The GBPJPY approaches the target– Forecast today – 30-10-2025

The GBPJPY pair approached the target near 200.45 in yesterday's trading, which forms an important support level to push it to form bullish rebound by hitting 202.10 level, to indicate regaining the bullish trend.

The price needs a new bullish momentum that allows it to provide new bullish close above 201.70 level, reinforcing the chances of targeting positive stations that are located near 202.55 and 203.25, while declining and holding below 200.45 will force it to suffer extra losses, to expect targeting 199.20 level initially.

The expected trading range for today is between 200.80 and 202.55

Trend forecast: Bullish by the stability of 200.45

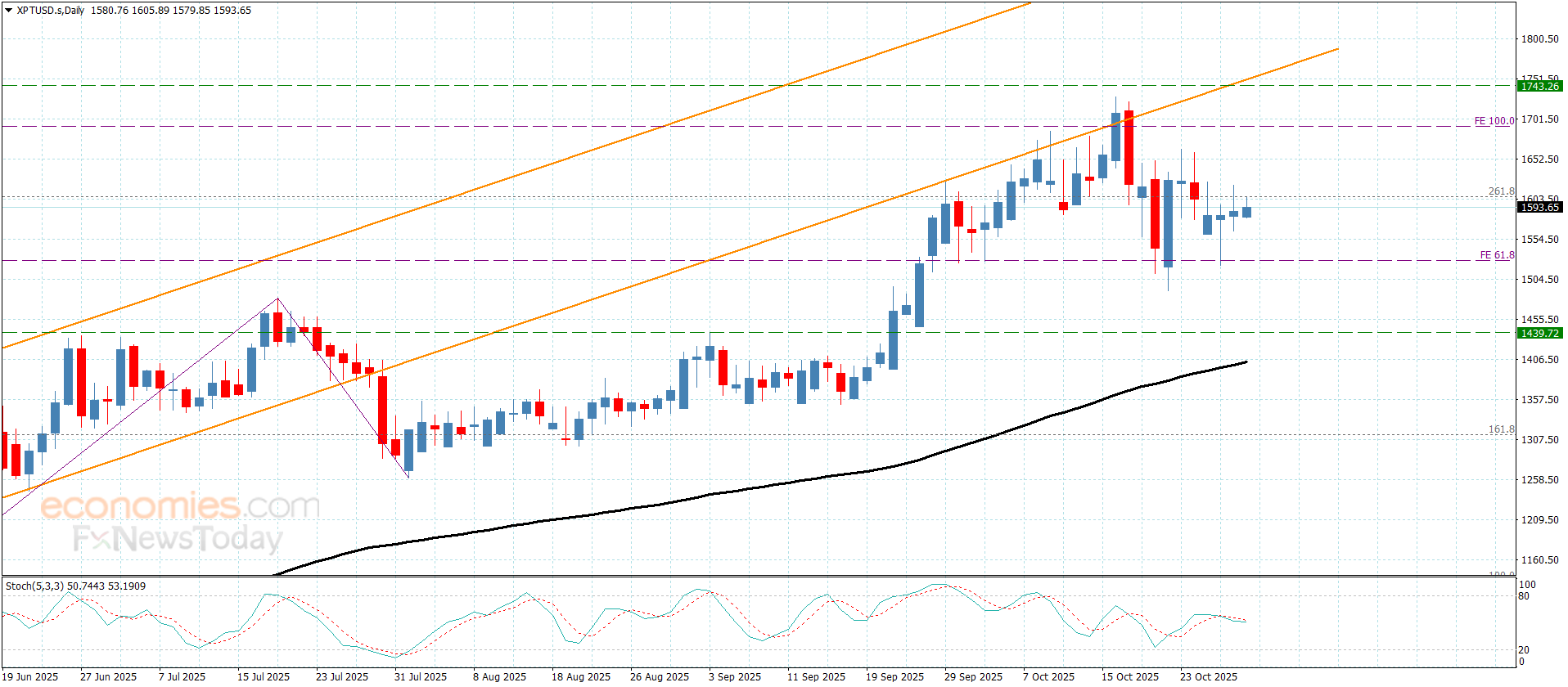

Platinum price provides sideways trading– Forecast today – 30-10-2025

Platinum price didn’t move anything in yesterday’s trading, due to the repeated confinement between the extra support at $1525.00, while $1605.00 level keeps forming a barrier against the attempts of activating the previously suggested bullish trend.

Providing more of the sideways trading until breaching the current barrier and holding above it, to confirm its readiness to record some gains by its rally towards $1665.00 and $1695.00, while breaking the support and holding below it will force the price to suffer new losses towards $1470.00 reaching the next support near $1440.00.

The expected trading range for today is between $1530.00 and $1605.00

Trend forecast: Sideways

Copper price needs to confirm the breach– Forecast today – 30-10-2025

Copper price touched $5.2300 level, then bounces to settle below $5.2000 level, which forces it to provide new sideways fluctuated moves near $5.1300 level.

The price needs a new bullish momentum, to confirm breaching the current obstacle, to rally towards the next target at $5.3200, while the failure to breach might force the price to provide bearish corrective trading, which forces it to suffer some losses by reaching $4.9500 followed by the extra support at $4.7500.

The expected trading range for today is between $5.0500 and $5.3200

Trend forecast: Bullish

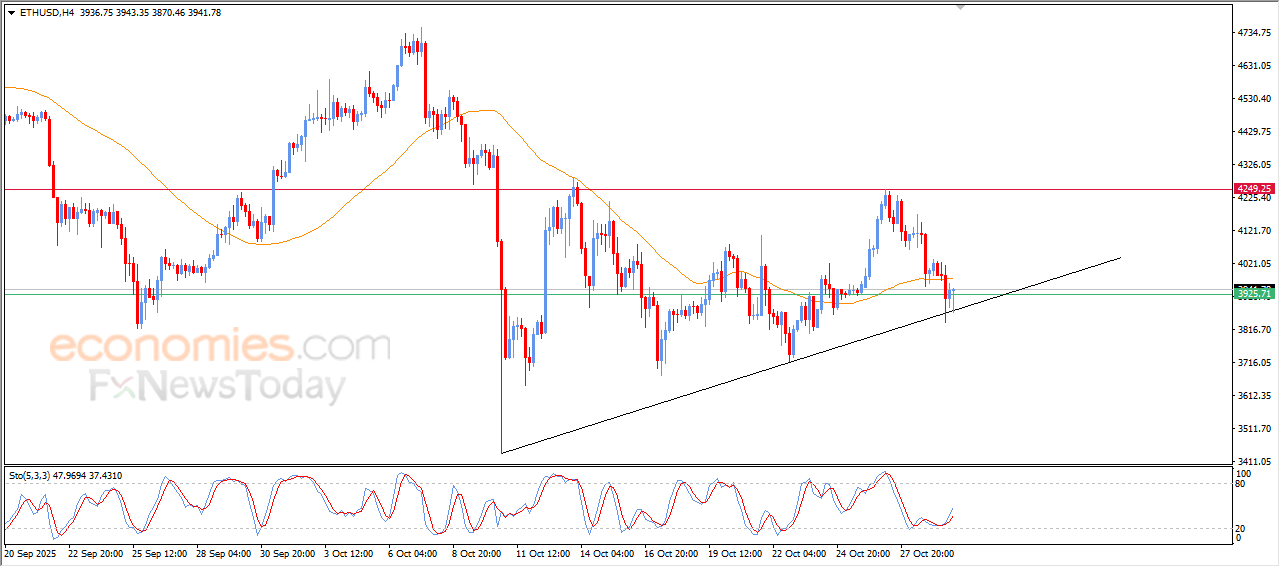

The (ETHUSD) is showing mixed signs- Analysis- 30-10-2025

The (ETHUSD) price rose slightly in its last intraday trading, due to its leaning on the support of bullish corrective trendline on the short-term basis, gaining bullish momentum that intensified due to the emergence of the positive signals on the relative strength indicators, after reaching oversold levels, on the other hand, the price is under negative pressure due to its trading below EMA50, which weighs on the price recovery.

VIP Trading Signals Performance by BestTradingSignal.com (13-17 Oct, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for 13-17, October 2025:

View Full Performance Report Telegram (https://t.me/besttradingsignalstocksbot?start=p88d632b0-66dd-11f0-a948-13815052d5ae)