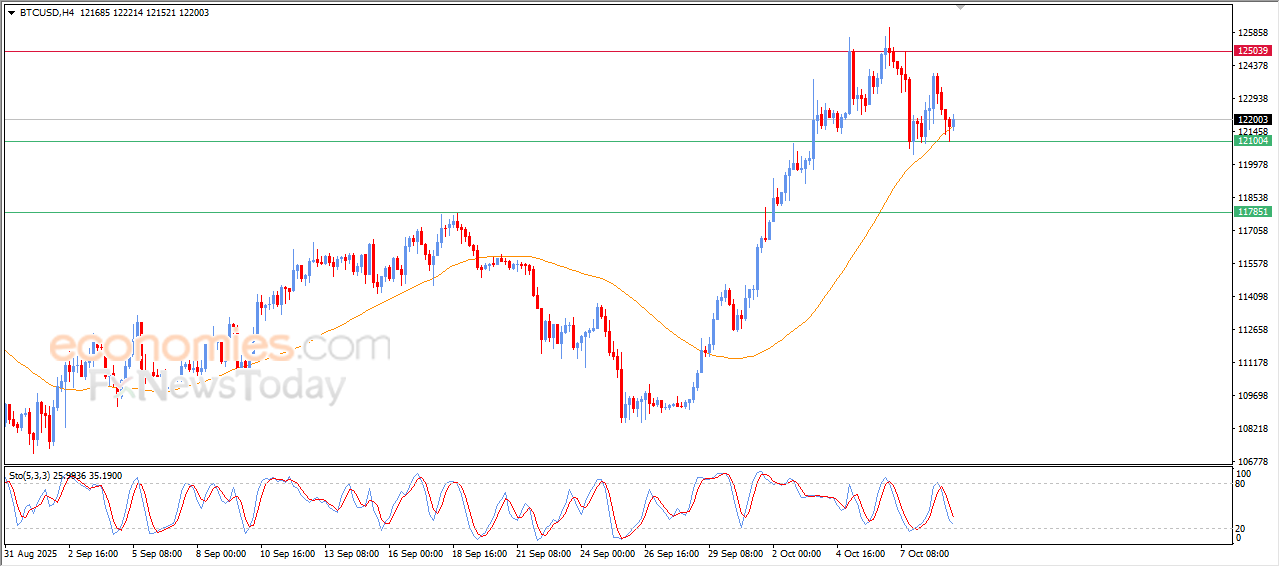

Forecast update for bitcoin -09-10-2025

Bitcoin (BTCUSD) prices got support in their last intraday trading, due to its lean on the support of its EMA50, gaining bullish momentum that helped it to achieve these last gains, amid the main bullish trend on the short-term basis, on the other hand, the negative signals remain emerge from the relative strength indicators, after reaching overbought levels, which might obstruct the upside moves on the near-term basis.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025:

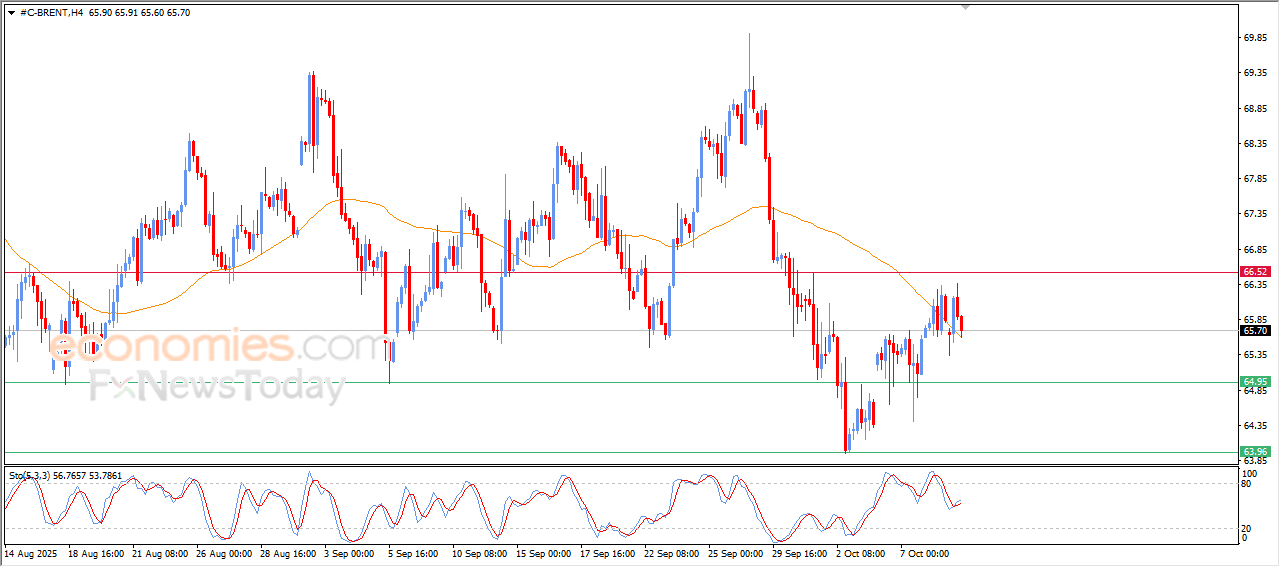

Forecast update for Brent crude oil -09-10-2025

Brent crude oil prices fluctuated clearly in its last intraday trading, where it moves within bullish corrective wave on the short-term basis, supported by positive signals that begin on the relative strength indicators after its exit from the previous overbought condition.

Despite this corrective momentum, the main trend remains bearish, as the selling pressure continues controlling the trading, especially with the trading below EMA50, which forms an obstacle against any rise, therefore, the indicators show that the short-term recovery is close, the broader outlook remains cautious, with the dominance of the bearish trend on the technical scene.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025:

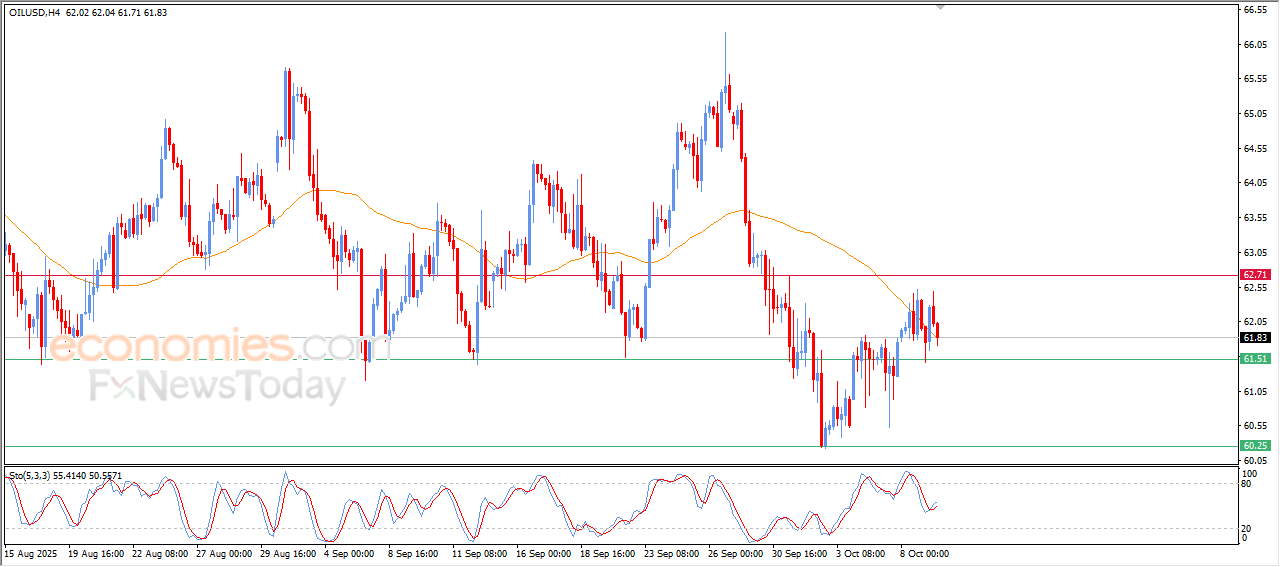

Forecast update for crude oil -09-10-2025

The price of (crude oil) witnessed fluctuated trading on its last intraday trading, amid the dominance of bullish corrective wave on the short-term basis, with the emergence of the positive signals on the relative strength indicators, after the price success in offloading their overbought conditions, on the other hand, the main bearish trend remains dominant, with the continuation of the negative pressure due to its trading below EMA50, decelerating the price rise.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025:

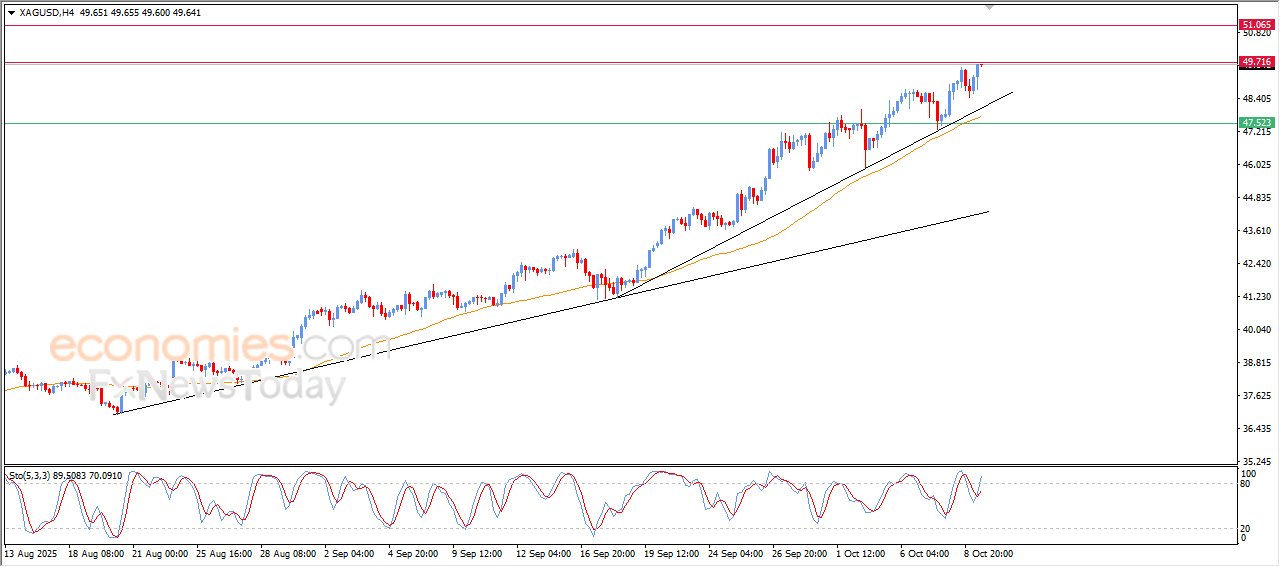

Forecast update for silver -09-10-2025

The price of (silver) stands on the thresholds of new all-time high in its last intraday trading, reaching our last expected target at $49.70, noting that the highest historical level for silver is located at $49.77, supported by its continuous trading above its EMA50, and under full dominance for the main bullish trend and its trading alongside minor trendline on the short-term basis, besides the emerging of the positive signals on the relative strength indicators, after offloading its overbought conditions in its previous trading, opening the way for achieving more of the gains.

VIP Trading Signals Performance by BestTradingSignal.com (Sept 29 – Oct 3, 2025)

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramFull VIP signals performance report for Sept 29 – Oct 3, 2025: