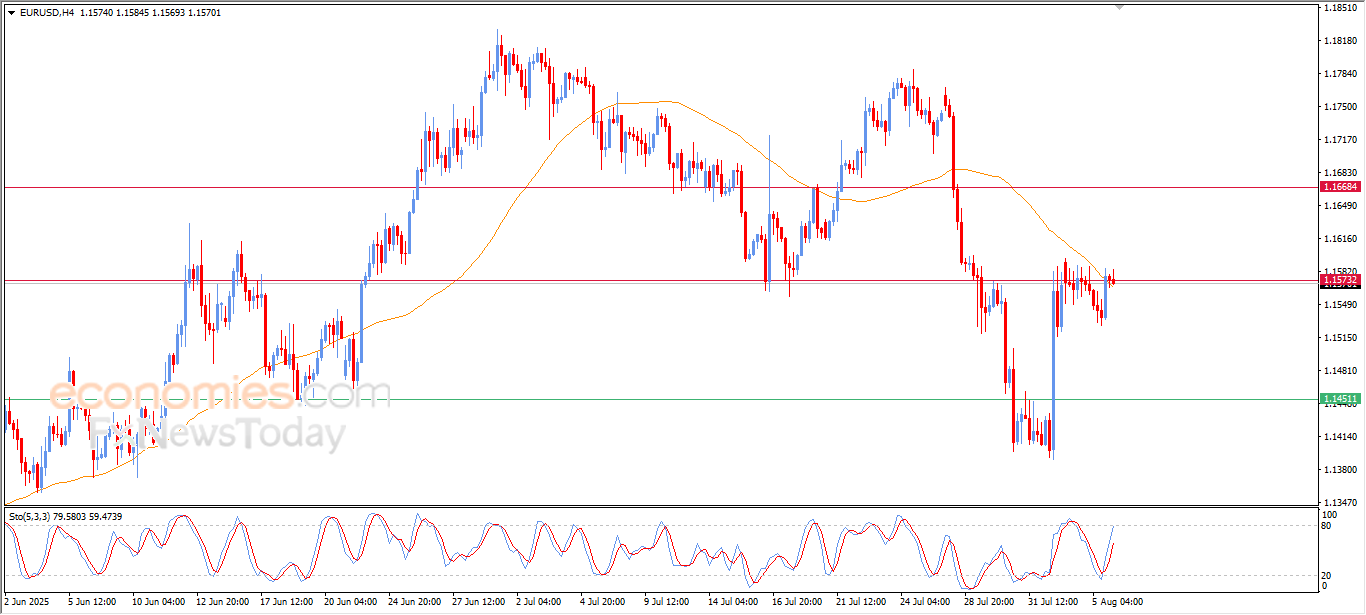

EURUSD struggles to get rid of its negative pressure-Analysis-06-08-2025

AI Summary

- EURUSD experienced a strong rise in its last intraday trading session, supported by positive signals on the RSI and minor bullish waves on a short-term basis

- The price reached a critical resistance level at 1.575 but struggled to overcome negative pressure from stability below EMA50

- BestTradingSignal.com offers professional trading signals for US stocks, crypto, forex, and VIP signals for various markets, with subscription packages starting from €44/month

The (EURUSD) settled with strong rise in its last intraday trading, supported by the emergence of positive signals on the (RSI), and under the dominance of strong minor bullish waves on the short-term basis.

This momentum allowed the price to reach the critical resistance level at 1.575, accompanied by its attempts to surpass the negative pressure that comes from its stability below EMA50, as a signal for its attempts to reinforce the breach and resume the rise.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

Stellar price faces positive outlook - Analysis - 05-08-2025

Stellar's price (XLMUSD) held onto slight gains in the latest intraday trading, as it attempts to overcome the negative pressure from the 50-period simple moving average and unwind its clear overbought conditions on the Relative Strength Indicators, which continue to emit negative signals. However, the price is also influenced by a positive short-term technical pattern — the falling wedge — which may support a swift recovery once surrounding bearish pressure eases.

Therefore, we expect the price to rise in the upcoming sessions, as long as support remains steady at $0.361200, targeting the key resistance level of $0.514783.

Today’s price forecast: Bullish.

Avalanche price faces negative pressure - Analysis - 05-08-2025

Avalanche's price (AVAXUSD) declined in the latest intraday trading after encountering resistance from the 50-period simple moving average. The cryptocurrency remains under the influence of a short-term corrective bearish wave, with a negative divergence beginning to form on the Relative Strength Indicators. These indicators have entered heavily overbought territory, showing exaggerated levels compared to price action, as negative signals begin to emerge.

Therefore, we expect the price to decline in the upcoming intraday sessions, as long as resistance remains firm at $23.15, targeting the support level of $20.60.

Today’s price forecast: Bearish.

Johnson & Johnson price pierces pivotal resistance - Forecast today - 05-08-2025

Johnson & Johnson's stock price (JNJ) turned green in the latest intraday trading, successfully breaking through the key resistance level at $168.85. The stock remains under the control of a short-term upward trend, trading along a rising slope and supported by sustained bullish pressure from holding above the 50-day SMA. The recent rise also follows a successful cooling of overbought signals on the Relative Strength Indicators, giving the stock greater room to pursue further gains.

Therefore, we expect the stock price to continue rising in upcoming sessions, especially as long as it remains above $168.85, targeting the next resistance level at $177.80.

Today’s price forecast: Bullish.