Tron price surrounded with positive pressures - Analysis - 04-08-2025

AI Summary

- TRON's price is continuing to climb, supported by sustained movement above the 50-period simple moving average and positive signals from Stochastic indicators

- The cryptocurrency's price is expected to continue rising in upcoming intraday sessions as long as support at $0.32080 holds, targeting the resistance level at $0.34304

- The expected trend for upcoming sessions is bullish

TRON’s price (TRXUSD) continued to climb in recent intraday trading, supported by sustained movement above the 50-period simple moving average, which acts as dynamic support and reinforces the positive trend. This rise is further backed by trading along a primary ascending trendline on the short-term chart, alongside positive signals from the Stochastic indicators, despite entering extreme overbought territory.

Therefore, we expect the cryptocurrency’s price to continue rising in upcoming intraday sessions, as long as support at $0.32080 holds, targeting the resistance level at $0.34304.

Expected trend for upcoming sessions: Bullish.

Litecoin price extends gains - Analysis - 04-08-2025

Litecoin’s price (LTCUSD) continued to rise in recent intraday trading, supported by a short-term bullish pattern — the falling wedge — along with sustained movement above the 50-period simple moving average and the dominance of a primary uptrend. However, emerging bearish crossover signals from the Stochastic indicators, following extreme overbought conditions, may limit further upside momentum.

Therefore, we expect the cryptocurrency’s price to rise in upcoming intraday sessions, as long as support at $108.50 holds, targeting the key resistance level at $122.30.

Expected trend for upcoming sessions: Bullish.

UnitedHealth price deepens losses - Forecast today - 04-08-2025

UnitedHealth Group Incorporated’s stock price (UNH) continued to decline in recent intraday trading, breaking below the key support level of $248.90. The stock remains under firm control of a primary bearish trend, trading along a short-term descending trendline. Persistent downward pressure is also evident from its position below the 50-day simple moving average, along with continued bearish signals from the Stochastic indicators.

Therefore, we expect the stock price to decline further in upcoming sessions, especially while staying below $248.90, targeting the next support level at $201.50.

Today’s price forecast: Bearish.

Mastercard price gives in to negative pressure - Forecast today - 04-08-2025

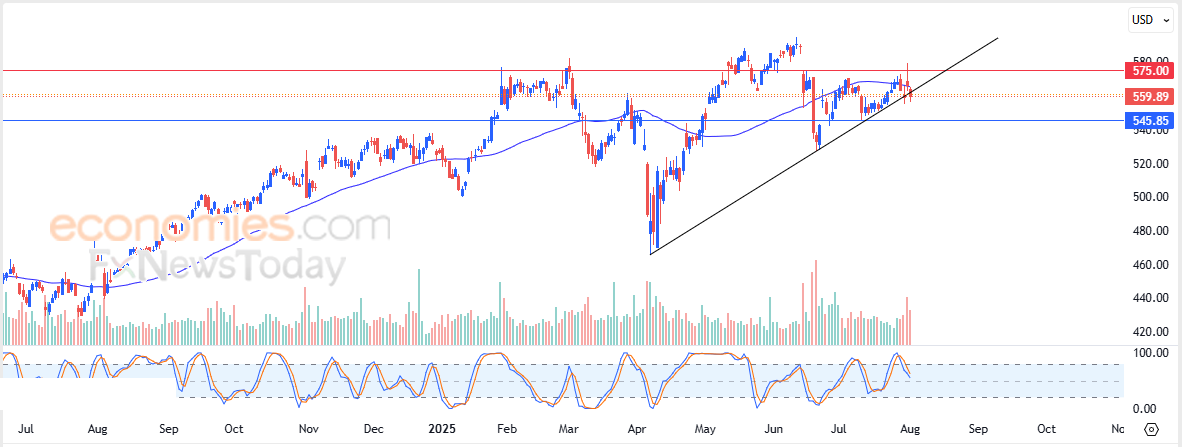

Mastercard Incorporated’s stock price (MA) declined in recent intraday trading after hitting resistance at its previous 50-day simple moving average. This exposed the stock to negative pressure, especially with the emergence of bearish signals from the Stochastic, which entered overbought territory. The increased selling pressure led the stock to break a short-term ascending trendline, reinforcing its bearish trajectory.

Therefore, we expect the stock price to decline in upcoming sessions, as long as resistance holds at $575.00, with the first support target at $545.85.

Today’s price forecast: Bearish.