EURUSD is under negative pressure-Analysis-30-09-2025

AI Summary

- EURUSD is facing negative pressure due to stability below EMA50 and failure to surpass critical resistance at 1.1730

- Relative strength indicators show fading bullish momentum, increasing chances of continued negative pressure in the near-term

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for various markets starting from €44/month

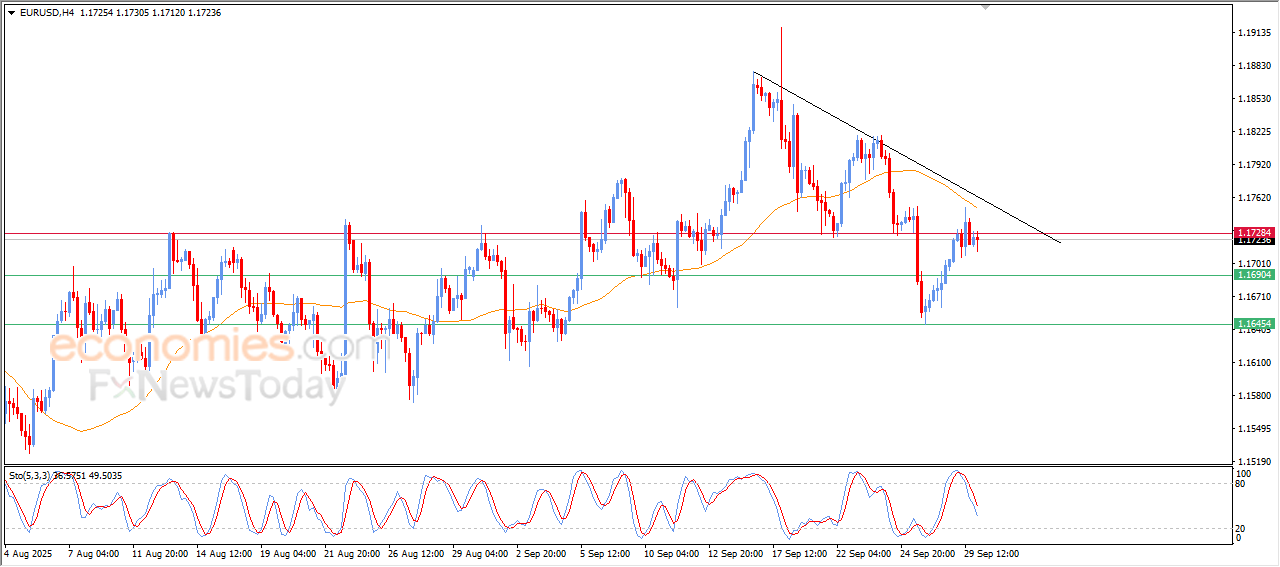

The (EURUSD) witnessed fluctuations on its last intraday levels, amid the continuation of the negative pressure that comes from its stability below its EMA50, with its failure to surpass the critical resistance at 1.1730, to remain under the dominance of the bearish correction trend on the short-term basis and its trading alongside trendline for this track.

Accompanied by the negative signals emerging from the relative strength indicators, after reaching overbought levels, which indicate the fading of the bullish momentum and reinforces the chances for the continuation of the negative pressure on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

Evening update for Bitcoin (BTCUSD) -29-09-2025

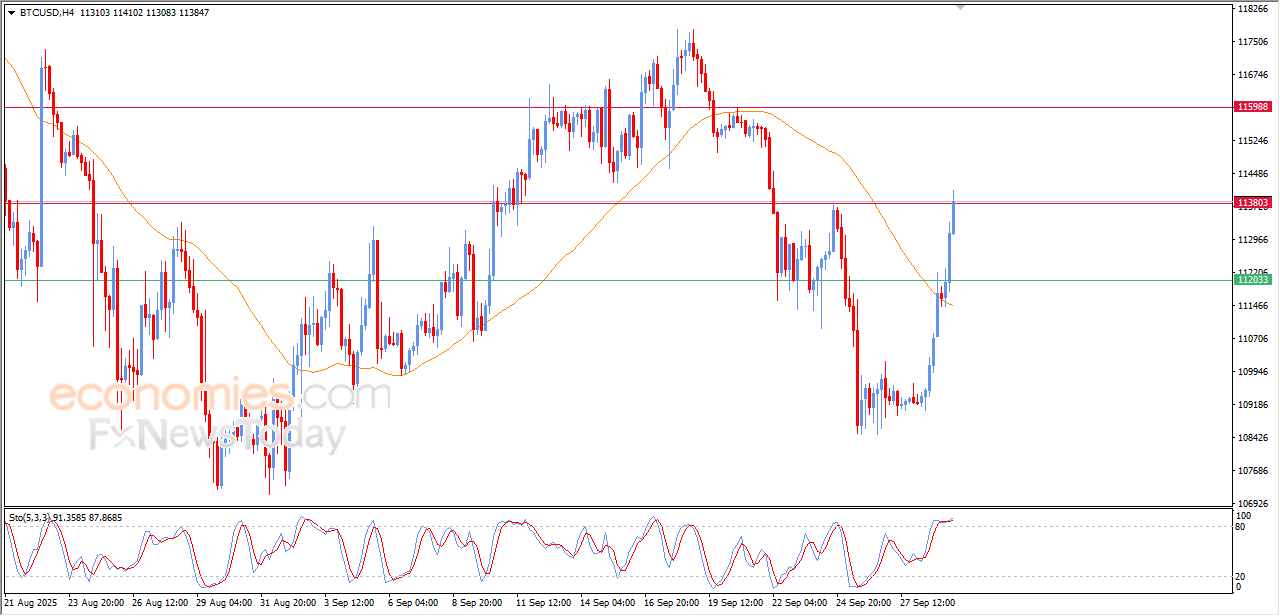

The (BTCUSD) price witnessed sharp rise in its last trading on the intraday levels, after breaching the key resistance level at $112,000, opening the way for targeting the next resistance level at $113,800, as we expected in our morning analysis, taking advantage of the dynamic support that is represented by its trading above EMA50, on the other hand, noticing that the relative strength indicators reached overbought levels, which might reduce the gains temporarily.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

Evening update for crude oil -29-09-2025

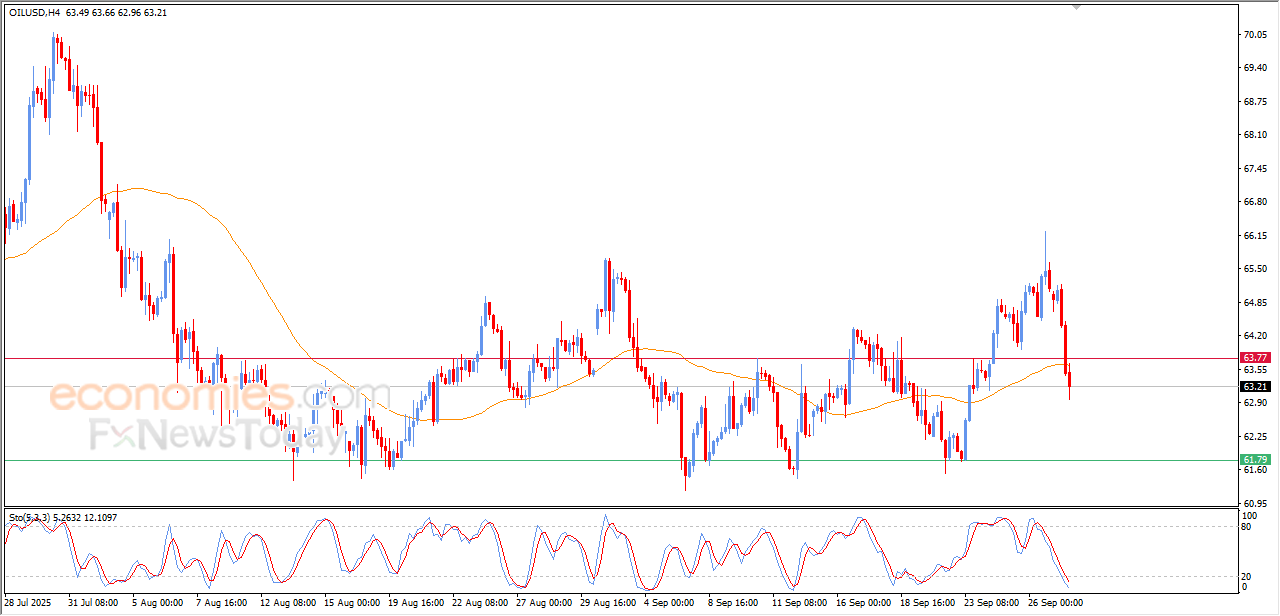

The (crude oil) continued the decline in its last intraday trading, ending hopes of its recovery on a short-term basis, where it surpassed the support of its EMA50, besides the emergence of the negative signals on the relative strength indicators, despite reaching oversold levels, which might limit the losses temporarily, and more potential downside moves on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

Evening update for Gold -29-09-2025

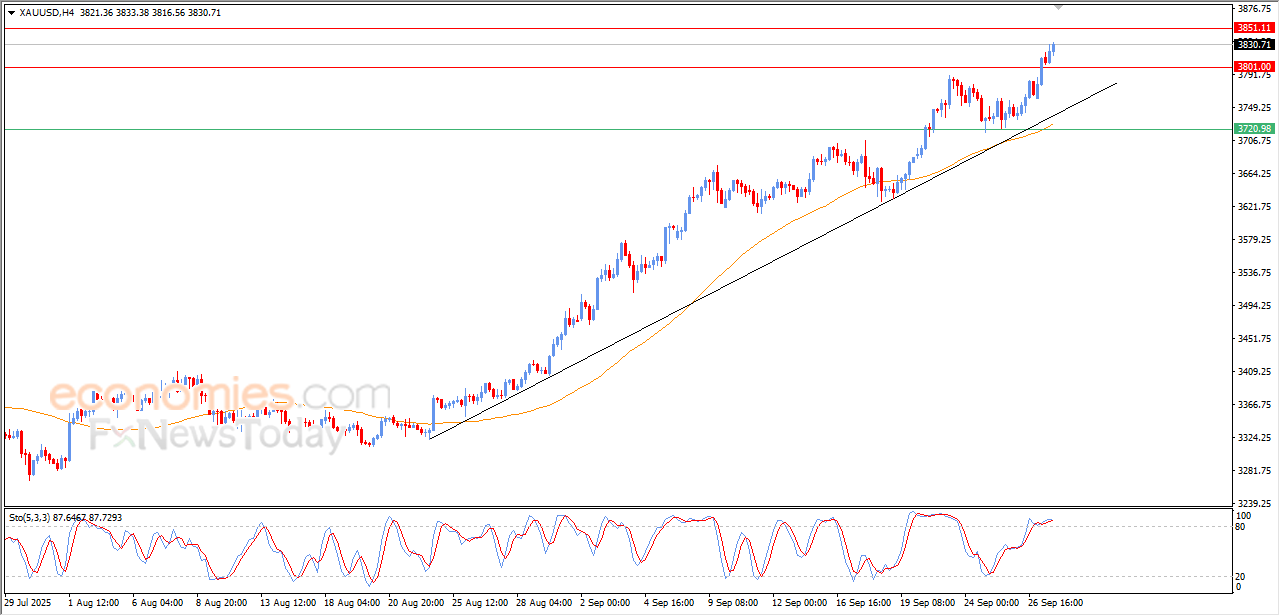

The (Gold) price extended its gains in its last intraday trading, to continue recording new all-time highs in every step to the upside, settled above $3,800 support, supported by its continued trading above its EMA50, and under the dominance of the main bullish trend line on the short-term basis and its trading alongside supportive trend line for this track.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: