What is the future of the Euro? Is there an investment opportunity right now?

Technical Analysis of EUR/USD

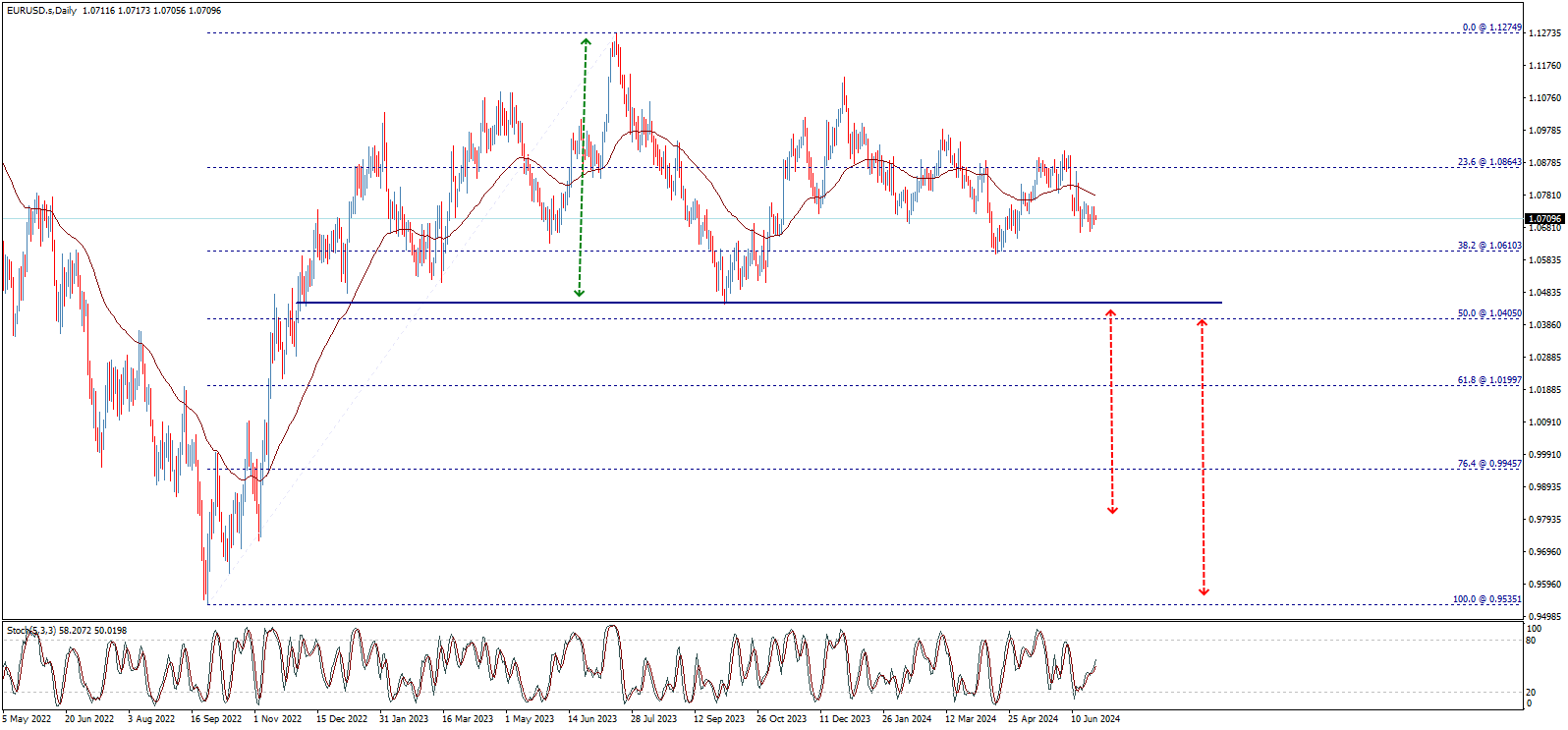

The weekly chart shows the long-term downtrend of the EUR/USD that began from its historical peak of 1.6036$ in mid-2008, falling strongly to parity around mid-2022, and making attempts to break this level but then recovering slightly within limited areas. The price continues to face downward pressures.

By measuring the Fibonacci retracement of the entire decline from the mentioned historical peak to the bottom at 0.9535$, we find that recent positive attempts stop at the 23.6% Fibonacci level, which forms strong resistance at 1.1070$, forcing the price to decline again, likely resuming the main downward trend.

More Negative Factors

On the daily timeframe, we notice that the recent rise halts for a short-term downward correction, potentially pushing the price to further declines reaching the aforementioned bottom. The price forms a bearish technical pattern represented by the double top shown in the following chart, meaning that breaking 1.0450$ will push the price to achieve negative targets starting at 0.9950$ and extending to 0.9535$.

Momentum indicators are losing their positivity, enhancing the likelihood of continued downward control in the upcoming period, with confirmation required by breaking 1.0450$ to maintain the downward wave on both short and long-term timeframes.

Additionally, recent movements on the intraday timeframe show that the price surpasses the resistance of the downward intraday channel, moving towards some upward correction, possibly testing areas 1.0815$ then 1.0865$ before declining again. On the other hand, the price needs to trade below 1.0685$ to strengthen the chances of decline in the coming period, activating more negative scenarios with targets starting at 1.0450$ and extending below parity, one dollar per euro.

In conclusion, technical factors suggest that the price will face new declines across most timeframes, with initial confirmation by breaking the 1.0600$ barrier, opening the door towards the neckline of the double top pattern at 1.0450$, gaining more negative incentives towards the mentioned targets.

Trend Reversal Points

Despite everything mentioned above, it is crucial to note that breaking 1.1070$ will lead the price to new recovery attempts and building an upward wave starting with testing the long-term downward channel resistance around 1.1330$. Breaking this level opens the door for additional upward correction targeting the next main objective at 1.2000$.

Best EUR/USD Trading Companies July 2024

Top 3 EUR Trading Platforms in July 2024

- Pepperstone Best overall broker for forex and CFDs trading.

- Plus500 Best trading company with global licenses.

- XM Best trading platform for beginners.

Future of the Euro: Amid the Ukraine War and the Rise of Anti-EU Parties!

The single European currency "Euro" faced intense selling during June, pushing the EUR/USD pair to its lowest level in a month and a half near the 1.06$ mark. These losses are attributed to two main reasons, the first being expected by the market, and the second being entirely unexpected, thus having a stronger impact.

The first reason: It was widely anticipated in the markets, as the European Central Bank (ECB) lowered European interest rates by 25 basis points during its meeting on June 6th, marking the first reduction in borrowing costs in Europe since 2016.

The second reason: It was entirely unexpected, having a stronger and more severe impact, as anti-EU parties managed to win a quarter of the seats in the unified European Parliament elections in Brussels.

After the ruling party in France was defeated in the European Union vote by the far-right, French President Emmanuel Macron decided to dissolve the local parliament and call for early elections in the country.

After the Euro had begun to adapt to the repercussions of the war in Ukraine, political risks surged again in the old continent. This time, these risks might form the nucleus of a storm that could lead to the disintegration of the European Union and the collapse of the single currency.

In this report, we will try to examine the future of the single European currency "Euro" in light of the ongoing Ukraine war and the strong rise of anti-EU parties in legislative elections.

Brief EUR/USD Analysis and Forecasts

- EUR/USD weekly forecast: The Euro may continue forming a short-term recovery cycle, aiming to trade above 1.08$.

- EUR/USD forecast for July: The Euro may regain its monthly gains in July against the US dollar if the ECB discloses more evidence of delaying the second interest rate cut this year.

- EUR/USD forecast for 2024: Some analysts expect that the EUR/USD pair is likely to trade in the upper half of the 1.05$ to 1.10$ range.

- EUR/USD forecast for 2025: According to ING Bank, the pair is undervalued and based on interest rate expectations, the EUR/USD pair should trade above the 1.20$ level in the coming years.

About the EUR/USD Pair

The EUR/USD pair is one of the most important major currency pairs in the foreign exchange market and is the most traded in the forex market.

The direction of the EUR/USD pair reflects the strength of the European Union economy compared to the US economy. Therefore, it is significantly affected by factors such as interest rate differentials, inflation, employment data, trade, and capital flows.

In addition to fundamental economic factors, a large part of the EUR/USD pricing is linked to geopolitical risks and tensions that cannot be measured in advance, as well as unexpected natural, health, and social disasters.

European Central Bank

According to most expectations about the June 6th meeting, the ECB lowered the main interest rate by 25 basis points to a range of 4.25%, marking the first reduction in European interest rates since September 2016.

The ECB stated: Based on an updated assessment of inflation expectations, it is now appropriate to ease the degree of monetary policy tightening after nine months of keeping interest rates unchanged.

The ECB's Board of Directors raised their average annual core inflation expectations for the Eurozone for 2024 to 2.5% from the previous 2.3%, and also raised the inflation forecast for 2025 to 2.2% from 2.0%, with the 2026 inflation forecast remaining unchanged at 1.9%.

ECB President Christine Lagarde said in the press conference: The decision to cut interest rates after holding them steady for nine months was based on inflation expectations and its recent direction, and that tight monetary policy has played its role in curbing demand so far.

Lagarde added: The ECB will continue to rely on data to determine the path of interest rates in the Eurozone. There are no commitments regarding interest rate movements.

Lagarde explained: The ECB will monitor economic data, growth, and inflation to make periodic interest rate decisions. She pointed out that inflation pressures remain persistent and strong.

Christine Lagarde said: Most inflation indicators in Europe slowed significantly in April, but inflation remains at high levels and wage growth is still strong.

Lagarde added: Inflation could exceed the ECB's expectations if wage growth rates continue to record high readings. The ECB will keep interest rates sufficiently restrictive as long as necessary to achieve the inflation target.

In response to a question, Lagarde said: I cannot say until later in the summer whether the ECB will take another step towards cutting interest rates. Lagarde added: Monetary policy has become more restrictive in real terms compared to last September.

Lagarde explained: The ECB's move today is only a slight easing of monetary policy tightness, but interest rates remain highly restrictive.

Lagarde said: The ECB will keep monetary policy at restrictive levels until inflation reaches the 2% target. She added: The ECB is still far from the neutral interest rate, and even if this neutral interest rate has risen, it is still far from current levels.

European Interest Rate

Bloomberg published a report, citing sources familiar with the matter following the ECB meeting, stating that ECB monetary policy committee members ruled out another interest rate cut at their upcoming meeting in July.

Currently, markets are betting on only one more European interest rate cut before the end of this year, following the ECB meeting and Christine Lagarde's comments.

Impacts of the Ukraine War

The global economy has been significantly affected since the outbreak of the Ukraine war in February 2022 following the Russian invasion, leading to major disruptions in international financial markets. The prices of global currencies, especially the Euro, fell widely, with the Euro sliding to its lowest level in 20 years in September 2022.

We attempt to briefly highlight the impacts of the Ukraine war and its profound effects on the Euro in terms of value, stability, and financial policies.

Economic Impacts

- Energy price fluctuations: One of the most significant factors affecting the Euro is energy price fluctuations. Many EU countries, especially Germany, heavily depend on energy imports from Russia, particularly natural gas. After European and US sanctions on Russia and reciprocal actions by Moscow, energy prices experienced unprecedented increases. This rise significantly and directly impacted production costs, leading to increased inflation in the Eurozone.

- Inflation: Inflation in the Eurozone rose significantly due to higher energy and raw material prices. The inflation rate in Europe reached a record high of 10.6% in October 2022 before gradually declining, nearing the ECB's target of 2% by late 2023. Many European countries experienced inflation rates not seen in decades, eroding consumer purchasing power and increasing operational costs for businesses. These inflationary pressures forced the ECB to abandon accommodative monetary policy and shift to contractionary monetary policy to combat inflation.

Monetary Policies

Faced with record-high inflation rates, the ECB found itself in a difficult position. It had to choose between supporting economic growth by maintaining low interest rates or combating inflation by raising them. Indeed, the ECB began raising interest rates from its July 2022 meeting until the September 2023 meeting, moving the benchmark rate from 0.00% to 4.50%, the highest level since 2001. Raising interest rates provided support to the Euro in the short and medium term by attracting foreign investments, but it also slowed economic growth and increased debt burdens on EU countries.

Financial Stability

The Ukraine crisis has raised widespread concerns about financial stability in the Eurozone. The war's impact led to increased market volatility and decreased investor confidence. This decline affected the Euro's value against major and minor currencies like the US dollar, British pound, and Australian dollar. Additionally, the risk of economic contraction in Europe heightened default risks, especially in highly indebted countries like Italy and Spain.

Political Impacts

- Rising political risks: The Ukraine war led to rising political risks in Europe. The escalating conflict and fears of the war spreading to other European countries caused political instability and increased pressures on European governments. Some countries witnessed a rise in populist and anti-EU parties, exploiting the crisis to promote their anti-EU integration agendas.

- EU unity: Despite the significant challenges, the EU showed a kind of unity in facing the crisis, with member states racing to impose economic sanctions on Russia and providing support to Ukraine. This unity could be positive for the Euro in the long term, enhancing confidence in the single currency and the European economy as a whole. However, ongoing economic and political pressures may test the EU's cohesion in the near future.

Social and Humanitarian Impacts

- Refugee crisis: The Ukraine war led to the largest refugee crisis in Europe since World War II. Millions of Ukrainians fled to EU countries seeking safety and stability. This massive influx affected local economies by increasing demand for social services and housing. Nevertheless, the swift European response in providing support and assistance could enhance European solidarity and contribute to relative stability.

- Social and economic ties: The social impacts of the war, including the refugee crisis, may have long-term effects on economic and social ties within the EU. Increased public spending to support refugees and infrastructure could lead to additional pressures on national budgets, potentially requiring adjustments in financial and economic policies.

Summary of Ukraine War Impacts

The Ukraine war's impact on the Euro is a complex mix of economic, political, and social factors. In the short term, the single currency has been negatively affected by rising inflation, energy price fluctuations, and political instability. In the long term, the Euro's future depends on the EU's ability to adapt to these challenges and maintain its unity and stability. The Ukraine crisis could be an opportunity to enhance European integration and develop more sustainable and flexible economic policies. Regardless of the direction things will take, the current crisis is a real test of the Euro and the EU's strength and stability as a whole.

Rising Political Risks in the EU

Political risks have significantly increased during June, especially after the recent European Parliament elections, with anti-EU parties winning nearly a quarter of the seats in the unified Parliament.

European Parliament Elections

With the results of the European Parliament elections held on Sunday, June 9th, far-right and far-right parties succeeded in winning nearly a quarter of the seats in the unified Parliament, up from one-fifth in 2019. Rabobank's chief macro strategist Stefan Koopman said: "The road ahead is still long, but the election consequences are clear now." Koopman added: "Although centrist parties retained the majority, the new European Parliament is the most extreme since its inception." ING Bank's head of foreign exchange analysis Chris Turner said: "Most people expected a shift to the right in these elections, and the results indicate that the European People's Party, led by Ursula von der Leyen, will still be able to lead the majority in the European Parliament. However, the events in France are what made the headlines."

Early Elections in France

French President Emmanuel Macron decided to dissolve the local parliament and call for early legislative elections in the country, following the European Parliament election results. The surprising French elections come after the centrist ruling coalition in France was defeated in the EU vote by the far-right led by Marine Le Pen. An exit poll showed that eurosceptic parties made the biggest gains in the European Parliament elections, prompting President Macron to take a risky gamble to restore his authority. Macron's party received only 15% of the votes, prompting him to call for legislative elections on June 30th, with the second round of voting on July 7th. Chris Turner said: "This move is widely seen as a gamble either to question French voters on whether they really want a far-right government or to give voters three years of experience with a far-right government before the next French presidential election in 2027."

Political Situation in France

The political situation in France will be the main focus of attention for Euro exchange rates in the coming weeks, and any deterioration in sentiment will lead to further weakness. Far-right and far-left parties are gaining momentum before the sudden parliamentary elections in France later this month, putting pressure on President Macron's centrist administration. Markets expect Macron's centrist party to lose the legislative vote, meaning he will have to accommodate a prime minister from the far left or far right. Market concerns are that this will lead to further deterioration in France's debt situation, which is already at worrying levels. The spread between French and German 10-year bond yields has widened significantly as investors sold French bonds in response to concerns about the country's debt trajectory amid political uncertainty.

French Budget

The European Commission says France's 2024 budget means it is at risk of violating the bloc's financial rules. (The EU will reinstate debt and deficit rules suspended during the COVID-19 pandemic this year.) The European Commission has already requested the French government to take the necessary steps to comply with EU financial rules. Macron's government has recently struggled to balance the country's financial profile with voters' demands for increased spending. According to forecasts released in late 2023, the Commission expects debt as a percentage of economic output to rise to 110% of GDP by 2025.

France Credit Rating Downgrade

Credit rating agency Standard & Poor's downgraded France's credit rating this month, pouring cold water on recent efforts by the French government to reorganize its public finances.

Rise of Anti-EU Parties in Europe

In recent years, Europe has seen a notable rise in anti-EU parties, raising questions about the future of the European Union and its single currency, the Euro. These parties, promoting nationalist policies and skepticism towards EU integration, have become influential political forces in many member states. The following section analyzes the impact of the rise of these parties on the EU's future and the Euro, examining the challenges they pose and the potential consequences.

Political Background

Growth of anti-EU parties: Over the past decade, anti-EU parties have made significant electoral gains in many member states. For example, France's National Rally, Austria's Freedom Party, and Germany's Alternative for Germany have all gained widespread support by criticizing EU policies and calling for the restoration of national sovereignty.

Reasons for the rise: Several reasons underlie the rise of these parties. These include:

- Economy: The global financial crisis and the Eurozone crisis left negative impacts on the European economy, increasing citizens' dissatisfaction.

- Immigration: Large waves of immigration, especially after the 2015 refugee crisis, raised many concerns about security and national identity.

- Identity and culture: The perception that the EU threatens national identity and local cultural traditions.

Economic Impacts

- Impact on monetary policy: The rise of anti-EU parties can directly affect the EU's monetary policy. If these parties reach power in several member states, they may seek to renegotiate financial terms and contributions to the EU budget, potentially reducing funding available for development and integration projects.

- Confidence in the Euro: The rise of anti-EU parties could negatively impact confidence in the Euro. Financial markets typically react negatively to political instability, leading to fluctuations in the Euro exchange rate and decreased investor confidence. The threat of some countries leaving the Eurozone could raise concerns about the single currency's future and stability.

Political Impacts

- Political cohesion of the EU: The rise of anti-EU parties could threaten political cohesion within the EU. These parties often advocate policies that conflict with the EU's core principles, such as freedom of movement and open trade. The rise of these forces may lead to divisions within the EU, making it difficult to achieve consensus on common policies.

- Institutional reforms: Pressure from anti-EU parties may push the EU towards institutional reforms. These parties might force EU leadership to reconsider some policies and make concessions to meet the demands of the most affected member states. These reforms could include modifying the rules for joining the Eurozone or renegotiating some core treaties.

Social Impacts

- Increasing divisions: The rise of anti-EU parties could lead to increased divisions within European societies. These parties often exploit nationalist sentiments and skepticism towards foreigners to bolster their base, potentially increasing social tensions and divisions among different population groups.

- Impact on immigration: Anti-EU parties may seek to impose stricter immigration controls. These policies could lead to significant changes in how the EU handles refugee and immigration issues, resulting in policy disparities among member states and affecting European solidarity.

Future Consequences

- Possibility of EU disintegration: In the worst-case scenario, the rise of anti-EU parties could threaten the EU's existence. Calls for membership referendums, as seen in the Brexit case, may recur in other countries, increasing the likelihood of disintegration.

- Future of the single currency: If anti-EU parties continue gaining influence, this could increase pressure on the Euro. Some countries may seek to return to their national currencies, threatening the Eurozone's stability. In the long term, this could reshape the European monetary system.

Summary on the Rise of Anti-EU Parties

The rise of anti-EU parties is one of the major challenges facing the EU and its single currency in the coming years. This rise reflects increasing doubts and concerns among citizens about the EU's future and its policies. While this poses a significant challenge, it can also drive reforms and improve European integration. The EU and the Euro's future depends on European leaders' ability to adapt to these challenges and provide solutions that enhance unity and stability on the continent.

Key Price Milestones for EUR/USD Pair

- January 1971: The EUR/USD pair recorded its all-time low at 53.65 cents per Euro.

- July 2008: The EUR/USD pair recorded its all-time high at 1.6038 dollars per Euro.

- February 1971: The EUR/USD pair recorded its all-time low closing at 53.78 cents per Euro.

- March 2008: The EUR/USD pair recorded its all-time high closing at 1.5788 dollars per Euro.

Best EUR/USD Performance in History

- 1985: Best annual performance ever for the EUR/USD pair, with a 29% rise.

- Q4 1987: Best quarterly performance ever for the EUR/USD pair, with a 17.50% rise.

- June 1973: Best monthly performance ever for the EUR/USD pair, with an 11% rise.

Worst EUR/USD Performance in History

- 1997: Worst annual performance ever for the EUR/USD pair, with a 14.5% drop.

- Q4 1992: Worst quarterly performance ever for the EUR/USD pair, with a 13% drop.

- March 1991: Worst monthly performance ever for the EUR/USD pair, with a 10.5% drop.

Key Events in EUR/USD Pair History

- January 1971: The EUR/USD pair began trading at 53.68 cents per Euro.

- August 1978: The EUR/USD pair traded above parity at 1 dollar per Euro for the first time ever.

- February 2008: The EUR/USD pair surpassed the 1.5-dollar mark per Euro for the first time in history.

Key EUR/USD Forecasts for 2024

- ING Bank: The bank updated its EUR/USD forecasts to trade above 1.10 dollars later this year and early next year.

- BNP Paribas: The bank expressed confidence in its medium-term forecast for the Euro's rise, based on the final tightening of interest rate differentials and other structural factors. The bank maintained its initial EUR/USD forecast for the end of 2024 at 1.15 dollars.

- Bank of America: Bank of America's 2024 EUR/USD forecast confirms it is more bearish on the US dollar than the consensus, as analysts say the Federal Reserve's interest rate cuts are "more significant to markets" than cuts by other central banks. Bank of America expects the EUR/USD exchange rate to exceed the 1.10-dollar mark in the coming months.

- Commerzbank: The bank's analysts expect the EUR/USD exchange rate to rise to 1.12 by September 2024 before falling to 1.08 by March 2025.

- Goldman Sachs: The bank expects the Euro to face challenges in 2024, predicting that the EUR/USD pair will remain at the 1.06-dollar level over a 6-month period.

Factors Affecting EUR/USD Forecasts

- ECB monetary policy (ECB): Interest rates: ECB interest rate decisions play a major role in determining the Euro's direction. Raising interest rates can boost the Euro, while lowering them may cause the currency to decline. Stimulus policies: Any stimulus programs or asset purchases can also impact the Euro's value. Increasing market liquidity can weaken the currency.

- Federal Reserve monetary policy (FED): Interest rates: Federal Reserve interest rate decisions directly affect the US dollar. Raising rates boosts the dollar, while lowering them weakens it. Quantitative easing: Quantitative easing programs and increased market liquidity can impact the dollar's value.

- Economic performance: Economic growth: Differences in economic growth rates between the US and the Eurozone affect EUR/USD forecasts. Strong economic performance in one region may support its currency. Inflation: Inflation rates influence monetary policies and thus the value of both currencies. High inflation in Europe may prompt the ECB to raise rates, boosting the Euro, and vice versa for the Federal Reserve and the dollar.

- Political stability: Political events: Elections, political crises, and the rise of anti-EU parties can impact confidence in the Euro. Political stability boosts the currency, while unrest weakens it. Trade policies: Trade relations between the US and Europe, including trade agreements and disputes, affect trade and investment flows, impacting EUR/USD.

- Energy prices: Oil and gas prices: Europe heavily relies on energy imports, and fluctuations in oil and gas prices impact the European economy and the Euro. Supply crises: Energy supply crises, such as sanctions on Russia, can lead to price increases and inflation, affecting the Euro's value.

- Geopolitical conditions: International crises: Geopolitical crises like the Ukraine war impact confidence and economic stability, affecting currency values. Foreign policies: Changes in US or European foreign policies can influence investment and trade flows, impacting EUR/USD.

- Investment flows: Foreign investments: Investment flows to the US or Europe impact currency demand. Increased investments in one region boost its currency. Stock and bond markets: Financial market performance can influence investment flows. For example, strong US stock market performance can support the dollar.

- Economic data: Employment reports: Job reports, such as the US non-farm payroll report, significantly impact the dollar. Confidence indicators: Consumer and business confidence indicators in the Eurozone and the US reflect economic health and influence currencies.

Conclusion

EUR/USD forecasts depend on a complex set of economic, political, and financial factors. Investors and traders should closely monitor developments in these areas to determine future trends for this important currency pair in the foreign exchange market. Changes in monetary policies, economic performance, political stability, and energy prices are all crucial factors in shaping EUR/USD forecasts.

Frequently Asked Questions about EUR/USD Pair

Is the EUR/USD exchange rate suitable for investment?

The EUR/USD pair trades around 1.07 dollars. In light of most forecasts pointing to an upward trend in the second half of this year, we believe that levels between 1.06 and 1.07 dollars are suitable for investment, with a target above 1.1 dollars.

How to Invest in the EUR/USD Pair?

The EUR/USD pair can be invested in several different ways:

- Spot EUR/USD Trading: The EUR/USD pair can be traded spot from global forex trading platforms.

- Futures Trading: Futures contracts obligate the buyer to buy or sell a specific asset at a predetermined price on a specified future date. Futures can be used to speculate on the EUR/USD pair's price direction. Futures require a significant margin, meaning you must deposit money as collateral for your position. Futures are risky investment tools and can lead to significant losses.

- Options Trading: Options contracts give the buyer the right, but not the obligation, to buy or sell a specific asset at a predetermined price on a specified future date. Options can be used to speculate on the EUR/USD pair's price direction or hedge risks. Options require a smaller margin than futures, making them more suitable for investors with limited capital. Options are complex investment tools and can be risky.

- CFD Trading: Contracts for Difference (CFDs) allow traders to speculate on the price direction of an asset without owning it. CFDs require a smaller margin than futures and options, making them more suitable for investors with limited capital. CFDs are risky investment tools and can lead to significant losses.

- Exchange-Traded Funds (ETFs): ETFs track the performance of an index or a basket of assets. Many ETFs include the EUR/USD pair. ETFs are an easy and diversified way to invest in the EUR/USD pair. ETFs are less risky than direct futures, options, or CFD trading.

Will the EUR/USD rate reach the 1.1-dollar threshold?

It is not entirely unlikely that the EUR/USD pair will rise in the coming months, targeting the important psychological barrier of 1.1 dollars, especially if the Federal Reserve begins cutting interest rates in September.

Is the EUR/USD rate expected to rise in 2024?

Yes, the EUR/USD rate is expected to rise in 2024 if political risks in Europe subside, with the ECB delaying the second interest rate cut, and the Federal Reserve cutting US interest rates early.

The GBPCAD hits the target – Forecast today – 1-7-2024

GBPCAD Price Analysis

Expected Scenario

- The GBPCAD price formed several bearish waves recently, achieving the correctional target at 1.7270, which now acts as solid support. It rebounded directly towards 1.7310.

- With frequent stability above the current support and positive momentum from major indicators, there is support for a bullish rally. We can anticipate an attempt to challenge 1.7345 soon, and surpassing it could lead to targeting the next positive level at 1.7395.

Expected Trading Range

Between 1.7275 and 1.7345.

Trend Forecast: Bullish

Natural gas price postpones the bullish rally – Forecast today – 1-7-2024

Natural Gas Price Analysis

Expected Scenario

- Natural gas price succumbed to negative pressures as stochastic reached oversold areas, crawling below the minor bullish channel’s support line at $2.700 to incur losses and settle near $2.580.

- The continued stability below the broken support suggests potential for further downward movement, targeting the MA55 near $2.460, with potential testing of the key support at $2.385, which will be crucial in determining the next major trend.

Expected Trading Range

Between $2.680 and $2.470.

Trend Forecast: Bearish

The EURJPY begins with bullish gap – Forecast today – 1-7-2024

EURJPY Price Analysis

Expected Scenario

- The EURJPY pair succeeded in holding above 171.60 recently, confirming its submission to the previously suggested bullish bias. It achieved significant gains by forming a bullish gap this morning and surpassing the 172.80 level to settle near 173.25 as shown on the chart.

- The sustained positive momentum from major indicators is expected to strengthen the bullish rally, potentially pushing towards the next positive target at 173.60, followed by aiming to reach the resistance line of the bullish channel at 174.00.

Expected Trading Range

Between 172.80 and 174.00.

Trend Forecast: Bullish