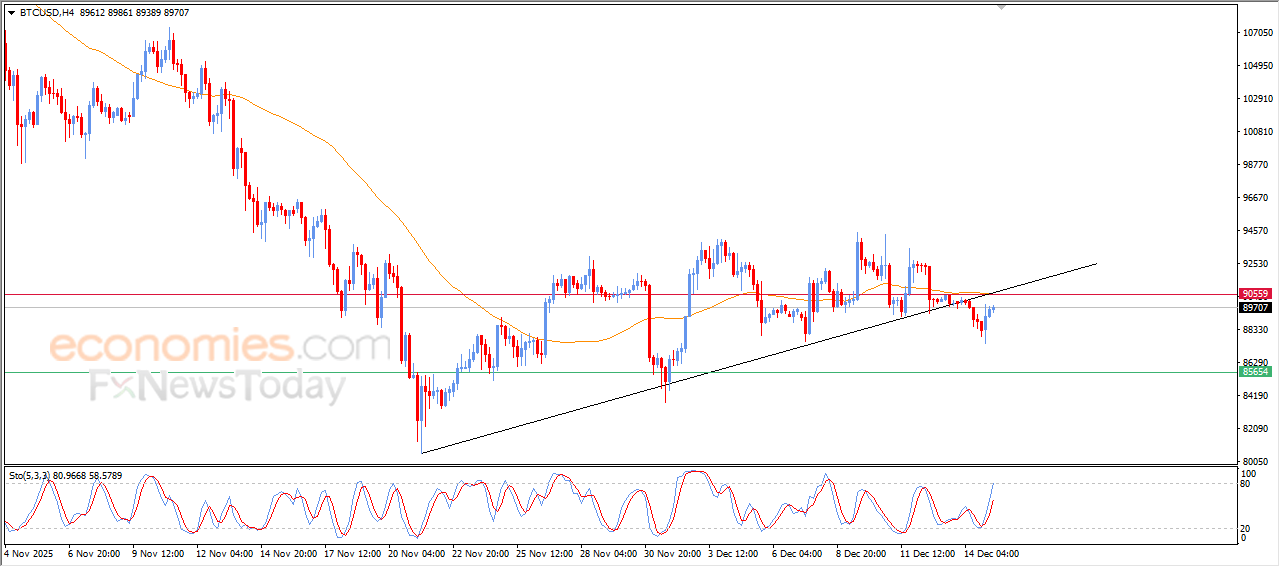

Forecast update for bitcoin -15-12-2025

Bitcoin (BTCUSD) prices rose in its last intraday trading, supported by the emergence of positive signals on the relative strength indicators, after reaching oversold levels previously, offloading these conditions especially with entering exaggerated overbought levels, indicating a quick decline to the bullish momentum, affected by breaking bullish corrective trend line on the short-term basis, and there is dynamic pressure that is represented by its trading below EMA50, reducing the chances of a recovery.

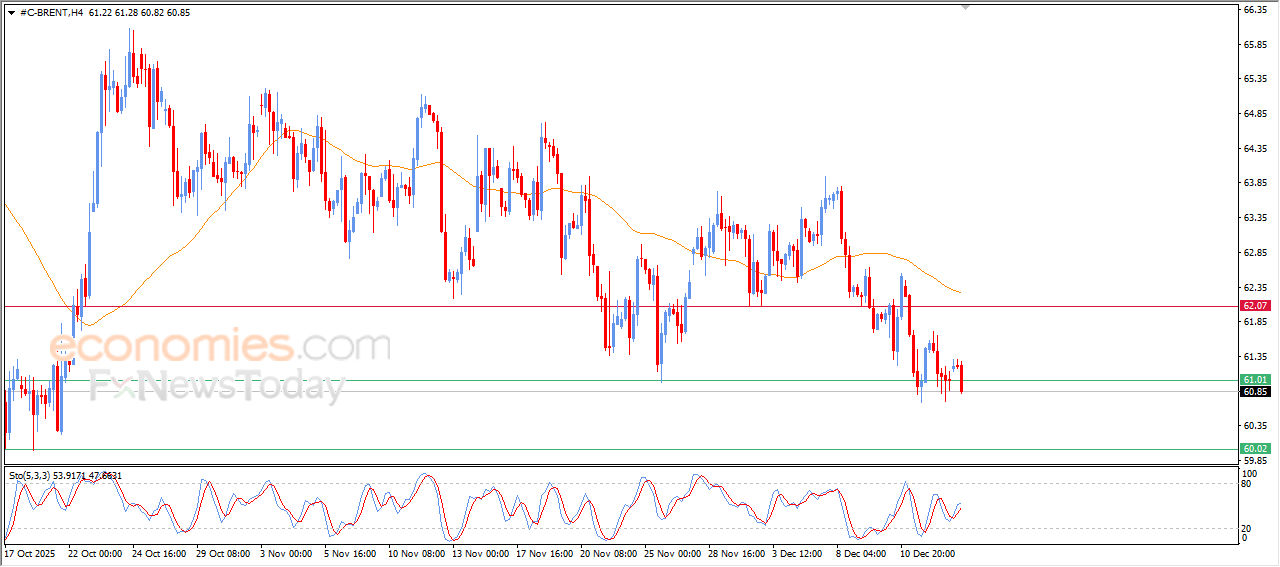

Forecast update for Brent crude oil -15-12-2025

Brent crude oil’s price witnessed sharp decline in its recent trading on the intraday levels, keeping the main bearish trend dominant on the short-term basis, with the continuation of the negative pressure that comes from its trading below EMA50, reinforcing the negative pressure around the price, breaking the key support at $61.00, confirming its momentum to deepen its losses on the short-term basis.

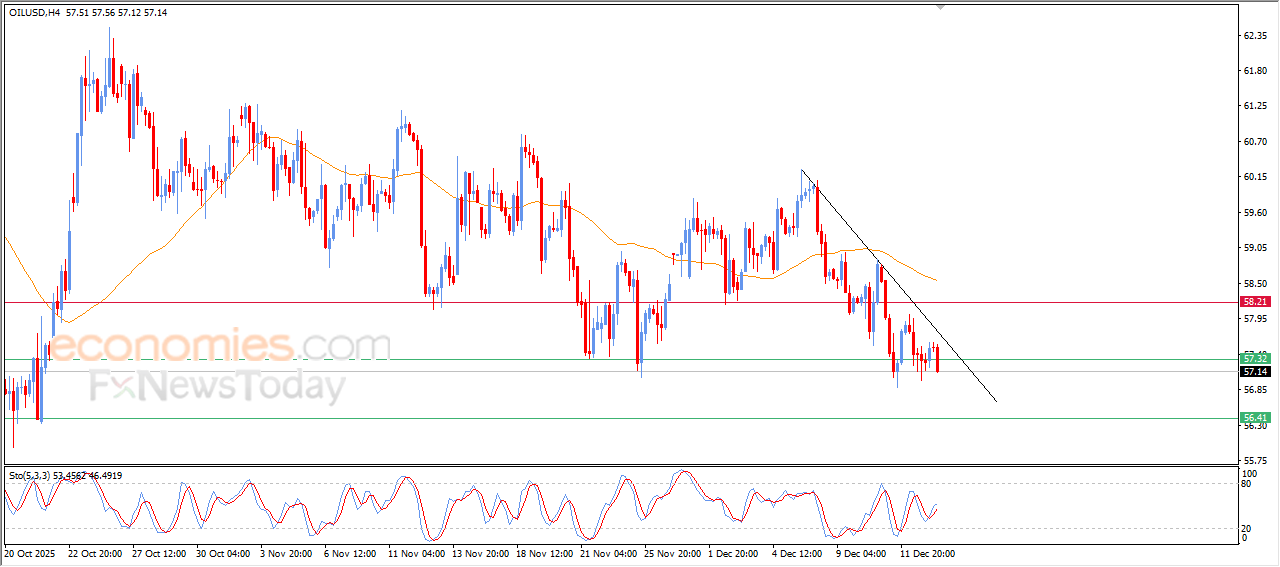

Forecast update for crude oil -15-12-2025

The price of (crude oil) declined in its last intraday trading, breaking the key support at $57.35, amid the continuation of the negative pressure due to its trading below EMA50, and the trading alongside steep minor bearish trend line on the intraday basis, the last decline came in spite of the emergence of positive signals on the relative strength indicators, to indicate entering new selling powers to turn the tables in the upcoming period.

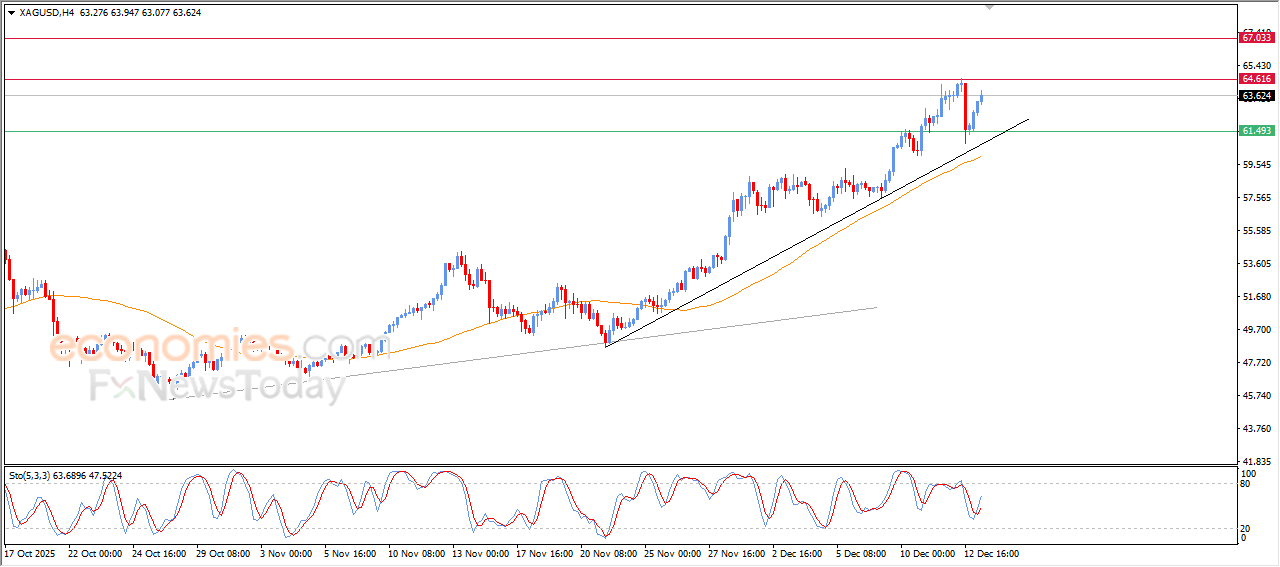

Forecast update for silver -15-12-2025

The price of (silver) extended its gains in its last intraday trading, approaching from its historical resistance at $64.60, recording new all-time highs supported by its continuous trading above EMA50, reinforcing the stability and dominance of the main bullish trend on the short-term basis, especially with its trading alongside supportive minor trend line, besides forming positive divergence on the relative strength indicators, after reaching exaggerated oversold levels compared to the price moves, with the emergence of the positive signals.