The GBPJPY approaches from the initial main target– Forecast today – 28-5-2025

The GBPJPY pair continued to form bullish waves by surpassing the obstacle at 194.60, approaching from its initial main target at 195.65, to form a strong barrier against it, forcing it to decline to 194.60.

Forming extra support at 194.00 level and the continuation of providing positive momentum by the main indicators, make us expect renewing the bullish attempts, to increase the chances for breaching 195.65 level, to open the way for recording new gains that might extend towards 196.45 reaching the next main target at 197.50.

The expected trading range for today is between 194.00 and 196.00

Trend forecast: Bullish

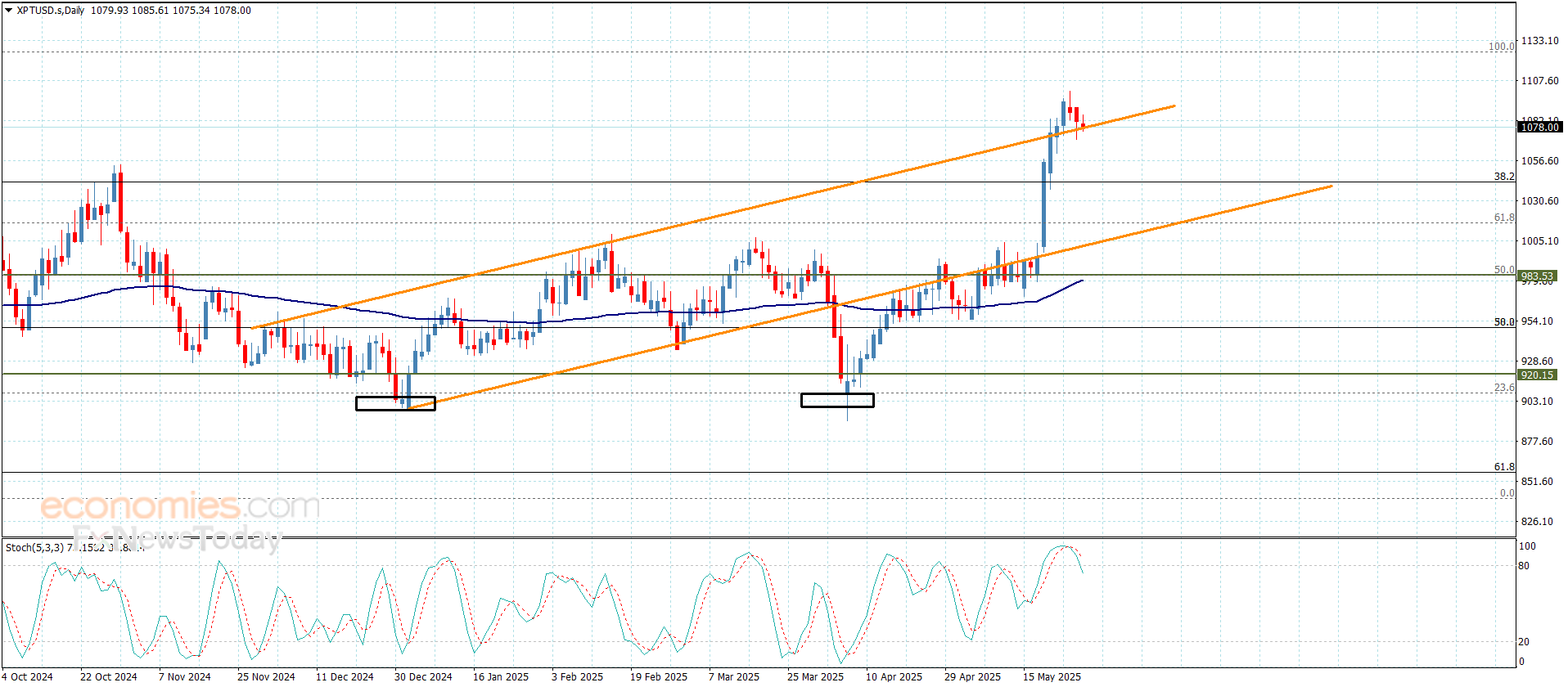

Platinum price might be forced to decline– Forecast today – 28-5-2025

Platinum price began activating with stochastic negativity, announcing delaying the bullish rally by its stability below $1100.00 level, to settle near the extra support at $1080.00.

The continuation of facing negative pressures make us expect activating the attempts of gathering the gains, by forming bearish correctional waves, to target $1068.00 and $1058.00, while gathering the positive momentum might assist to renew the bullish attempts by surpassing the obstacle at $1100.00 to reach the next main target at $1125.00.

The expected trading range for today is between $1068.00 and $ 1100.00

Trend forecast: Bearish

Copper price trades within Fibonacci correction– Forecast today – 28-5-2025

Copper price began moving between Fibonacci correction levels that were measured from the price decline from $5.320 reaching to the bottom at $4.000, to notice its confinement between 50%Fibonacci correction level at $4.6600, which represents an extra barrier against the bullish attempts, while 61.8% Fibonacci correction level at $4.8100 represents a barrier against the bullish rally.

The continuation of the price fluctuations bearishly and forming an extra strong barrier at $4.8900 level, we will return to prefer the negativity in the near trading, to expect reaching the moving average 55 at $4.5650, then attempting to press on $4.5000, while surpassing the bearish scenario requires positive closes above $4.8900 level in the near trading.

The expected trading range for today is between $4.5600 and $4.7400

Trend forecast: Bearish

GBPUSD attempts to correct the bullish trend-Analysis-28-05-2025

The (GBPUSD) price settled lower in its last intraday trading, amid the pair’s attempts to gain positive momentum that might assist it to recover and rise again, by looking for a higher low that might assist to rise again, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line, with the continuation of the positive pressure that comes from its trading above its EMA50, besides the (RSI) reaching to the oversold levels, exaggeratedly compared to the price move, which suggest forming a positive divergence.