The CADCHF is moving away from the support– Forecast today – 12-2-2026

The CADCHF confirmed the continuation of the bullish corrective scenario by providing new bullish closes above $0.5595 support, to begin recording some gains by hitting 0.5635 level.

Forming extra support at 0.5650 level and beginning of providing bullish momentum by stochastic will increase the chances of recording extra gains, to reach 0.5720 and 0.5750.

The expected trading range for today is between 0.5650 and 0.5750

Trend forecast: Bullish

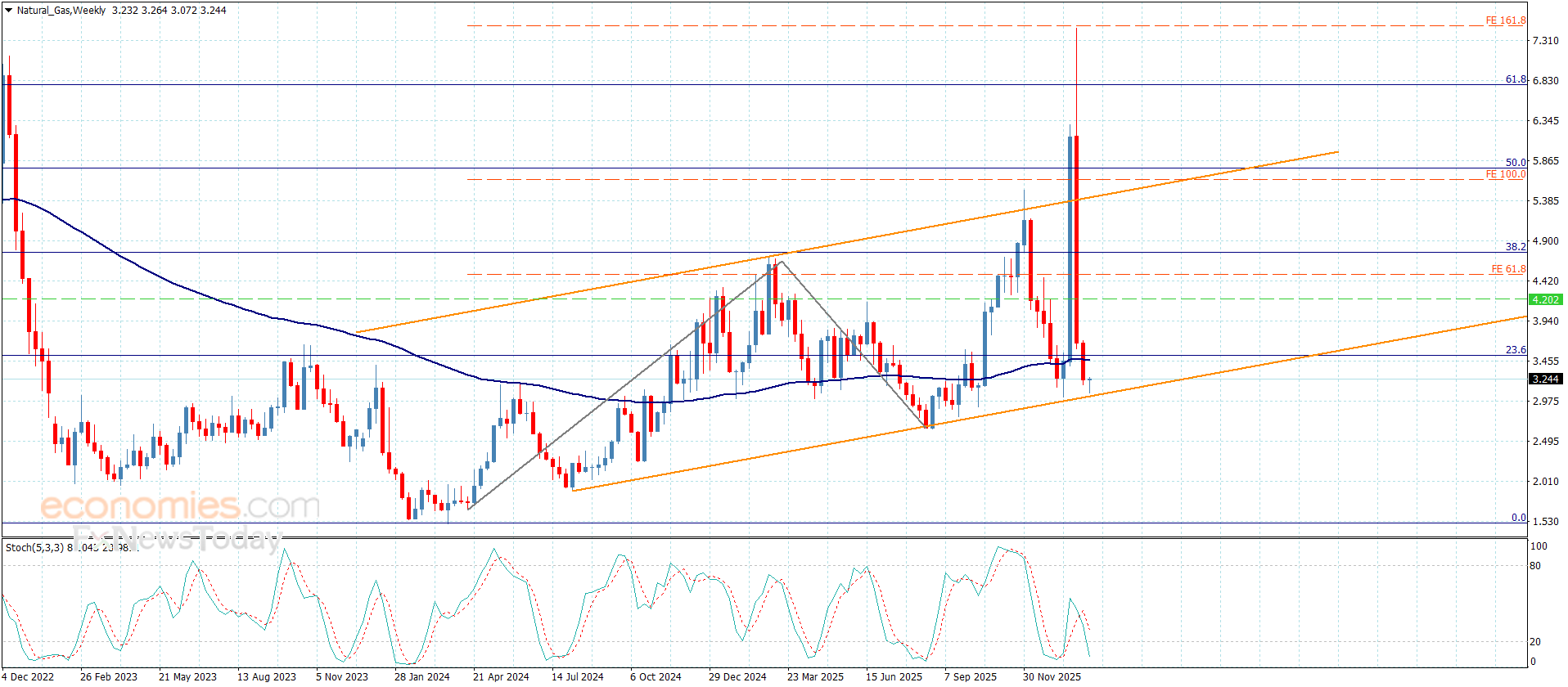

Natural gas price settles above the support level– Forecast today – 12-2-2026

Natural gas price continued resisting stochastic negativity, to settle above $3.050 support and its rally towards $3.250 level, to confirm the previously suggested bullish scenario.

Gathering bullish momentum in the current period trading is important to surpass the barrier at $3.520, to begin recording several gains by its rally towards $3.910 initially, while breaking the current support and holding below it will confirm its move to a new bearish phase, which forces it to suffer more losses by reaching $2.850 and $2.660.

The expected trading range for today is between $3.000 and $3.450

Trend forecast: Bullish

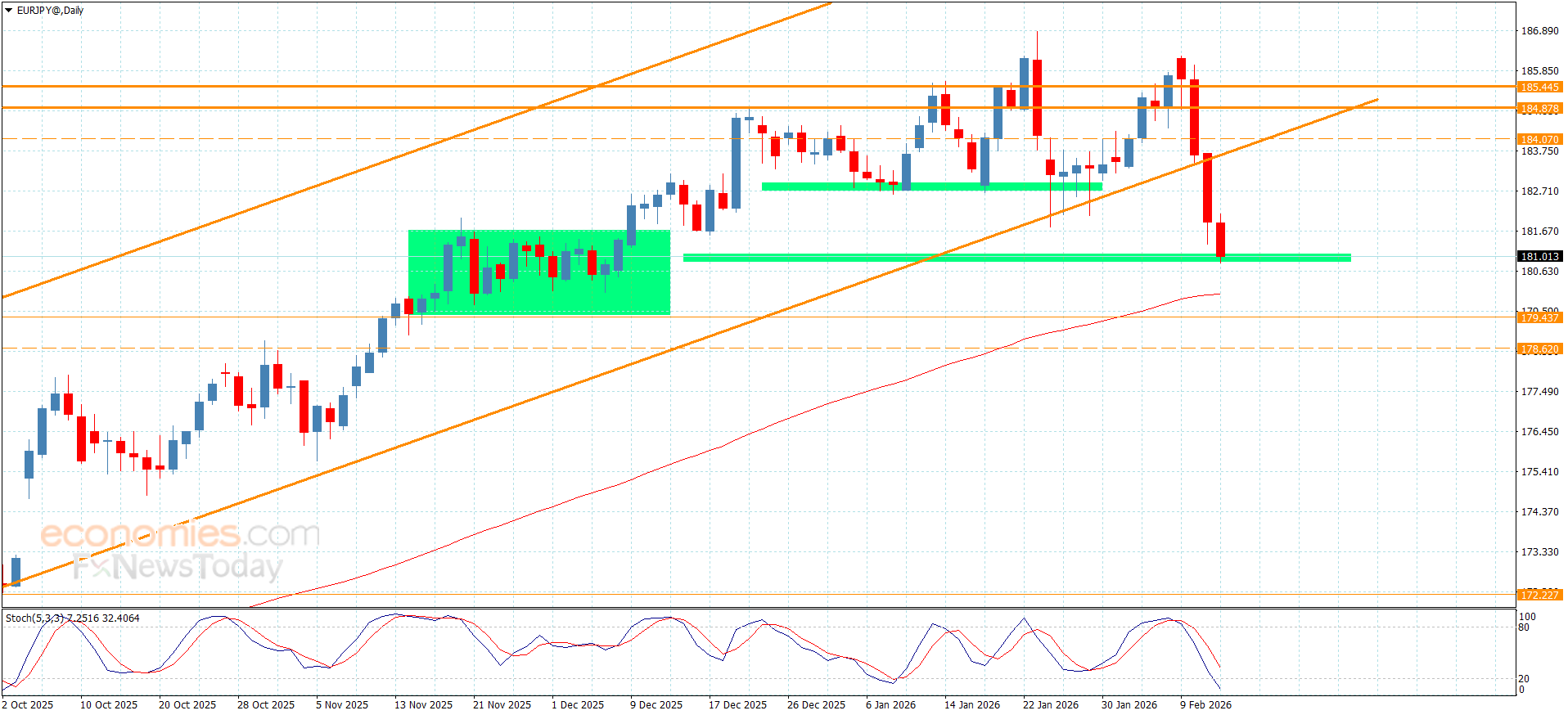

The EURJPY achieves the negative target– Forecast today – 12-2-2026

The EURJPY pair benefited from its stability below the broken bullish channel’s support, which represents a strong barrier at 183.55, activating with the negativity of the indicators by its approach from the main target at 181.05.

The price might be forced to provide sideways trading due to the contradiction of the main indicators, noting that reaching below the current support will open the way for targeting extra negative stations that might begin at 180.40 and 179.45.

The expected trading range for today is between 180.40 and 182.15

Trend forecast: Bearish

The GBPJPY breaks an important support level– Forecast today – 12-2-2026

The GBPJPY pair surrendered to the negative factors, to resume the previously suggested negative attack, to notice breaking the targeted support at 209.10, forcing it to suffer extra losses by reaching 207.65 as appears in the above image.

Note that the continuation of the price stability below 209.10 level, which might form a strong barrier will force the price to resume the negative trading, to expect reaching 207.00 followed by the next support base at 205.10 level, while its rally above 209.10 will increase the chances of activating the attempts of recovering the losses by its rally gradually towards 209.75 and 210.45.

The expected trading range for today is between 207.00 and 208.80

Trend forecast: Bearish