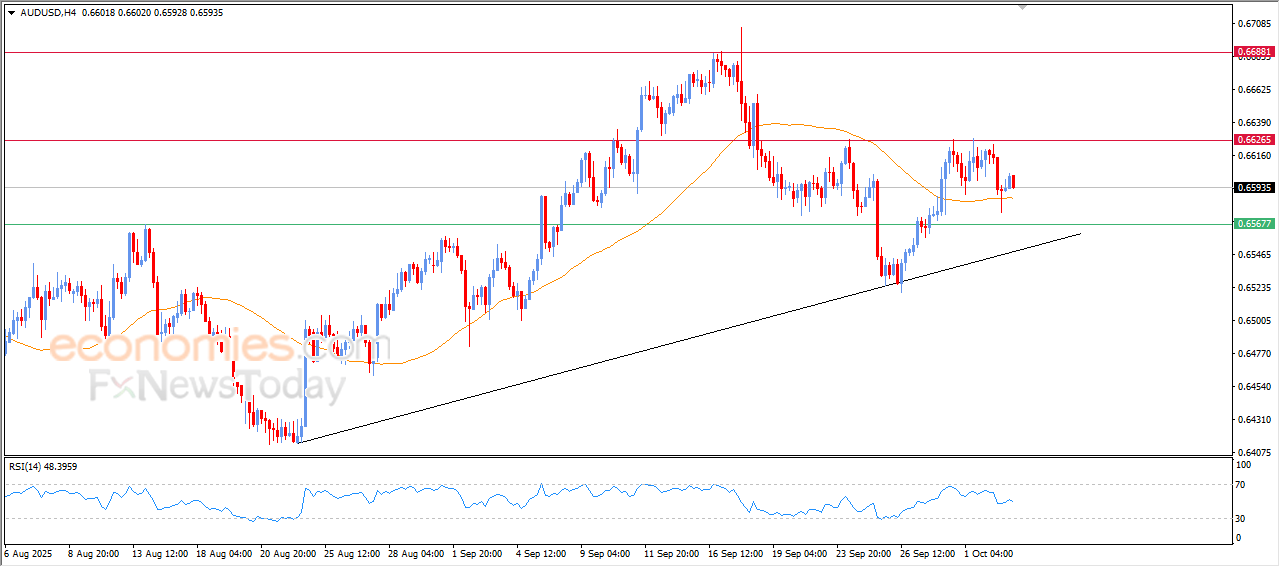

The AUDUSD price attempts to gather positive momentum- Analysis-03-10-2025

The (AUDUSD) price declined in its last intraday trading, amid the attempts to gain bullish momentum that might help it to recover and rise again, leaning on the support of its EMA50, reinforcing the stability of the main bullish trend amid its trading alongside trendline on the short-term basis, besides the emergence of the positive signals on the relative strength indicators.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

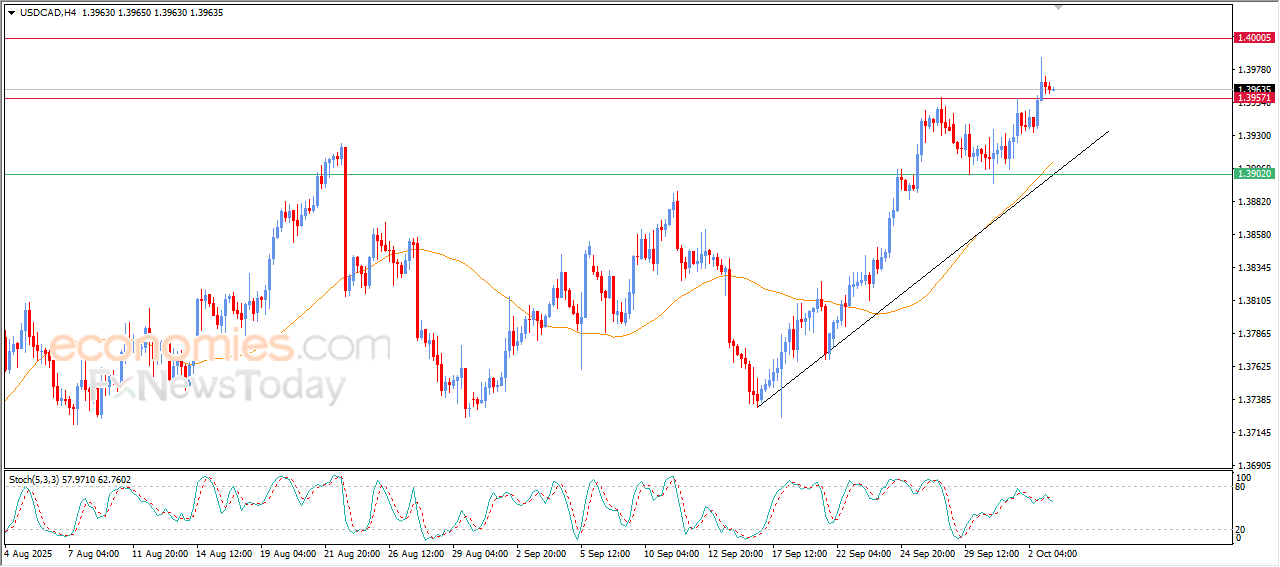

The USDCAD breaches critical resistance- Analysis-03-10-2025

The (USDCAD) price declined in its last intraday trading, gathering the gains of its previous gains, attempting to offload some of its overbought conditions on the relative strength indicators, with the emergence of the negative signals from them. Despite this intraday decline, the price remains stable above the key resistance of 1.3955, to confirm breaching it, amid the continuation of the dynamic support that is represented by its trading above EMA50 and under the dominance of the main bullish trend and its trading alongside trendline on the short-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

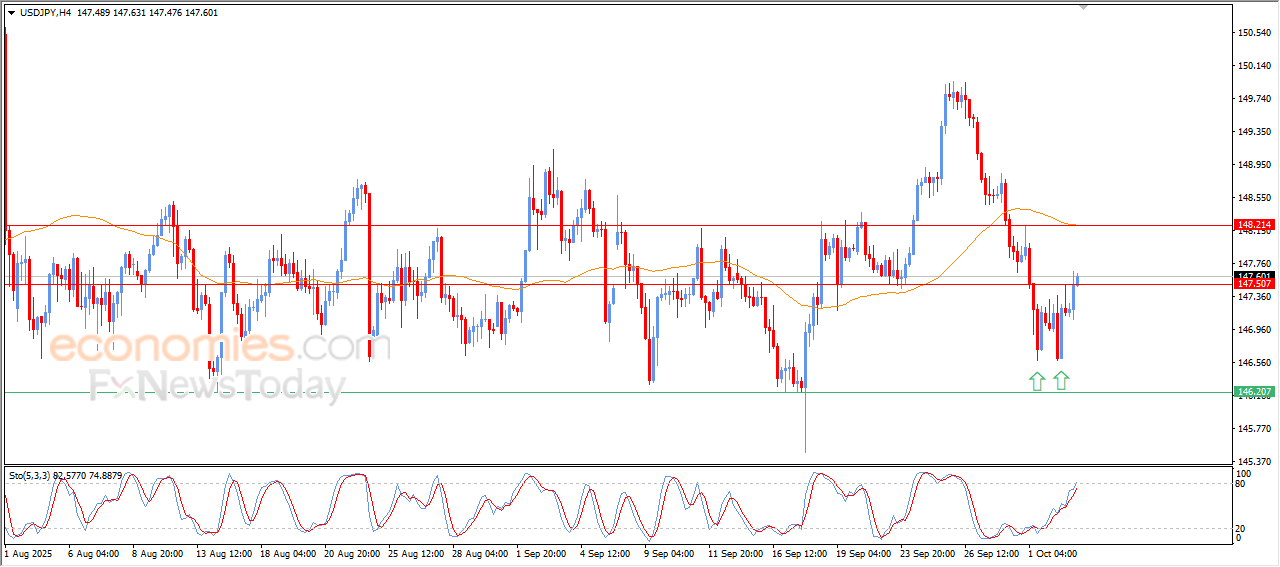

The USDJPY is attacking the neckline of a positive technical formation -Analysis-03-10-2025

The (USDJPY) reinforced its gains on its last intraday levels, supported by the emergence of the positive signals on the relative strength indicators, attacking the key resistance at 147.50, that represents the neckline of positive technical pattern (the double bottom pattern), which might push the price to target new resistance levels on the near-term basis, if it breaches the resistance, on the other hand, the pair remains under negative pressure due to its trading below EMA50, reducing the chances for its recovery on the near term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

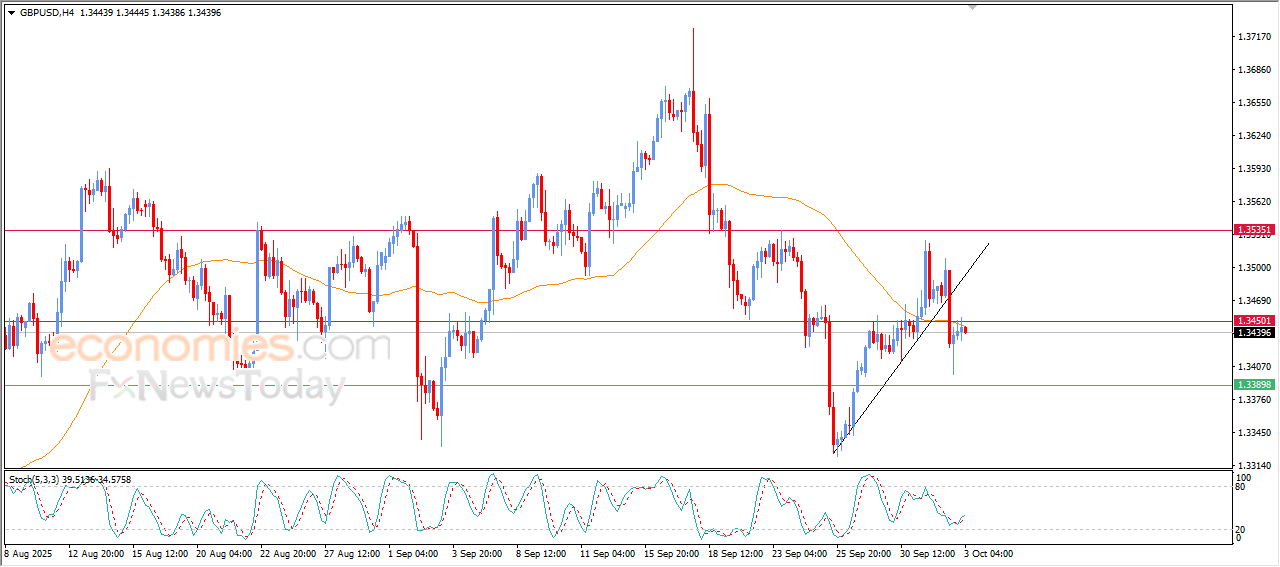

GBPUSD hits the resistance of its simple moving average- Analysis-03-10-2025

The (GBPUSD) price settled with a cautious rises in its last intraday levels, supported by the emergence of the positive signals from the relative strength indicators, after reaching oversold levels, in attempt to offload some of these conditions, to hit the resistance of its EMA50, putting it under negative pressure that forced it to stop its intraday gains, amid its affection by breaking a bullish corrective trend line on the short-term basis, reducing the chances of its recovery and intensifies the negative pressure.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: