The GBPCAD leans above the moving average 55– Forecast today – 28-7-2025

AI Summary

- GBPCAD ended bearish correctional, stable near 1.8390 facing moving average 55

- Preference for bullish trading targeting 1.8470 and 1.8580 levels

- Expected trading range for today between 1.8360 and 1.8470, trend forecasted as bullish

The GBPCAD ended the last bearish correctional by its stability near 1.8390, facing the moving average 55, reinforcing the stability of the extra support near 1.8355, increasing the chances for renewing the positive action in the near and medium period trading.

Therefore, we will begin by preferring the bullish trading that might target 1.8470 level, reaching the next target at 1.8580, while the price declined below the support mentioned and holding below it, will confirm its surrender to the bearish correctional scenario, which forces it to suffer more of the losses by reaching 1.8310 and 1.8270.

The expected trading range for today is between 1.8360 and 1.8470

Trend forecast: Bullish

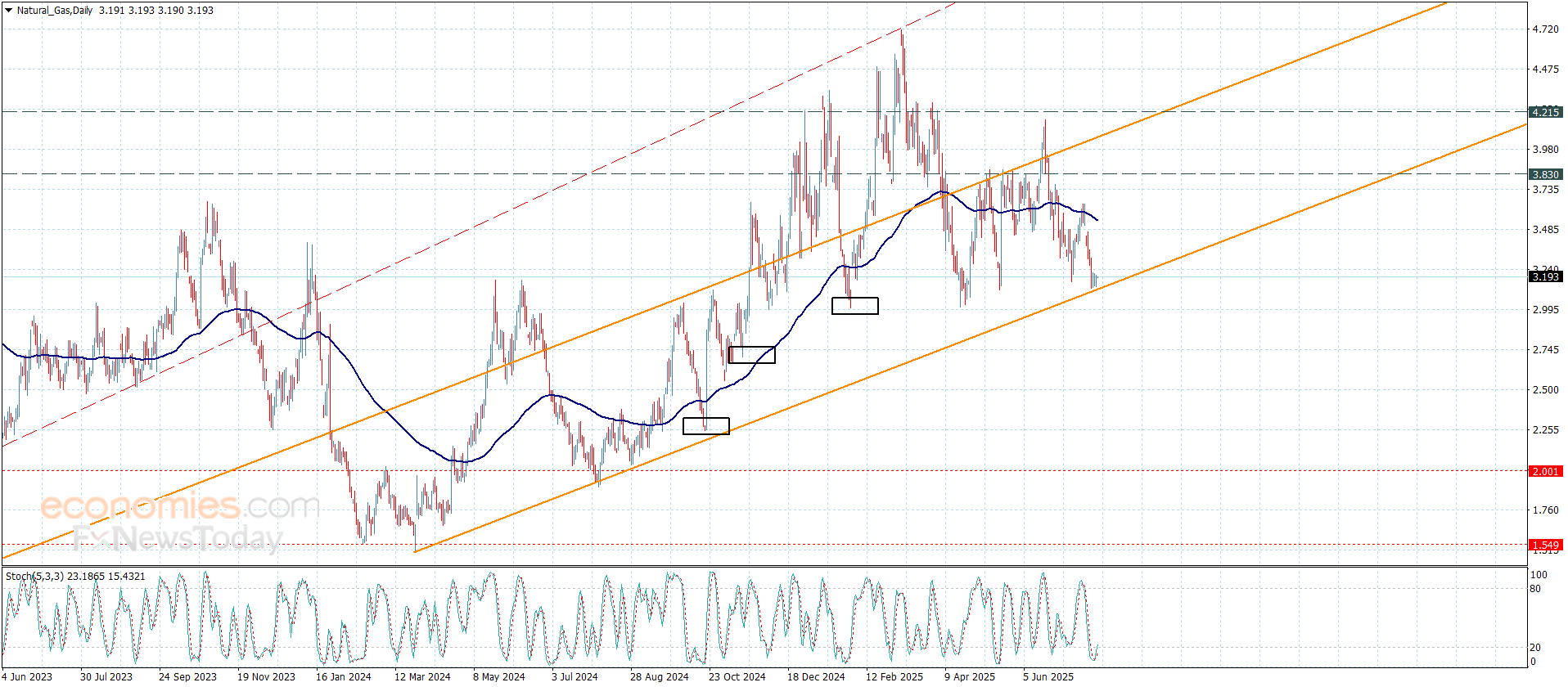

Natural gas price reaches the support of the bullish channel’s support– Forecast today – 28-7-2025

Natural gas price continued forming bearish correctional trading in the last trading, approaching from the support of the bullish channel’s support at $3.110, forming a key for detecting the main trend in the upcoming trading.

The price success to settle above the current support will provide a chance for begin forming strong bullish trading, to target $3.350 level reaching the moving average 55 near $3.560, while facing new bearish pressures and reaching below the current support will confirm its move to a new bearish station, which forces it to suffer several losses by reaching $2.860 and $2.730.

The expected trading range for today is between $3.110 and $3.350

Trend forecast: Bullish

The EURJPY eases the way for a new rise– Forecast today – 28-7-2025

The EURJPY pair succeeded in surpassing the resistance near 173.25, announcing its readiness to resume the bullish attack by hitting 173.90 level, and forming some sideways trading to gather positive momentum again.

Confirming the importance of the stability above the breached resistance, reinforcing the chances for reaching the extra targets that are located near 174.25 reaching 1.809%Fibonacci extension level at 175.20, forming the next main target for the near and medium trading.

The expected trading range for today is between 173.20 and 174.20

Trend forecast: Bullish

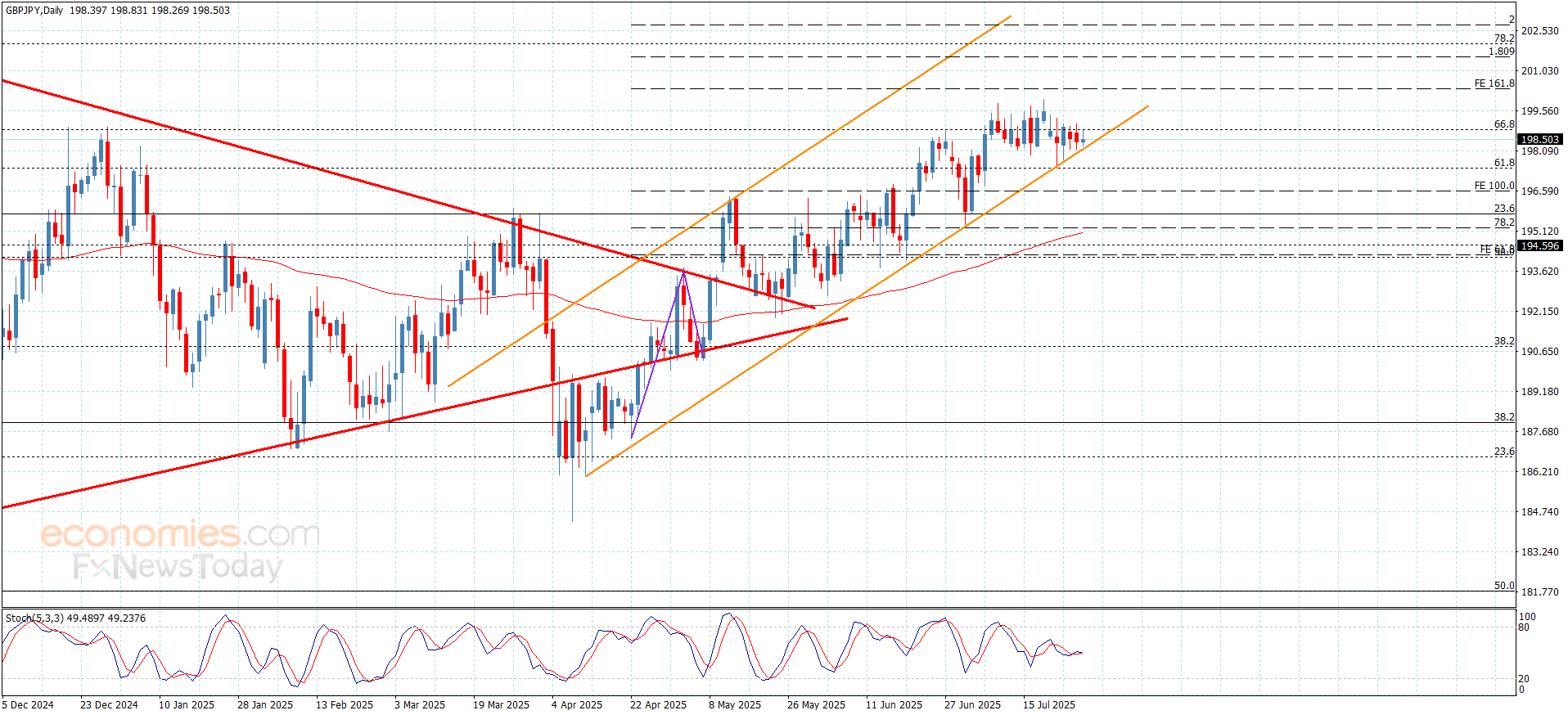

The GBPJPY attempts to settle within the bullish channel– Forecast today – 28-7-2025

The GBPJPY pair continued facing stochastic negativity in the last trading by providing repeated positive closes above the support of the minor bullish channel at 198.10, reinforcing the chances for gathering the positive momentum, and activating the bullish attempts to target 199.25 level, then wait for reaching the next main target at 200.35.

Noting that the price decline below the current support will force it to form some of the bearish correctional trading by reaching 197.50, reaching the main support at 196.56.

The expected trading range for today is between 198.25 and 200.35

Trend forecast: Bullish