Did You Miss the Train? The Future of Crypto in the Next 5 Years

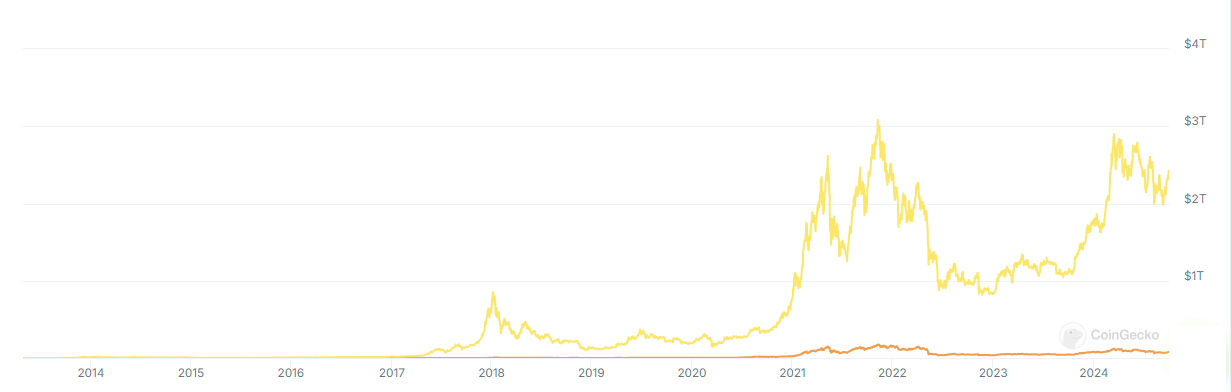

When Satoshi Nakamoto introduced Bitcoin to the world in 2009, the unique characteristics of this currency sparked the emergence of many other cryptocurrencies or alternative currencies like Litecoin and Namecoin. Ethereum later introduced a more advanced blockchain in 2015, revolutionizing the blockchain system, leading to rapid growth in the cryptocurrency markets over the past five years. For instance, Bitcoin hit lows below $4,000 in 2019 but surpassed $70,000 in just a few years. Today, about 6.8% of people worldwide own cryptocurrencies, while the global cryptocurrency market is valued at $2.13 trillion.

DeFi Growth

Decentralized Finance (DeFi) has become an important trend in the cryptocurrency landscape due to its unique advantages of providing financial services without intermediaries like banks or brokerage firms. Everything is automated within the protocol via smart contracts. DeFi applications first appeared on Ethereum and have since expanded to include other networks like Solana, Binance Smart Chain, and Avalanche. The goal is to simplify access to various financial services easily without the need for a central authority or third-party intervention. Decentralized exchanges offer the ability to conduct transactions directly without the need for numerous operations or high fees.

Regulatory Intervention

The cryptocurrency sector is likely to thrive in the next five years due to significant developments like ETF approvals and increased regulatory measures. While regulations may bring some risks to the cryptocurrency world, they also promise many benefits, such as protecting investors and securing stability. More importantly, cryptocurrency regulations could open up new opportunities, such as cryptocurrency ETFs.

Recently, the U.S. Securities and Exchange Commission approved cryptocurrency ETFs, including Bitcoin ETFs. You can see how bolstering regulations can improve the legitimacy of the cryptocurrency market and attract more investors. However, on the other hand, excessive regulatory pressure could stifle innovation and reduce the decentralization aspect that differentiates cryptocurrencies from other financial instruments.

Bitcoin Halving

This represents a recurring event on the Bitcoin blockchain that involves cutting Bitcoin mining rewards in half. The first three halvings (2012, 2016, 2020) led to prolonged price surges, with peaks lasting 12-17 months, each creating new all-time highs due to reduced supply caused by fewer mining activities.

The fourth halving occurred in April 2024, reducing the mining reward from 6.25 Bitcoin to 3.125 Bitcoin. Although the expected price surge hasn’t materialized yet, many experts believe it will begin later this year, potentially starting in Q4 2024 and continuing through most of 2025 as in previous cycles. The fifth Bitcoin halving will occur in 2028, and it's expected to trigger new price rallies as the mining reward for every 10 minutes will drop to just 1.5625 Bitcoin.

Institutional Adoption

Major companies like Microsoft, AMC, Tesla, AT&T, and PayPal have adopted cryptocurrencies for financial transactions, and this trend is growing. Many more companies are expected to join in the future. For example, MicroStrategy continues to invest heavily in Bitcoin, fueling more institutional investments.

AI's Future in Crypto

AI is already revolutionizing many industries and sectors, and the crypto world will undoubtedly be affected. One of the key game-changing impacts will be increasing security and making fraud more difficult, boosting investor confidence in cryptocurrencies. Additionally, AI will make cryptocurrency trading easier, faster, and more efficient.

Conclusion

The future of cryptocurrencies looks bright in the next five years, with predictions of more investment, especially from retail investors. Technological innovations, including interoperability solutions and decentralized finance, as well as tokenization of real-world assets, will play a role. Regulatory developments are also expected, covering financial crimes and investor protection.

Major Challenges Facing Cryptocurrencies

| Challenge | Details |

|---|---|

| Regulatory Intervention | While regulations bring some risks, they protect investors and increase legitimacy. |

| Technological Developments | Interoperability solutions and DeFi will drive progress. |

Key Predictions on Cryptocurrencies

- Goldman Sachs expects oil prices to rise to $85 per barrel this year.

- Citi Bank forecasts oil prices will reach $95 per barrel this year.

- Morgan Stanley predicts oil will hit $98 per barrel by the end of 2024.

- Deutsche Bank expects oil prices to reach $97 per barrel by the end of 2024.

Best Crypto Trading Platforms 2025

- Pepperstone - Best overall crypto trading broker for beginners. Multiple regulated licenses. Minimum deposit: $0. 20% discount on deposit.

- Plus500 - Best licensed broker for investing in cryptocurrencies CFDs. Multiple regulated licenses. Minimum deposit: $100.

- XM - Top crypto trading platform for educational materials and copy trading. Multiple regulated licenses. Minimum deposit: $5. Periodic competitions and bonuses.

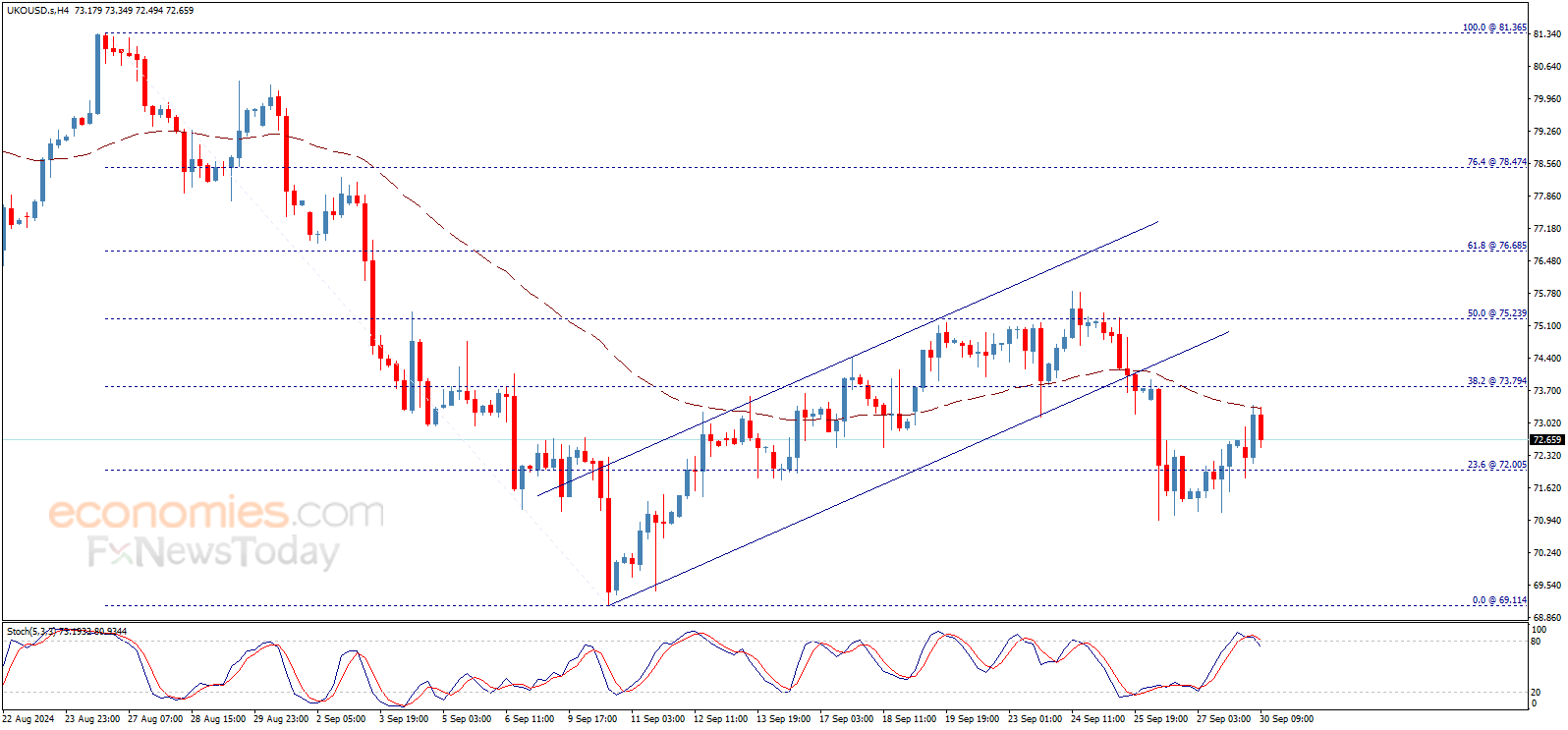

Brent oil price forecast update 30-09-2024

Brent oil price faced strong resistance formed by the EMA50 against the attempts to rise, to rebound bearishly and head towards testing 72.00$, and as we mentioned this morning, holding above this level is required to keep the bullish trend scenario active for today, which targets 73.80$ followed by 75.24$ levels as next main stations.

Note that breaking 72.00$ will push the price to turn to decline and target 70.90$ areas initially.

The expected trading range for today is between 71.40$ support and 74.40$ resistance.

Trend forecast: Bullish

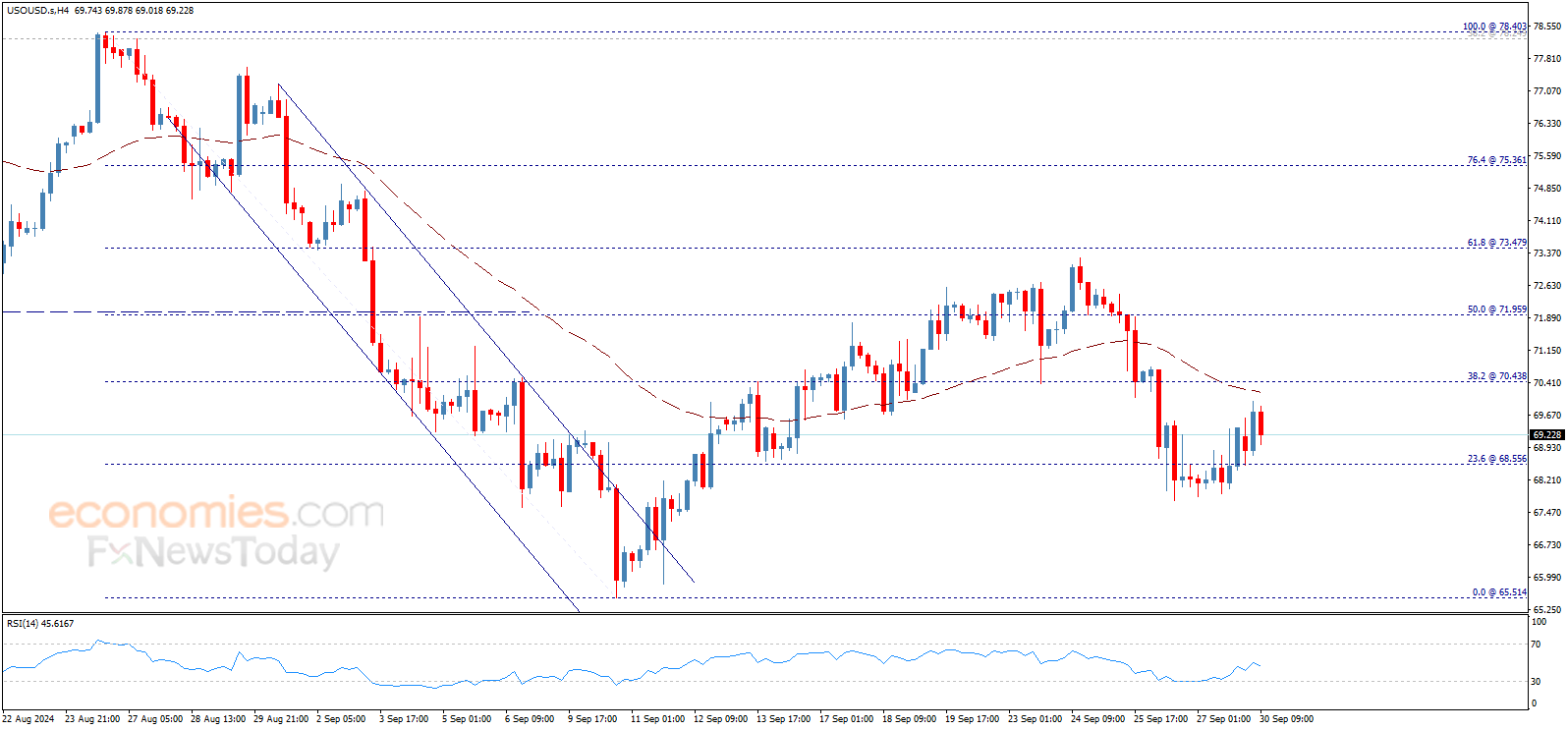

Crude oil price forecast update 30-09-2024

Crude oil price shows bearish bias now after the rise that it witnessed this morning, to approach the key support 68.55$, and the price needs to consolidate above this level to keep the bullish trend valid for today, which targets 70.44$ initially, reminding you that breaching it will push the price to 71.95$ as a next target, while breaking 68.55$ represents the key to turn to decline and build bearish wave on the intraday basis.

The expected trading range for today is between 68.00$ support and 71.00$ resistance

Trend forecast: Bullish

Silver price forecast update 30-09-2024

Silver price settles around 31.50$ level since morning, and as long as the price is below 31.70$, our bearish overview will remain valid for today, as we are waiting to test 31.00$ mainly, reminding you that breaking this level will push the price towards 30.06$ as a next negative station.

The expected trading range for today is between 31.00$ support and 31.85$ resistance.

Trend forecast: Bearish