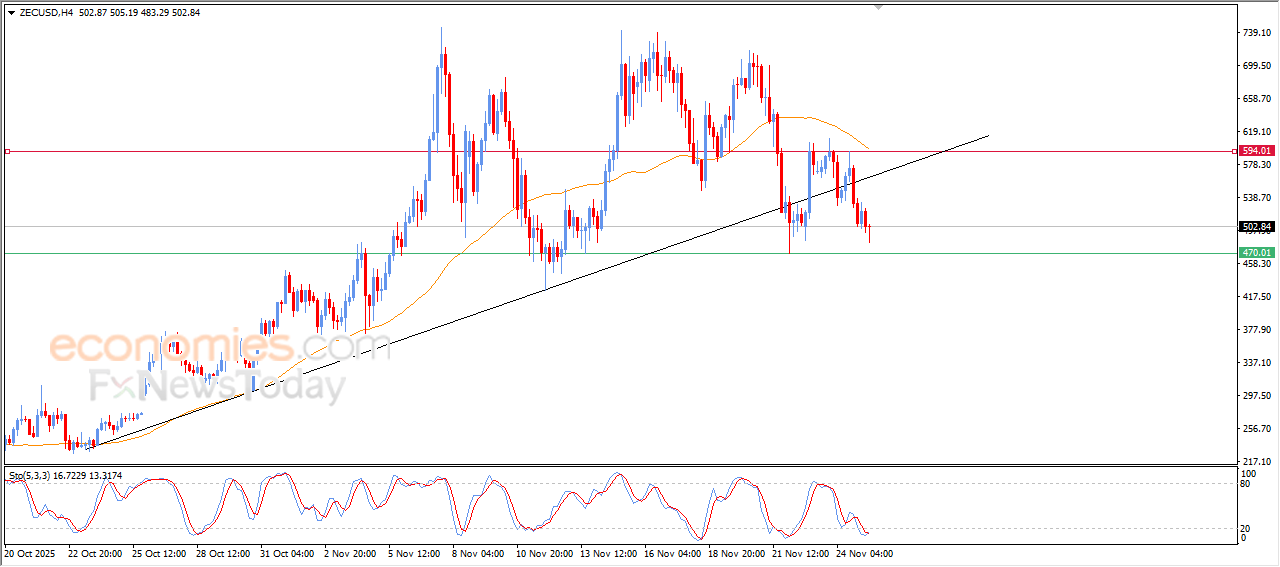

Zcash price breaks upside trend line - Analysis - 25-11-2025

The price of Zcash (ZECUSD) continued to decline in its latest intraday trading, confirming a break of a major descending trendline over the short term. This comes amid ongoing negative pressure as the price remains below its 50-period simple moving average, reducing the chances of any meaningful recovery in the near term. Meanwhile, the relative strength indicators continue to send negative signals despite settling in deeply oversold areas.

Therefore, we expect the price of the cryptocurrency to decline in the coming intraday sessions, targeting the key support level of 470.0 in preparation for breaking it.

Today’s price forecast: Bearish

Bank of America price bolsters gains - Forecast today - 25-11-2025

Bank of America (BAC) edged higher in its latest intraday trading, supported by its rebound from the 50-day simple moving average. This comes within the context of a dominant short-term uptrend, alongside the early formation of a positive divergence on the Relative Strength Indicators after reaching extremely oversold levels relative to price movement, with bullish signals beginning to appear.

Therefore, we expect the stock to rise in the upcoming sessions, provided the support level at 50.95 dollars holds, targeting the key resistance at 54.70 dollars.

Today’s price forecast: Bullish

3M price readies to attack pivotal resistance - Forecast today - 25-11-2025

3M (MMM) rose in its latest intraday trading, preparing to challenge the key resistance level at 172.85 dollars. The move is supported by the stock’s continued trading above its 50-day simple moving average, within a dominant short-term uptrend and along a rising trendline that reinforces this trajectory. Positive signals have also begun to appear on the Relative Strength Indicators after reaching extreme oversold levels, accompanied by a noticeable increase in trading volumes that supports stronger bullish activity ahead.

Therefore, we expect the stock to rise in the upcoming sessions, especially if it succeeds in breaking above the mentioned resistance at 172.85 dollars, after which it would target its next resistance level at 181.30 dollars.

Today’s price forecast: Bullish

Coinbase price tries to vent off oversold saturation - Forecast today - 25-11-2025

Coinbase Global (COIN) posted a slight increase in its latest intraday trading, as the stock attempts to recover part of its previous losses while also trying to unwind its clear oversold pressure on the Relative Strength Indicators, especially with positive signals starting to appear. This comes despite the dominance of a steep short-term corrective downtrend and continued negative pressure from trading below its 50-day simple moving average.

Therefore, our expectations lean toward a decline in the stock’s price in the upcoming sessions, particularly if it breaks below the key support at $235.30, after which it would target its next support level at $193.35.

Today’s price forecast: Bearish