Bitcoin price (BTCUSD) forecast update - 05-11-2024

Bitcoin price (BTCUSD) trades with clear positivity to breach the bearish channel’s resistance line and test the key resistance 69160.00$, which urges caution from the upcoming trading, as the price needs to consolidate below this level to keep the bearish trend scenario active for today, which its next target located at 65485.00$, noting that breaching the mentioned resistance will lead the price to achieve additional gains that reach 71550.00$ as a next positive station.

The expected trading range for today is between 66000.00$ support and 69600.00$ resistance.

Trend forecast: Bearish

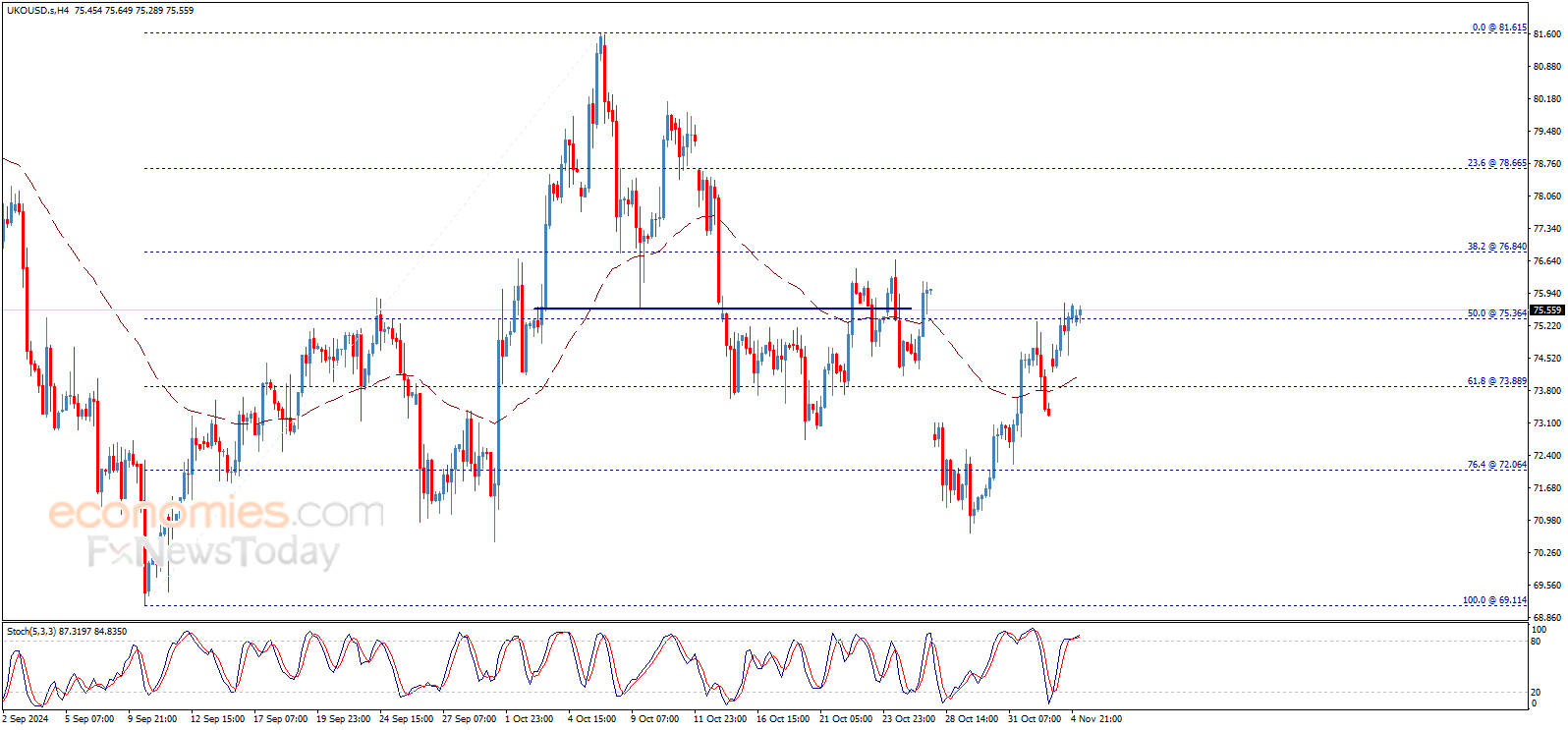

Brent oil price forecast update 05-11-2024

Brent oil price keeps its stability above 75.36$ level, to keep the positive scenario valid for today, waiting to gather positive momentum that assist to push the price to resume the bullish trend that its next target located at 76.84$, noting that breaking 75.36$ will put the price under negative pressure that targets 73.90$ mainly.

The expected trading range for today is between 74.20$ support and 77.20$ resistance.

Trend forecast: Bullish

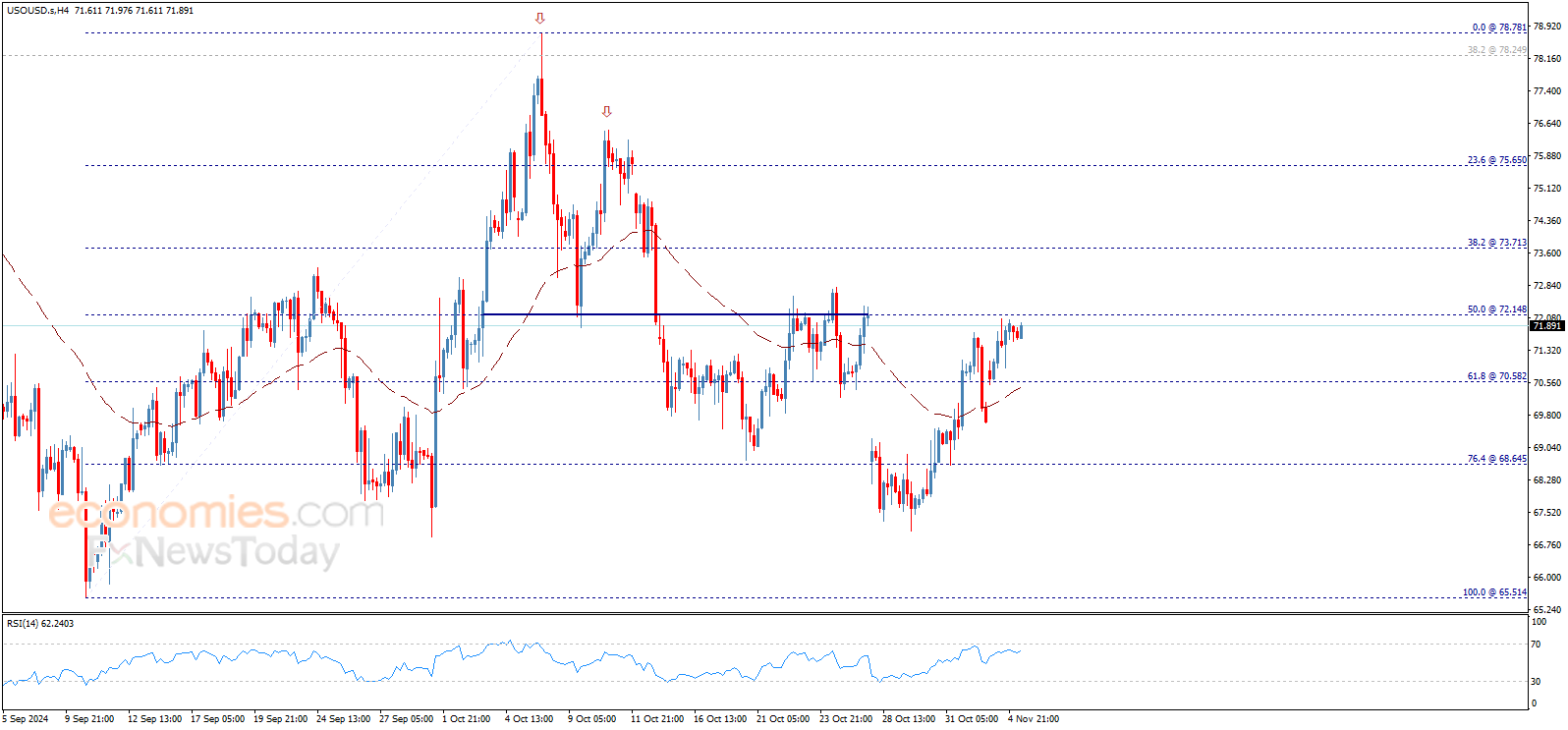

Crude oil price forecast update 05-11-2024

Crude oil price fluctuates within tight range since morning, settling near 72.15$ level, thus, no change to the expected bullish trend scenario for today, which its targets begin by breaching the mentioned level to confirm heading towards 73.70$ as a next positive station, reminding you that the continuation of the bullish wave depends on the price stability above 70.58$.

The expected trading range for today is between 70.50$ support and 73.50$ resistance

Trend forecast: Bullish

Silver price forecast update 05-11-2024

Silver price shows some bullish bias now affected by the strength of the bullish channel’s support line that appears on the chart besides stochastic positivity, and it might head to test 33.04$ before turning back to decline again.

Until now, the negative scenario still valid depending on the negative effect of the double top pattern conditioned by the price stability below 33.04$, reminding you that the next main target is located at 31.95$.

The expected trading range for today is between 31.80$ support and 32.70$ resistance.

Trend forecast: Bearish