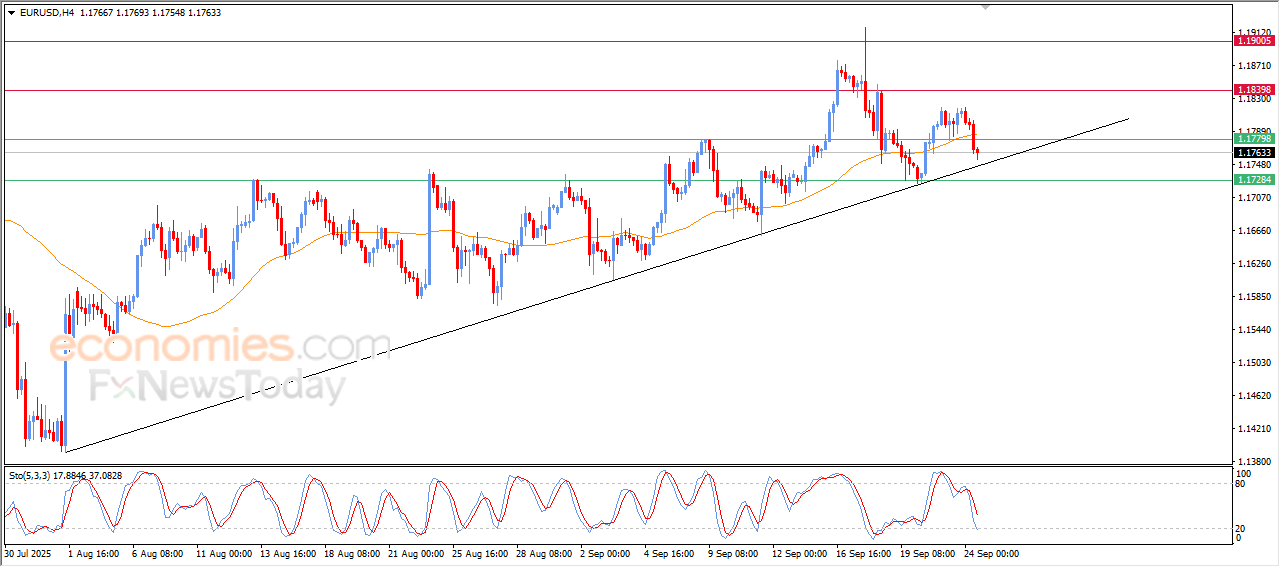

Forecast update for EURUSD -24-09-2025.

AI Summary

- EURUSD price declined in last intraday trading, facing negative signals on relative strength indicators and surpassing EMA50 support

- VIP Trading Signals Performance by BestTradingSignal.com offers high-accuracy signals for US stocks, crypto, forex, and more

- Subscription packages tailored for different markets available via Telegram, with VIP signals including Gold, Oil, Forex, Bitcoin, Ethereum, and Indices

The price of (EURUSD) declined in its last intraday trading, amid the emergence of the negative signals on the relative strength indicators, surpassing the support of its EMA50, putting it under pressure and reduces the chances of its recovery on the near term, there is one chance remain for its stability on the support of main bullish trend line on the short-term basis, as a last attempt to gain the required positive momentum to recover.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

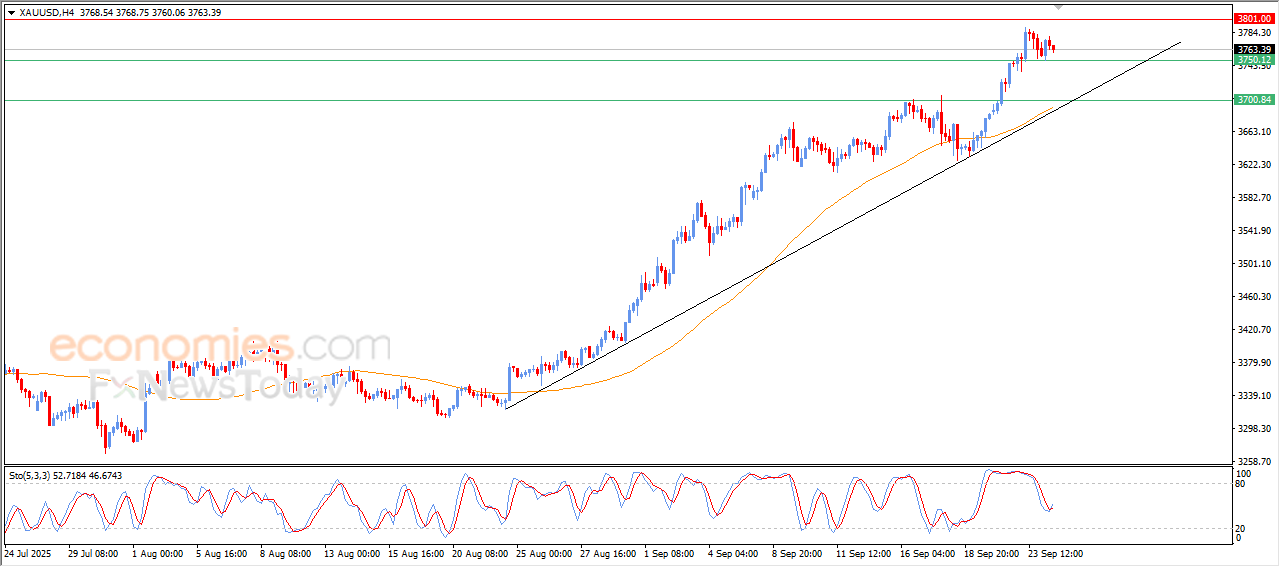

Forecast update for Gold -24-09-2025

The price of (Gold) declined slightly in its last intraday trading, amid the attempts of gain =ing bullish momentum that might help it to resume its strong gains on the near-term basis, with the beginning of positive overlapping signals on the relative strength indicators, opening the way for achieving new all-time highs, amid the dominance of the main bullish trend on the short-term basis and its trading alongside trendline.

VIP Trading Signals Performance by BestTradingSignal.com (September 15–19, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 15–19, 2025:

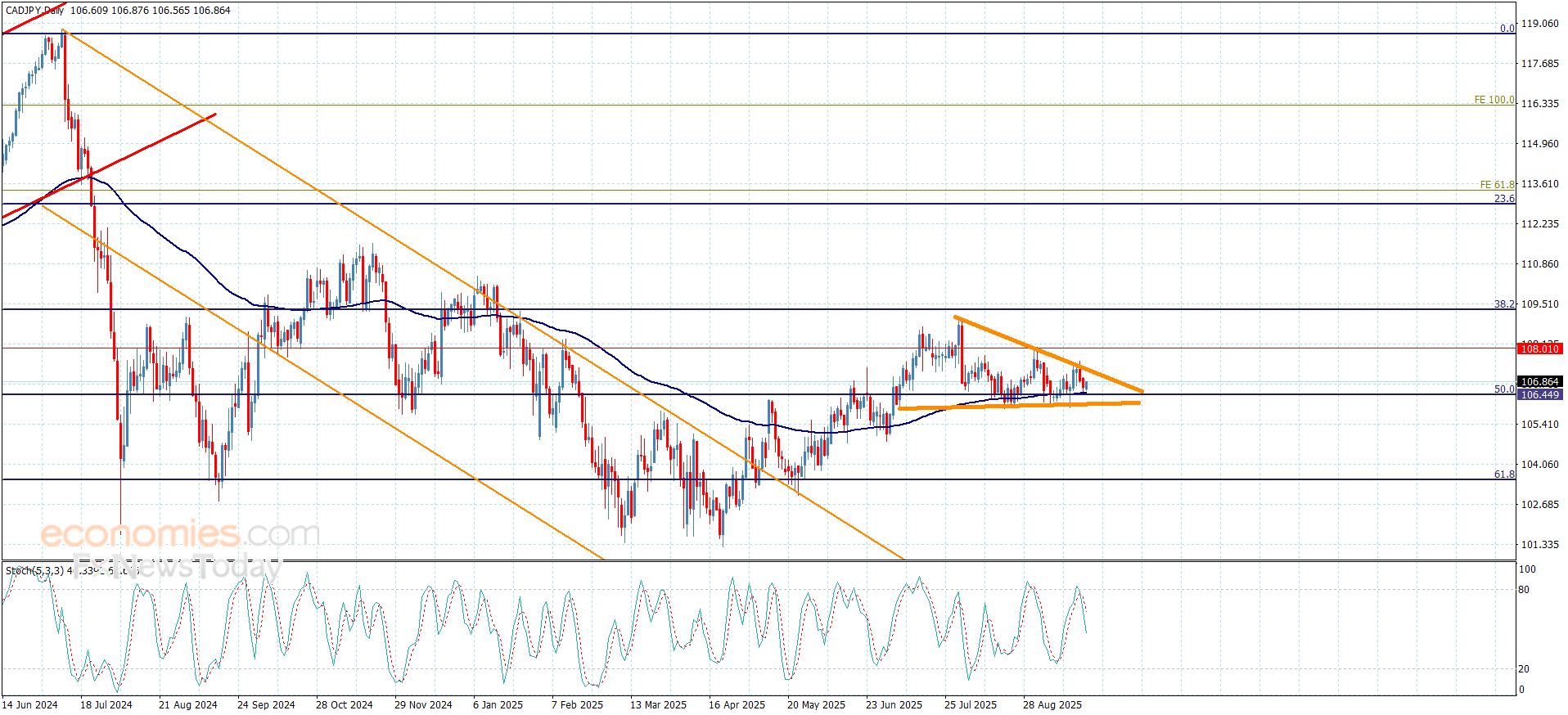

The CADJPY is waiting for surpassing the resistance– Forecast today – 24-9-2025

The CADJPY repeated its fluctuation within the ascending triangle pattern, affected by the contradiction between the main indicators, especially by stochastic decline to 50 level, which forces it to settle near106.80.

Reminding you that the stability above the ascending triangle’s support at 106.05 forms a main factor to confirm the bullish attempts, to keep waiting for breaching the resistance at 107.25 then begin targeting the main stations by its rally to 108.00 reaching 108.65 in the near term period.

The expected trading range for today is between 106.35 and 107.45

Trend forecast: Bullish

Natural gas price delays the decline– Forecast today – 24-9-2025

Natural gas price took advantage of the positive momentum that comes from stochastic rally above EMA50 in yesterday’s trading, delaying the negative attack by its stability above $3.050, achieving some gains by its stability near $3.150.

The current rise didn’t affect the main bearish scenario, due to its stability below the main resistance at $2.265, to expect forming sideways trading, then begin forming bearish waves, to press on $2.820 level again, while its success in surpassing the resistance and holding above it will turn the bullish track again, providing strong chance for recording several gains by its rally to $3.450 initially.

The expected trading range for today is between $2.820 and $3.220

Trend forecast: Bearish