Bitcoin (BTCUSD) is under negative pressures- Analysis-02-02-2026

Bitcoin’s price declined during its last intraday trading, amid the dominance of the main bearish trend on short-term basis, with its trading alongside supportive trend line for this path, indicating the continuation of the dominant selling pressures, which increases with the trading below EMA50, which turned into dynamic resistance that limits any near recovery attempts.

Noticing the emergence of negative signals from relative strength indicators, after offloading their oversold conditions, opening the way for recording more losses on near-term basis, preferring the continuation of the negative performance unless clear reversal technical signals appear.

Therefore, our expectations suggest a decline in BTCUSD in its upcoming intraday trading, if it settles below $80,000, to target $74,000 support.

Expected trading range is bewteen$74,000 support and $80,000 resistance.

Today’s forecast: Bearish

Crude oil prices break the neckline of a negative technical pattern- Analysis-02-02-2026

Crude oil prices declined in their last intraday trading, to break $63.50 key support, which represents the neckline of negative technical pattern that formed on short-term basis, which is the double top pattern, this decline was accompanied by the emergence of negative signals from relative strength indicators, after offloading its oversold conditions, opening the way for recording this decline.

On the other hand, the price remains benefited from the dynamic support that is represented by its trading above EMA50, reinforcing the stability and dominance of the main bullish trend, especially with its trading alongside minor trend line on short-term basis, keeping the chances of a recovery and a bullish rebound valid in the upcoming period.

Therefore, we expect crude oil to decline in upcoming intraday trading, if it settles below $63.50 to target $61.50 key support.

The expected trading range for today is between $61.50 support and $65.00 resistance.

Today’s forecast: Bearish

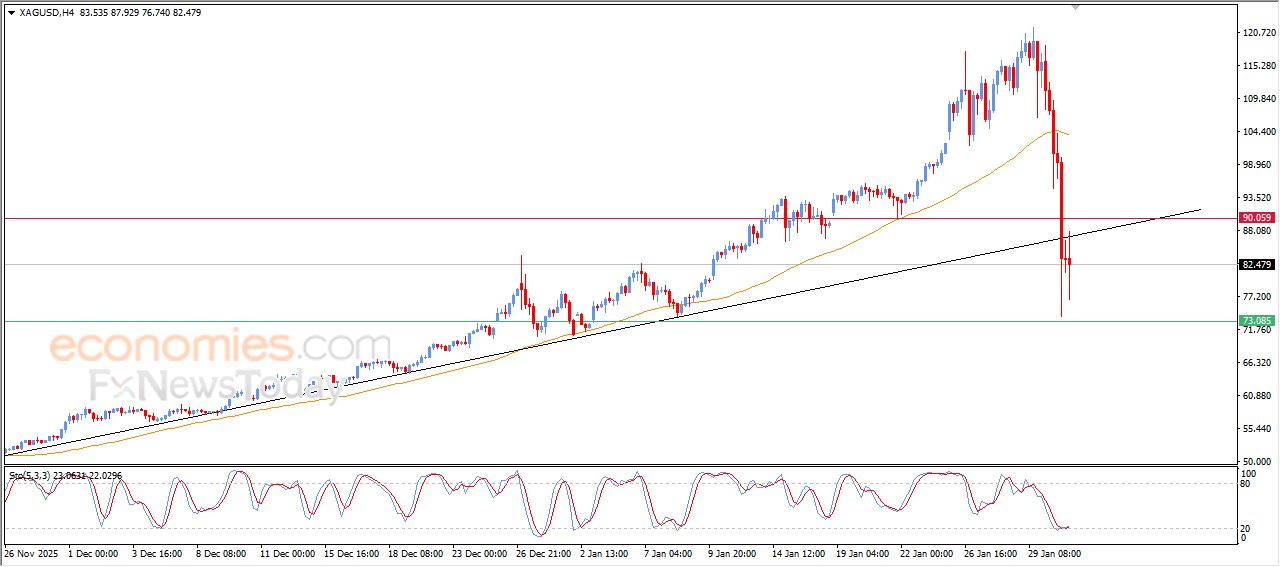

Silver Price is experiencing oversold condition that eases the extent of the losses– Analysis-02-02-2026

Silver prices (SILVER) declined in their recent intraday trading, affected by the continuation of the negative pressure due to its trading below EMA50, to confirm breaking short-term bullish trendline, which increased the extent of the negative pressures and weakened the chances of quick recovery.

On the other hand, we notice the emergence of positive overlapping signals on relative strength indicators after reaching oversold levels, helping the price to settle and enter fluctuating moves, to attempt to offload some of these oversold conditions, paving the way for potential deceleration in losses or a limited intraday rebound.

Accordingly, we suggest a decline in sliver’s upcoming intraday trading, by its stability below $90.00, to target $73.00 support.

The expected trading range is between $73.00 support and $93.00 resistance.

Today’s forecast: bearish

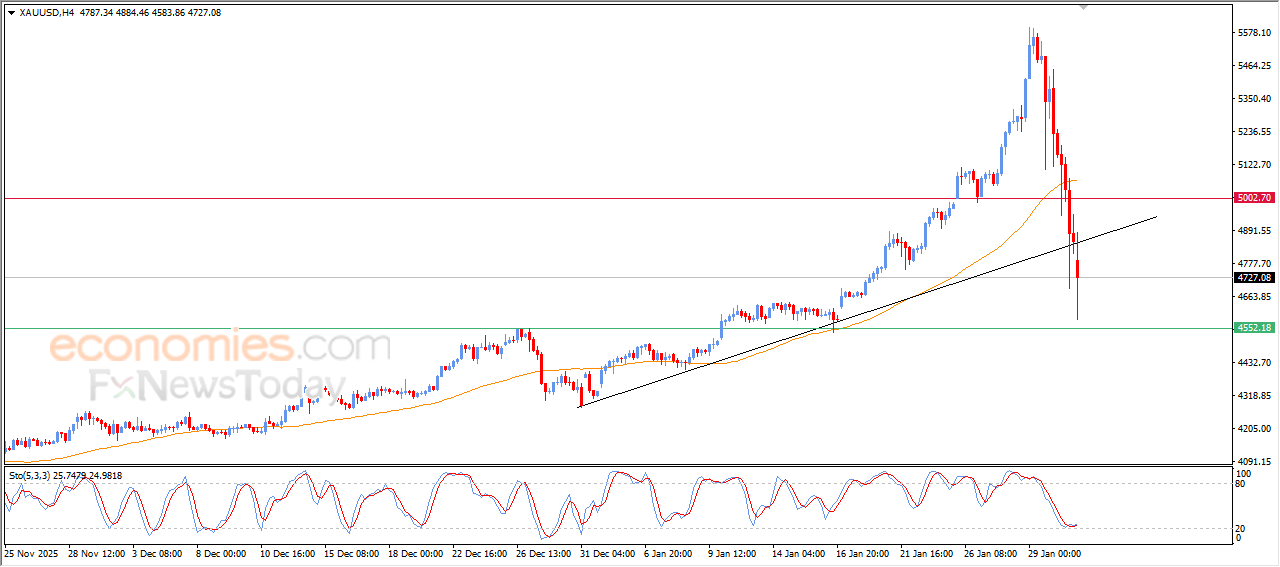

Gold price breaks bullish trend line - Analysis-02-02-2026

Gold prices (GOLD) continued their sharp decline during recent intraday trading, to break short-term bullish trend line, as negative technical signals that increased the selling pressures, accompanied by its trading below EMA0, which turned into dynamic resistance that reduced the chances of quick recovery on near period.

Despite these negative pressures, we notice positive overlapping signals on relative strength indicators after reaching oversold levels, this was reflected through intraday fluctuations, paving the way for temporary rebound or at least eases the extent of the losses in its upcoming trading.

Accordingly, we suggest a decline in gold prices during upcoming intraday trading, if it settles below $5,000, to target initial support level at $4,550.

The expected trading range is between $4,550 support and $5,000 resistance.

Today’s forecast: Bearish