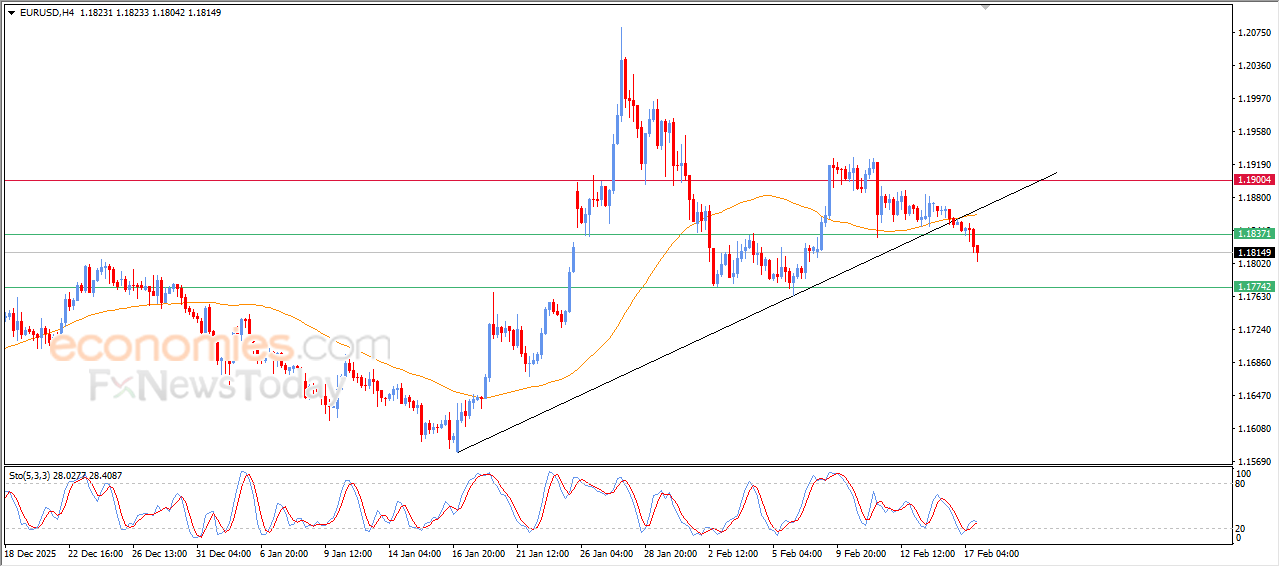

Evening update for EURUSD-17-02-2026

(EURUSD) kept declining in its last intraday trading, affected by breaking main bullish trend line on short-term basis, with negative pressure due to its trading below EMA50, breaking 1.1835, in a clear signal for its momentum to continue the decline in the upcoming period.

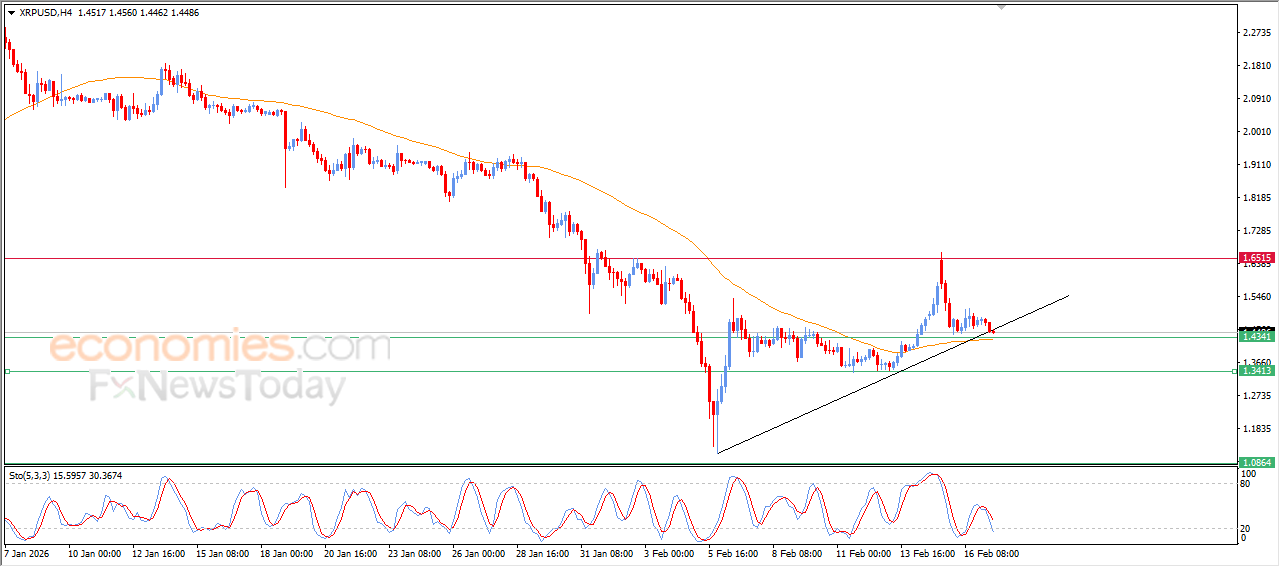

Ripple seeks a supportive bottom - Analysis - 17-02-2026

XRPUSD price recorded a decline in its latest intraday trading, coming under negative pressure from RSI and Stochastic signals, while attempting to form a higher low that could act as a base for renewed positive momentum and recovery. The pullback found support at a short-term corrective upward trend line, in addition to dynamic support from the 50-day SMA, which improves the chances of a near-term rebound.

Therefore we expect the cryptocurrency price to rise in upcoming intraday trading, provided that support at $1.4340 holds, targeting the key resistance level at $1.6500.

Today’s price forecast: Neutral

AT&T price stalls - Forecast today - 17-02-2026

AT&T (T) stock price recorded a slight decline in its latest intraday trading, as the stock is taking a pause to collect gains after its previous rise, while attempting to unwind part of its clearly overbought conditions on RSI and Stochastic. This pullback comes as part of a positive reset that could help the stock resume its strong upward movement in the near term, amid the dominance of a sharp short-term upward wave and continued positive support from trading above the 50-day SMA.

Therefore we expect the stock price to rise in upcoming trading, as long as support at $27.50 holds, targeting the key resistance level at $29.80.

Today’s price forecast: Bullish

Tesla price shows more negative signs - Forecast today - 17-02-2026

Tesla, Inc. (TSLA) stock price recorded a decline in its latest intraday trading, after the stock previously broke a major upward trend line, adding technical weakness. The price remains under negative and dynamic pressure as it continues to trade below the 50-day SMA, which reduces the chances of a sustainable recovery in the near term, especially with RSI and Stochastic showing a fresh negative crossover after reaching strongly overbought levels.

Therefore we expect the stock price to fall in upcoming trading, as long as resistance at $436.35 holds, targeting the key support level at $373.75.

Today’s price forecast: Bearish