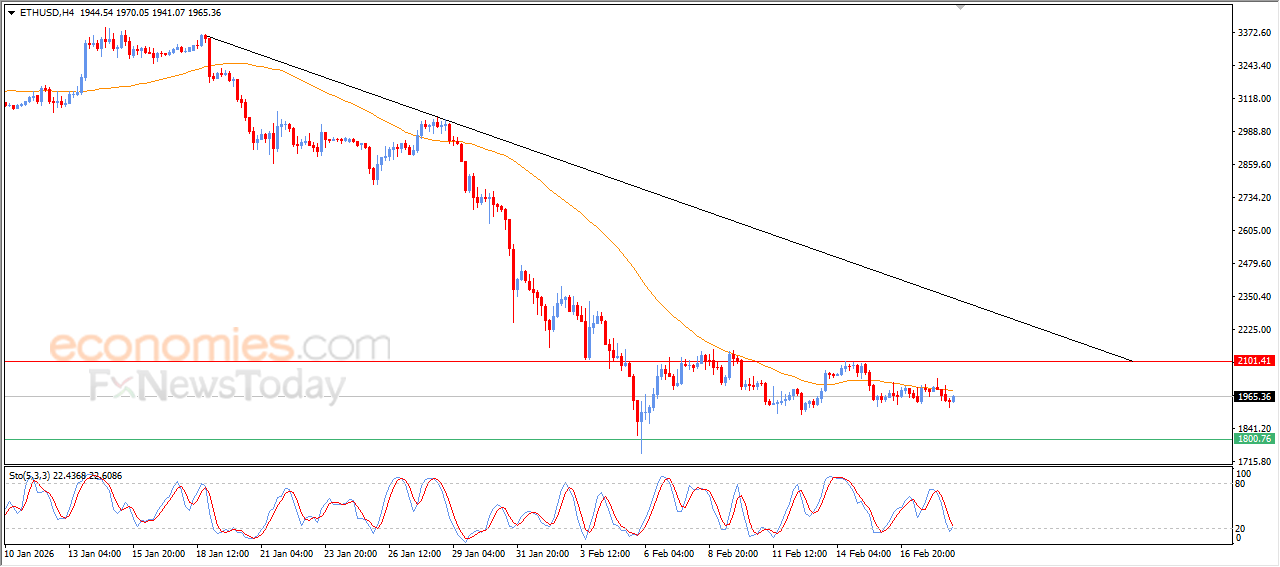

The (ETHUSD) continues its fluctuating moves- Analysis- 19-02-2026

The (ETHUSD) price continues its fluctuating moves on its last intraday levels, under the dominance of the main bearish trend on short-term basis, with the continuation of the negative dynamic pressure that is represented by its trading below EMA50, on the other hand, we notice the emergence of positive overlapping signals from relative strength indicators, after reaching oversold levels, which formed a base that provides renewed bullish momentum that prevents the price decline.

Brent crude oil price is preparing to reach key resistance- Analysis- 19-02-2026

The (Brent) price witnessed sharp gains in its last intraday trading, to return the balance of the main bullish trend on short-term basis, with its trading alongside supportive trend line for this track, taking advantage of the dynamic pressure that is represented by its trading above EMA50, preparing to reach $70.30 key resistance, on the other hand, we notice the emergence of negative overlapping signals from relative strength indicators, after reaching overbought levels, which might reduce the gains in the upcoming period.

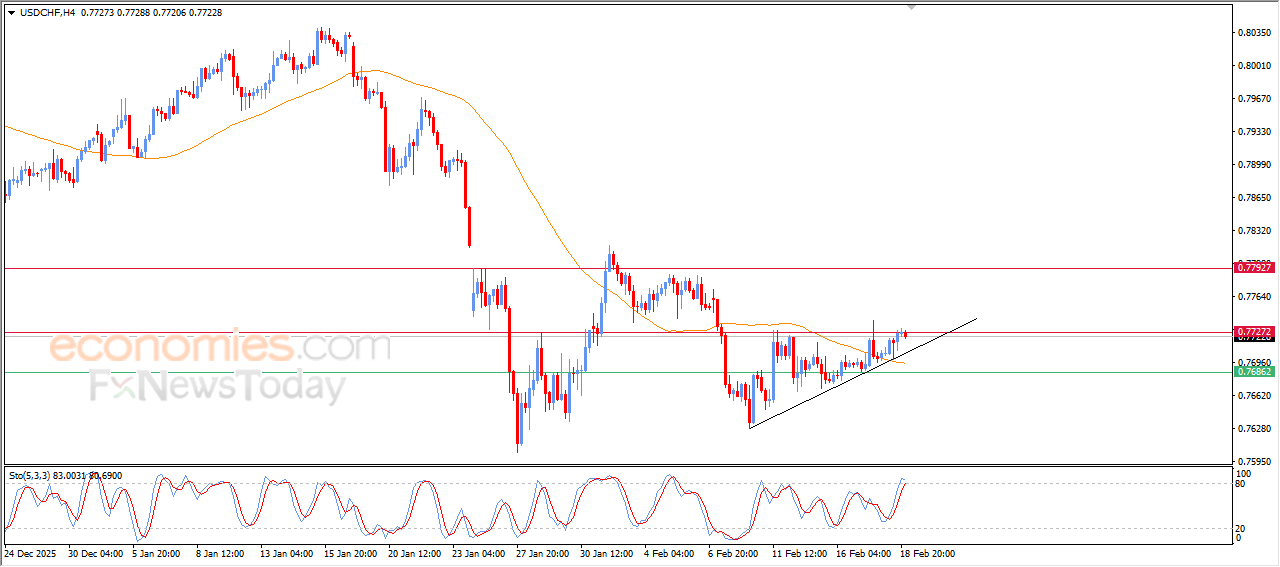

The USDCHF Price struggles to breach stubborn resistance- Analysis-19-02-2026

The (USDCHF) price settles on losses in its last intraday trading, amid its attempts to breach the stubborn key resistance at 0.7725, amid the dominance of the bullish corrective trend on short-term basis, with its trading alongside supportive minor trend line for this path, taking advantage of the dynamic support that is represented by its trading above EMA50, besides the emergence of positive signals from relative strength indicators, despite reaching overbought levels.

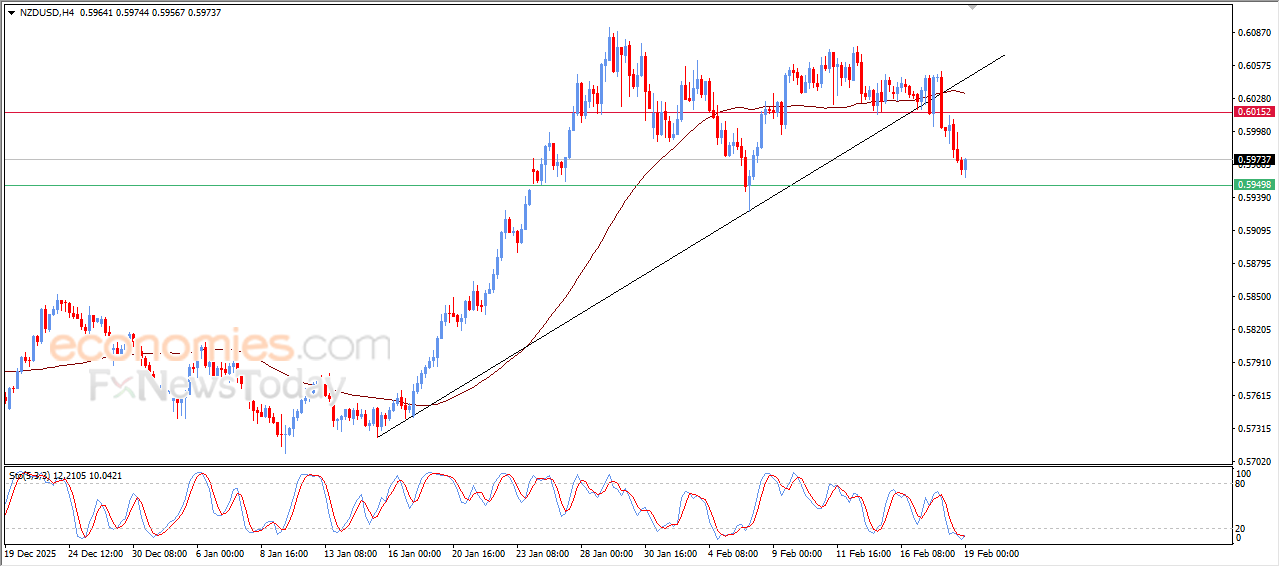

NZDUSD is attempting to recover some of its losses-Analysis-19-02-2026

The (NZDUSD) price rose in its last intraday trading, in attempt to recover some of its previous losses, attempting to recover some of its clear oversold conditions on relative strength indicators, especially with the emergence of positive overlapping signals, amid the continuation of the negative pressure due to its trading below EMA50, reducing the chances of full recovery on near-term basis, especially with the dominance of bearish corrective wave on short-term basis.