The CADJPY remains bullish– Forecast today – 4-8-2025

AI Summary

- CADJPY remains bullish despite facing bearish pressures

- Stability above 106.40 support level reinforces positive momentum towards 108.10

- Expected trading range for today is between 106.50 and 107.90, with a bullish trend forecast

Despite facing strong bearish pressures and forming sharp decline by targeting 106.70, the main bullish track of the CADJPY remains valid by its stability above 50%Fibonacci correction level, which represents an important support at 106.40.

Note that the possibility of forming sideways trading due to the contradiction between the main indicators, but the stability above the mentioned support will reinforce the chances for gathering the positive momentum, to ease the mission of its rally to 108.10, surpassing this obstacle might extend the trading to the next main target at 109.30.

The expected trading range for today is between 106.50 and 107.90

Trend forecast: Bullish

Natural gas price repeats the pressure on the support– Forecast today – 4-8-2025

Natural gas price remains affected by the negativity of the main indicators besides its negative stability below $3.320 level, to notice renewing the negative pressure on the neckline of the head and shoulders pattern at $3.000, reminding you that breaking this level will confirm the price move to a new negative station, forcing it to suffer deep losses that might begin at $2.710 and $2.390, we should wait for achieving the break and confirming a negative close below it to avoid any losses that might be caused by the price attempt to regain the bullish bias.

The expected trading range for today is between $2.710 and $3.150

Trend forecast: Bearish

The EURJPY needs positive momentum– Forecast today – 4-8-2025

The EURJPY pair attempted to achieve some gains by its rally to 172.38, but its neediness to the continuous positive momentum that pushed it to form a quick negative rebound, to settle near extra support at 170.45 level.

Note that the stability of the trading above 170.45, increasing the chances for gathering the positive momentum to ease the mission of reaching the positive stations by its rally to 171.60 initially, followed by the next main target at 172.80, while the return to fluctuate below the current support will force it to suffer several losses by reaching 169.80 then to the extra support near 168.45.

The expected trading range for today is between 170.45 and 171.60

Trend forecast: Bullish

The GBPJPY suffers big losses– Forecast today – 4-8-2025

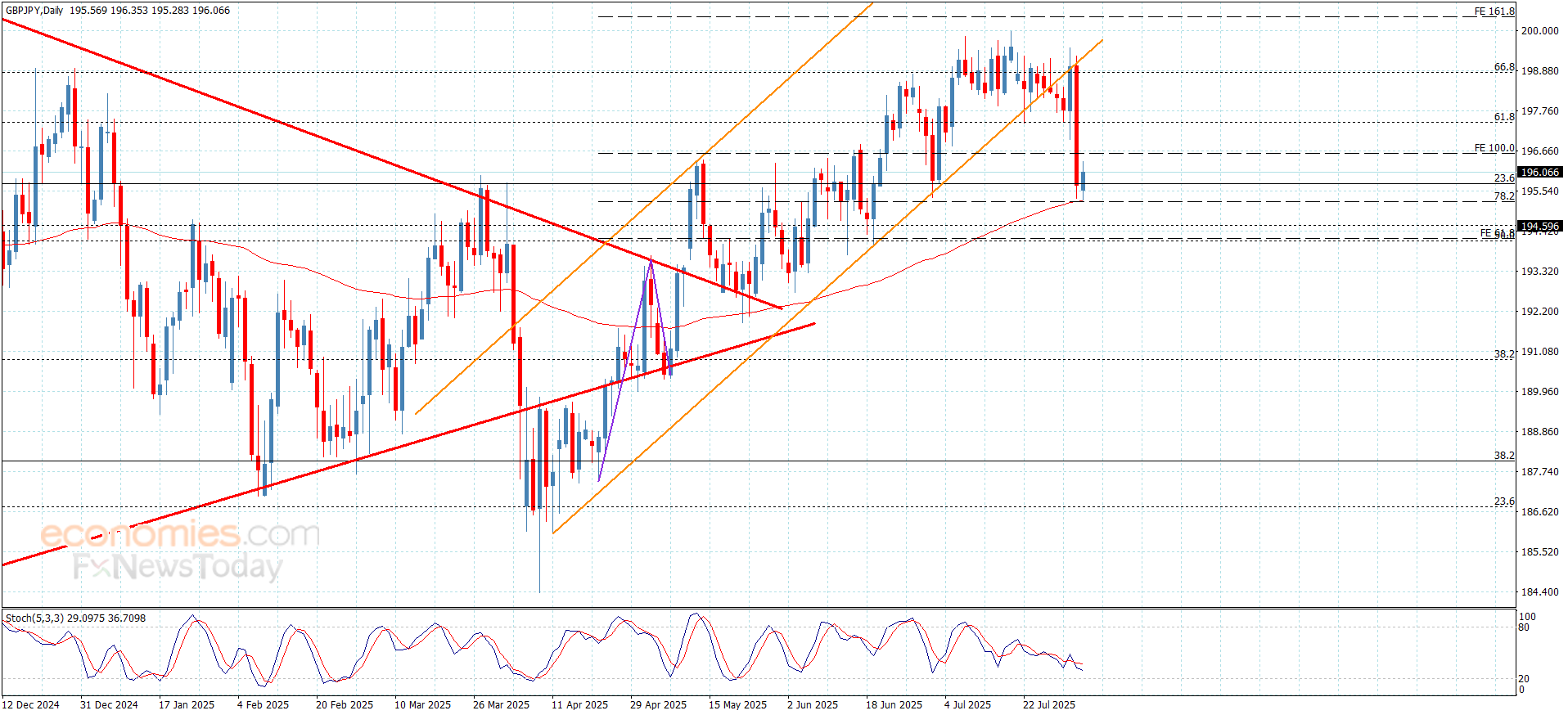

The GBPJPY pair didn’t settle above the support of the minor bullish channel at 198.70, forcing it to suffer deep losses by its decline to 195.35, facing the moving average 55 that supports the stability of 78.2%Fibonacci correction level as appears in the above image.

Noticing the beginning of forming bullish waves since this morning, but it couldn’t regain the bullish bias until surpassing the obstacle at 196.60, which allows it to resume the rise and achieve extra gains that might extend to 197.05 and 197.40, while the decline below 195.35 and holding below it will confirm its surrender to the bearish bias domination, which forces it to suffer extra losses by reaching 194.55.

The expected trading range for today is between 195.70 and 196.90

Trend forecast: Bullish