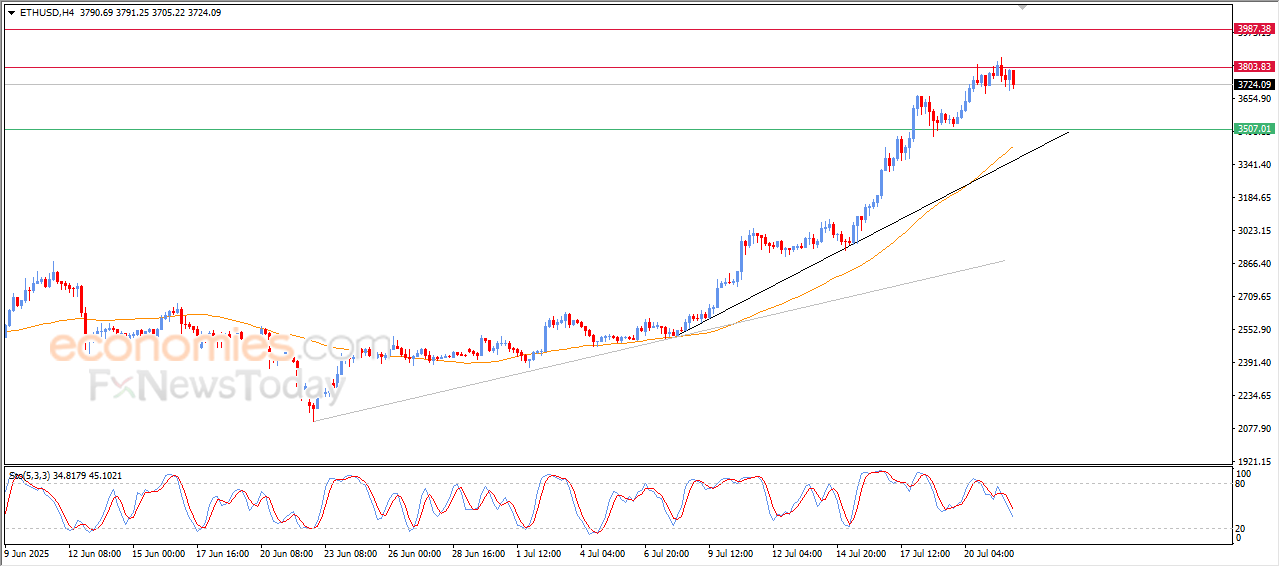

The (ETHUSD) attempts to gain positive momentum- 22-07-2025

AI Summary

- ETHUSD price declined in last trading due to resistance at $3,800

- Negative signals on RSI indicate attempt to offload overbought condition

- Bullish momentum needed to breach resistance and recover

The (ETHUSD) price declined in its last intraday trading, due to the stability of the current resistance at $3,800, with the emergence of the negative signals on the (RSI), after reaching overbought levels, to attempt to offload this overbought condition, and gain a bullish momentum that might help it to recover and breach this resistance, amid the dominance of the main bullish trend and its trading alongside a minor bias line on the short-term basis.

High-Accuracy Trading Signals – Provided by BestTradingSignal.com

Subscribe now to professional, carefully structured packages covering major global markets. Receive signals directly via Telegram from our expert team.

- US Stock Signals starting from €44/month – Subscribe here

- Crypto Signals starting from €49/month – Subscribe here

- Forex Signals starting from €49/month – Subscribe here

- VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) starting from €179/month – Subscribe here

The longer your subscription, the bigger the discount and the better the rate.

See the full results here: Trading Signal Results by BestTradingSignal.com; Week of July 14–18, 2025

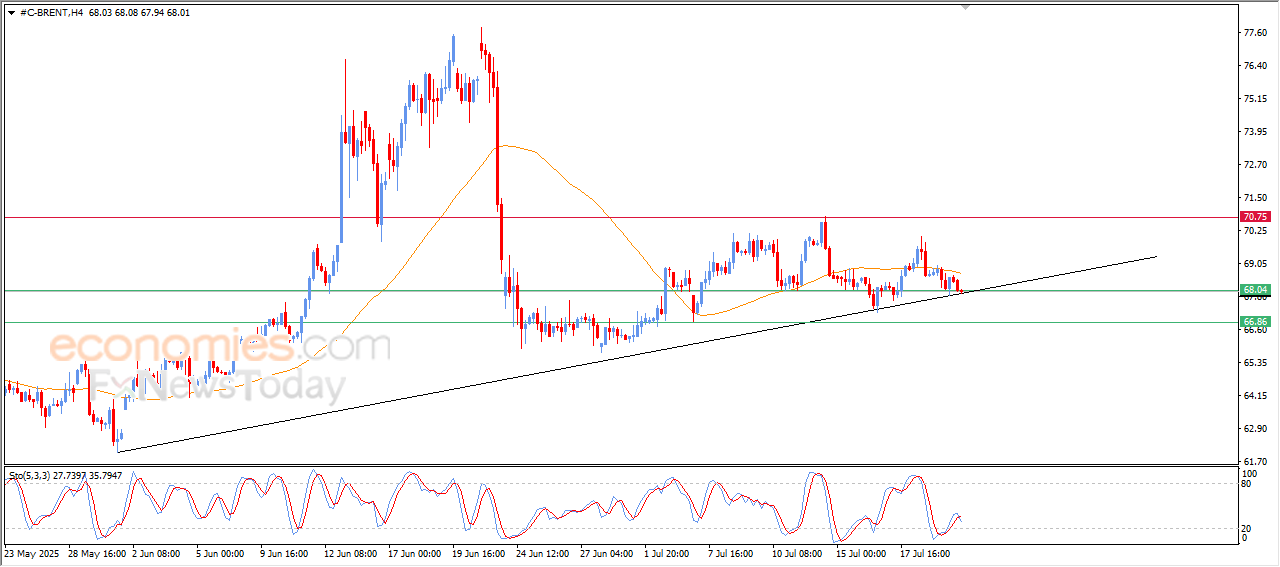

Brent crude oil is leaning on a main bullish trend line- Analysis-22-07-2025

The (Brent) price declined in its last intraday trading, amid the continuation of the negative pressure due to its trading below EMA50, with the beginning of negative overlapping signals on the (RSI), after the price success in offloading its oversold conditions previously, to lean on the support of a main bullish trend line on the short-term basis as a last attempt to gain bullish momentum that might help it to recover and rise again.

High-Accuracy Trading Signals – Provided by BestTradingSignal.com

Subscribe now to professional, carefully structured packages covering major global markets. Receive signals directly via Telegram from our expert team.

- US Stock Signals starting from €44/month – Subscribe here

- Crypto Signals starting from €49/month – Subscribe here

- Forex Signals starting from €49/month – Subscribe here

- VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) starting from €179/month – Subscribe here

The longer your subscription, the bigger the discount and the better the rate.

See the full results here: Trading Signal Results by BestTradingSignal.com; Week of July 14–18, 2025

Silver price is getting ready to attack critical resistance -Analysis-22-07-2025

The (silver) price rose in its last intraday trading, preparing to attack the critical resistance level at $39.10, after it’s success in offloading some of its clear overbought conditions on the (RSI), opening the way for achieving more of the gains, amid the dominance of the main bullish trend on the short-term basis and its trading alongside a bias line, supported by its continuous trading above its EMA50, representing a dynamic support that assists the stability of the bullish trend.

High-Accuracy Trading Signals – Provided by BestTradingSignal.com

Subscribe now to professional, carefully structured packages covering major global markets. Receive signals directly via Telegram from our expert team.

- US Stock Signals starting from €44/month – Subscribe here

- Crypto Signals starting from €49/month – Subscribe here

- Forex Signals starting from €49/month – Subscribe here

- VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) starting from €179/month – Subscribe here

The longer your subscription, the bigger the discount and the better the rate.

See the full results here: Trading Signal Results by BestTradingSignal.com; Week of July 14–18, 2025

The USDCHF is exhausting its positive opportunities -Analysis-22-07-2025

The (USDCHF) price settled low in its last intraday trading, by continuous negative pressure due to its trading below EMA50, to lean on the support of bullish correctional trend line on the short-term basis, as a last chance for gaining positive momentum that might assist it to recover and rise again, especially with the emergence of positive overlapping signals on the (RSI), after reaching oversold levels.

High-Accuracy Trading Signals – Provided by BestTradingSignal.com

Subscribe now to professional, carefully structured packages covering major global markets. Receive signals directly via Telegram from our expert team.

- US Stock Signals starting from €44/month – Subscribe here

- Crypto Signals starting from €49/month – Subscribe here

- Forex Signals starting from €49/month – Subscribe here

- VIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) starting from €179/month – Subscribe here

The longer your subscription, the bigger the discount and the better the rate.

See the full results here: Trading Signal Results by BestTradingSignal.com; Week of July 14–18, 2025