The (ETHUSD) gets ready to reach its current resistance- 21-07-2025

AI Summary

- ETHUSD price is expected to reach the current resistance level at $3,800

- Success in offloading overbought conditions on the RSI provides room for gains

- Trading alongside main and minor bias lines indicates strength of bullish trend

The (ETHUSD) price rose in its last intraday trading, getting ready to attack the current resistance level at $3,800, after its success in offloading some of its overbought conditions on the (RSI) previously, providing bigger space to achieve more of the gains, amid the dominance of the main bullish trend and its trading alongside main and minor bias line on the short-term basis, indicating the strength of this trend.

Brent crude oil is moving in a limited range- Analysis-21-07-2025

The (Brent) price witnessed calm trading in tight range of sideways trading in the intraday levels, accompanied by negative pressure due to its trading below its EMA50 against the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line, with the (RSI) reaching oversold levels, exaggeratedly compared to the price move, suggesting the beginning of forming positive divergence.

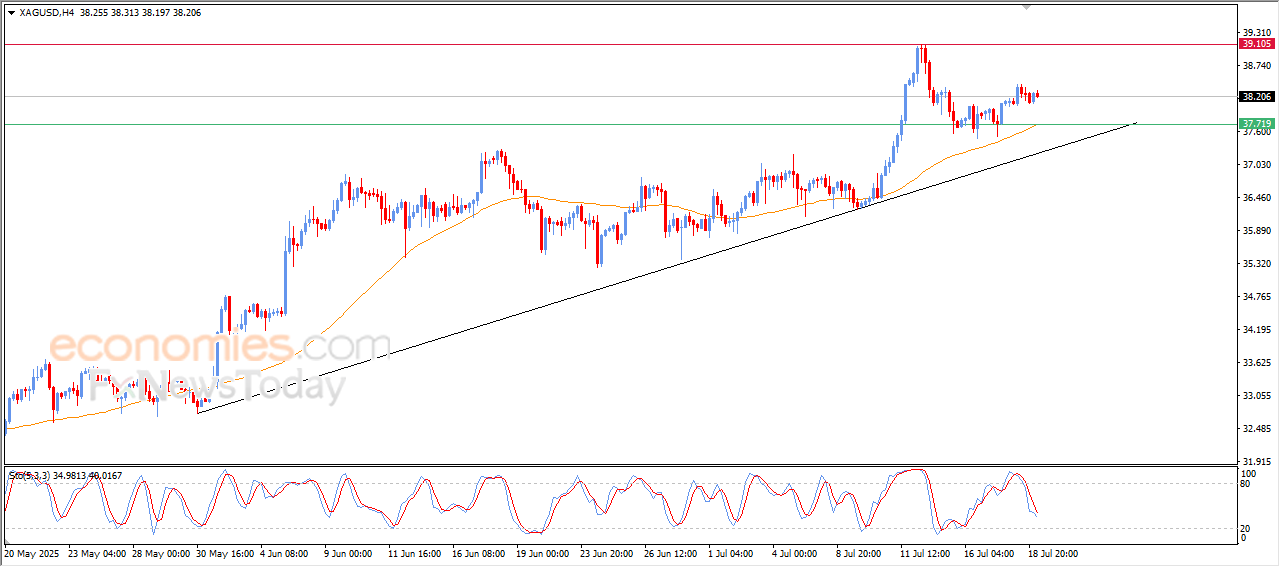

Silver price is gathering its strength -Analysis-21-07-2025

The (silver) price witnessed calm moves that prefer declining slightly in its last intraday trading, amid the emergence of the negative signals on the (RSI), after reaching overbought levels previously, attempting to gain a positive momentum that might assist it to recover and rise again, amid the continuation of the main bullish trend dominance on the short-term basis and its trading alongside a bias line.

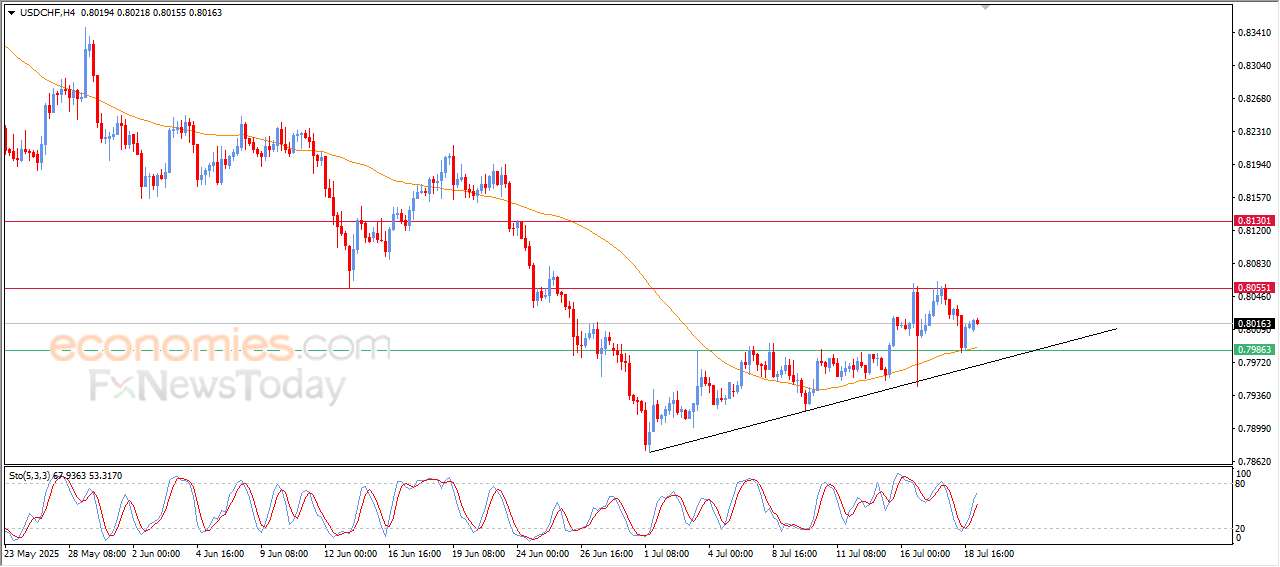

The USDCHF is under the dominance of the bullish correctional trend -Analysis-21-07-2025

The (USDCHF) price settled high in its last intraday trading, amid the continuation of the positive pressure that comes from its trading above EMA50, providing bullish momentum previously, due to its lean on this support, amid the dominance of the bullish correctional trend on the short-term basis and its trading alongside a bias line, with the emergence of the positive signals on the (RSI), after reaching oversold levels.