Ripple loses ground as investors flee risky assets

Most cryptocurrencies lost ground on Wednesday amid a weak risk appetite following underwhelming US data.

Earlier data showed US job opportunities down to 7.7 million in July from June’s 7.9 million openings, while analysts expected 8.1 million.

The US ISM manufacturing PMI shrank for the fifth month in a row in August, clocking in at 47.2.

Later this week, US private sector employment data will be released, followed by the official payrolls report on Friday.

Otherwise, Atlanta Fed President Raphael Bostic said he’s ready to back an interest rate cut even with inflation about the Fed’s target, as waiting too long could lead to unnecessary disruptions to the labor market.

Ripple

On trading, Ripple fell 1.4% as of 21:07 GMT on Coinmarketcap to $0.5582.

Loonie climbs after policy decision by Bank of Canada

The Canadian dollar rose against most major rivals today after a policy decision by the Bank of Canada today.

The BOC decided to cut interest rates by 25 basis points to 4.25%, the third such cut in a row.

In a statement, the central bank said it might issue more rate cuts this year if conditions continued to improve.

The rate cut was widely expected by analysts as inflation cooled while economic activities softened in June and July.

Mainline Canadian consumer prices rose 2.5% in July, marching steadily towards the bank’s 2% target.

On trading, the CAD/USD pair rose 0.3% as of 20:55 GMT to 0.74.

Aussie

The Australian dollar rose 0.2% against its US counterpart as of 20:55 GMT to 0.6721.

Official Australian data showed the GDP grew 0.2% in the second quarter as expected.

US Dollar

The dollar index fell 0.5% as of 20:34 GMT to 101.3, with a session-high at 101.7, and a low at 101.2

Earlier data showed job opportunities down to 7.7 million in July from June’s 7.9 million openings, while analysts expected 8.1 million.

The US ISM manufacturing PMI shrank for the fifth month in a row in August, clocking in at 47.2.

Later this week, US private sector employment data will be released, followed by the official payrolls report on Friday.

Otherwise, Atlanta Fed President Raphael Bostic said he’s ready to back an interest rate cut even with inflation about the Fed’s target, as waiting too long could lead to unnecessary disruptions to the labor market.

Introducing Bullionz's New Crypto Exchange

Bullionz was founded with the aim to provide individuals interested in buying and selling gold, with a user-friendly interface for trading gold. The backbone of its platform was based on its ERC-20 gold-backed Ethereum-based digital token asset, BTXG. This token, which has a 1:1 ratio allocation to 1 gram of real gold, helped the company combine the stability of gold and precious metals with the advanced digital technology of crypto. Yet as the company has grown, it sought to expand.

In an effort to broaden its scope of operations, Bullionz established a new cryptocurrency exchange within its platform. The cutting-edge platform offers its clientele the opportunity to easily enter the real world of digital currencies in a way that is both seamless and convenient. Via a safe and user-friendly interface, and a multitude of cryptocurrency trading instruments, Bullionz is pioneering the cryptocurrency trading experience for all.

Details of Bullionz’s New Crypto Exchange

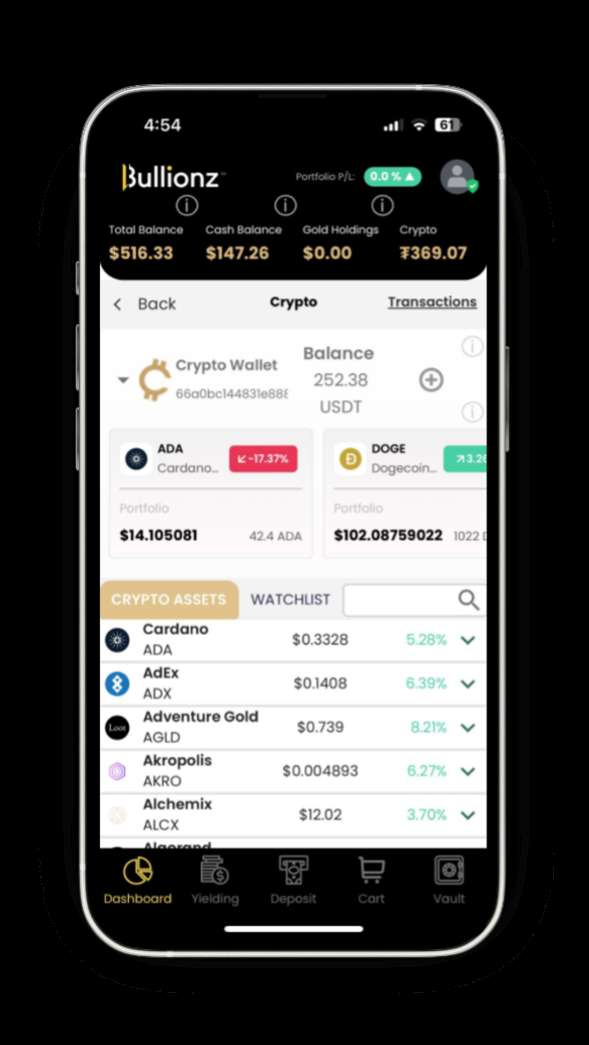

To satisfy the ever-increasing demand for trading digital assets, Bullionz has introduced a brand-new cryptocurrency exchange within its platform, representing a revolutionary expansion of their existing investment services. The platform offers a secure and user-friendly design that is compatible with investors of all skill levels. However, the most notable aspect of their new exchange is the vast variety of cryptocurrencies offered to trade. Digital tokens offered include, but are not limited to, Bitcoin, Ethereum, Litecoin, Doge, Shiba Inu, XRP, USDT, Ton, Solana, and many others. This list of available currencies expands across over 300 different tokens, including the company’s own BTXG token. By incorporating its own digital asset, which is backed by real physical gold, Bullionz presents investors with a one-of-a-kind opportunity to diversify their portfolios on a multi-front stance, by combining the stability of gold with the dynamic technological potential of cryptocurrencies.

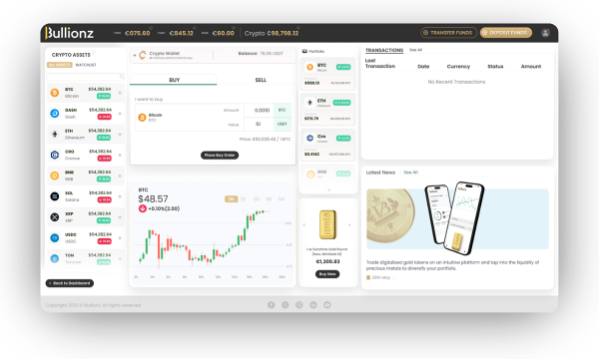

The platform’s interface effortlessly displays an easy-to-use trading experience, with a searchable list of investable cryptocurrencies on the far left. Next to this, users can transfer funds between their Gold Wallets and Crypto Wallets as well as choosing alternative wallets to work from. Beneath this, the company displays a simple Buy and Sell order mechanism to purchase or exchange selected cryptocurrencies based on amount or value. Below this, the platform displays a comprehensive candlestick charting widget that shows the market value of a selected cryptocurrency over the course of various timeframes. Users can also see a portfolio of their crypto holdings, list of transaction history, as well as the latest news on cryptocurrency.

Expected Impact on The Market

By introducing this brand-new cryptocurrency exchange, Bullionz is strategically positioning itself at the crossroads of traditional and digital platforms. With this move, it is anticipated that the market will see a substantial impact, resulting in an increase in market liquidity and the attraction of a broad investor base.

This stems from the fact that typically, traditional investors are often unwilling to enter the cryptocurrency market as they tend to be concerned about the trustworthiness and security of such platforms. Yet due to its well-established reputation in the precious metals industry, Bullionz offers a degree of confidence and credibility to the table that is absent in more recent cryptocurrency platforms. As such, Bullionz hopes to draw a wave of conventional investors by bridging the gap between traditional gold investments and the dynamic world of cryptocurrencies. This will result in an expansion of the market's participant base and an increase in overall liquidity.

The new exchange that Bullionz has introduced allows potential investors to rethink portfolio diversification strategies. The company’s own BTXG token–a cryptocurrency that is backed by physical gold; provides a novel investment vehicle. This hybrid method is anticipated to be appealing to investors who are inclined to avoid risk and are looking for more secure entry points into the unpredictable cryptocurrency market. Because of this, other financial institutions would have a sense of pressure to innovate and provide products that are comparable, which would ultimately result in a wider acceptance and incorporation of hybrid financial instruments in the market.

Finally, the all-encompassing strategy that Bullionz takes, which includes extensive customer support and resources, is expected to improve the entire user experience and establish new standards for the quality of service in the cryptocurrency exchange market. Bullionz empowers users and improves their trading experience by giving broad tools, such as cryptocurrency candlestick charts, news update articles, and more, that will assist investors in making decisions based on accurate information. It is anticipated that this customer-centric approach will attract a user base that is eager to learn, loyal to the platform, and it may also encourage competitors to improve their services, which will ultimately be to the entirety of the cryptocurrency trading community's advantage.

Other Services

The trading of gold is Bullionz’s area of expertise, and they offer an entire platform for buying and selling gold assets, complete with competitive pricing and real-time market data. Bullionz also provides clients with safe gold storage options, which ensures that their investments are kept in a secure environment. In addition, Bullionz's online store allows consumers to acquire physical gold conveniently, including bullions, minted bars, and coins, all of which are delivered to client homes with excellent service and an unwavering commitment to reliability. Overall, Bullionz initially positioned itself as a versatile and reliable partner in the market for precious metals thanks to its offering of a new and modernized way to own gold.

To summarize, Bullionz's new cryptocurrency exchange is not only a new service; rather, it is a catalyst for substantial market transformation, promoting innovation, security, and growth in the digital asset field. Furthermore, Bullionz is committed to the safety and reliability of its users as reflected by its use of sophisticated encryption technologies and multi-layer security protocols to protect user data and assets. In addition, its exchange provides customers with real-time market data as well as a portfolio of advanced trading tools, which enables users to make trading decisions that are both educated and fast.

By combining cutting-edge technology with Bullionz's well-known competence in gold trading, the company has established a new benchmark for providing financial services. This has enabled the company to provide investors with a complete solution to meet all their investment requirements. As the cryptocurrency market transforms, Bullionz's new exchange is well-positioned to emerge as a significant participant, propelling the industry toward innovation and economic expansion.

Wall Street edges up after data

US stock indices rose even as pressures continued to mount on the tech sector, while investors assess the outlook of monetary policies following weak data yesterday.

The US ISM manufacturing PMI shrank for the fifth month in a row in August, clocking in at 47.2.

Later this week, US private sector employment data will be released, followed by the official payrolls report on Friday.

On trading, Dow Jones rose 0.1%, or 15 points as of 17:48 GMT to 40,952, while S&P 500 stabilized at 5528, as NASDAQ added 0.1%, or 18 points to 17,154.