The EURUSD price forecast update - 24-07-2024

The EURUSD price starts to break 1.0840$ level and attempts to hold below it, which supports the continuation of the expected bearish trend for today, paving the way to achieve our negative targets that start at 1.0806$ followed by 1.0774$ levels, waiting for more decline in the upcoming sessions unless the price rallied to breach 1.0880$ and hold above it.

The expected trading range for today is between 1.0760$ support and 1.0880$ resistance.

Trend forecast: Bearish

Apple Stock in Historic Rise Thanks to AI Revolution - Is This the Best Opportunity to Trade AAPL?

Technical Analysis of Apple Inc. Stock

For more than ten years, Apple Inc. stock has been moving in a primary upward trend, interspersed with some temporary declines and sideways movements at times. Looking at the weekly chart, we find that the stock is moving within a long-term ascending channel, carrying the price to achieve more expected gains in the coming period.

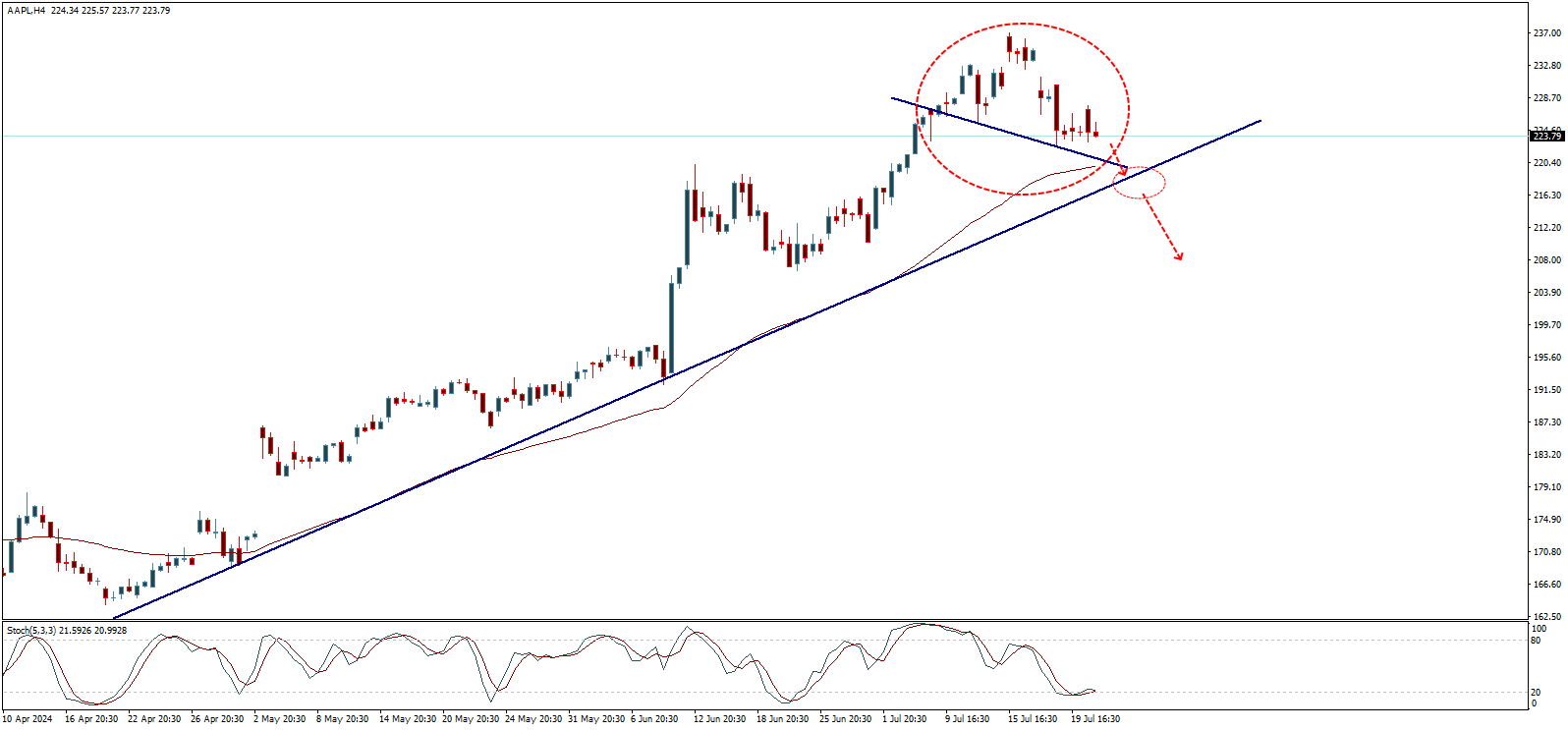

The 50-moving average holds the price to achieve further gains and supports the continuation of the upward trend. However, we notice that the stock has lost its positive momentum and closed last week negatively, providing indications of a potential short-term bearish correction, as shown in the following chart:

Negative Correction Stations

The main corrective targets start with testing the $193.90 areas, and it is essential to note that breaking this level will extend the bearish wave to target the $180.55 then $167.22 areas primarily, with a bearish inclination expected in the coming period, especially after confirming the break of the $210.35 minor support level.

Confirming the bearish correction needs a negative catalyst to activate the potential bearish wave, which can be observed through shorter time frames, where we find that the price is forming a head and shoulders pattern, with its confirmation level at $220.75. Therefore, breaking this level will pressure the price to break through the short-term upward trend line and confirm the start of the bearish correction to achieve the mentioned targets.

We note that the expected bearish correction will push the price to visit the support of the long-term ascending channel, from where the stock is expected to resume the upward trend journey and achieve new positive targets extending to the $260.00 then $270.00 areas as the next main stations.

Summary

The long-term upward trend is still in effect, but it is expected to be preceded by some bearish correction and a visit to the main ascending channel support before bouncing back upwards to resume the primary upward trend. Note that surpassing the resistance barrier located at $235.00 will enable the stock to continue rising and nullify the proposed bearish correction scenario.

Best Broker for Trading Apple Inc. Shares 2024

- Pepperstone, the best broker for trading US stocks. Reliable for beginners. Dubai license. Minimum deposit: $0. 20% discount on trading.

- Plus500, the best licensed broker for trading US stocks. Dubai license. Minimum deposit: $100.

- XM, the best platform for trading US stocks. Provides educational materials and trade copying. Dubai license. Minimum deposit: $5. Regular competitions and cash prizes.

Apple Stock Analysis and Forecasts for 2024 and 2025

Apple Inc. stock has experienced an unprecedented historical surge thanks to the remarkable advancements in AI technologies, making it the talk of global financial markets.

Apple stock managed to reach its all-time high at $237 in mid-July, amid expectations that the tech giant will witness a new boom in sales and profits, especially after integrating AI technologies into the new "iPhone 16".

Apple shares have risen more than 20% this year, giving the company a market value of $3.45 trillion, making it the world's largest company by market value.

Apple, known for its pioneering innovations in technology and electronics, now finds itself at the heart of a new technological revolution opening limitless horizons.

The increasing reliance on AI in various business and daily life fields has significantly contributed to Apple's position as a leading company investing heavily in this promising field.

Apple has always been at the forefront of companies driving technological innovation. Since its founding, it has introduced many products that have changed our way of life, from personal computers to smartphones that have become an integral part of our daily lives.

With the world entering the age of AI, Apple continues to follow its innovative approach, investing heavily in developing AI technologies and their diverse applications.

AI technologies play a vital role in enhancing Apple's products' capabilities, from improving device performance and increasing efficiency to developing new features based on machine learning and big data analysis.

For example, AI technologies are used to improve the user experience on Apple devices, from developing its intelligent assistant "Siri", which relies on deep learning techniques to understand and accurately execute voice commands, to smart photography features in iPhones that use AI to enhance photo and video quality.

The AI technology revolution has not only driven a surge in Apple stock performance but has also helped reshape the future of the company and the technology industry as a whole.

Thanks to its smart investments and continuous innovations, Apple remains in the lead, making its stock one of the most attractive to investors seeking strong and continuous investment opportunities in the evolving tech sector.

This historical surge in Apple stock is a testament to the company's ability to adapt to rapid changes in technology and the market, ensuring its continued success and growth in the future.

With the continued development of AI technologies and the emergence of new applications, it seems that Apple is on the verge of a new chapter of progress and innovation that will continue to amaze the world and push its stock to new heights.

Strong Market Value Growth

Apple has added about $300 billion in market value since it revealed its ambitions to integrate AI technologies into its new "iPhone 16". Investors are betting that these developments and movements will lead to a massive cycle of new phone purchases.

Apple Intelligence Technology

Apple, which has named its new technologies "Apple Intelligence", plans a major overhaul of its digital assistant Siri and a series of new features for its robust 2.2 billion device base.

The company resorted to this technology to keep up with Google and OpenAI, backed by Microsoft, aiming to attract customers to upgrade their devices so they can use the new technology.

Apple's technology aims to integrate a range of AI-dependent tasks, such as summarizing, text creation, photo editing, and enhanced search, into its operating system for iPhones and iPads.

Concise Apple Stock Analyses and Forecasts

- Apple Stock Forecast This Week: After recording a new high at $237, Apple stock entered a short-term bearish correction cycle, aiming to test the support area around $220.

- Apple Stock Forecast for July: Apple stock is likely to achieve monthly gains in July, thanks to positive market sentiment as the US approaches interest rate cuts.

- Apple Stock Forecast for 2024: Apple stock is expected to record new highs during the remaining months of this year, approaching the psychological barrier of $300 for the first time in history.

- Apple Stock Forecast for 2025: If Apple stock surpasses the $300 barrier, the next target will be the $500 barrier during the first half of 2025.

About Apple

Apple Inc. is one of the world's leading companies in technology and electronics, having established itself as a symbol of continuous innovation and development since its founding in 1976 by Steve Jobs and Steve Wozniak.

Today, Apple is the largest company by market value globally, thanks to a series of pioneering products that have transformed the face of technology and communication.

History and Origins

Apple's story began in a small garage in Los Altos, California, where Jobs and Wozniak assembled the company's first personal computer, the "Apple I".

Thanks to this innovation, Apple achieved its first commercial success, followed by a series of successes with the launch of the "Apple II", which became one of the first commercially successful personal computers in the world.

Flagship Products

Since its founding, Apple has launched many products that have become symbols of innovation in the tech world. Some of the most prominent products include:

- Mac: A series of personal computers known for their elegant design and powerful performance. This series has evolved to include desktop and laptop computers like MacBook and iMac.

- iPhone: A revolutionary smartphone first introduced by Apple in 2007, which changed how people communicate and use the internet. The iPhone features the iOS operating system and the App Store, which hosts millions of apps.

- iPad: A tablet introduced by Apple in 2010, combining the functions of a computer and a smartphone in one device. The iPad has become popular for use in education, entertainment, and business.

- Apple Watch: A smartwatch launched by Apple in 2015, offering a wide range of health and fitness functions in addition to communication and notifications.

- Apple TV: A device for streaming entertainment content, allowing users to access a wide range of movies, TV shows, and music online.

Innovation and Technology

Apple is a leader in technology innovation, continually developing and improving its products using the latest technologies. The company relies heavily on AI and machine learning in its products to enhance the user experience.

For example, Apple's intelligent assistant "Siri" enables the accurate and easy execution of voice commands, while iPhone cameras use AI to enhance the quality of photos and videos.

Company Culture

Apple enjoys a unique culture that focuses on design, quality, and innovation. The company is known for its elegant and simple designs and meticulous details in its products.

It also has a large community of developers contributing to developing innovative apps and games for the App Store.

Sustainability and Social Responsibility

Apple strives for sustainability and reduces environmental impact by using recycled materials in its products, reducing energy consumption in manufacturing processes, and increasing the use of renewable energy.

The company is also committed to its social responsibility by supporting education, local communities, and promoting equality and diversity in the workplace.

Future Challenges

Apple continues to explore new fields such as augmented and virtual reality, self-driving cars, and financial services through Apple Pay.

However, the company faces significant challenges such as intense competition in the tech market, concerns about privacy and security, and regulatory changes in global markets.

Apple Q2 2024 Earnings: Comprehensive Analysis

Apple announced its financial results for the second quarter of 2024, showing a slight decline in revenue and earnings compared to the second quarter of 2023.

Key Points from the Results:

- Revenue: $90.8 billion, down 4% year-over-year.

- Diluted earnings per share: $1.53, slightly down year-over-year.

- iPhone sales: $45.96 billion, slightly down year-over-year.

- Services sales: $20.8 billion, up 12% year-over-year.

- Personal computer sales: $10.9 billion, up 7% year-over-year.

- Smart home products sales: $8.1 billion, up 8% year-over-year.

Comments on the Results:

- Despite the decline in revenue and earnings, Apple showed strong performance in many areas, such as services sales, personal computers, and wearables.

- iPhone sales were negatively affected by weak supply chains and declining demand in China.

- Apple continues to invest in research and development and expand its product and service range.

- The company announced an increase in its dividend and distribution of dividends to shareholders.

Future Outlook:

- Apple expects its revenue to grow at an annual rate of 5-7% in the third quarter of 2024.

- The company faces some challenges, such as ongoing supply chain disruptions, rising inflation, and tightening monetary policy.

- Despite these challenges, Apple remains in a strong position and has good prospects for future growth.

Analysts' Opinions:

- Analysts remain optimistic about Apple's future prospects.

- They point to the strength of its brand, diverse products and services, and strong financial position.

- They advise investors to hold on to Apple shares for the long term.

Apple and AI Interaction

Apple is one of the leading tech companies investing heavily in AI and integrating it into its products and services to improve the user experience and offer innovative features. Apple's global interaction with AI is manifested in several key aspects:

Siri Personal Assistant

Siri, Apple's intelligent personal assistant, is one of the most prominent examples of Apple's interaction with AI, relying on machine learning and natural language processing techniques to understand and execute user commands.

Siri can perform various tasks such as sending messages, setting reminders, playing music, and even controlling smart home devices.

Photography Enhancement

Apple uses AI to enhance the quality of photography in its devices, especially the iPhone.

iPhone cameras rely on AI technologies to recognize scenes and objects and adjust settings automatically to get the best possible photo.

Smart HDR, Night Mode, and Portrait improvements are all examples of how AI is used to enhance the photography experience.

Machine Learning and Health Applications

Apple uses AI in health and fitness applications to analyze health data and provide personalized recommendations.

For example, the Health app uses machine learning algorithms to monitor physical activity and sleep, providing accurate insights to help users improve their overall health.

Face ID Recognition

Face ID technology used by Apple in iPhones and iPad Pros relies heavily on AI.

This technology uses advanced algorithms to recognize faces to unlock the device securely and quickly. Face ID adapts to changes in the user's appearance over time, increasing its accuracy and security.

Improving User Experience in iOS

Apple integrates AI into iOS to enhance the user experience. For example, the Smart Suggestions feature uses AI to provide personalized recommendations based on user behavior and preferences.

AI is also used to improve battery performance and manage apps more efficiently and effectively.

Developer Tools Development

Apple empowers developers to use AI in their applications by providing advanced tools and software applications like Core ML.

These tools enable developers to easily integrate machine learning algorithms into their applications, helping them deliver innovative and personalized user experiences.

Smart Devices Interaction

Apple is developing the Home Kit system, which allows users to control smart home devices using AI.

Thanks to the integration of Siri and Home Kit, users can control lighting, heating, and other home devices through voice commands, enhancing user comfort and ease of managing their smart homes.

Key Price Points for Apple Stock

- July 1982: Apple stock recorded its all-time low at $0.0379.

- July 2024: Apple stock recorded its all-time high at $237.23.

- June 1982: Apple stock recorded its all-time low closing price at $0.0439.

- July 2024: Apple stock recorded its all-time high closing price at $234.82.

Best Performance of Apple Stock in History

- 1998: Best annual performance ever for Apple stock, with a rise of 212%.

- Q1 1998: Best quarterly performance ever for Apple stock, with a rise of 110%.

- January 2001: Best monthly performance ever for Apple stock, with a rise of 45%.

Worst Performance of Apple Stock in History

- 2000: Worst annual performance ever for Apple stock, with a drop of 71%.

- Q3 1983: Worst quarterly performance ever for Apple stock, with a drop of 53%.

- September 2000: Worst monthly performance ever for Apple stock, with a drop of 58%.

Major Events in Apple's History

- December 1980: Apple shares began trading on Wall Street at $0.0991.

- December 1980: Apple stock traded above $0.100 for the first time ever.

- April 1987: Apple stock surpassed the $0.25 barrier for the first time in history.

- March 1991: Apple stock traded above $0.500 for the first time ever.

- March 2000: Apple stock surpassed the $1.0 barrier for the first time in history.

- October 2007: Apple stock traded above $5.0 for the first time ever.

- January 2011: Apple stock surpassed the $10 barrier for the first time in history.

- November 2014: Apple stock traded above $25 for the first time ever.

- August 2018: Apple stock surpassed the $50 barrier for the first time in history.

- July 2020: Apple stock traded above $100 for the first time ever.

- June 2024: Apple stock surpassed the $200 barrier for the first time in history.

Key Expectations for Apple Stock in 2024

- Bank of America: The bank expects Apple stock to reach $225 by the end of 2024.

- Goldman Sachs: The group expects Apple stock to reach $250 by the end of 2024.

- Citi Group: The group expects Apple stock to reach $270 by the end of 2024.

- Wells Fargo: The financial services company expects Apple stock to reach $300 by the end of 2024.

- UBS: The German bank expects Apple stock to reach $280 by the end of 2024.

- J.P. Morgan: The group expects Apple stock to reach $270 by the end of 2024.

- Morgan Stanley: The group expects Apple stock to reach $275 by the end of 2024.

- Sanford C. Bernstein: The company expects Apple stock to reach $290 before the end of 2024.

- Wedbush: The company expects Apple stock to reach $300 before the end of this year.

Factors Affecting Apple Stock Forecasts

Apple stock forecasts are influenced by several key factors related to the company and the overall market. Below are some important factors that can affect Apple's stock performance:

1. Technological Innovation and Product Launches

Technological innovations and new product launches are among the main factors influencing Apple's stock. New products, such as new versions of the iPhone, iPad, and Mac, as well as completely new devices like smart glasses, can lead to increased demand and significant profits.

2. Company Financial Performance

Apple's financial results, including revenue, net profits, and profit margins, affect its stock forecasts. Apple regularly announces its financial reports, and any increase or decrease in these figures can affect the stock price.

3. Innovation in AI and Technology

Apple invests heavily in AI and modern technologies such as augmented and virtual reality and cloud services. The introduction of new technologies and developments in these areas can increase the stock value.

4. Global Market and International Expansion

Apple relies heavily on global markets for its revenues. Performance in emerging markets such as China and India can have a significant impact on future forecasts.

Any changes in international trade policies or export restrictions can affect the company's performance.

5. Market Competition

Apple faces intense competition from other tech companies such as Samsung, Google, and Microsoft. The ability to outperform competitors and offer better products can enhance its stock performance.

6. Government Policies and Regulations

Any changes in government policies or regulations related to technology, privacy, and cybersecurity can affect Apple's operations. New laws affecting product pricing or taxes can change profit forecasts.

7. Macroeconomics and Market Conditions

Apple's stock forecasts also depend on general economic conditions such as inflation, interest rates, and changes in GDP. The overall financial market and economic conditions can affect investor confidence and expectations.

8. Service Innovation

Apple also focuses on offering a variety of services such as Apple Music, Apple TV+, Apple Pay, and iCloud. Growth in these services and increased subscriptions can boost the company's revenues and positively affect the stock price.

9. Company Management and Leadership

Effective management and leadership are crucial factors affecting a company's success. Changes in top leadership or strategy can affect investor confidence and, consequently, the stock price.

Frequently Asked Questions About Apple

Is Apple Stock Price Suitable for Investment?

Apple stock is currently trading around $225. In light of most predictions pointing to a bullish market for the world's largest company by market value, we believe levels of $210 to $200 are suitable for investment, targeting above $300 in 2024 and around $500 in 2025.

How to Invest in Apple?

You cannot invest directly in Apple because it is a public company, not a tradable instrument. However, there are two main ways to indirectly invest in Apple:

- Buying Apple Shares (NASDAQ: AAPL):

- You can buy Apple shares through a broker or an online trading platform.

- When you buy Apple shares, you become a small owner of the company and benefit from its profits and future growth.

- Apple shares are a risky investment, and their value can fluctuate significantly.

- ETFs That Include Apple:

- ETFs track the performance of an index or a basket of stocks.

- Many ETFs include Apple, such as QQQ and VGT.

- ETFs provide an easy and diversified way to invest in Apple.

- ETFs are less risky than individual company shares because they are spread over a group of stocks.

Will Apple Stock Reach $300 in 2024?

In light of recent developments regarding the future of US interest rates and the current full pricing around two cuts in September and November, the tech sector will be the biggest beneficiary of market liquidity and reduced borrowing costs.

Therefore, it is not entirely unlikely for Apple stock to rise to $300 in 2024, with strong surpassing of this level in the following years.

Is Apple Stock Expected to Rise in 2024?

Yes, Apple stock is expected to continue rising this year, as most predictions from major institutions, banks, and experts remain stable about Apple stock being in a bullish market.

Largest Companies by Market Value in 2024

- Apple Inc., USA - $3.45 trillion

- Microsoft, USA - $3.31 trillion

- NVIDIA, USA - $3.02 trillion

- Alphabet (Google), USA - $2.256 trillion

- Amazon, USA - $1.939 trillion

- Aramco, Saudi Arabia - $1.814 trillion

- Meta (Facebook), USA - $1.239 trillion

- Berkshire Hathaway, USA - $935 billion

- Taiwan Semiconductor Manufacturing Company (TSMC), Taiwan - $880 billion

- Eli Lilly, USA - $791 billion

List of Companies Investing in AI

- Microsoft - MSFT

- Alphabet (Google) - GOOGL

- Amazon - AMZN

- NVIDIA - NVDA

- IBM - IBM

- Tesla - TSLA

- Adobe - ADBE

- Apple - AAPL

- Meta (Facebook) - META

- Intel - INTC

- Salesforce - CRM

- Baidu - BIDU

- Oracle - ORCL

- Snap Inc. - SNAP

The CADJPY exits the bullish track – Forecast today – 24-7-2024

The CADJPY price faced strong negative pressures by fluctuating below the MA55 in addition to stochastic reach to the oversold areas, to force it to crawl below the bullish channel’s support line at 113.30 and suffer big losses by reaching 111.90.

The continuous negative closings below 113.30 that forms solid resistance now against the bearish trades allows us to suggest more negative attempts, to target 111.45 as a next station, while breaking it might extend losses towards 110.00 on the medium term basis.

The expected trading range for today is between 112.85 and 111.45

Trend forecast: Bearish

Natural gas price keeps the negativity – Forecast today – 24-7-2024

Natural gas price kept its consolidation within the bearish channel, affected by the MA55 reach to the additional barrier at 2.340$, to push it to form some negative waves and settle near 2.190$.

We notice stochastic attempt to crawl towards the oversold areas, to increase the negative pressures on the price and expect attacking 2.140$ level soon, while breaking it will force the price to suffer additional losses that might extend towards 2.070$ and 1.950$.

The expected trading range for today is between 2.280$ and 2.140$

Trend forecast: Bearish