Hedera price tries to vent off overbought saturation - Analysis - 02-10-2025

Hedera (HBARUSD) held higher in its latest intraday trading, consolidating after prior gains while attempting to build positive momentum that could help it resume its strong rally. At the same time, it is working to unwind overbought conditions on the RSI, especially with bearish signals starting to appear. Despite this, the cryptocurrency remains supported by trading above its 50-day simple moving average and by its earlier breakout from a descending price channel that had previously capped its short-term moves.

Therefore, we expect the cryptocurrency to rise in upcoming trading, as long as support at 8.78 holds, targeting the key resistance level of 10.81.

Today’s price forecast: Bullish.

VeThor Token price extends gains - Analysis - 02-10-2025

VeThor Token (VTHOUSD) continued to rise in its latest intraday trading, remaining under the influence of a short-term corrective bullish wave and supported by its ongoing trades above the 50-day simple moving average. However, RSI indicators have begun flashing bearish signals after reaching heavily overbought zones, which could cap the token’s gains in the near term.

Therefore, we expect the cryptocurrency to rise in upcoming trading, as long as it holds above 0.001631, targeting the key resistance level of 0.001771.

Today’s price forecast: Bullish.

Zscaler price surrounded with positive pressures - Forecast today - 02-10-2025

Zscaler Inc (ZS) stock rose in its latest intraday trading, with the medium-term main bullish trend prevailing and its movements aligned with a short-term ascending trendline supporting this trajectory. The stock also continues to benefit from positive pressure as it trades above its 50-day simple moving average. In the background, RSI indicators are showing positive signals despite being in heavily overbought territory.

Therefore, we expect the stock to rise in upcoming trading, as long as support at 283.00 holds, targeting the key resistance level of 318.45.

Today’s price forecast: Bullish.

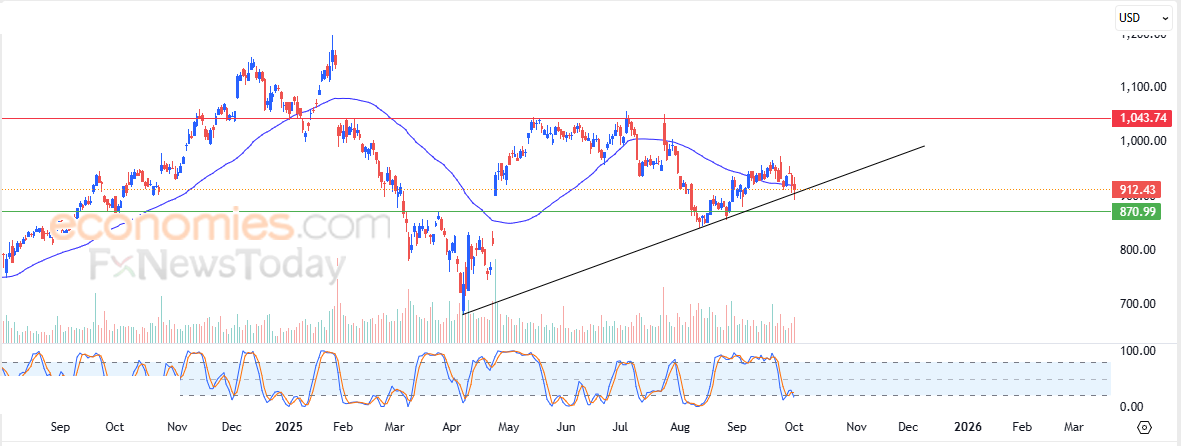

ServiceNow price exhausts positive chances - Forecast today - 02-10-2025

ServiceNow (NOW) stock declined in its latest intraday trading, attempting to gain positive momentum that could help it recover and climb again. The stock’s recent drop brought it to the support of the 50-day simple moving average, coinciding with its reliance on a short-term corrective ascending trendline. Meanwhile, the RSI has reached heavily oversold levels.

Therefore, our outlook leans toward a potential rebound in upcoming trading, provided support at 871.00 holds, with the stock targeting the key psychological resistance at 1,000.

Today’s price forecast: Neutral.