Polygon price between a rock and a hard place - Analysis - 10-09-2025

AI Summary

- Polygon (MATICUSDT) price declined due to negative signals in Stochastic indicators and trading below its 50-day SMA

- Short-term main bullish trend remains in control, with trading moving along an upward slope line supporting recovery in the near term

- Expectation for Polygon price to rise in upcoming intraday trading, targeting key resistance level of 0.292 as long as support level of 0.263 holds

Polygon (MATICUSDT) price declined in its latest intraday trading, as negative signals appeared in the Stochastic indicators, while additional bearish pressure came from trading below its 50-day SMA. However, the short-term main bullish trend remains in control, with trading moving along an upward slope line that supports this path, which increases the chances of recovery in the near term.

Therefore, we expect the currency to rise in its upcoming intraday trading, as long as the support level of 0.263 holds, to then target the key resistance level of 0.292.

Today’s price forecast: Bullish.

Alchemy price receives positive push - Analysis - 10-09-2025

Alchemy Pay (ACHUSD) price advanced in its latest intraday trading, after finding support at its 50-day SMA, which provided positive momentum helping it achieve these gains. This comes alongside the beginning of a positive divergence in the Stochastic indicators after reaching strongly oversold levels, exaggerated relative to the price movement, with positive signals starting to appear. The short-term corrective bullish wave also remains in control on the intraday levels.

Therefore, we expect the currency to rise in its upcoming intraday trading, provided the support level of 0.018888 holds, to then target the resistance level of 0.020540.

Today’s price forecast: Bullish.

On Holding price faces negative outlook - Forecast today - 10-09-2025

On Holding AG (ONON) stock declined in its latest intraday trading, with the short-term corrective bearish trend remaining in control as trading moves along a downward slope line. Negative pressure also continues from trading below its previous 50-day SMA, while additional bearish signals are appearing in the Stochastic indicators after previously reaching strongly overbought levels, exaggerated relative to the stock’s movement.

Therefore, we expect the stock to decline in its upcoming trading, as long as the resistance level of 48.00 holds, to then target the support level of 40.35.

Today’s price forecast: Bearish.

Broadcom price stalls - Forecast today - 10-09-2025

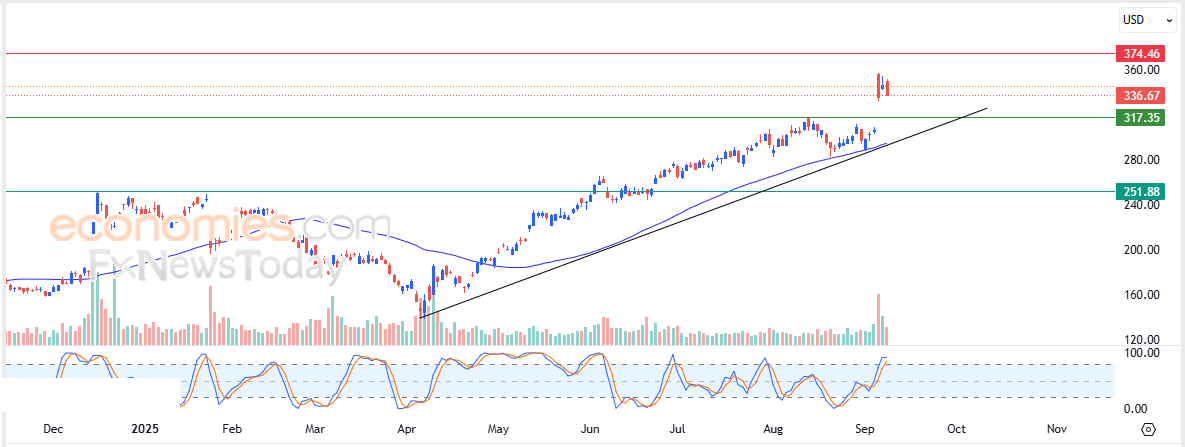

Broadcom (AVGO) stock declined in its latest intraday trading, as it undergoes profit-taking from earlier gains while attempting to gather positive momentum that could support recovery and renewed rise. At the same time, the stock is working to unwind part of its clear overbought levels in the Stochastic indicators, especially with a negative crossover beginning to appear. The outlook remains supported by continued trading above its previous 50-day SMA, while the main short-term bullish trend is still in control with trading along an upward slope line.

Therefore, we expect the stock to rise in its upcoming trading, as long as it remains stable above 317.35, to then target the resistance level of 374.50.

Today’s price forecast: Bullish.