Forecast update for EURUSD -01-08-2025

AI Summary

- The price of EURUSD rose slightly in intraday trading, attempting to recover early losses and offload oversold levels on the RSI.

- Bearish correctional wave dominance indicates selling power superiority in the near-term, restricting recovery attempts.

- BestTradingSignal.com offers high-accuracy trading signals for various markets, with subscription options starting at €44/month.

The price of (EURUSD) rose slightly in its last intraday trading, attempting to recover its early losses, to offload some of its clear oversold levels on the (RSI), especially with the emergence of positive signals that reinforce the chances for intraday stability.

This limited rise comes amid the continuation of the dominance of bearish correctional wave, indicating the superiority of the selling powers on the trading in the near-term basis, imposing restrictions on any attempts for recovery.

BestTradingSignal.com – Professional Trading Signals

High-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s most important markets – all powered by BestTradingSignal.com .

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramThe longer the subscription, the greater the savings and the more value you get.

Weekly performance report available here: Signals Performance – Week of July 21–25, 2025

The EURNZD renews the positive action– Forecast today – 1-8-2025

The EURNZD ended the correctional decline after testing the top level of the support base by hitting 1.9280 level, forming a strong bullish rally to notice reaching 1.9420.

We expect to form a strong extra support at the 1.9345 level and provide positive momentum by the positive momentum makes the price resume the bullish attempts to reach 1.9480 and surpassing it will extend the trading directly to the next positive target near 1.9530.

The expected trading range for today is between 1.9360 and 1.9480

Trend forecast: Bullish

The EURJPY renews the positive action– Forecast today – 1-8-2025

The EURJPY pair confirmed the stability of the bullish track by its rally above 170.45 level yesterday, which allows it to record several gains by reaching 172.30 as appears in the above image. The 170.45 level will remain the line between the return of the bearish correctional track or resuming the main bullish attack, to expect providing positive momentum by stochastic, in attempt to target 172.80 level, to repeat the pressure on the resistance at 173.45.

The expected trading range for today is between 171.40 and 172.80

Trend forecast: Bullish by the stability of 170.45

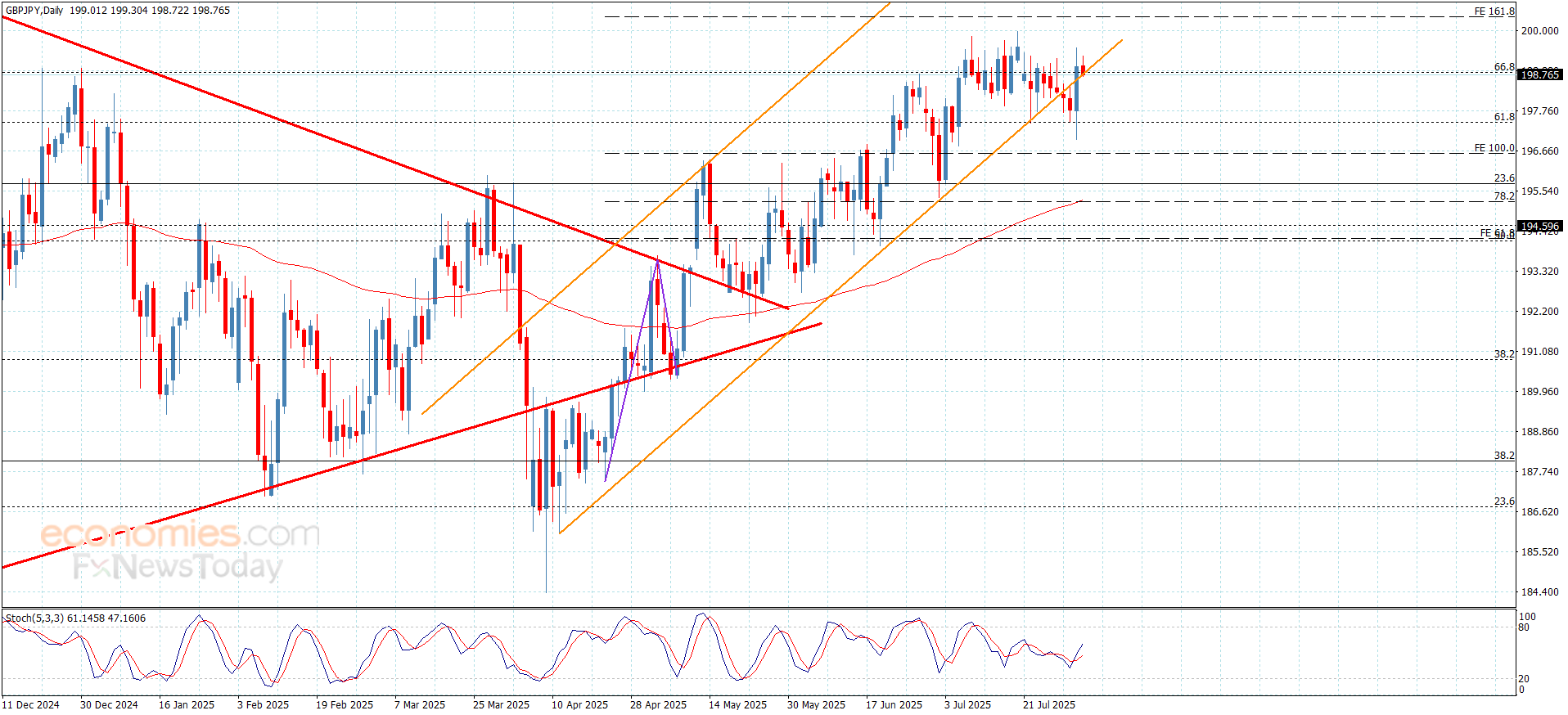

The GBPJPY takes advantage from the positive pressures– Forecast today – 1-8-2025

The GBPJPY pair took advantage of providing positive momentum by stochastic to bounce again above 61.8%Fibonacci correction level at 197.50, forming a strong bullish rally and achieving 199.50 level.

Noticing the attempt of testing the support of the bullish channel that is represented by 198.70 level, confirming that holding above it is important to increase the chances for forming new bullish waves to target 199.80 level, reaching the next main target at 200.35, while breaking the current support will confirm the instability of the price and there is a chance for a decline towards 198.10 before any attempt to record any of the suggested targets.

The expected trading range for today is between 198.70 and 199.80

Trend forecast: Bullish