EURUSD is recording cautious gains -Analysis-18-07-2025

AI Summary

- EURUSD is experiencing cautious gains in its last intraday trading

- Positive signals on the RSI are present, but indicators show overbought conditions, suggesting a potential end to the bullish momentum

- Bearish correctional trend pressure on a short-term basis may lead to a new bearish correction wave

The (EURUSD) recorded a sharp rise in its last intraday trading, supported by the emergence of positive signals on the (RSI), but these indicators are showing exaggerated overbought conditions compared to the price move, indicating that ending the current bullish momentum is close.

This rise comes due to the bearish correctional trend pressure on the short-term basis, with the continuation of the trading alongside a bearish bias line, and its stability below EMA50, reinforcing the possibilities for facing a new bearish correction wave.

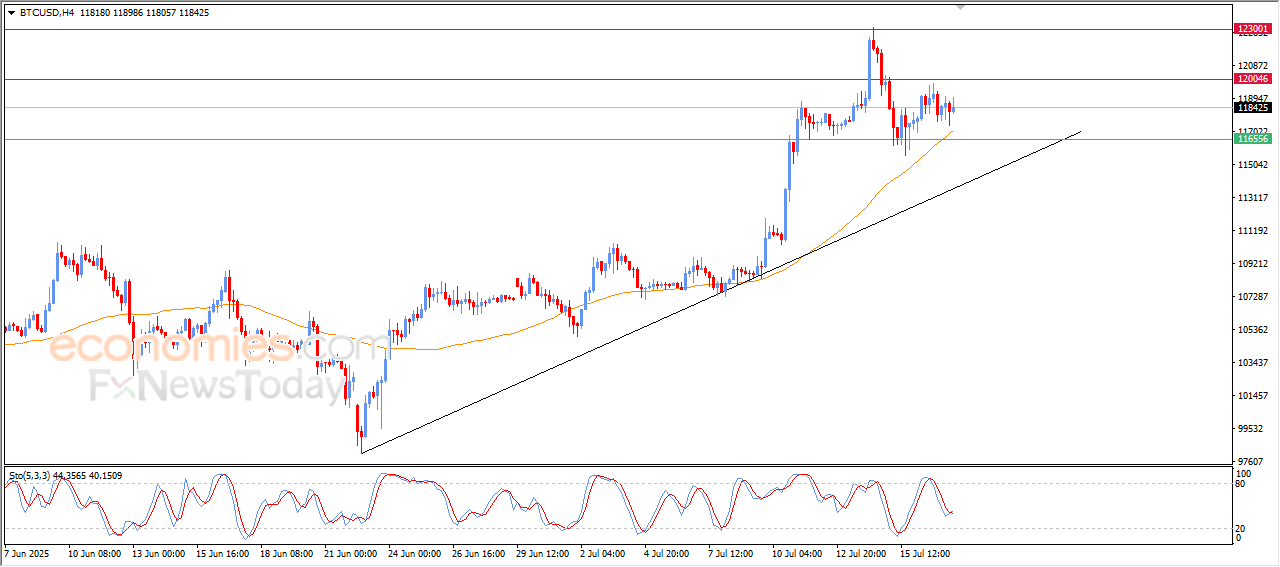

Evening update for Bitcoin (BTCUSD) -17-07-2025

The (BTCUSD) witnessed fluctuated trading in the last intraday levels, amid its attempts to gain a positive momentum that might assist it to recover and rise again, amid the continuation of the positive pressure that comes from its trading above EMA50, and under the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line, noticing the beginning of positive overlapping signals on the (RSI), after the price success in offloading its overbought condition.

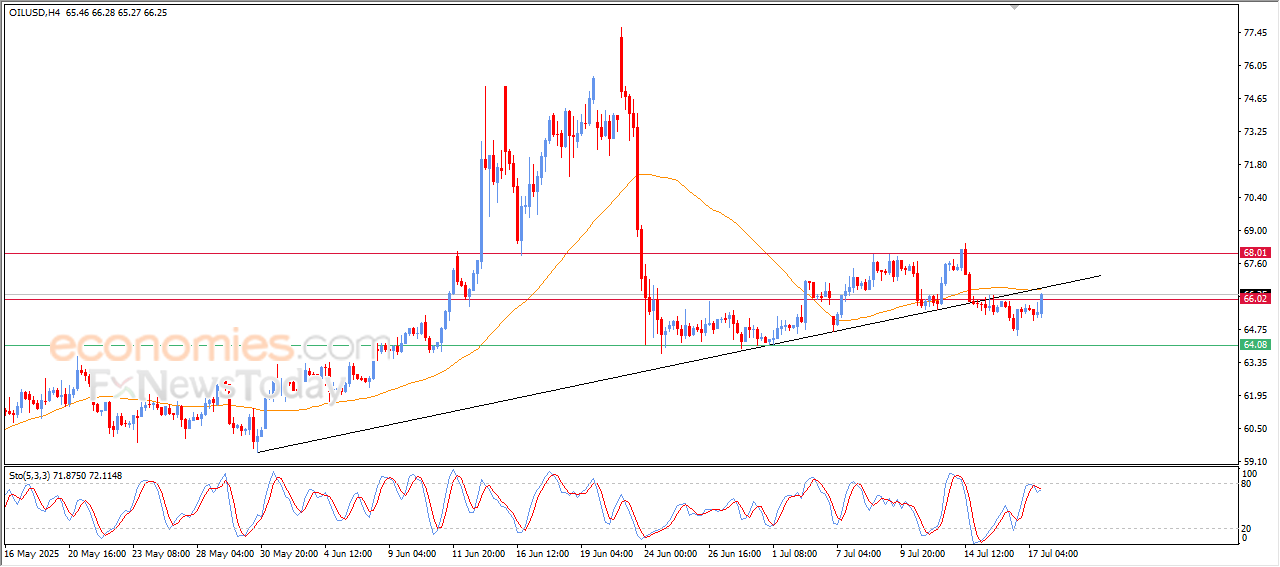

Evening update for crude oil -17-07-2025

The (crude oil) rose in its last intraday trading, reaching the resistance of EMA50, accompanied by retesting the bullish trend line on the short-term basis, amid the emergence of the negative signals on the (RSI), after reaching overbought levels.

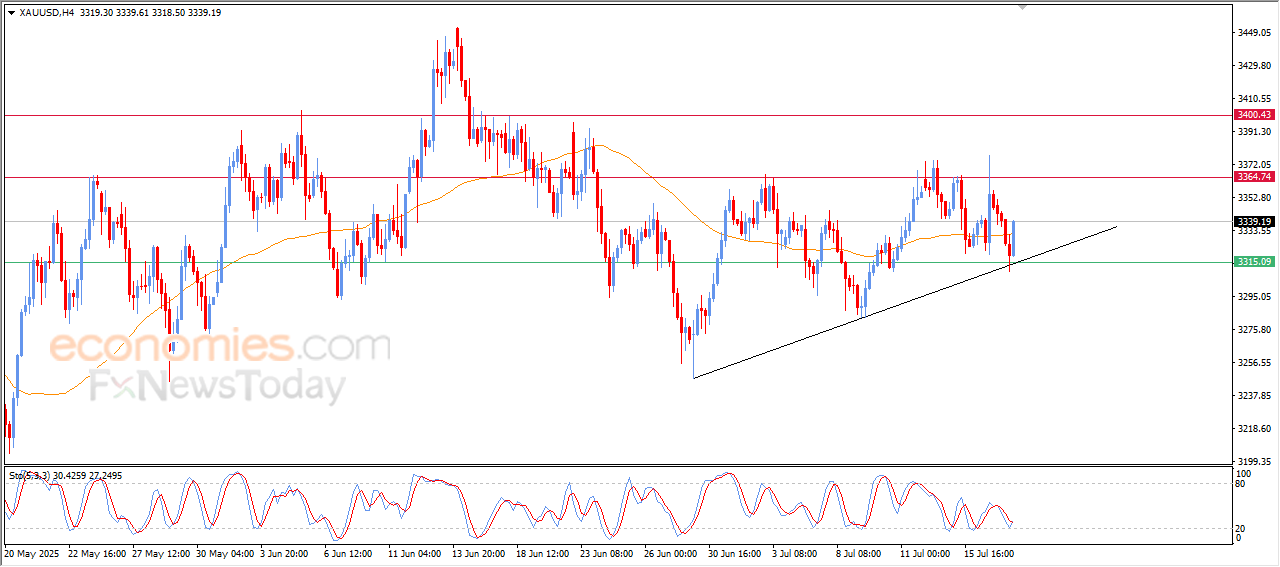

Evening update for Gold -17-07-2025

The (Gold) rose in its last intraday trading, due to its lean on the support of its EMA50, providing positive momentum that assisted in achieving the strong gains, to surpass the resistance of EMA50, surpassing its negative pressure, with the beginning of positive overlapping signals on the (RSI) after reaching oversold levels.