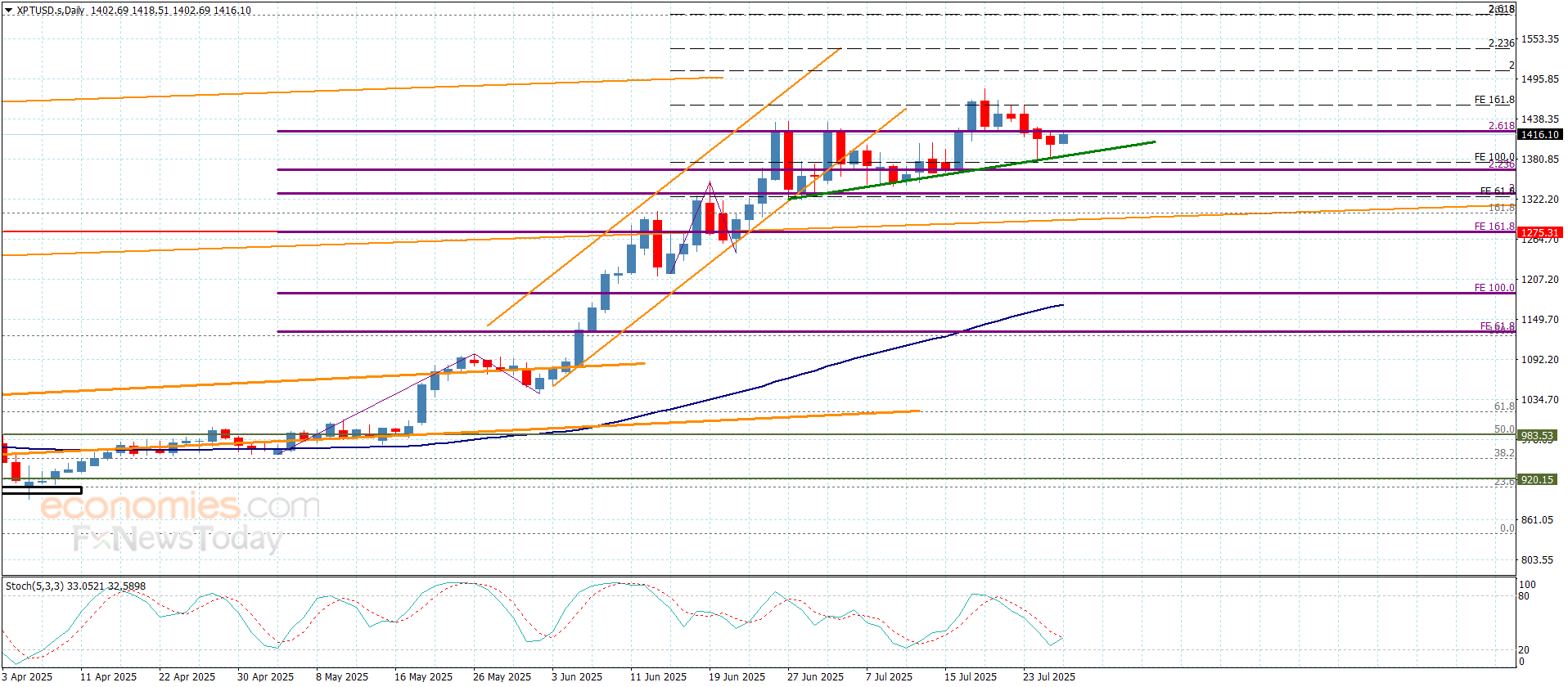

Platinum price receives the positive momentum– Forecast today – 28-7-2025

Platinum price ended the correctional trading by testing the extra support at $1381.00, forming a confirmation key for the continuation of the positive continuation, attacking the barrier at $1420.000 level, to find an exit for resuming the bullish attempts.

Stochastic begins to provide positive momentum by its repeated stability above 20 level, which makes us wait for breaching the current barrier and holding above it, to ease the mission of targeting $1458.00 level, and surpassing it will provide a chance for achieving new gains that might extend to $1480.00 and $1507.00.

The expected trading range for today is between $1390.00 and $1458.00

Trend forecast: Bullish

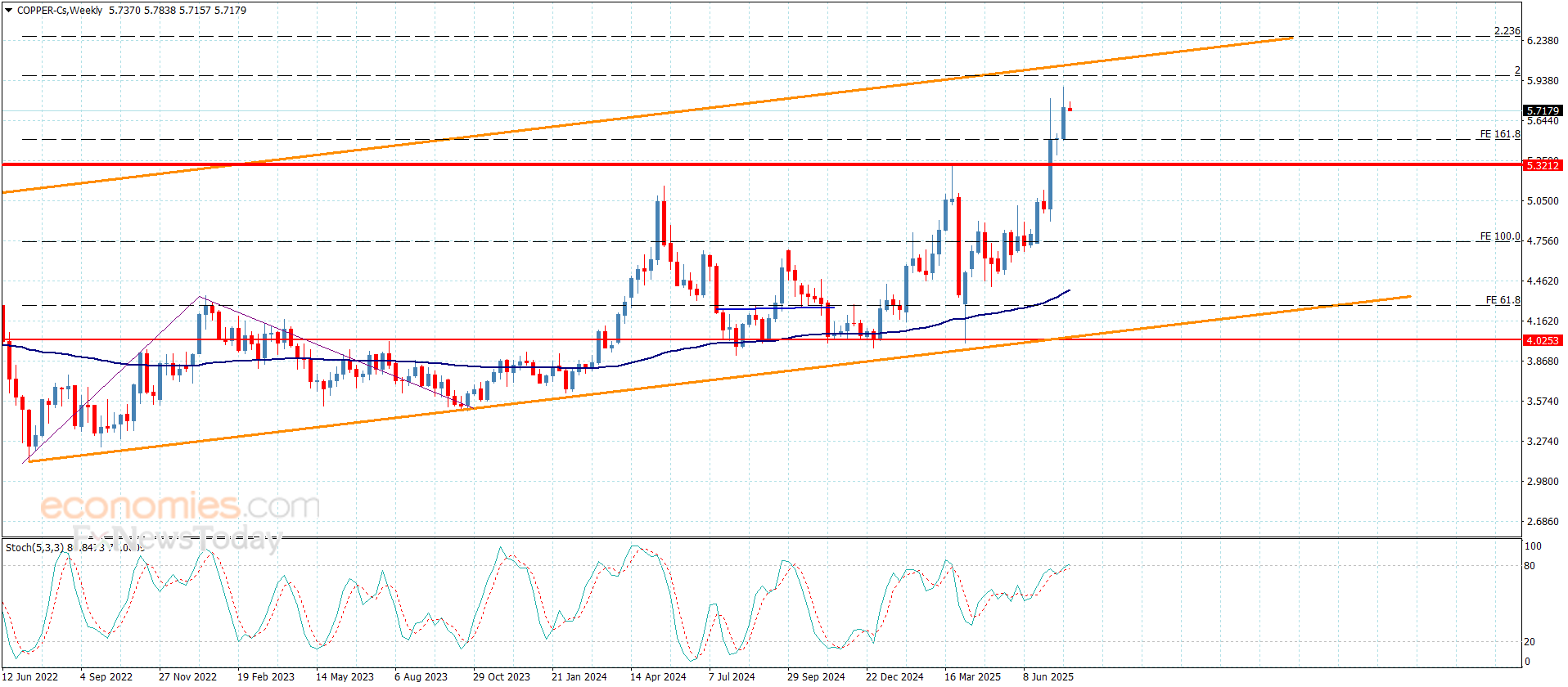

Copper price remains positive– Forecast today – 28-7-2025

Copper price continued providing positive close in the last period by its stability above the support at $5.3200, to notice achieving big gains by its rally in Friday to $5.8900, then attempt to gather some of the gains by forming temporary correctional rebound and its fluctuation near $5.7100.

Forming extra support at $5.500 level makes us expect gathering the required positive momentum, reinforcing the efficiency of the bullish scenario until reaching Fibonacci extension level at $5.9750, then attempts to press on the bullish channel’s resistance at $6.0700.

The expected trading range for today is between $5.6200 and $5.9750

Trend forecast: Bullish

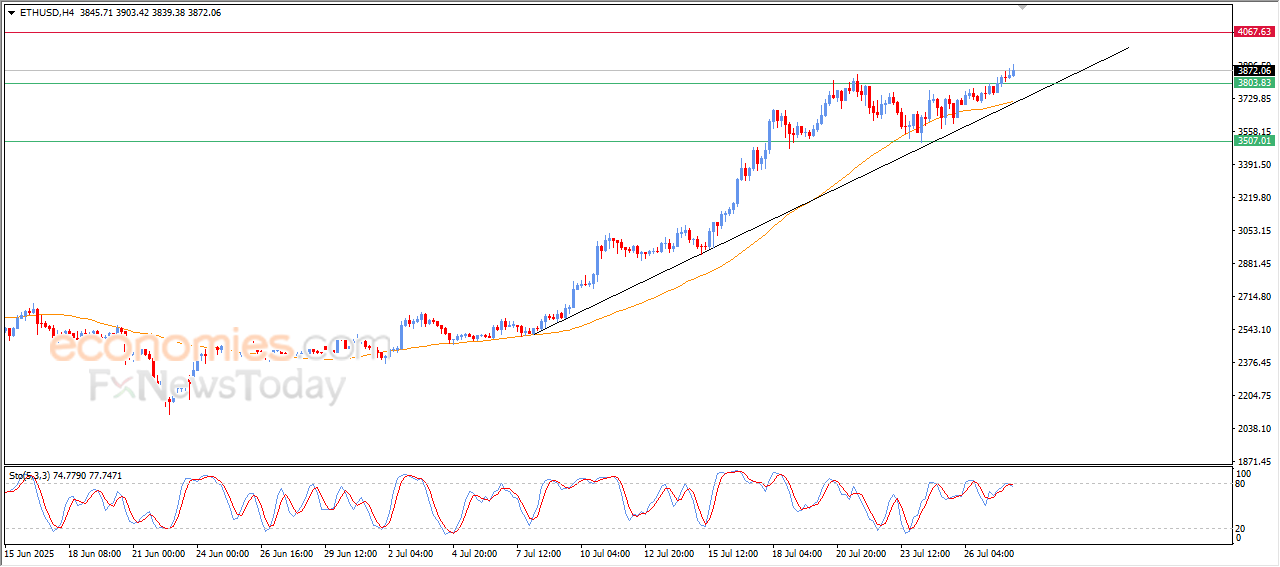

The (ETHUSD) soars high-Analysis- 28-07-2025

The (ETHUSD) price expanded its gains in its last intraday trading, to confirm breaching the critical resistance level at $3,800, amid the dominance of the main bullish trend and its trading alongside a bias line, with the continuation of the dynamic support that is represented in its trading above its EMA50, on the other hand, we notice the beginning of negative overlapping signals on the (RSI), after reaching overbought level, which may put pressure on the upcoming gains of the price with the beginning of offloading this overbought conditions.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Signals Performance – Week of July 21–25, 2025