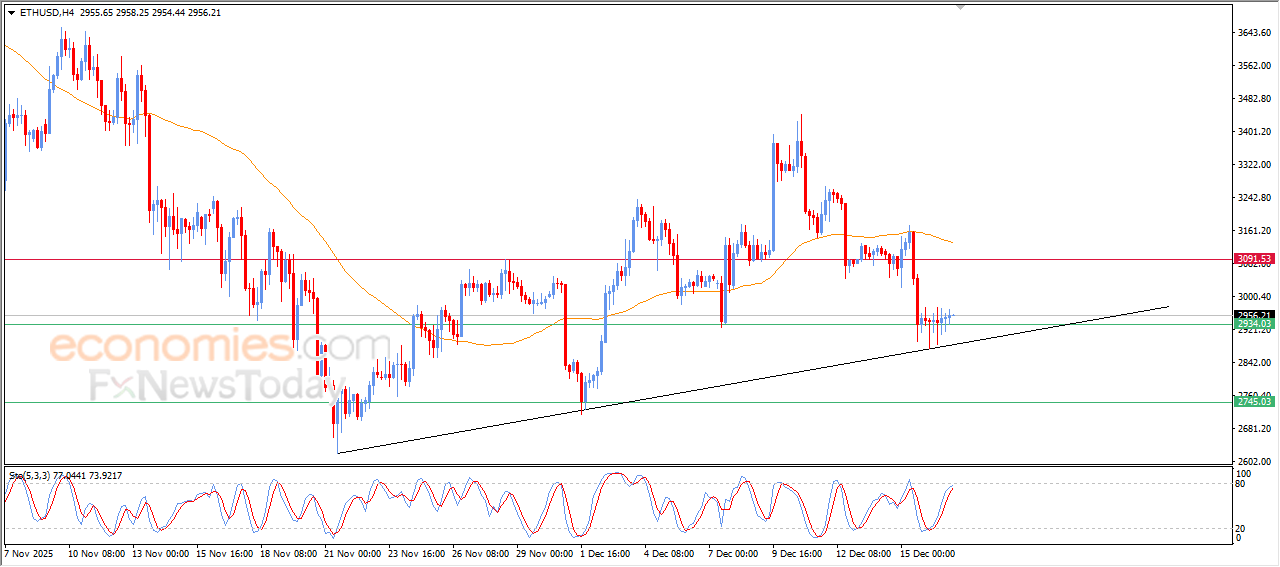

The (ETHUSD) is fluctuating in tight range trading area- Analysis- 17-12-2025

The (ETHUSD) price witnessed fluctuated trading on its last intraday levels, leaning on the support of bullish corrective trend line on the short-term basis, supported by the emergence of positive signals on the relative strength indicators, reaching overbought levels, indicating a quick fading to the bullish momentum, amid the continuation of the negative pressure due to its trading below EMA50, reducing the chances of full recovery on the near-term basis.

Brent crude oil begins to offload its oversold conditions- Analysis- 17-12-2025

The (Brent) price jumped higher on its last intraday trading, after reaching our expected target at $59.20 support, amid the dominance of the main bearish trend, with continuous negative pressure due to its trading below EMA50, reducing the chances of sustainable recovery on the near-term basis, to recover some of its previous losses, and attempts to offload some of the clear oversold conditions on the relative strength indicators, especially with the emergence of positive signals from there.

Silver price is recording new all-time highs - Analysis-17-12-2025

Silver price jumped higher in its last intraday trading, breaching the key resistance at $64.60, this resistance represented potential target in our previous analysis, to record new historical levels, supported by its trading above EMA50, which represents a dynamic support that reinforces the stability and strength of the main bullish trend, with its trading alongside minor trend line on the short-term basis, with the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels.

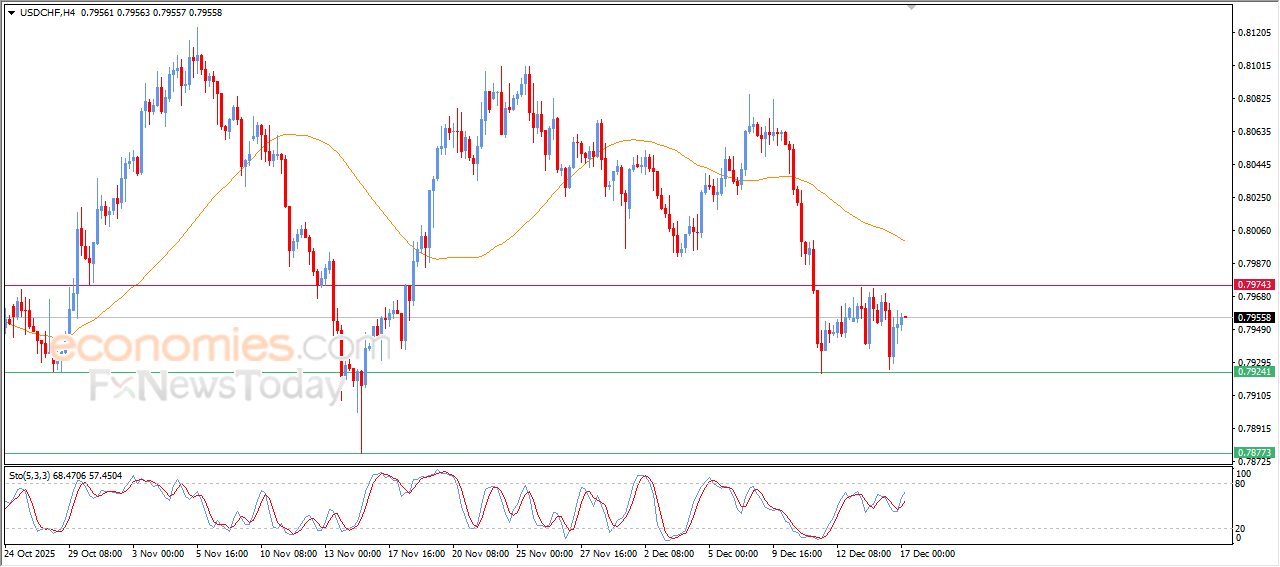

The USDCHF price witnesses fluctuating trading- Analysis-17-12-2025

The (USDCHF) price settled on a rise in its last intraday trading, amid fluctuating trading supported by the emergence of positive signals from the relative strength indicators, on the other hand we notice the continuation of the negative pressure due to its trading below EMA50, and under the dominance of steep minor bearish wave on the short-term basis, reducing the chances of the price recovery on the near-term basis.