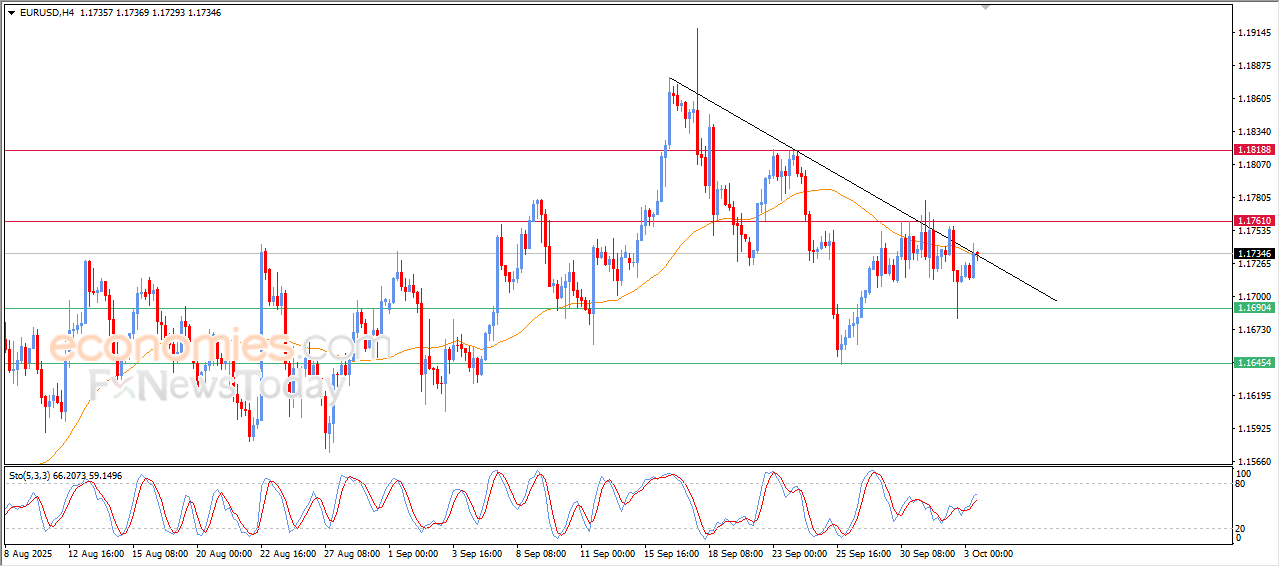

Forecast update for EURUSD -03-10-2025.

The price of (EURUSD) rose in its last intraday trading, supported by the emergence of positive signals on the relative strength indicators, reaching the resistance of its EMA50, testing bearish corrective trend line on the short-term basis, intensifying the importance of this area as critical resistance, which will detect the upcoming trend on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

The GBPAUD settles above the support– Forecast today – 3-10-2025

The GBPAUD continued to face negative pressure in the last period, keeping its stability above 2.0320 support to reinforce the chances of activating the bullish attack.

To notice providing positive momentum by stochastic stability above 20 level, motivating the price to form bullish waves, to target 2.0450 level to repeat the pressure on 23.6%Fibonacci corrective level at 2.0515 to find an exit to resume the rise in the upcoming period trading.

The expected trading range for today is between 2.0325 and 2.0515

Trend forecast: Bullish

Natural gas price achieves the second target– Forecast today – 3-10-2025

Natural gas price reached $3.600 level, achieving the second suggested target in the previous report, which forced it to form quick correctional rebound, to settle near $3.440.

The intraday sideways trading is caused by stochastic exit from the overbought level, to expect providing unstable mixed trading until gathering the extra positive momentum, to ease the mission of resuming the bullish attack, and reaching extra stations that are represented by $3.710 and $3.830.

The expected trading range for today is between $3.380 and $3.600

Trend forecast: Fluctuated

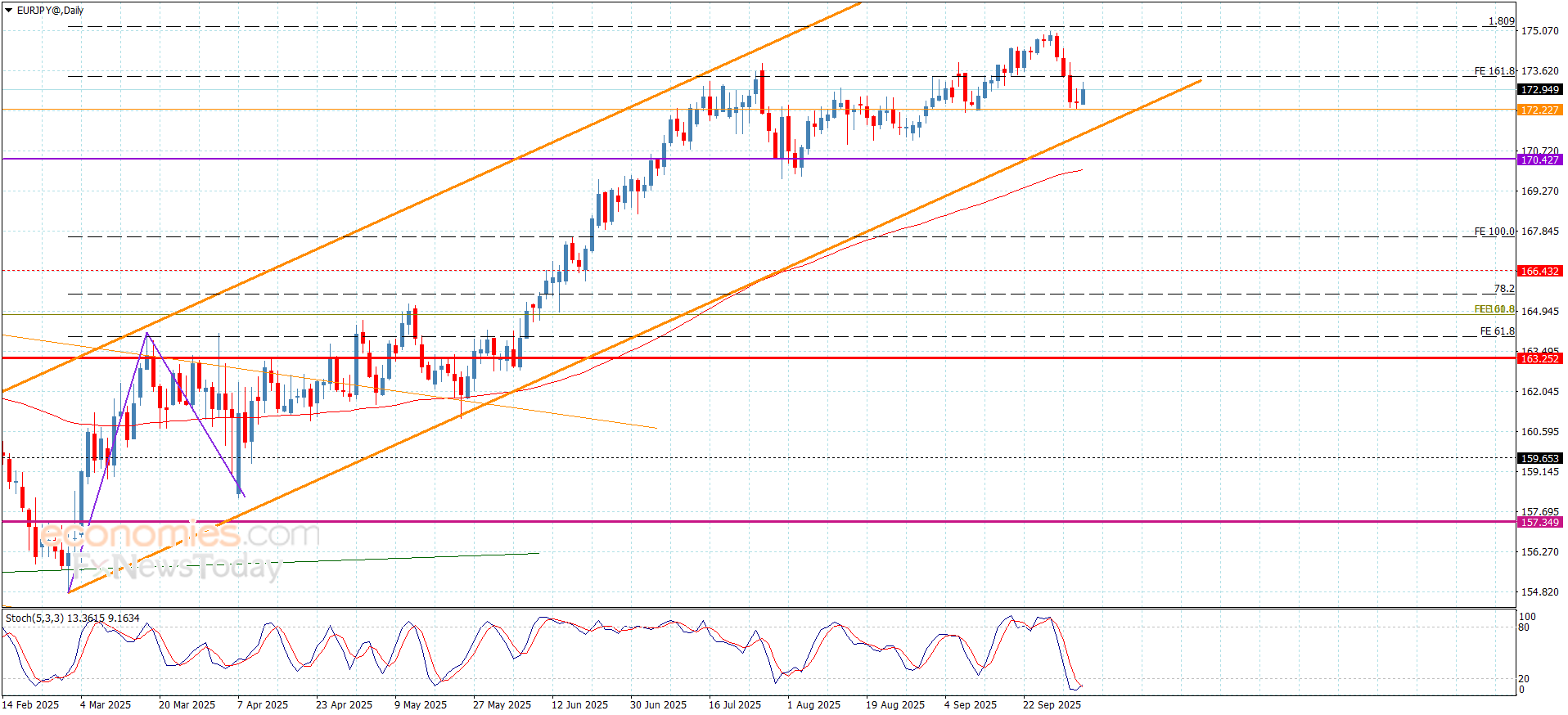

The EURJPY keeps the bullish bias– Forecast today – 3-10-2025

The EURJPY pair kept its positive stability above the extra support level at 172.20, which allowed it to achieve some gains, to notice its rally towards 173.20, approaching from the initial barrier at 173.40 level.

By the above image, we notice stochastic attempt to exit the oversold level, opening the way for more of the positive stations by its rally to 174.40, while suffering new negative pressure and reaching below 172.20 might push it to attack the support of the main bullish channel at 171.45 before any attempt to hit the positive targets.

The expected trading range for today is between 172.20 and 173.70

Trend forecast: Bullish