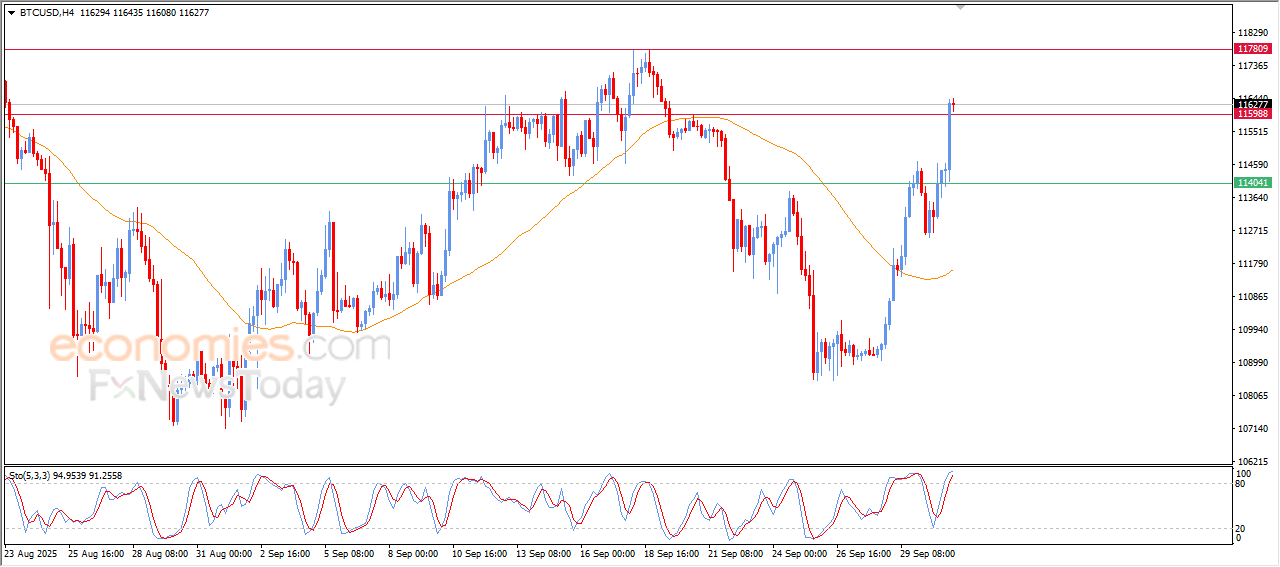

Forecast update for bitcoin-01-10-2025

AI Summary

- Bitcoin price reached $116,000, supported by positive signals on relative strength indicators and trading above EMA50

- BestTradingSignal.com offers high-accuracy trading signals for US stocks, crypto, forex, and VIP signals for gold, oil, forex, bitcoin, ethereum, and indices

- Subscription packages range from €44/month for US Stock Signals to €179/month for VIP Signals

The price of (BTCUSD) resumed its strong gains on its last intraday levels, reaching our last expected target at the resistance $116,000, supported by the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels and under the dominance of strong minor bullish wave on the short-term basis, besides the continuation of the dynamic support that is represented by its trading above EMA50, which supports this bullish track.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

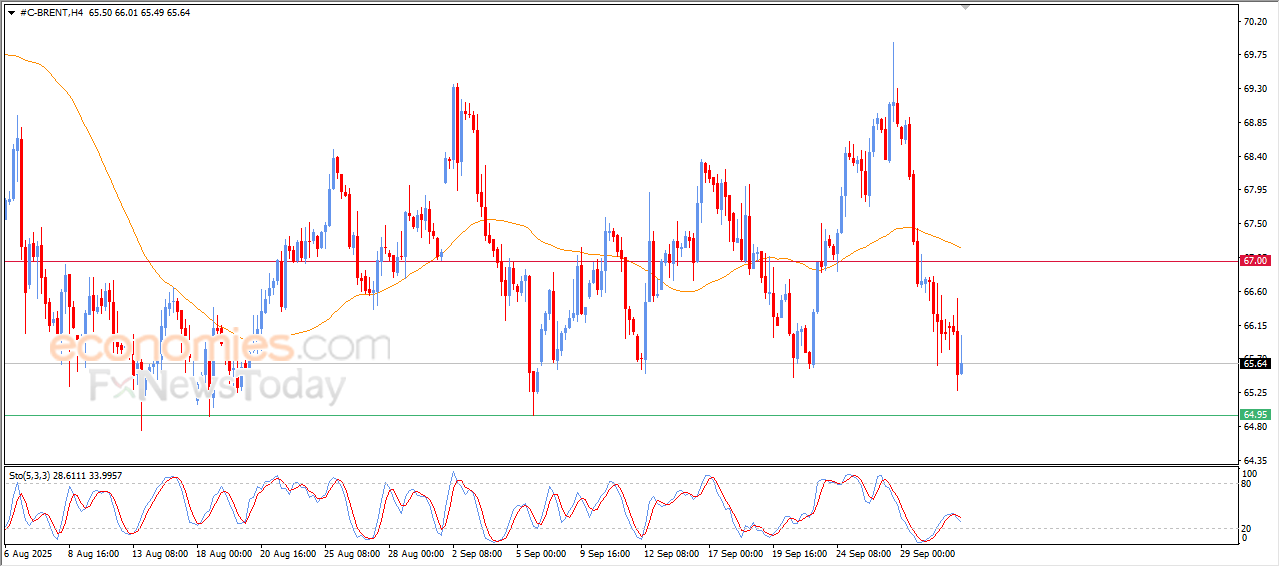

Forecast update for Brent crude oil -01-10-2025

Brent crude oil prices witnessed fluctuated trading on its last intraday levels, amid the dominance of steep bearish sub-wave, with the continuation of the negative pressure that comes from its trading below EMA50, reducing the chances for the price recovery on the near-term basis, amid the emergence of the negative signals on the relative strength indicators, after its success in offloading its oversold conditions, opening the way for recording more of the losses in the upcoming period.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

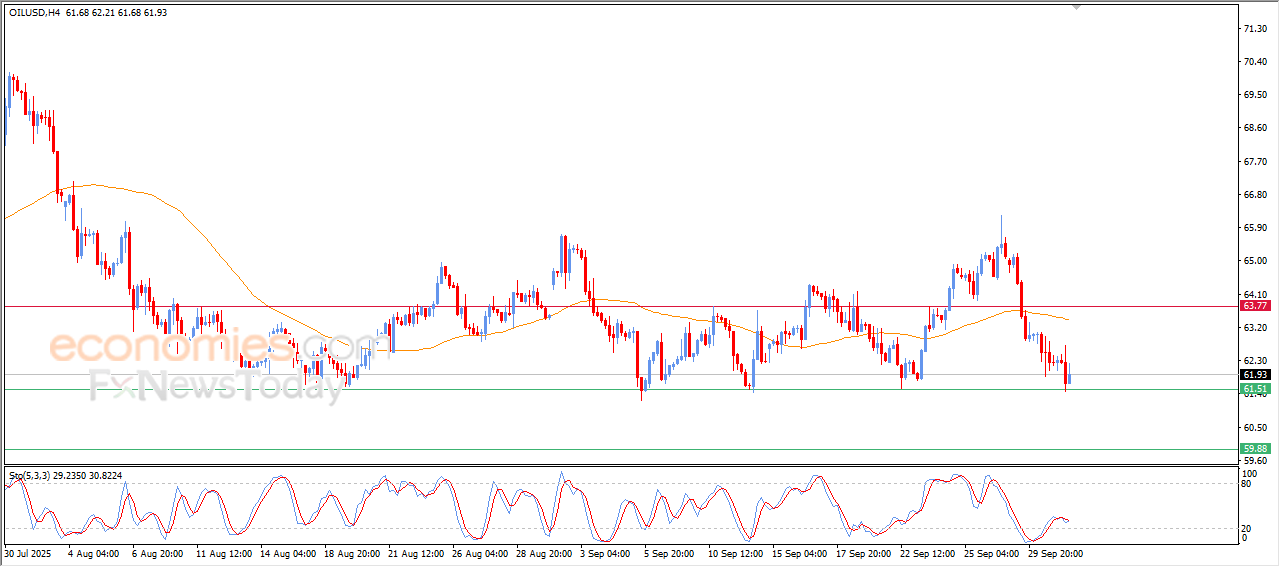

Forecast update for crude oil -01-10-2025

The price of (crude oil) rose in its last intraday trading, affected by its reaching our last target at the critical support level of $61.50, the stability of this support provides positive momentum that helped it to bounce higher in attempt to recover some of its previous losses, amid the continuation of the negative pressure that comes from its trading below EMA50, with the emergence of the negative signals on the relative strength indicators, after offloading its oversold conditions in its previous trading, which increases the bearish pressure on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025:

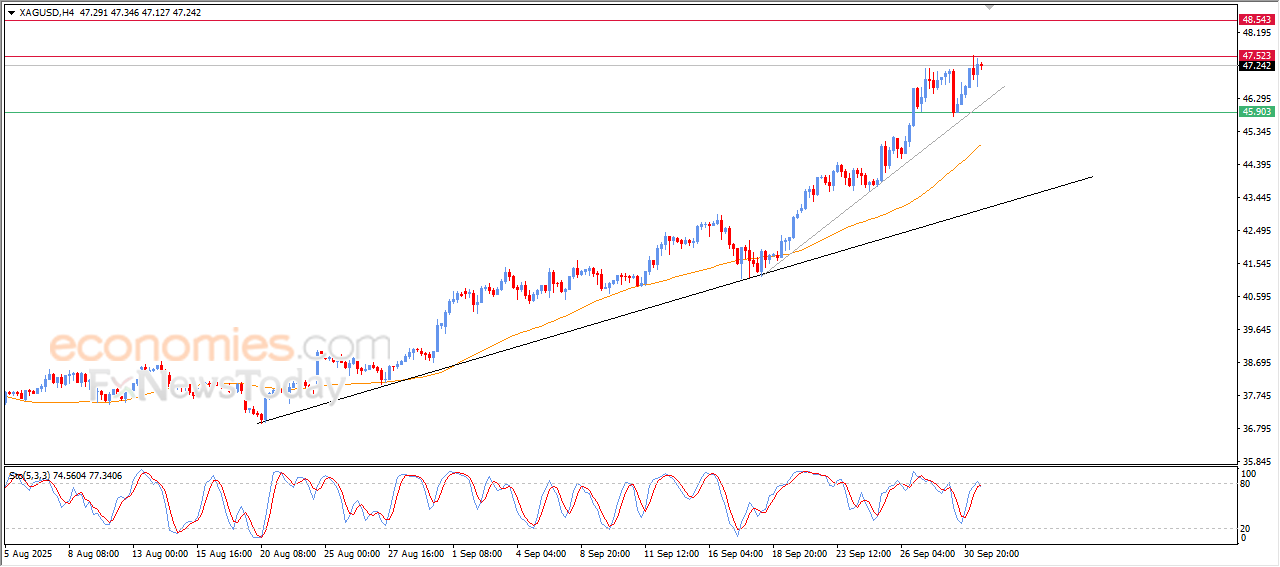

Forecast update for silver -01-10-2025

The price of (silver) settled gains in its last intraday trading, attempting to reach the current resistance level at $47.50, amid the dominance of the main bullish trend on the short-term basis and its trading alongside main and minor trend lines that indicates the strength and dominance of this track, besides the emerging of positive signals from the relative strength indicators, and the continuation of the positive pressure that comes from its trading above EMA50, which represents dynamic support that assist the stability of the bullish track.

VIP Trading Signals Performance by BestTradingSignal.com (September 22–26, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for September 22–26, 2025: