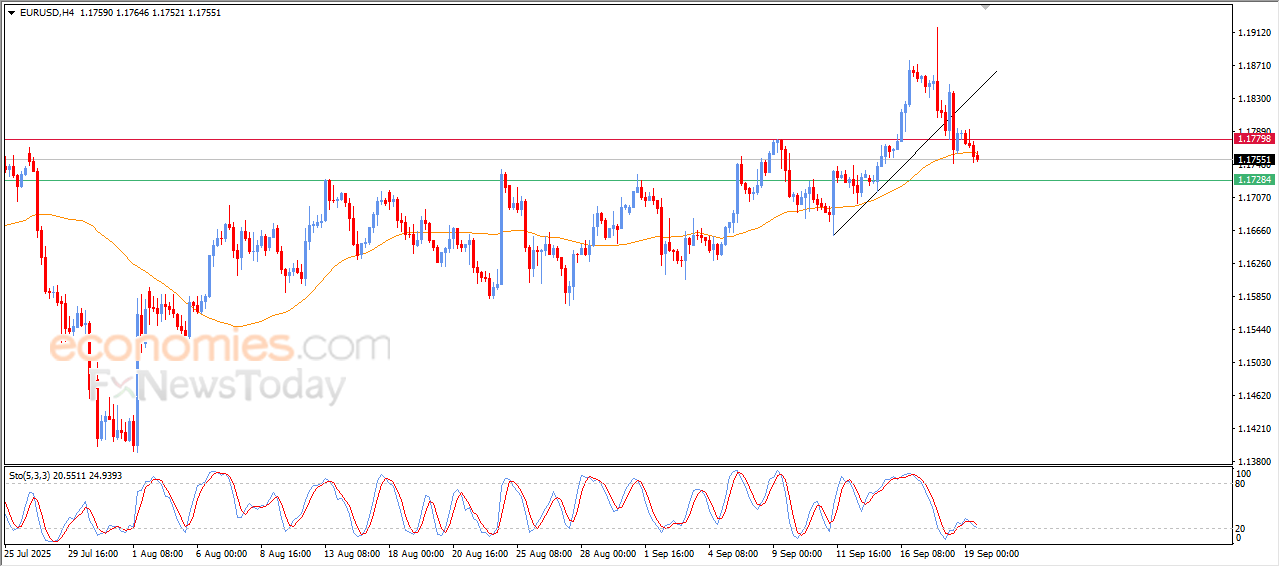

Forecast update for EURUSD -19-09-2025.

AI Summary

- EURUSD continued to decline due to breaking minor bullish bias line and surpassing EMA50 support, leading to negative pressure and signals on relative strength indicators

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets

- Subscription packages range from €44/month for US Stock Signals to €179/month for VIP Signals, with performance reports available for review

The price of (EURUSD) continued its decline in its last intraday trading, affected by breaking minor bullish bias line on the intraday levels, to surpass the support of its EMA50, intensifies the negative pressure around it, noticing the emergence of the negative signals on the relative strength indicators, after offloading some of its oversold levels, opening the way for recording more of the downside moves.

VIP Trading Signals Performance by BestTradingSignal.com (September 8–12, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 8–12, 2025:

The EURGBP price is paving the way for a new rise– Forecast today – 19-9-2025

The EURGBP ended its last correctional trading by testing the support at 0.8630, then begin activating with the main indicators’ positivity, to notice surpassing the barrier at 0.8685, to begin recording new gains by reaching 0.8720.

The continuation of the positive momentum by stochastic fluctuation near 80 level will increase the efficiency of the bullish track, to expect targeting extra positive stations by its rally near 0.8750 and 0.8780.

The expected trading range for today is between 0.8690 and 0.8750

Trend forecast: Bullish

Natural gas price receives the negative momentum– Forecast today – 19-9-2025

Natural gas price succeeded in gathering the negative momentum, which allows it to settle below the main resistance at $3.240, to notice forming bearish waves and holding near the initial target at $2.940.

The continuation of the negative pressure will provide strong chance for forming new bearish moves, to expect attacking the barrier of $2.820, then attempts to reach the support near $2.620, to form the main target of the near period trading.

The expected trading range for today is between $2.820 and $3.000

Trend forecast: Bearish

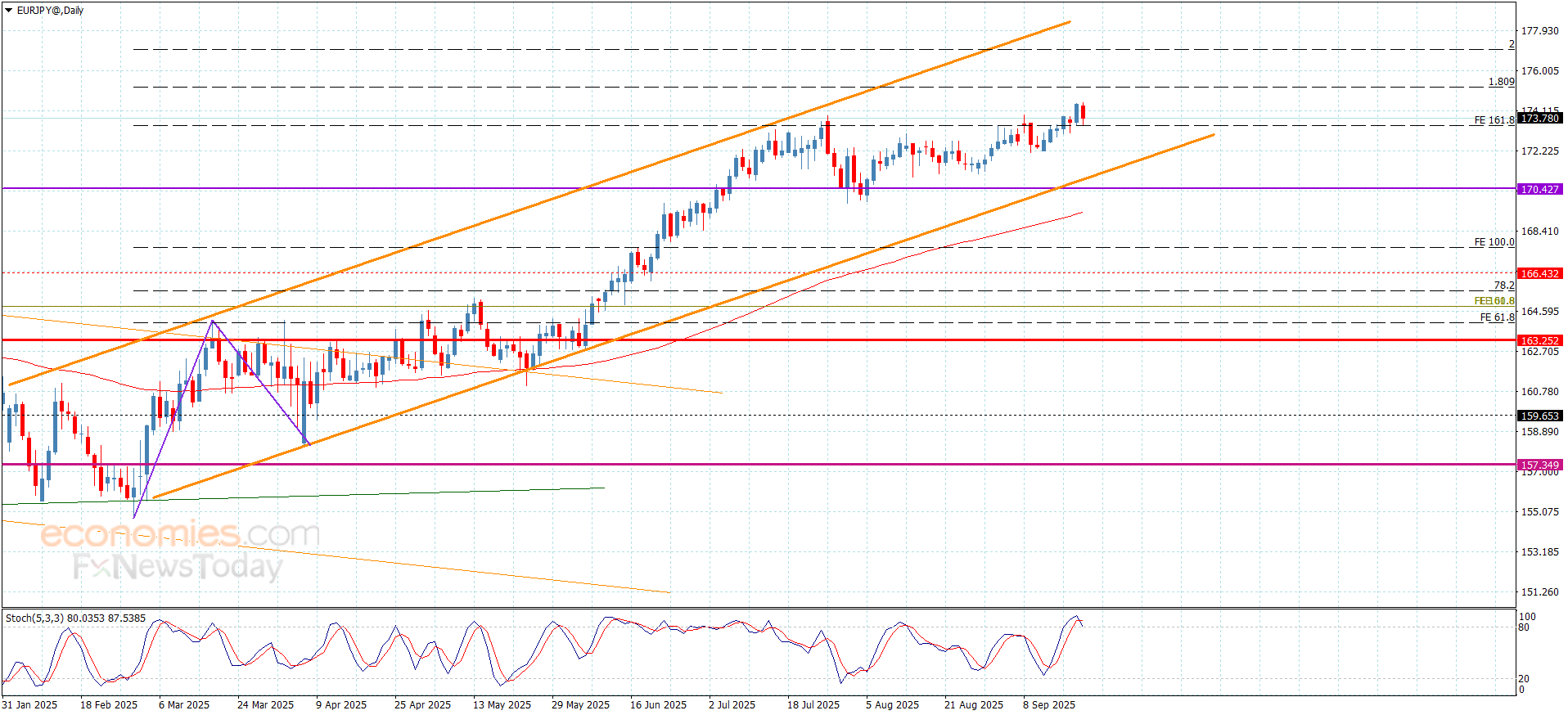

The EURJPY records the initial target– Forecast today – 19-9-2025

The EURJPY pair formed new bullish rally, to record the initial extra target at 174.25, then bounced quickly to retest the breached barrier, which represents a new support at 173.40.

The suggested scenario depends on the stability of the current support, as the price stability makes us expect renewing the bullish attempts to target new positive stations that begin at 175.20, while facing negative pressures and reaching below this support will increase the chances for activating the bearish correctional track again, which forces it to suffer some losses by reaching 172.80, followed by the support of the bullish channel at 171.15.

The expected trading range for today is between 173.40 and 175.20

Trend forecast: Bullish