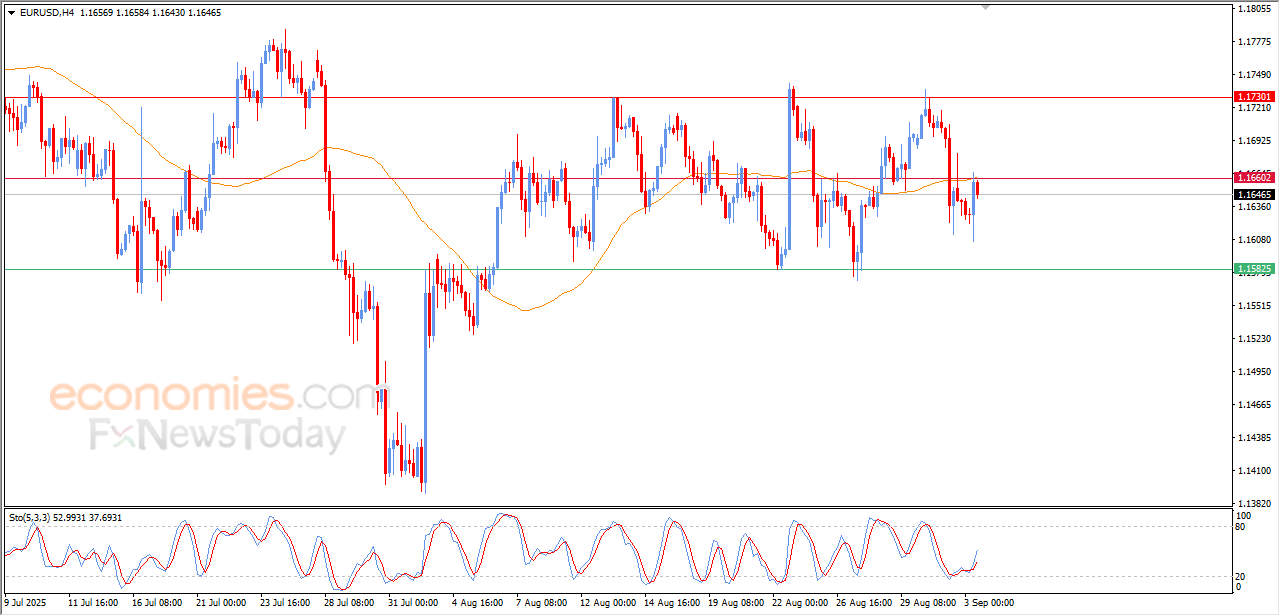

Forecast update for EURUSD -03-09-2025.

AI Summary

- EURUSD price declined in last intraday trading, attempting to recover losses but hitting resistance at EMA50

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets

- VIP signals performance report for August 25-29, 2025 available for viewing on the website

The price of (EURUSD) declined in its last intraday trading, after it attempted to recover its yesterday’s losses in its early trading today, and it attempted to offload some of its clear oversold conditions on the (RSI), especially with the emergence of the positive signals from there, to hit the resistance of its EMA50, which forced the price to decline again.

VIP Trading Signals Performance by BestTradingSignal.com (August 25–29, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for August 25–29, 2025:

The CADCHF keeps the positive attempts– Forecast today – 3-9-2025

Despite the neediness of the CADCHF to the positive momentum in the last period, but it its positive stability above the support at 0.5780 supports the chances of activating the suggested bullish correctional attempts, to fluctuate near 0.5830.

By the above image, we notice stochastic attempt to provide positive momentum by its stability above 20 level, to increase the chances for targeting the positive stations by its rally towards 0.5910, surpassing it might succeed in renewing the pressure on the barrier at 0.6020 level.

The expected trading range for today is between 0.5800 and 0.5910

Trend forecast: Bullish

Natural gas price repeats the negative closes– Forecast today – 3-9-2025

Natural gas price touched $2.880 level, to repeat testing the barrier near $3.050, attempting to gather more of the negative momentum to confirm the continuation of the suggested negativity.

Reminding you that the bearish scenario will remain valid if the price settles below the main resistance at $3.185, gathering the negative momentum will make is reach the negative stations that begin at $2.810 reaching the obstacle near $2.620.

The expected trading range for today is between $2.810 and $3.100

Trend forecast: Bearish

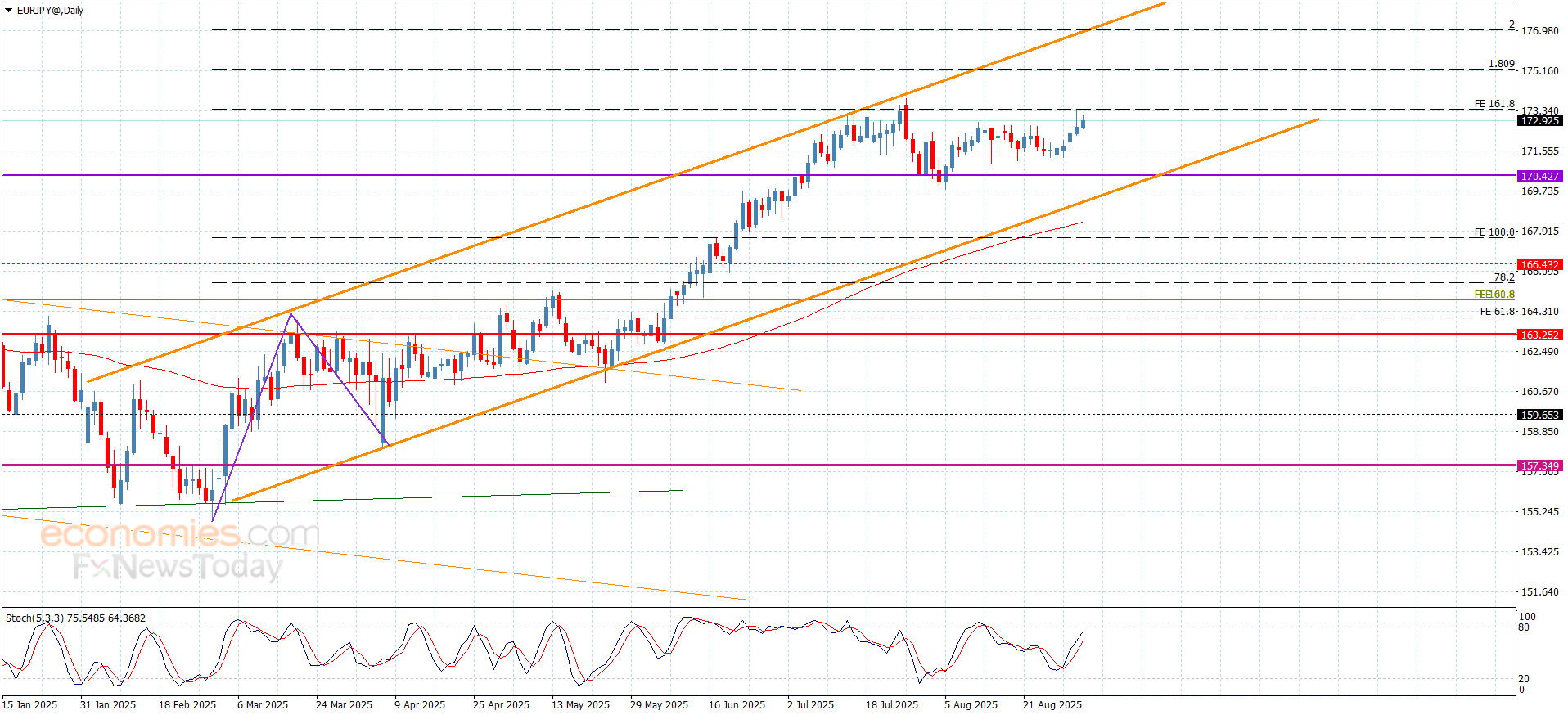

The EURJPY achieves the initial target– Forecast today – 3-9-2025

The EURJPY pair continued forming bullish waves, reaching the target at 173.40, forming strong obstacles to force it to form some sideways trading by its stability at 172.80.

Despite the continuation of providing positive momentum, we confirm that waiting to breach the current barrier is important to confirm its readiness to achieve extra gains that might extend to 174.20 reaching the next main target at 175.20, while the failure to achieve the breach will force the price to provide mixed trading with a chance for the price decline temporarily towards 171.30.

The expected trading range for today is between 172.35 and 174.20

Trend forecast: Bullish