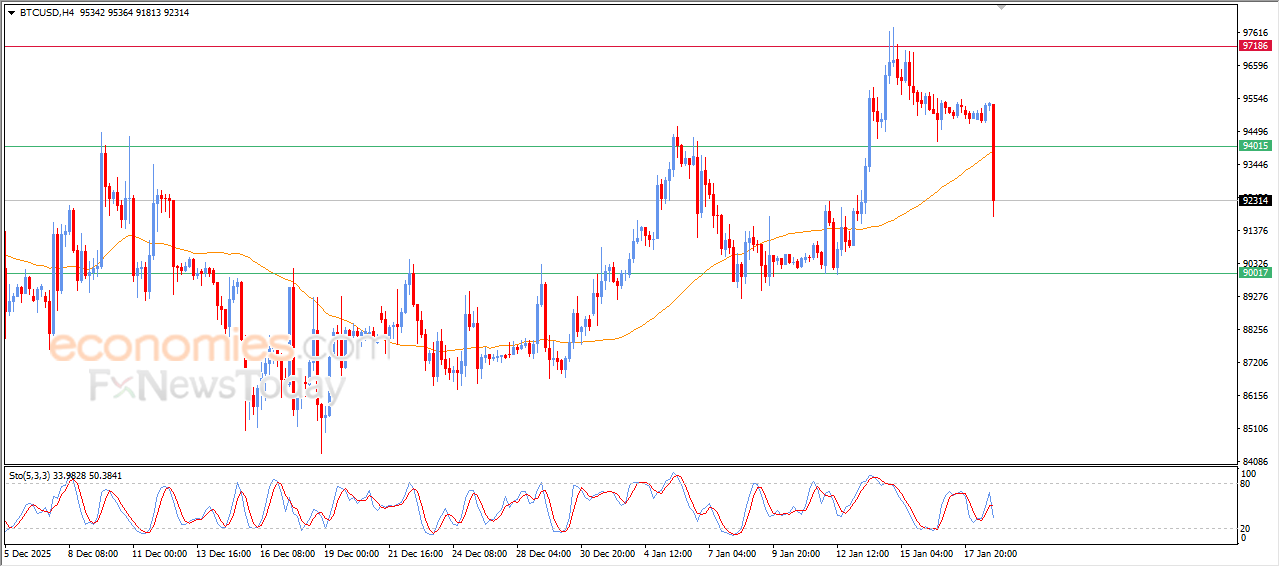

Bitcoin (BTCUSD) is experiencing a free fall- Analysis-19-01-2026

Bitcoin’s price slipped lower during its last intraday trading, affected by the emergence of negative signals from relative strength indicators, after offloading its oversold conditions, opening the way for the return of the selling pressures and recording new losses on a near-term basis.

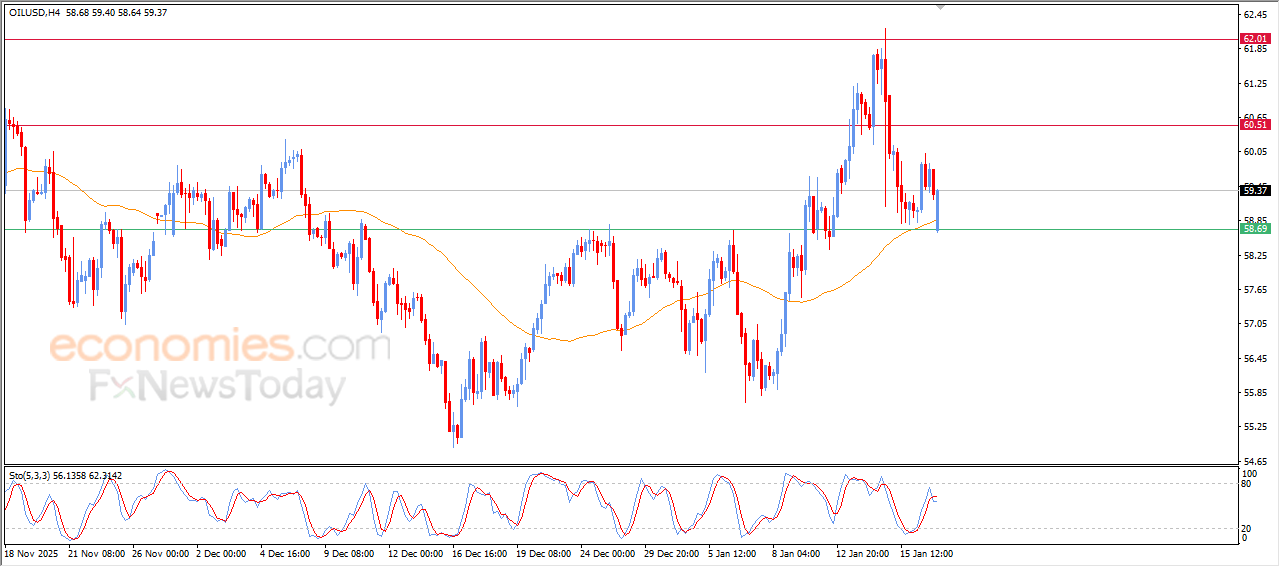

Crude oil prices get bullish momentum- Analysis-19-01-2026

Crude oil prices succeeded in turning its early losses into slight gains in the last intraday trading, benefiting from EMA50’s support, which provided bullish momentum that helped it to erase these losses and return to a positive zone.

This comes amid the attempts of offloading the overbought conditions on relative strength indicators, especially with the emergence of negative overlapping signals, however the main bullish trend remains dominant on the price’s short-term trading, keeping the chances of settling and resuming the rise valid in the upcoming period.

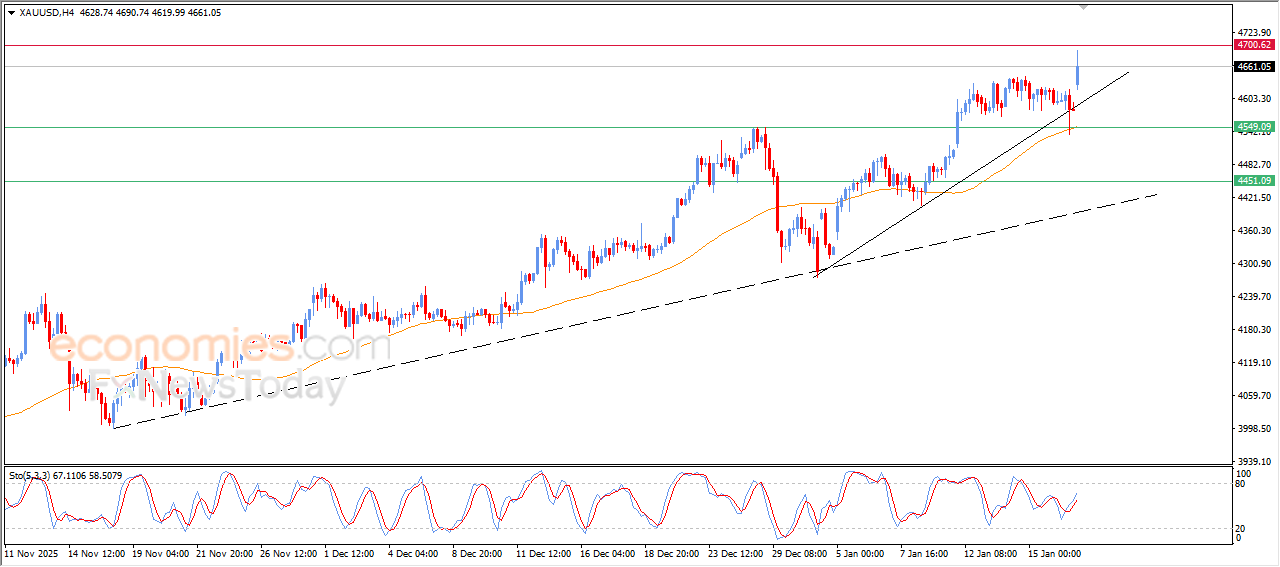

Gold price is recording new all-time highs in its last intraday trading- Analysis-19-01-2026

Gold witnessed sharp declines in its recent intraday trading, recording new historical levels, benefiting from EMA50’s support, accompanied by leaning on minor bullish trend line on a short-term basis, providing solid technical base for achieving this strong rise.

This performance was supported by the emergence of positive signals from the relative strength indicators, after reaching oversold levels, reinforcing the bullish momentum and supporting the continuation of the gains in the near trading.

EURUSD price is experiencing sudden rebound within bearish channel- Analysis-19-01-2026

The (EURUSD) price rose suddenly in its last intraday trading, turning its early losses into gains, in quick rebounding move despite its trading within bearish corrective channel on a short-term basis.

Despite this rise, the negative pressures remain valid due to the trading below EMA50, which limits the strength of this rise and it might rebound if the near resistance levels remain intact, especially with the emergence of negative signals from relative strength indicators after reaching exaggerated overbought levels, compared to the price move, indicating a potential decline in the bullish momentum.