The GBPCHF confirms the positivity– Forecast today – 12-8-2025

AI Summary

- GBPCHF confirmed bullish trading by breaching barrier at 1.0825 and hitting 1.0915 level

- Price may provide sideways trading while waiting for positive momentum to press on 50% Fibonacci correction level at 1.0935

- Expected trading range for today is between 1.0860 and 1.0935, with a bullish trend forecasted

GBPCHF continued to form strong bullish trading as it confirmed breaching the barrier at 1.0825, recording some extra gains by hitting 1.0915 level, which forces it to form an intraday negative rebound, affected by stochastic exit from the overbought level.

The price might be forced to provide sideways trading, to keep waiting for the positive momentum, which allows it to press on 50%Fibonacci correction level at 1.0935, and surpassing it will make it success to record extra gains that might extend at 1.0995 and 1.1025 initially.

The expected trading range for today is between 1.0860 and 1.0935

Trend forecast: Bullish

Natural gas price repeats the negative closes– Forecast today – 12-8-2025

Natural gas prices repeatedly provide negative closes below $3.100 level, which represents an extension for the broken support, to reinforce activating the negative pattern to confirm its readiness to form sharp decline in the near period, to expect targeting $2.720 level reaching 100%Fibonacci extension level at $2.390.

While the price rally above $3.100 and providing positive close will cancel the bearish scenario, providing a chance for recovering the previously achieved losses by recording several gains that begin at $3.220 and $3.430.

The expected trading range for today is between $2.710 and $3.050

Trend forecast: Bearish

The EURJPY approaches from the target– Forecast today – 12-8-2025

The EURJPY pair continued providing positive closes above the intraday obstacle at 172.00 level, keeping the bullish track by approaching the initial extra target at 172.65.

No escape for resuming the bullish attack, due to the continuation of providing positive momentum by the main indicators, to keep waiting for its rally to the barrier at 173.45, waiting for confirming its readiness to record extra gains that might extend to 174.40 in the near period trading.

The expected trading range for today is between 171.95 and 173.45

Trend forecast: Bullish

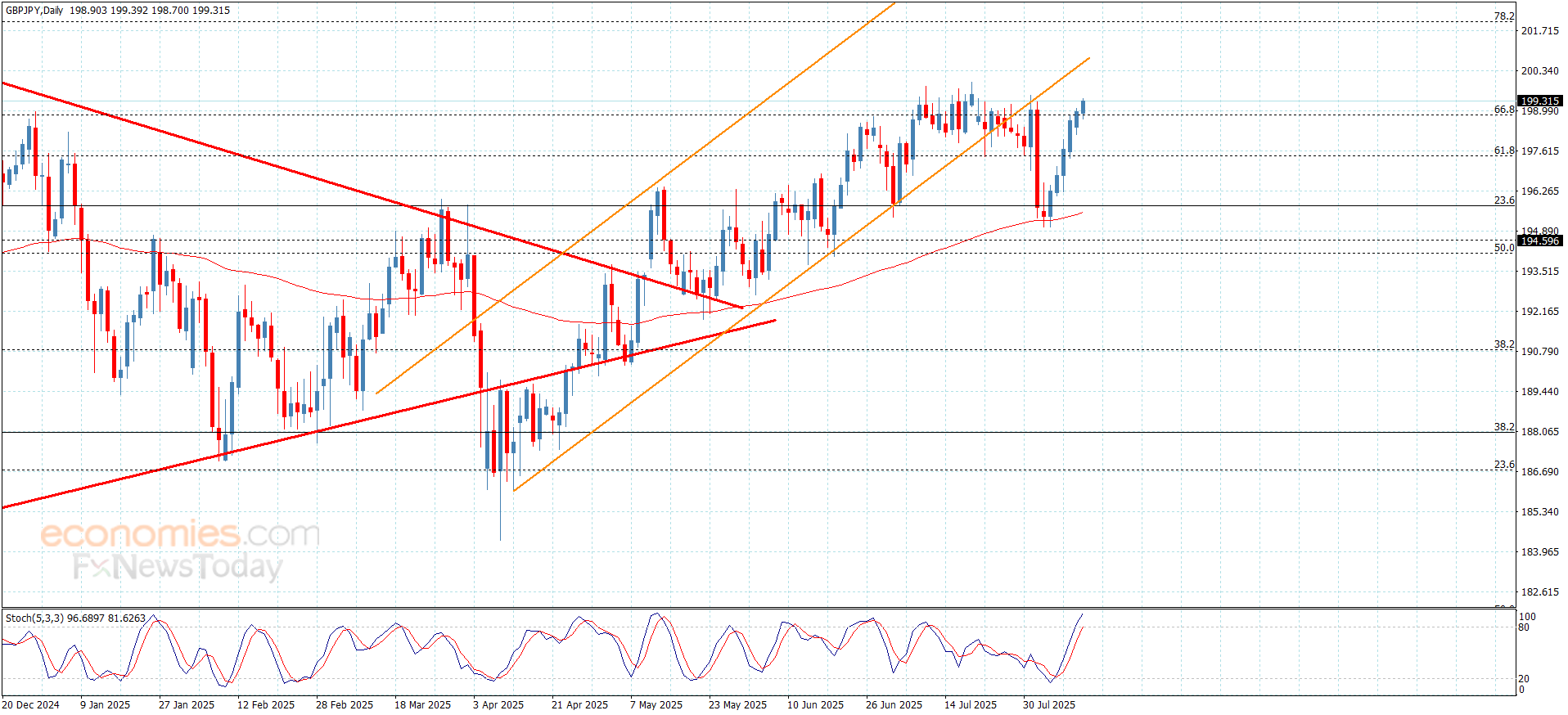

The GBPJPY achieves the breach– Forecast today – 12-8-2025

The GBPJPY pair succeeded to breach the barrier at 198.85, to confirm its readiness to resume the bullish attack, reaching 199.35 taking advantage of providing positive momentum by the main indicators.

We expect forming bullish trading, to target new positive stations that might begin at 200.40, to confirm entering the bullish channel’s levels, then attempts to target 78.2%Fiboancci level at 202.000, while the risk of changing the bullish trend requires forming a sharp decline, to settle below 61.8%Fibonacci correction level at 197.45.

The expected trading range for today is between 198.70 and 200.40

Trend forecast: Bullish