Bitcoin (BTCUSD) attempts to offload its overbought condition -Analysis-08-08-2025

AI Summary

- Bitcoin (BTCUSD) is experiencing a slight decline in price as it attempts to offload its overbought condition, with a main bullish trend remaining dominant on a short-term basis

- The decline in price may provide an opportunity for new bullish momentum if the current support level is maintained, but breaking it could lead to a deeper correctional wave

- BestTradingSignal.com offers professional trading signals for US stocks, crypto, forex, and VIP signals for various markets, with subscription packages starting at €44/month

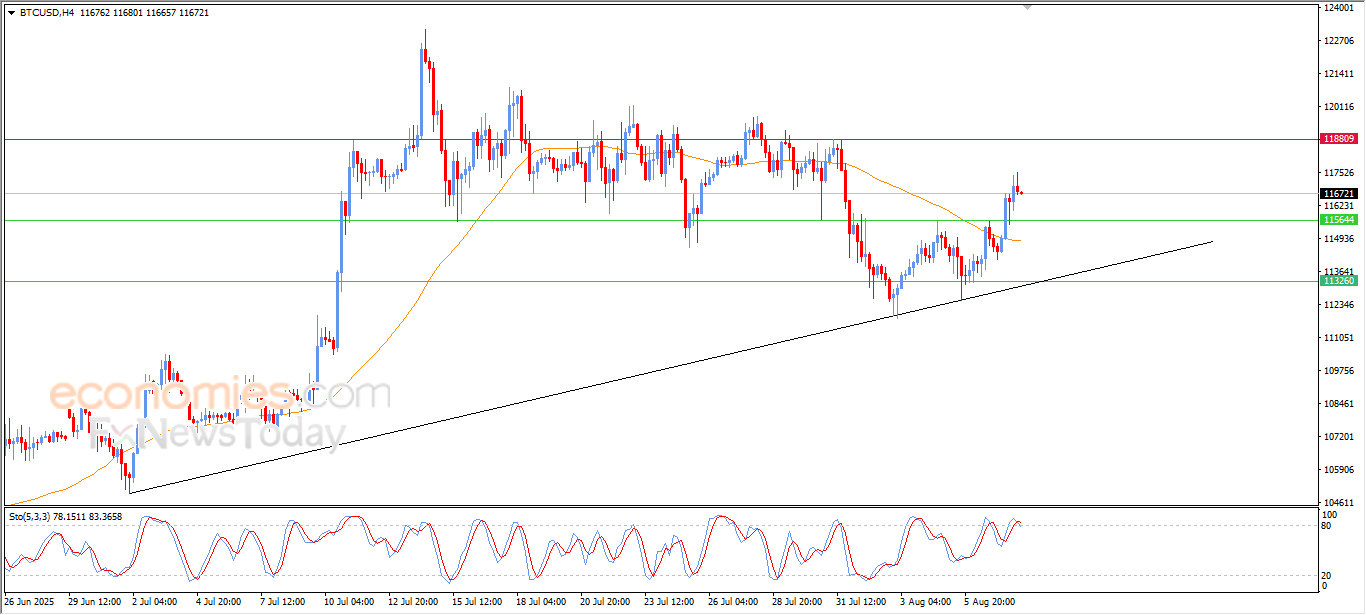

The price of Bitcoin (BTCUSD) declined slightly in its last intraday trading, in a correctional move to gather the gains of the previous rises, and the attempt of offloading the clear overbought condition on the (RSI), especially with the emergence of the negative signals, and the main bullish trend remains the dominant on the short-term basis, supported by the trading alongside a supportive bullish bias for this trend, and its stability above EMA50.

This decline might provide a chance for gaining new bullish momentum that helps it to regain the bullish track, if the price kept the current support level, while breaking it will open the way for deeper correctional wave before any attempt to rebound again.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

Crude oil prices are under negative pressure-Analysis-08-08-2025

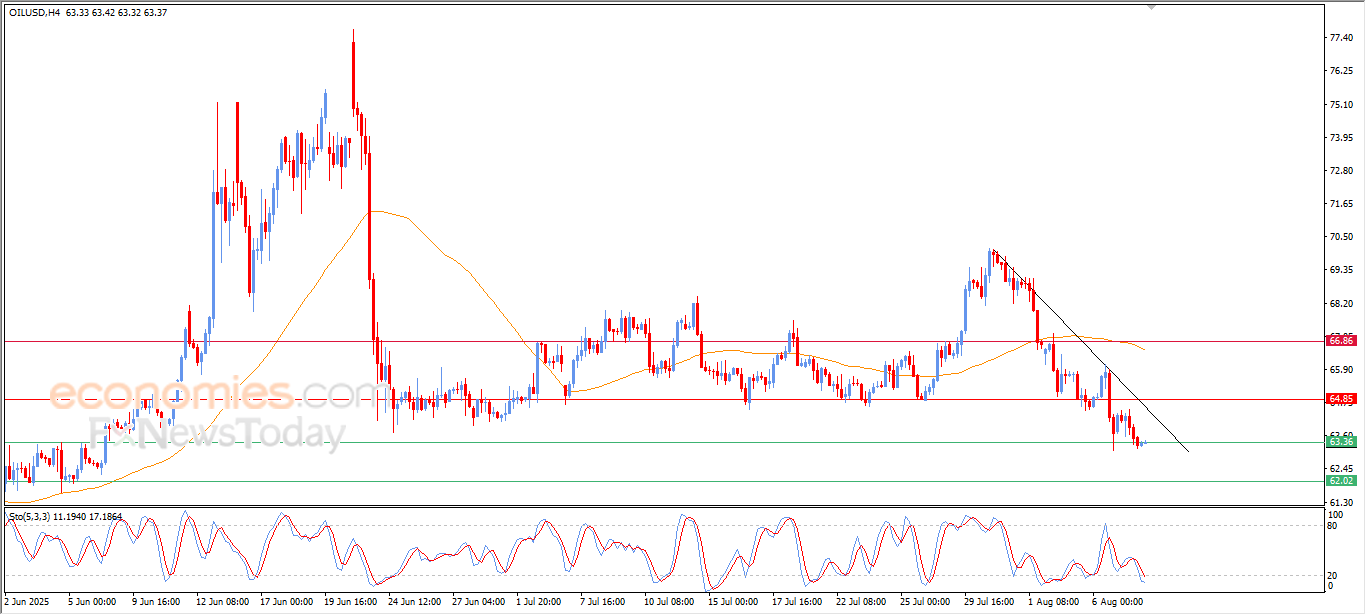

The (crude oil) price settled at sharp losses in its last intraday trading, affected by the continuation of the negative pressure from its stability below EMA50, and it remains under the dominance of minor bearish wave on the short-term basis, moving alongside bearish bias line, indicating the strength of the dominant negative momentum.

The emergence of the negative signals on the (RSI) reinforces this technical scene, despite entering oversold levels, indicating the continuation of the pressure unless witnessing strong bouncing attempts to break the dominant bearish track.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

Gold price declines affected by main resistance -Analysis-08-08-2025

The (Gold) price declined in its last intraday trading, after hitting the main resistance level at $3,400, which represents our potential target in our previous report. This decline came due to the stability of this resistance, attempting to gain positive momentum that might allow it to breach this level.

At the same time, gold price attempts to offload the clear overbought condition on the (RSI), especially with the beginning of negative signals, despite the continuation of the minor bullish wave on the short-term basis, indicating the strength of the dominant positive trend until now.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link:

EURUSD is attacking stubborn resistance-Analysis-08-08-2025

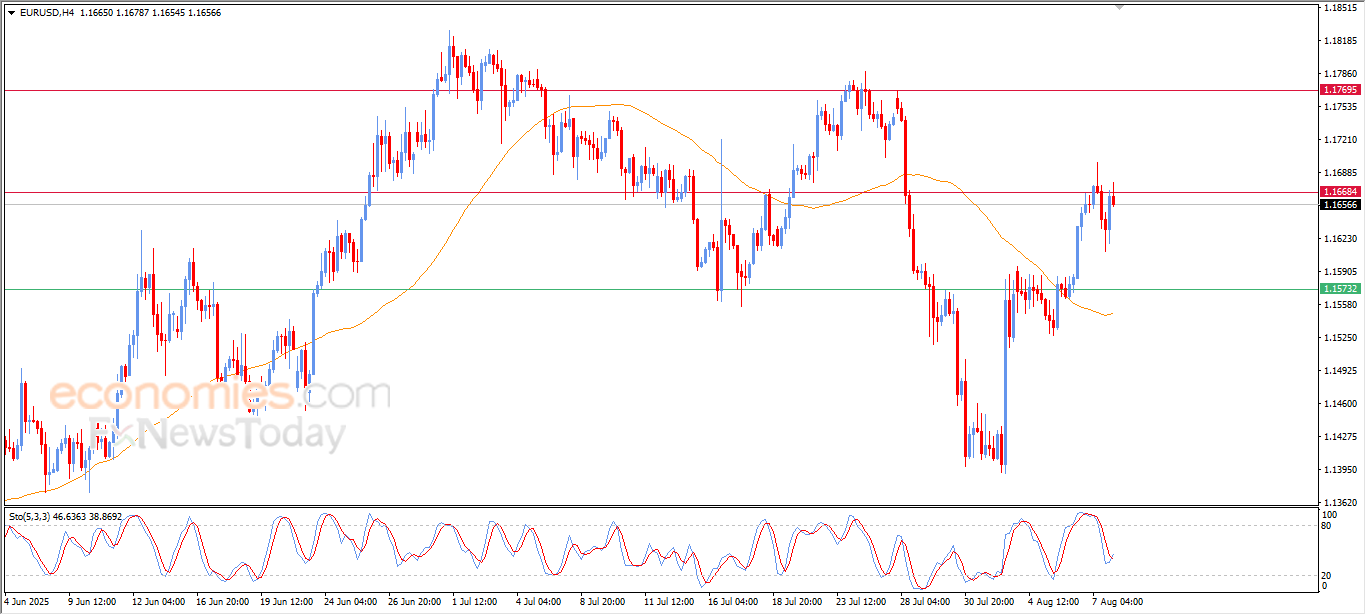

The (EURUSD) settled with strong gains in its last intraday trading, attacking the stubborn significant resistance at 1.1670, amid the dominance of strong bullish wave on the short-term basis, supported by its trading above EMA50, indicating the continuation of the positive momentum.

This trend is supported by the bullish overlapping signals on the (RSI), after offloading the overbought condition, opening the way for achieving more of the gains on the intraday basis, waiting for clear breach for the resistance to open the way for higher targets.

BestTradingSignal.com – Professional Trading Signals

Get high-accuracy trading signals delivered directly to your Telegram. Subscribe to specialized packages tailored for the world’s top markets:

US Stock Signals from €44/month

Subscribe via TelegramCrypto Signals from €49/month

Subscribe via TelegramForex Signals from €49/month

Subscribe via TelegramVIP Signals (Gold, Oil, Forex, Bitcoin, Ethereum, Indices) from €179/month

Subscribe via TelegramVIP Trading Signals Performance – July 28 – August 1, 2025

To view the full performance report for this week, visit the following link: