Will Ethereum reach the $10,000 mark? Here’s what top traders are saying

Table of Contents

- Technical Analysis of Ethereum Price – (ETHUSD)

- Key Direction Points

- Best Ethereum Trading Platforms June 2024

- Top 3 Ethereum Trading Companies in June 2024

- Ethereum Analysis and Price Predictions for 2024 and 2025

- Concise Analyses and Predictions for Ethereum Prices

- About Ethereum

- History of Ethereum

- How Does Ethereum Work?

- Cryptocurrency: Ether (ETH)

- Decentralized Applications (dApps)

- Impact of Ethereum on the Digital World

- Decentralized Finance (DeFi)

- Non-Fungible Tokens (NFTs)

- Challenges and Future

- Technical Challenges

- Regulation and Security

- Continuous Innovation

- Importance of Ethereum

- Initial Approval of Ethereum ETFs

- Advantages of Ethereum ETFs

- Massive Regulatory Approvals Support Crypto Industry

- Global Monetary Easing Cycle

- Key Price Levels for Ethereum

- Best Historical Performance of Ethereum Prices

- Worst Historical Performance of Ethereum Prices

- Significant Events in Ethereum History

- Major Ethereum Price Predictions for 2024

- Factors Affecting Ethereum Price Predictions

- Frequently Asked Questions about Ethereum

- Is the Current Ethereum Price Suitable for Investment?

- How to Invest in Ethereum?

- Will Ethereum Prices Reach $10,000?

- Are Ethereum Prices Expected to Rise in 2024?

Technical Analysis of Ethereum Price – (ETHUSD)

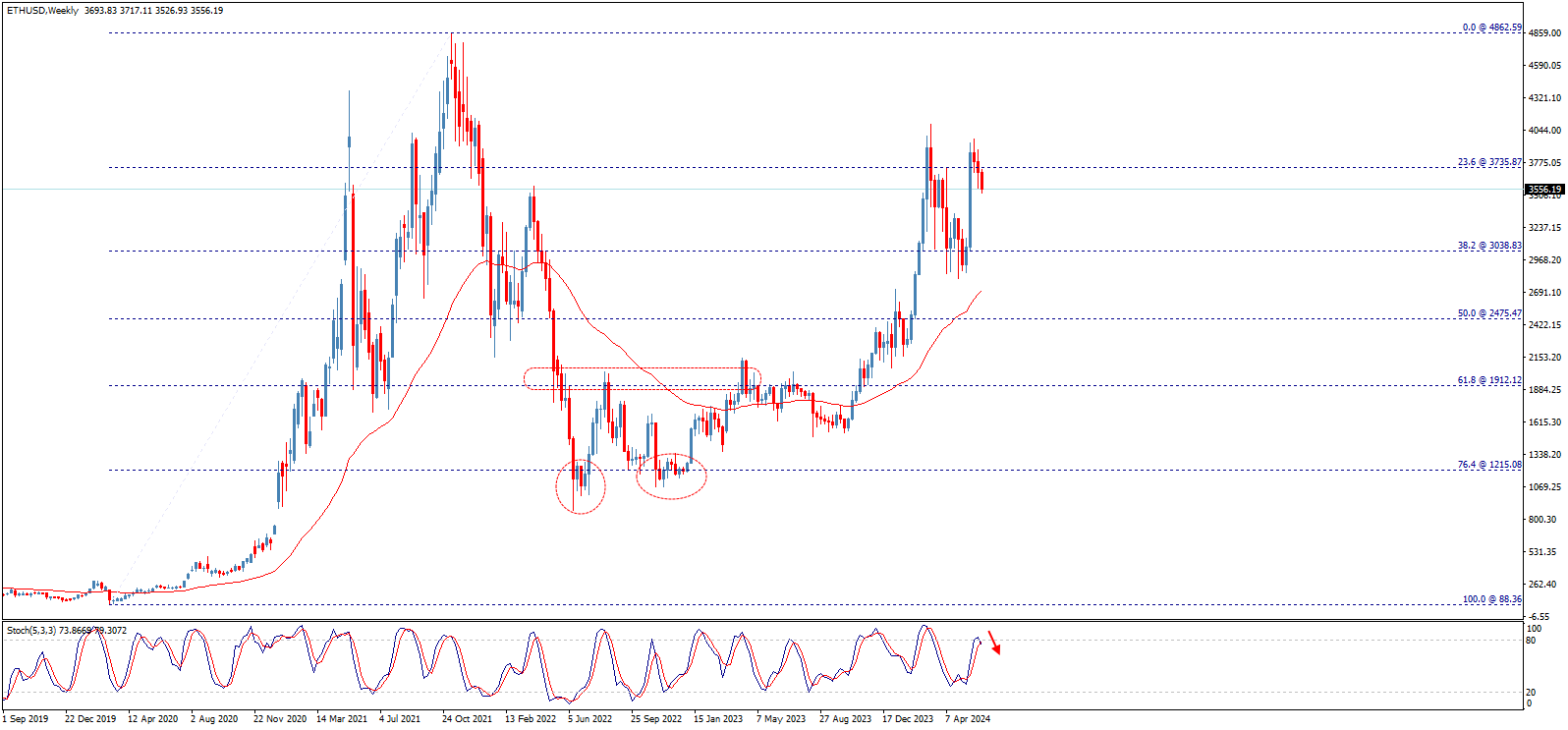

By studying the weekly chart of Ethereum price (ETHUSD), we find that the upward momentum that the price began in early 2020 from the $88.36 areas stopped when it recorded the historical peak at $4862.59, starting a downward correction that reached the maximum correction area around the 76.4% Fibonacci level. It made attempts to break the $1000 barrier, but it started recovering again to build a new upward wave that reached the areas where the price is currently trading.

In recent weeks, we notice that the price is taking a downward path, providing signs of a potential return to a new downward correction, especially as the Stochastic indicator shows clear negative signals on the weekly timeframe. On shorter timeframes, we find that the price is on its way to forming a double top pattern after recording a recent lower peak, as shown in the following chart:

We notice that the price is on its way to a downward correction of the recent upward wave that started from the $1070.70 areas, and the price is approaching the 23.6% Fibonacci level at $3382.70, noting that breaking it will push the price to test the neckline of the double top pattern around $2940.90. Continuing negative pressure and breaking this level will push the price to incur additional losses reaching the $2226.70 areas and may extend to $1785.00.

On the other hand, on intraday timeframes, the price faces more negative pressures that may be a reason for a downward momentum to activate the current downward correction wave and then confirm the completion of the negative pattern towards the targets mentioned in the previous paragraph.

Therefore, we indicate that the price may face negative pressures in the coming period, which may extend to reach the levels of $2940.90, then $2226.70 as negative stops in the short term before trying to resume the main upward trend again.

Key Direction Points:

- Breaking the level of $2940.90 will cause the downward wave to extend to the areas of $2226.70, then $1785.00 in the short and medium term, and the price will need to gather strong positive momentum to help return to the upward path again.

- Breaking the resistance at $3925.00 will stop the current negative pressures and lead the price to resume the main upward trend again, aiming to achieve new gains starting by visiting the areas of $4370.00 and extending to reach the previously recorded historical peak at $4862.60.

Best Ethereum Trading Platforms June 2024

Top 3 Ethereum Trading Brokers in June 2024

- Pepperstone, the best trusted and licensed global trading company for Ethereum trading.

- Plus500, the best trusted and licensed global trading company for Ethereum trading.

- XM, the best trading platform suitable for beginners in Ethereum trading.

Ethereum Analysis and Price Predictions for 2024 and 2025

Ethereum prices quickly returned to the upward market trend during May's trading after a temporary downward pause during April's trading. This strong return came after an initial regulatory approval for the launch of Ethereum ETFs on US exchanges.

The approval of the US Securities and Exchange Commission (SEC) for Ethereum ETFs is a significant regulatory development concerning the second-largest cryptocurrency in the world.

It is expected that these massive positive developments regarding regulatory, technical, and fundamental frameworks will attract more institutional flows and investments into crypto assets in general and Ethereum in particular.

With the shift of investment in the cryptocurrency "Ethereum" to a more attractive environment, many global institutions and banks have started to adjust their future forecasts about the levels that the second most important cryptocurrency in the world could reach over 2024 and 2025.

Expectations have become more aggressive with the likelihood of surpassing the $5,000 barrier this year and possibly reaching $10,000 by the end of the year and the following year.

Concise Analyses and Predictions for Ethereum Prices

- Ethereum price predictions for this week: The second-largest cryptocurrency in the world may succeed in trading again above $4,000 this week if the Federal Reserve's results are less aggressive and the inflation data in the United States are cool.

- Ethereum price predictions for June: Ethereum prices are likely to continue their monthly gains in June, recording new higher levels in several years.

- Ethereum price predictions for 2024: With the record barrier exceeding $5,000, the path becomes open to recording many historical levels, and the target is the next psychological barrier at $10,000.

- Ethereum price predictions for 2025: If the $10,000 barrier is strongly surpassed, the next targets for cryptocurrency prices could be $15,000 and then $20,000.

About Ethereum

In the world of cryptocurrencies, Ethereum is one of the most famous and influential names after Bitcoin. Since its launch in 2015, Ethereum has changed many concepts about how blockchain technology is used, providing a versatile platform that goes beyond just being a digital currency.

History of Ethereum

The idea of Ethereum began with "Vitalik Buterin," a young Russian-Canadian programmer who saw greater potentials for blockchain technology than just financial transactions. In 2013, Buterin published a white paper explaining his vision for a platform that could run smart contracts using blockchain. This idea garnered widespread attention and the project was funded through a crowdfunding campaign in 2014, raising over $18 million. The network officially launched on July 30, 2015, and Ethereum quickly proved its ability to turn ideas into reality.

How Does Ethereum Work?

Ethereum is a platform that relies on blockchain technology to run decentralized applications (dApps) and smart contracts. Smart contracts are self-executing protocols that automatically execute when certain conditions are met. These contracts enable parties to interact without an intermediary, reducing costs and increasing efficiency.

Cryptocurrency: Ether (ETH)

Ether (ETH) is the native currency of the Ethereum network and is used to pay transaction fees and computing costs on the network. Unlike Bitcoin, which aims to be a pure digital currency, Ether acts as fuel for the Ethereum system, making it an essential tool for running smart contracts and decentralized applications.

Decentralized Applications (dApps)

One of Ethereum's biggest advantages is the ability to run decentralized applications. These applications run on the blockchain network and can be used in various fields, ranging from finance (DeFi) to gaming, insurance, and supply chains. Decentralized applications are characterized by transparency and security, as every operation is recorded on the blockchain and cannot be modified or tampered with.

Impact of Ethereum on the Digital World

Decentralized Finance (DeFi)

Among the biggest areas that Ethereum has significantly influenced is decentralized finance or DeFi. DeFi provides financial services such as lending, borrowing, and trading without the need for traditional intermediaries like banks. DeFi relies on smart contracts to operate these services, allowing users to access financial services easily and at low costs.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) are another type of application that has spread thanks to Ethereum. NFTs are unique units of digital assets that can be owned and sold, such as digital artwork, music, and virtual collectibles. NFTs represent a revolution in how digital assets are distributed and owned, opening up new horizons for artists and creators.

Challenges and Future

Technical Challenges

Despite its successes, Ethereum faces several technical challenges. One of the biggest issues is scalability, as the network can become slow and expensive during periods of congestion. Developers are working on solutions such as "Ethereum 2.0" to improve performance by transitioning the network from a proof-of-work (PoW) system to a proof-of-stake (PoS) system.

Regulation and Security

With increasing interest in cryptocurrencies, regulation and security have become crucial issues. Ethereum has faced some notable attacks, such as the DAO attack in 2016, which led to the network splitting into Ethereum and Ethereum Classic. Maintaining the security of the Ethereum network and other digital networks requires continuous updates and technical improvements.

Continuous Innovation

Ethereum remains at the forefront of innovation in the blockchain and cryptocurrency field. With the continuous development of decentralized applications and smart contracts, Ethereum continues to provide new solutions to traditional problems and contributes to building a more inclusive and flexible digital economy.

Importance of Ethereum

Ethereum represents more than just a cryptocurrency; it is an integrated ecosystem that can change many aspects of our digital lives. From decentralized finance to non-fungible tokens, Ethereum opens new doors for innovation and creativity. With ongoing development and improvement, the future of Ethereum looks promising and full of potential, making it one of the fundamental pillars in the blockchain world.

Initial Approval of Ethereum ETFs

On May 23, the US Securities and Exchange Commission (SEC) approved (19b-4) filings for eight issuers of spot Ethereum ETFs, allowing them to be listed and traded on their respective exchanges. The first batch of approved Ethereum ETFs includes filings from VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, Ark 21Shares, Invesco Galaxy, and Bitwise. While the approval of (19b-4) filings is a positive sign from the US securities regulator, ETF issuers also need to obtain approval for their (S-1) filings, which may take several months, according to an ETF analyst at Bloomberg.

Advantages of Ethereum ETFs

Julius Baer Bank economist "Manuel Villegas" confirmed the advantages of the ETF market, including lower implicit costs due to lower spreads, less slippage, and reduced tracking errors. It is worth noting that spreads and slippage in ETFs are even lower than some centralized exchanges, providing significant benefits for investors. Regulated ETFs allow investors to gain exposure to cryptocurrencies, bypassing the hassles of storing coins.

Massive Regulatory Approvals Support Crypto Industry

After the approval of the launch of Bitcoin ETFs in the United States, regulatory approvals for financial assets linked to cryptocurrencies continue in most parts of the world. In the United Kingdom, the London Stock Exchange said it would accept the issuance of bonds backed by Bitcoin and Ethereum, and the Thai securities regulator indicated that it would open offshore cryptocurrency ETFs to individual buyers. With the approval of the Hong Kong Securities Regulatory Commission, trading of six spot Bitcoin ETFs began on Tuesday, April 30, 2024.

Global Monetary Easing Cycle

- In March, the Swiss National Bank (SNB) unexpectedly cut its benchmark interest rate to start a new monetary easing cycle, and the Mexican central bank cut interest rates, while the Federal Reserve, the European Central Bank, and the Bank of England laid the foundation for what is called easing monetary policy in the coming months.

- In early June, the European Central Bank and the Bank of Canada cut interest rates by about 25 basis points, thanks to easing inflationary pressures and slowing economic activities.

- Market experts said: In the medium term, there seems to be clear optimism for stocks, residential real estate, gold, and cryptocurrencies, thanks to the global monetary easing cycle that will result in the injection of new liquidity into the markets.

Key Price Levels for Ethereum

- October 2015: Ethereum's price recorded the lowest level ever at 40 cents per unit.

- November 2023: Ethereum's price recorded the highest level ever at $4,868 per unit.

- October 2015: Ethereum's price recorded the lowest closing level ever at 90 cents per unit.

- November 2023: Ethereum's price recorded the highest closing level ever at $4,630 per unit.

Best Historical Performance of Ethereum Prices

- Year 2017: The best annual performance ever for Ethereum, with a rise of 9,240%.

- Q1 2016: The best quarterly performance ever for Ethereum, with a rise of 1,120%.

- March 2017: The best monthly performance ever for Ethereum, with a rise of 216%.

Worst Historical Performance of Ethereum Prices

- Year 2018: The worst annual performance ever for Ethereum, with a decline of 82%.

- Q2 2021: The worst quarterly performance ever for Ethereum, with a decline of 67%.

- March 2018: The worst monthly performance ever for Ethereum, with a decline of 54%.

Significant Events in Ethereum History

- August 2015: Ethereum's digital currency trading started at $2.8.

- September 2015: Ethereum traded below $1 for the first time ever.

- February 2016: Ethereum's price exceeded the $5 barrier per unit for the first time in history.

- March 2016: Ethereum's price exceeded the $10 barrier per unit for the first time in history.

- March 2017: Ethereum's price exceeded the $50 barrier per unit for the first time ever.

- May 2017: Ethereum's price exceeded the $100 barrier per unit for the first time ever.

- November 2017: Ethereum's price exceeded the $500 barrier per unit for the first time in history.

- January 2018: Ethereum's price exceeded the $1,000 barrier per unit for the first time in history.

- February 2021: Ethereum's price exceeded the $2,000 barrier per unit for the first time ever.

- May 2021: Ethereum's price exceeded the $3,000 and $4,000 barriers per unit for the first time ever.

Major Ethereum Price Predictions for 2024

- Goldman Sachs Group expects: The price of Ethereum will reach $8,000 by the end of 2024. This is due to optimism about the continued growth of the decentralized finance (DeFi) sectors, Web 3.0 applications, and the anticipated Ethereum 2.0 upgrade.

- Morgan Stanley Group expects: The price of Ethereum will reach $10,000 by the end of 2024. This is due to the growth of technical innovations and increased demand for digital currencies.

- UBS Bank expects: The price of Ethereum will reach $12,000 by the end of 2024. This is due to the growth of technical innovations and increased government investments in digital infrastructure.

- Grayscale, the largest investor in cryptocurrency ETFs, expects: The price of Ethereum will reach $10,000 per unit by the end of 2024, driven by increased demand from institutions and large investors.

- Binance, the largest digital platform in the world, expects: Ethereum prices to reach $10,000 by the end of 2024.

- LongForecast analysts expect: Ethereum will continue to rise in 2024, reaching $5,350 by the end of the year.

- ETC Group expects: Ethereum will slightly exceed the $10,000 level in 2024, due to long-term investment increases.

Factors Affecting Ethereum Price Predictions

- Institutional Investment: The entry of major financial institutions into the digital currency market is a key factor in boosting demand for Ethereum, which could lead to higher prices.

- Government Regulation: The regulatory environment surrounding digital currencies is still unclear, and new regulations can play a significant role in determining price trends.

- Market Sentiment: Investor sentiment plays a major role in the price movements of digital currencies, as fears or optimism can lead to significant price fluctuations.

- Macro-Economic Performance: Macro-economic factors, such as interest rates and economic growth, can affect investors' risk appetite, which may reflect on digital currency prices.

- Technological Developments: New technological developments in the blockchain and digital currency field can improve their functionality and adoption, which may drive prices up.

Frequently Asked Questions about Ethereum

Is the Current Ethereum Price Suitable for Investment?

Ethereum is currently trading around $4,000 per unit. In light of most forecasts pointing to a bullish market for the second-largest cryptocurrency in the world in 2024, we believe that levels between $3,000 and $4,000 are suitable for investment, with the target above $10,000.

How to Invest in Ethereum?

There are several different ways to invest in Ethereum:

- Spot Ethereum Purchase: You can buy spot Ethereum from trusted digital currency trading platforms, and global currencies such as the US dollar and euro can be used to buy Ethereum.

- Long-Term Investment: You can hold Ethereum for a long time and expect its price to rise over time, leading to significant returns. This requires good risk assessment and the ability to tolerate high price volatility.

- Exchange-Traded Funds (ETFs): Some financial markets, especially in the United States, will offer ETFs linked to Ethereum performance, allowing investors to access this market easily through stock trading.

- Global Stocks: By buying shares of companies related to providing digital services and blockchain technology, especially those traded in US markets on Wall Street.

Will Ethereum Prices Reach $10,000?

In light of recent developments in the digital asset market and other global markets, it is not entirely unlikely that Ethereum prices will rise to $10,000 this year, with this level strongly surpassed in the coming years.

Are Ethereum Prices Expected to Rise in 2024?

Yes, Ethereum prices are expected to continue rising this year. Most expectations from major institutions, banks, and experts are stable around Ethereum entering a bullish market as it approaches breaking the $5,000 barrier per unit.

Brent oil price forecast update 13-06-2024

Brent Oil Price Analysis

Expected Scenario

- Brent oil price faces clear negative pressure to break 82.40$ level and attempt to hold above it, to hint potential turn to decline, which urges caution from the upcoming trading, as confirming the break will push the price to suffer additional losses that reach 81.20$ followed by 80.08$ levels.

- The price needs to trade above 82.40$ again to revive the positive scenario that targets 83.70$ followed by 84.77$ levels mainly.

Expected Trading Range

Between 81.10$ support and 84.00$ resistance.

Trend Forecast: Bullish

Crude oil price forecast update 13-06-2024

Crude Oil Price Analysis

Expected Scenario

- Crude oil price keeps declining to reach the key support 77.64$, and as we mentioned this morning, the price needs to hold above this level to keep the bullish trend scenario active for today, as breaking it will put the price under negative pressure that targets 76.70$ followed by 75.25$ levels as next main stations.

- The price needs to get a positive motive that assists to rally towards our first expected target at 79.55$.

Expected Trading Range

Between 77.00$ support and 80.00$ resistance.

Trend Forecast: Bullish

Silver price forecast update 13-06-2024

Silver Price Analysis

Expected Scenario

- Silver price is testing the key resistance 29.30$ now, and the price needs to hold below this level as a first condition to the continuation of the expected bearish trend, which targets 28.55$ as a next main station.

- Surpassing the mentioned level will extend the bullish wave to reach 27.65$, while breaching 29.30$ followed by 30.06$ levels will stop the expected decline and lead the price to turn to rise.

Expected Trading Range

Between 28.60$ support and 29.50$ resistance.

Trend Forecast: Bearish