The EURJPY is testing a key support– Forecast today – 19-1-2026

The EURJPY pair activated with temporary negative pressures this morning, reaching below 183.40 level temporarily, to test strong support at 182.75, to bounce quickly towards the moving average 55, announcing the continuation of the main bullish scenario.

Stochastic rally above 50 level will reinforce the chances of resuming the bullish attempts, to expect reaching 184.10, which formed a key barrier against the bullish attempts, as surpassing this barrier will ease the mission of recording extra gains that might begin at 184.85, while the failure of the breach will force the price to provide new mixed trading, with a chance to decline towards 183.00 and 182.65.

The expected trading range for today is between 183.25 and 184.10

Trend forecast: Bullish

5,360 Pips with 96.5% Accuracy in One Week (12–16 January 2026) – BestTradingSignal Weekly Performance Report

Market volatility remained elevated during the week of 12–16 January 2026, creating strong opportunities across commodities, indices, and major currency pairs. Traders operating with a structured approach were able to capitalize on clear directional momentum, particularly in precious metals.

During this period, BestTradingSignal delivered a solid and consistent performance, driven mainly by Gold and Silver, with additional contributions from energy markets, indices, and FX pairs.

Weekly Performance Summary

For the week 12–16 January 2026, BestTradingSignal recorded:

-

Net result: +5,360 pips

-

Pip-based accuracy: 96.5%

-

Markets covered: Gold, Silver, USOIL, NASDAQ, Dow Jones, EURUSD, GBPUSD, USDJPY, GBPJPY

Gold was the primary driver of performance, supported by a strong move in Silver, while indices and FX pairs added consistent gains.

Market Context

Precious metals dominated trading activity during the week, with Gold producing multiple high-momentum moves aligned with broader risk sentiment. Silver added a significant contribution through a strong directional breakout.

Additional opportunities emerged in:

-

USOIL, reacting to short-term energy volatility

-

Dow Jones and NASDAQ, offering clean index setups

-

Major FX pairs, contributing controlled, directional moves

This diversified exposure ensured stable performance across multiple asset classes.

Risk Management and Accuracy

A 96.5% pip-based accuracy reflects strict discipline in trade execution and risk control. Losing movements were limited, while profitable trades were allowed to extend, resulting in a strong net outcome.

The strategy focuses on:

-

Predefined entry and exit levels

-

Strict stop-loss discipline

-

Logical profit targets

-

Consistent, rules-based execution

Revenue Illustration

To provide perspective on the week’s result (5,360 pips), the approximate potential outcome by position size is:

-

0.01 lot: approximately $536

-

0.10 lot: approximately $5,360

-

1.00 lot: approximately $53,600

Figures are illustrative only and depend on instrument, execution quality, broker conditions, and individual risk management.

Conclusion

The week of 12–16 January 2026 highlighted the effectiveness of disciplined, structured trading. By capturing 5,360 pips with 96.5% accuracy, BestTradingSignal continued to deliver consistent results across commodities, indices, and FX markets.

To receive upcoming signals in real time via Telegram:

The GBPJPY tests a solid support base– Forecast today – 19-1-2026

The GBPJPY pair opened today’s trading with bearish price gap, to suffer some losses by reaching 210.65 and facing strong support base that represents support line that confirms the bullish scenario in the upcoming trading, to notice its rally towards 211.55 again.

Note that gathering bullish momentum is important for resuming the positive attempts, to settle above 212.20 level, to confirm its stability within the bullish channel levels, then attempts to achieve extra gains by its rally towards 212.85 and 213.45, while breaking the current support base will force it suffer extra losses that might begin at 209.65.

The expected trading range for today is between 210.65 and 212.85

Trend forecast: Bullish

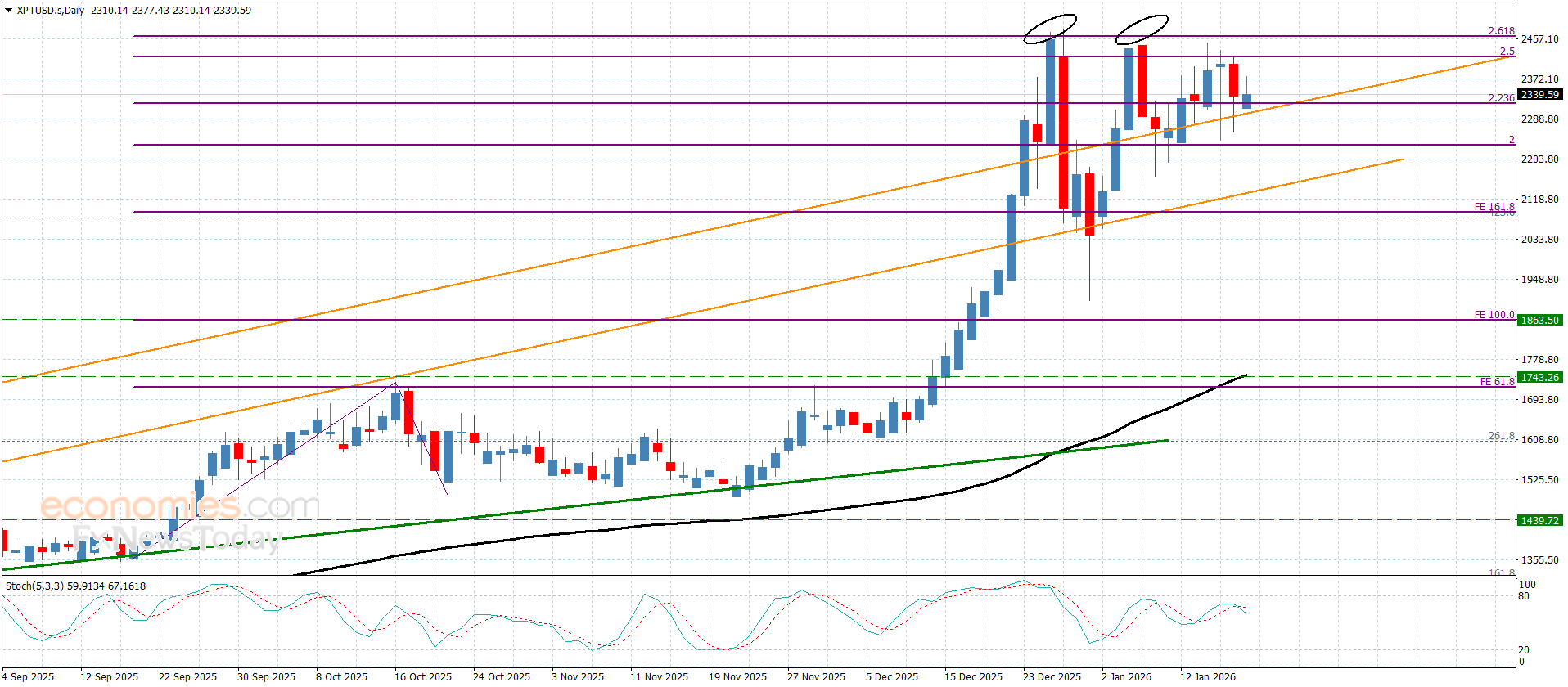

Platinum price surrenders to the contradiction between the main indicators– Forecast today – 19-1-2026

Platinum price succeeded in settling positively above the initial main support at $2230.00, but couldn’t motivate it to resume the bullish attack, to notice its surrender to the contradiction between the main indicators and providing sideways fluctuation by its stability near $2345.00.

The mixed trading might continue until gathering extra positive momentum, to ease the mission on its rally towards $2420.00 level, then attempts to record new all-time highs by targeting $2500.00 level.

The expected trading range for today is between $2280.00 and $2420.00

Trend forecast: Bullish