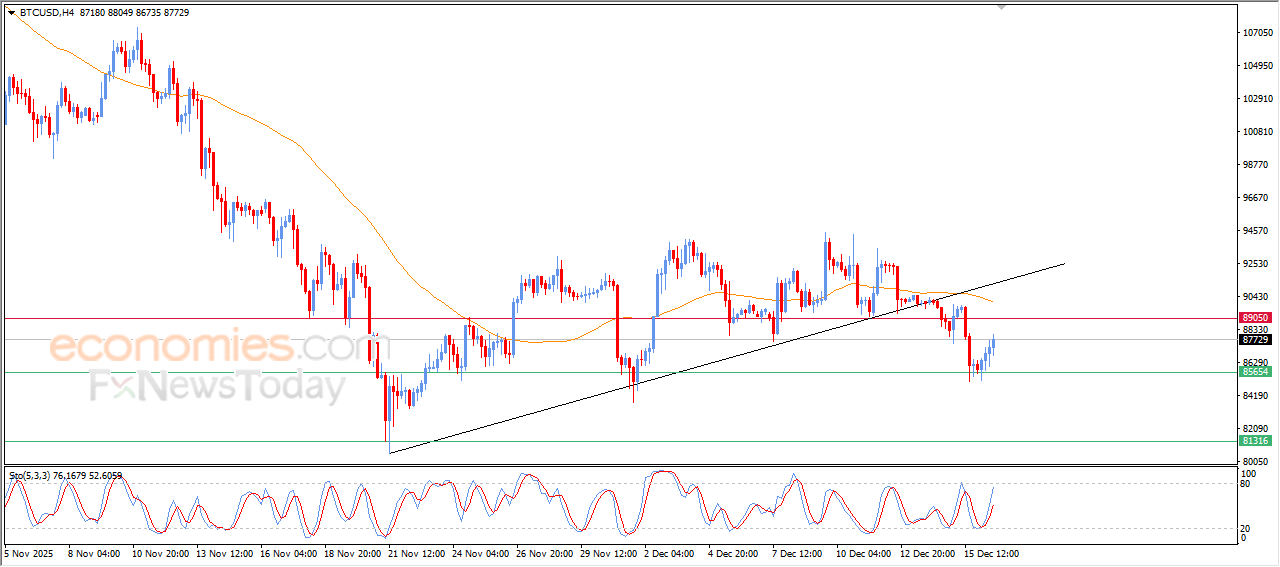

Evening update for Bitcoin (BTCUSD) -16-12-2025

The (BTCUSD) price continued the cautious rise in its last intraday trading, supported by the emergence of the positive signals on the relative strength indicators, after reaching oversold levels, affected by breaking bullish corrective trend line on the short-term basis, with the continuation of the dynamic negative pressure that is represented by its trading below EMA50, reducing the chances of the price recovery on the near-term basis.

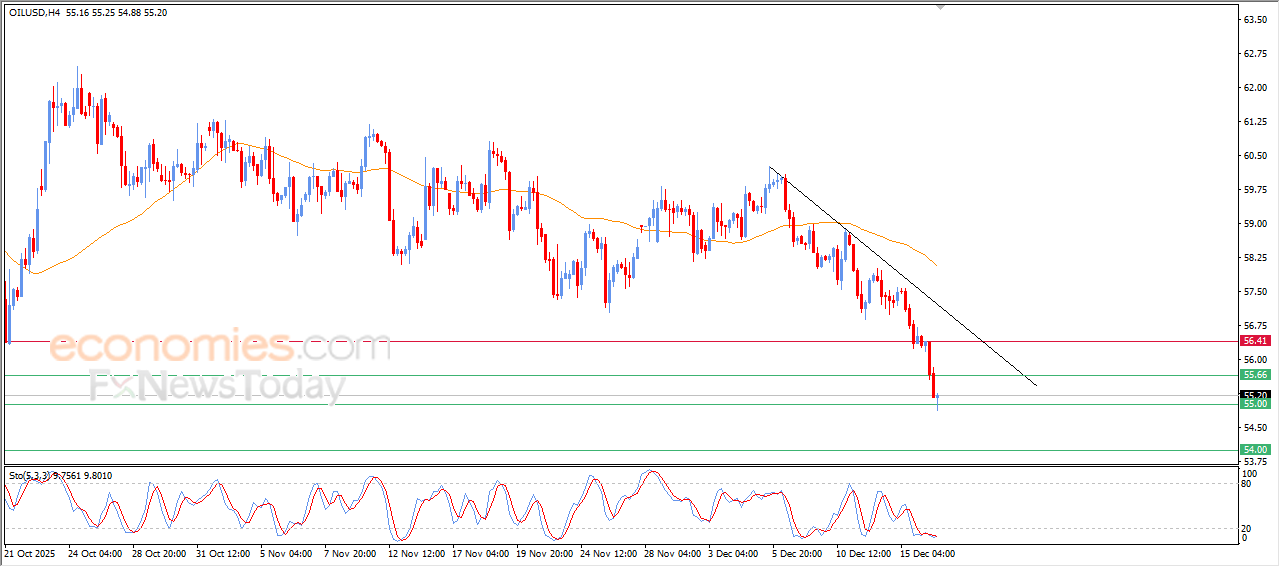

Evening update for crude oil -16-12-2025

The (crude oil) deepened its losses in its last trading on the intraday levels, reaching our expected target at $55.00 support, amid the dominance of the main bearish trend and its trading alongside steep minor trendline on the short-term basis, on the other hand we notice the emergence of positive overlapping signals on the relative strength indicators, after reaching oversold levels, which might reduce the losses in the upcoming period.

Evening update for Gold -16-12-2025

(Gold) jumped higher in its last intraday trading, to return to settle above $4,300, supported by the emergence of positive signals on relative strength indicators, after forming positive divergence after reaching oversold levels, exaggeratedly compared by the price move, amid the dominance of the main bullish trend and its trading alongside minor trend line on the short-term basis.

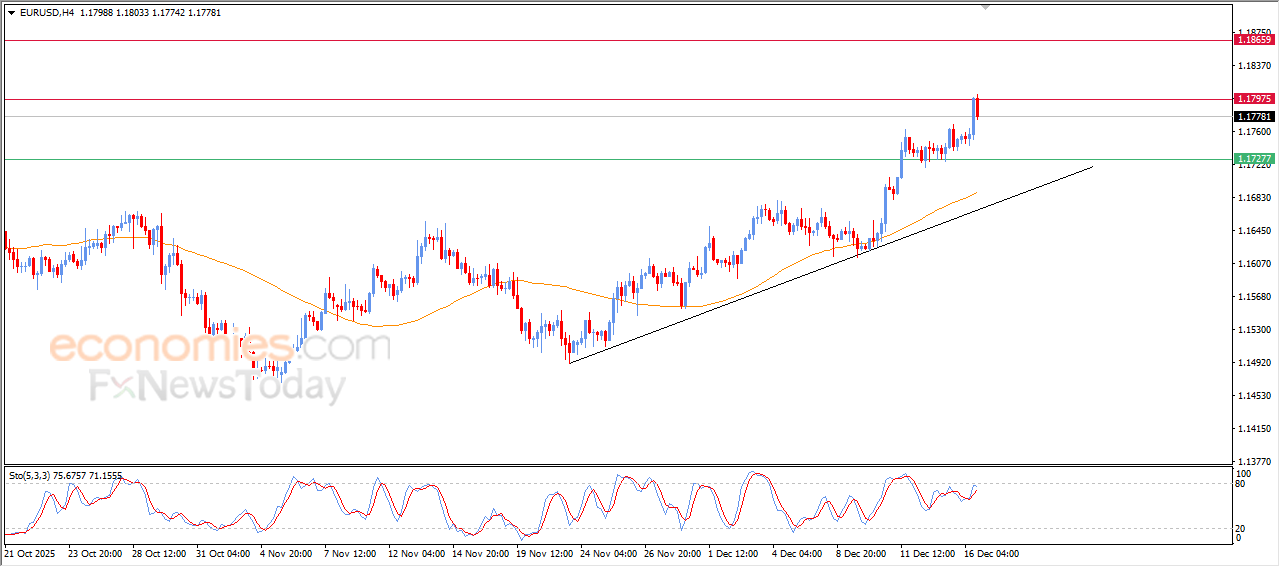

Evening update for EURUSD -16-12-2025

The (EURUSD) declined on its last intraday trading, after reaching our expected target at the resistance at 1.1795, to gather the gains of its previous rises, attempting to gain bullish momentum that might help it breach this resistance, amid the dominance of the main bullish trend and its trading alongside minor trend line on the short-term basis, with the emergence of the positive signals on the relative strength indicators, despite reaching overbought levels.