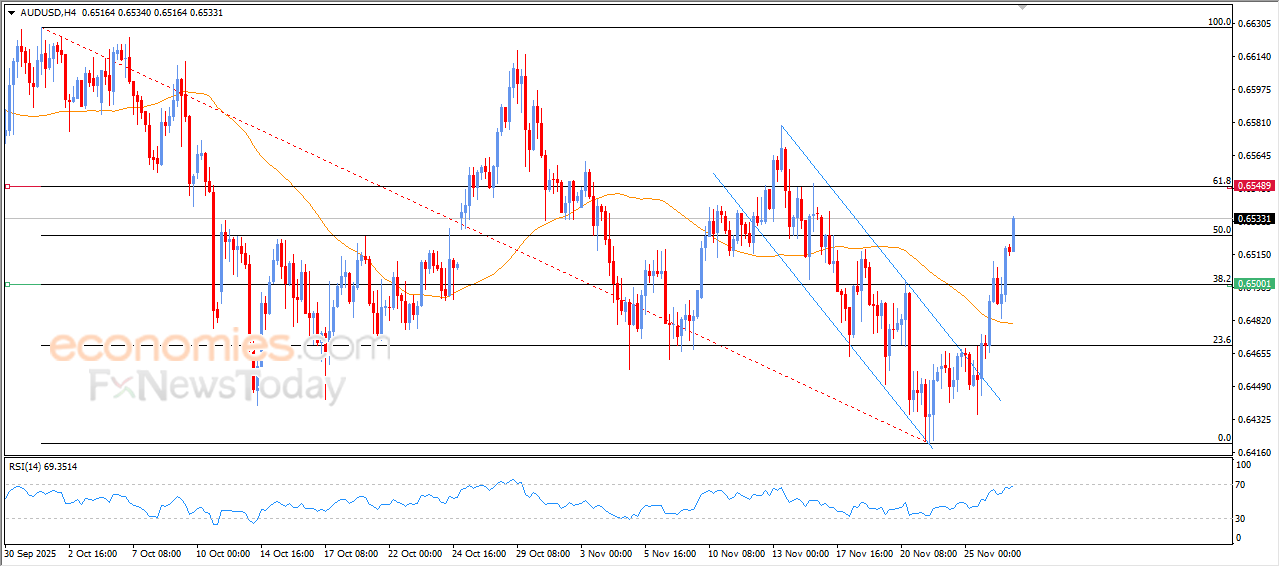

The AUDUSD price achieves our suggested target- Analysis-27-11-2025

The (AUDUSD) price kept rising in its last intraday trading, to breach 0.6525 resistance, this resistance represents %50 Fibonacci corrective levels of the last bearish wave on the short-term basis( from 0.6628 to 0.2422), to surpass our expected target in our previous analysis at 0.6515, amid the continuation of the dynamic support that is represented by its trading above EMA50, with the emergence of positive signals on the relative strength indicators, despite reaching overbought levels.

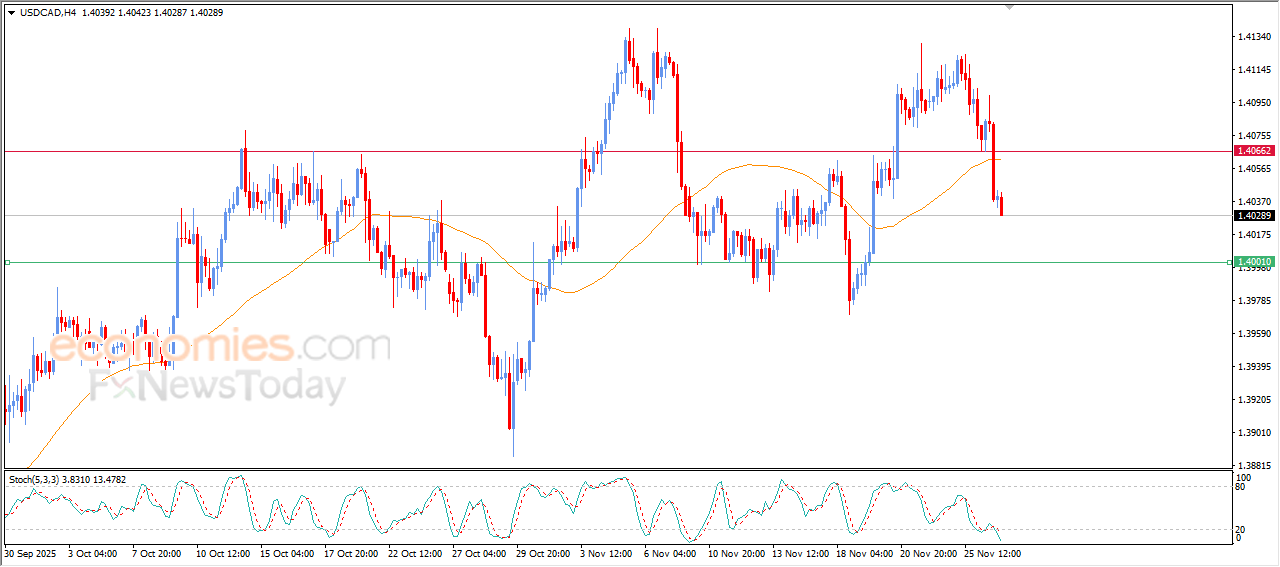

The USDCAD price is deepening its losses- Analysis-27-11-2025

The (USDCAD) price continued it decline sharply in its last intraday trading, amid the dominance of bearish corrective wave that helped it surpass the support of its EMA50, putting it under intensive negative pressure and reduced the chances of full recovery on the near-term basis, especially with the continuation of the negative signals on the relative strength indicators, despite reaching oversold levels.

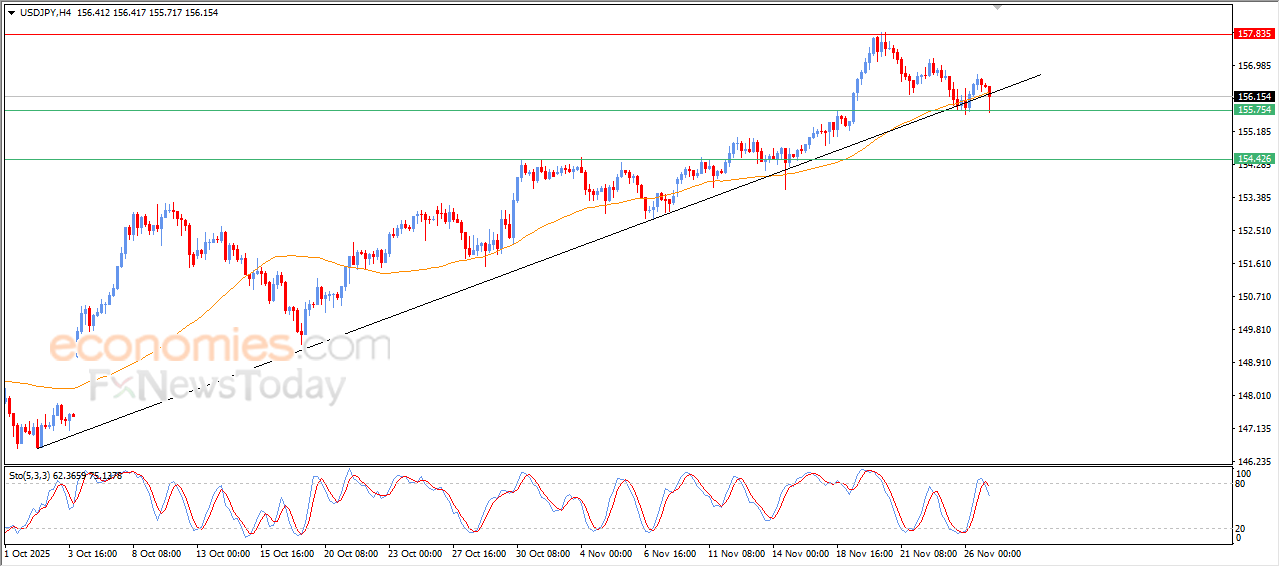

The USDJPY clings to the main trend-Analysis-27-11-2025

The (USDJPY) witnessed fluctuated trading in its last intraday trading, with the beginning of forming negative divergence of the relative strength indicators, after reaching overbought levels, exaggeratedly compared to the price move, with the emergence of negative signals from there, pressing on the price.

On the other hand, the price is leaning on a main bullish trend line on the short-term basis, accompanied by its leaning on the support of EMA50, leaning to an intraday fluctuating trading in attempt to look for a new trend.

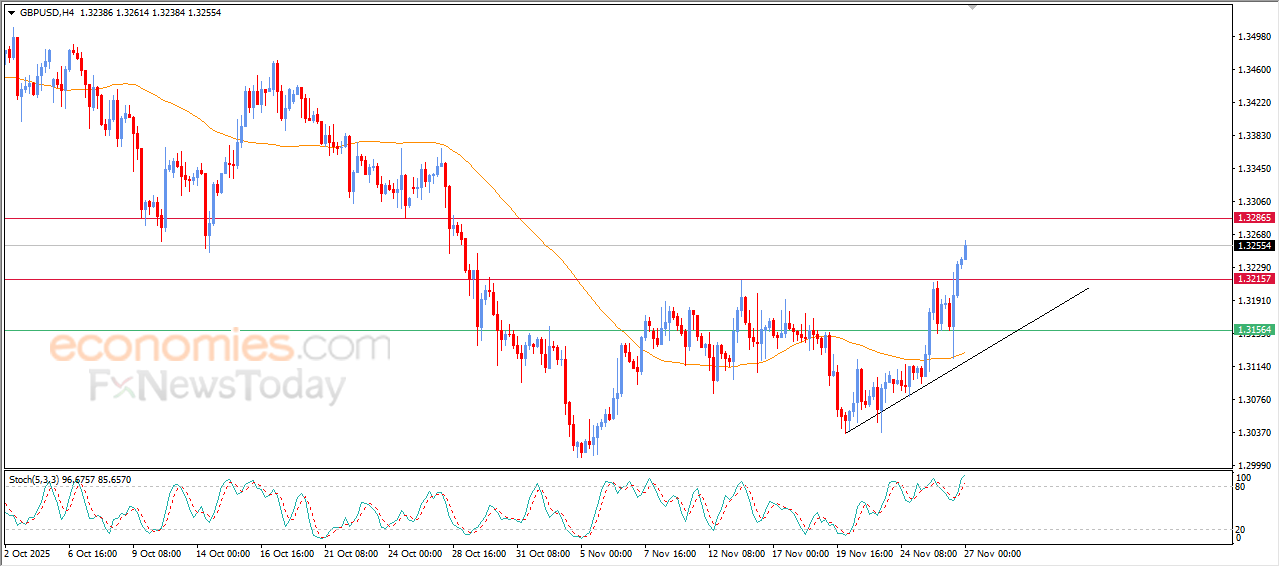

GBPUSD price extends its gains- Analysis-27-11-2025

The (GBPUSD) price kept rising in its recent intraday trading, breaching the key resistance at 1.3215, providing renewed bullish momentum that helped it to extend its intraday gains, amid the continuation of the positive support due to its trading above EMA50, and under the dominance of the bullish corrective trend on the short-term basis, besides the emergence of the relative strength indicators, despite reaching overbought levels.