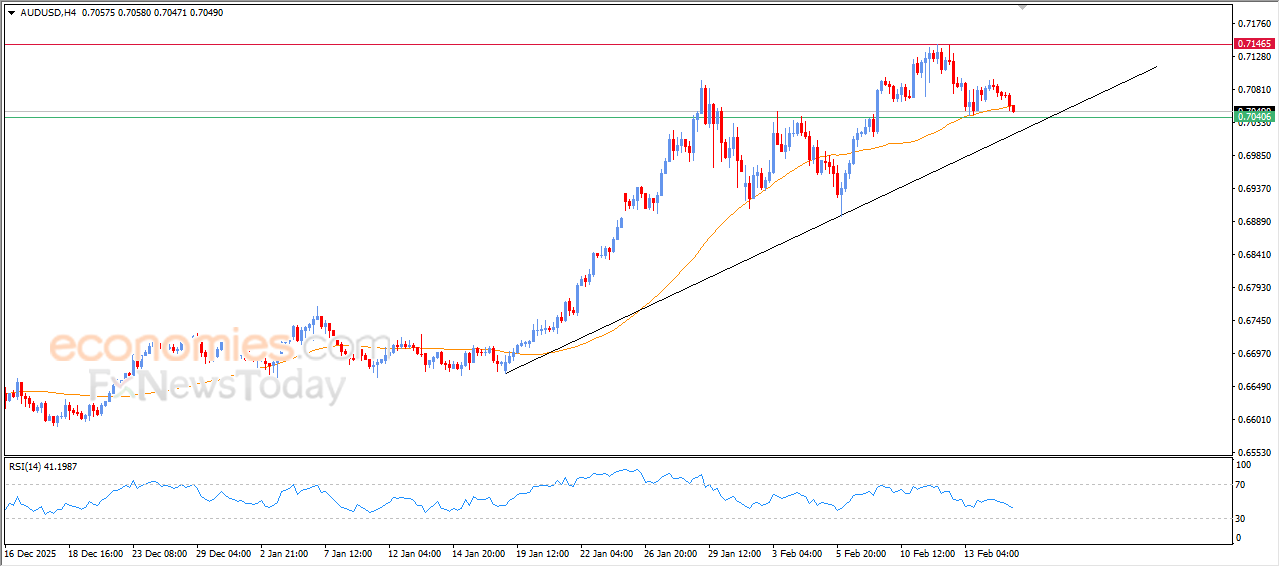

The AUDUSD price is exhausting its positive opportunities- Analysis-17-02-2026

The (AUDUSD) price declined in its last intraday trading, amid the emergence of the negative signals from relative strength indicators, after offloading its oversold conditions, amid the attempts of looking for rising low to take it as a base that might help it to gain the required bullish momentum for its recovery, to lean on EMA50’s support, amid the dominance of the main bullish trend on short-term basis, and its trading alongside supportive trend line for this path.

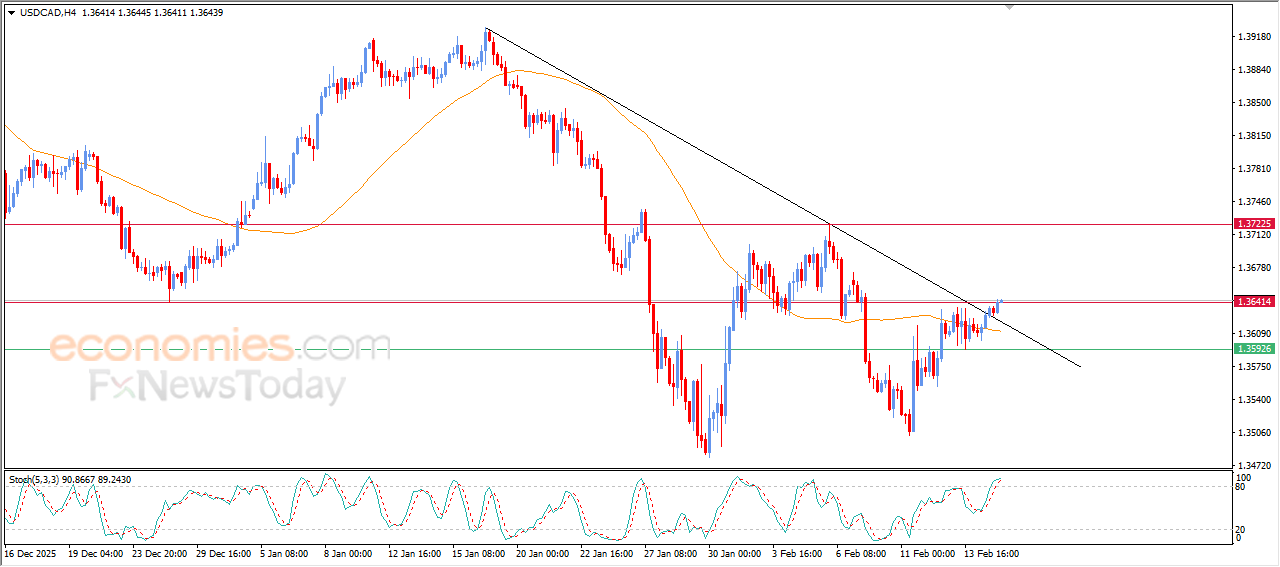

The USDCAD prices breach main bearish trend line- Analysis-17-02-2026

The (USDCAD) price rose in its last intraday trading, taking advantage of the dynamic support that is represented by its trading above EMA50, gaining bullish momentum that helped it to breach main bearish trend line on short-term basis, reinforcing the chances of extending these gains in the upcoming period, on the other hand,, we notice the emergence of negative overlapping signals from relative strength indicators, after reaching overbought levels, which might reduce the upcoming gains.

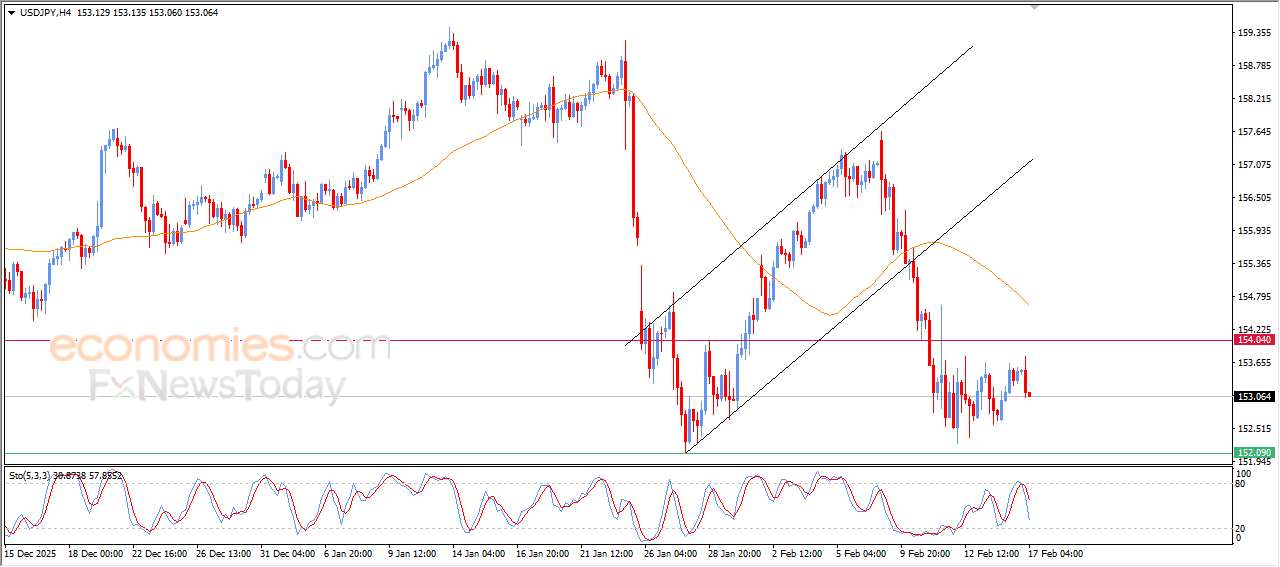

The USDJPY surrenders to the negative pressures-Analysis-17-02-2026

The (USDJPY) declined in its last intraday trading, with the emergence of negative signals from the relative strength indicators, after reaching overbought levels, amid the continuation of the negative and dynamic pressure that is represented by its trading below EMA50, reinforcing the stability and dominance of the main bearish trend on short-term basis, affected by the exit from bullish corrective channel’s range previously.

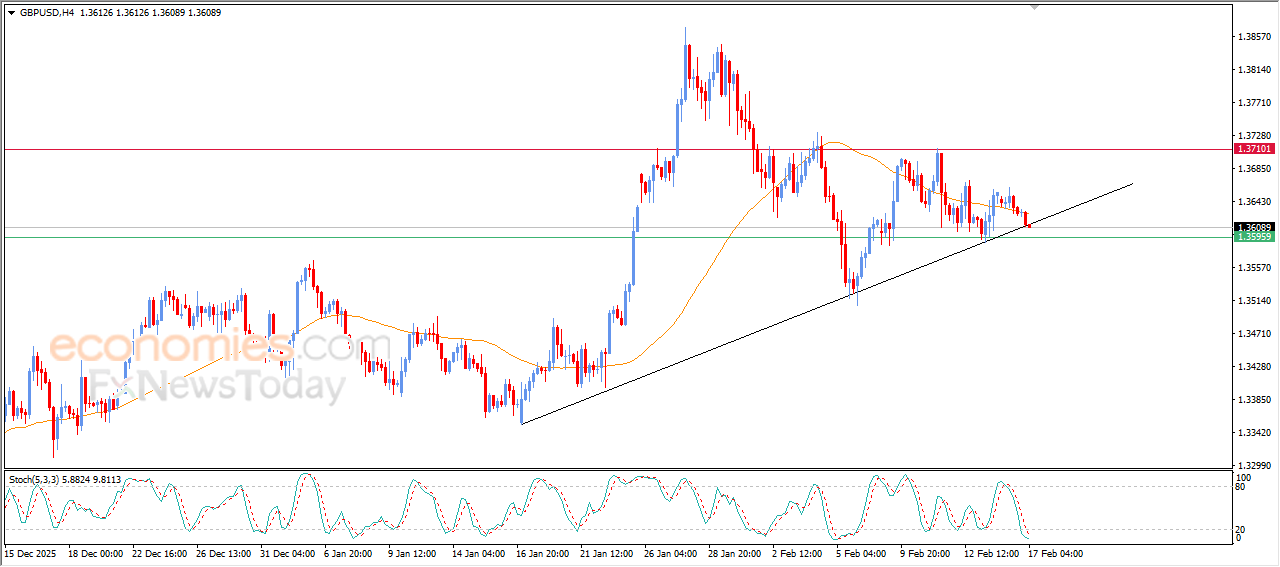

GBPUSD price is between mixed signals - Analysis- 17-02-2026

GBPUSD declined in its last intraday trading, surpassing EMA50’s support, which put it under negative pressure, but it remains leaning on main bullish trend’s support line on short-term basis, providing chance for fining a new higher low to use it as a base to gain the required bullish momentum for its recovery and rising again, reinforces by the relative strength indicators reaching oversold levels, exaggeratedly compared to the price move, indicating the beginning of forming positive divergence.